INVESTORS SEDUCED by CNBC and the STOCK CHARTS COMPLETELY MISS the BIG PICTURE!

Stock-Markets / Stock Market 2022 Feb 10, 2022 - 03:56 PM GMTBy: Nadeem_Walayat

Dear Reader

Have you capitalised on the stock investing lemmings as they leapt off the investing cliff as I and many of my patrons / readers have been doing? If not why not?

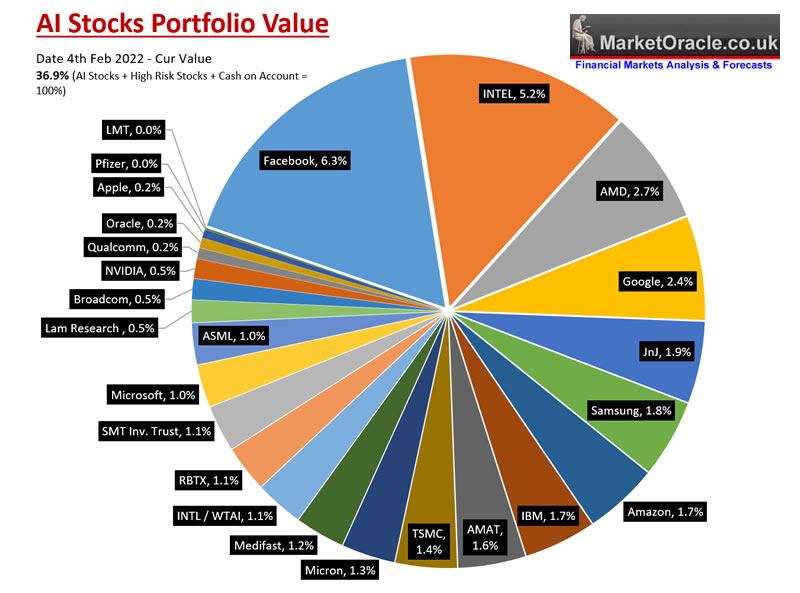

For instance during the PANIC I have expanded my exposure to my select list of AI tech stocks form 22.7% to 36.9%.

Just $4 per month for AHEAD of the curve analysis, else it's a case of being left at the mercy of the clowns on the likes of CNBC who were promoting buying Facebook stock hours before earnings collapse.

Only to then promote selling the stock AFTER it had collapsed!

Enjoy your trip to a zero account balance if watch the likes of the CNBC financial clowns show!

Whilst my latest just posted extensive analysis lays out my plan of what to expect and do NEXT as we head towards the first Fed rate hike (hint stocks will bottom BEFORE the first Fed rate hike).

Stock Market in the Eye of the Storm, Visualising AI Tech Stocks Buying Levels

Content:

m = f - Everything is Waving!

How to Invest in Stocks 20202 and Beyond

Stock Market Calm In the Eye of the Storm

Stock Market Forward Guidance

50% DRAWDOWNS ARE THE NORM!

Current State of Draw downs

Quantum AI Stocks Portfolio Current

AI Tech Stocks Buying Levels

Earnings Growth Factor

GOOGLE TO BE SLICIED INTO 20 PIECES!

FACBOOK MISSION ACCOMPLISHED Whilst CNBC Clowns Buy the TOP and SELL the BOTTOM!

MICROSOFT Short and Sharp

Still Waiting to Take a BITE out of APPLE

NVIDIA is ARMless - To Buy or Not to Buy, that is the question.

AMD - The Chip Master

TSMC - The World's Supreme Chip Fabricator

AMAZON the Dark Horse!

ARKK SARK SHORT FUND

And access to my recent timely analysis lays out how to invest in during the panic of 2022,

HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

The whole of which was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

This article forms part 1 of my recent extensive analysis on BUYING the PANIC in TECH STOCKS, that seeks to give investors a cold shower, so that they understand of what is bubbling under the surface.

AI Stocks Multi Buying Levels to Capitalise on the Stock Market Panic of 2022

THE VALUATION RESET

INVESTORS SEDUCED BY STOCK CHARTS COMPLETELY MISS THE THE BIG PICTURE!

QUANTUM COMPUTERS

AI Tech Stocks 2022 Correction

Stock Market Trend Forecast Current State

Dow Max Draw Down 2022

ACCUMULATE DEVIATIONS FROM THE HIGHS IN GOOD STOCKS!

NEW STOCKS

The Fishes that Have So Far Gotten Away

AI Tech Stocks Funds Revision

QUANTUM AI STOCKS MULTI BUYING LEVELS

NEW Investors

NETFLIX - You Cannot Say You Weren't Warned!

ARKK MATHS

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Pandemic Rear View Mirror - Next Potential Catastrophe?

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

Again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

For investors to do what needs to be done then they have to be in a BUBBLE!

No, not a STOCKS bubble but an INFORMATION bubble, else it's likely a case of this -

INDECISION, Second guessing, investing is like being in a drafty house where one can plug most holes but still some drafts get through.

HOWEVER, worse for many is that they leave their doors and windows WIDE OPEN to allowing full flow of information that sows doubt and confusion. For in addition to the usually clueless financial mainstream media we also have the barely out of puberty youtubers with huge followings who were barely a few weeks ago FOMO-ing at the mouth into the likes of Tesla now AFTER the drop, AFTER TEsla has fallen to $800 are in full PANIC SELL EVERYTHING CRASH MODE! Greta Thunberg would say Blah Blah Blah Blah! This is what investors are exposed to so it is no wonder most run around like headless chickens flipping between FOMO BUY EVERYTHING to PANIC SELL EVERYTHING!

And so it has been this past week, while where so called INFORMATION, would even CONFUSES ME! MAXIMUM CONFUSION with the objective of sowing doubt in what I am doing, what if I am wrong, what if this is 2000, 2008 or worse 1929, though I quickly shrug off the noise and focus on my list of stocks to buy at there prospective buying levels and get on with the business of placing and revising orders as I collect the stock certificates from the lemmings as they leap off the stocks cliff, all I need are basic price charts devoid of any indicators and my list of stocks to buy, nothing more, I don't need to know the utterances of the clowns on CNBC and youtube.

THE VALUATION RESET

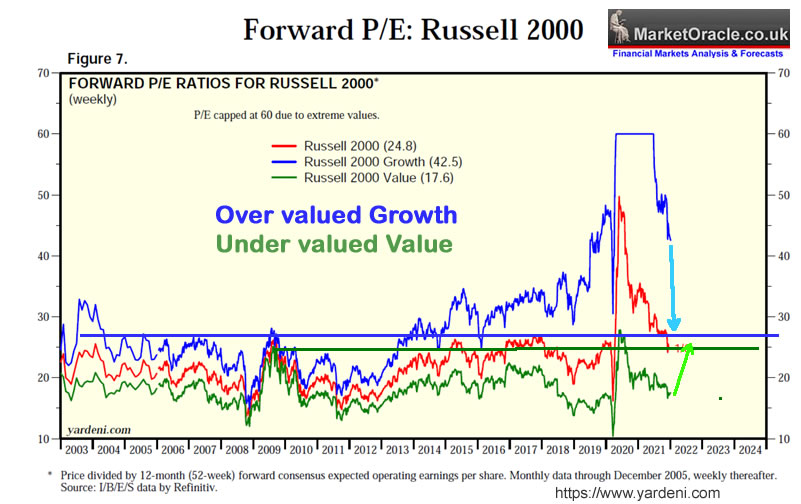

The valuation reset is the rotation out of over valued growth stocks the pinnacle of which populate Cathy Wood's ARK funds and into under valued low PE usually dividend paying stocks as the following illustrates for the Russell Small cap stocks where high value stocks were bid up to to fever pitch ridiculous valuations whilst the value stocks were largely neglected by the market and as you can see we are a long way from the value reset from running it's course so this could play out for most of 2022. Where our AI tech stocks are concerned this translates into the higher the PE stocks facing greater downwards pressure for the likes of Nvidia, AMD, Microsoft and Amazon. Conversely the lower the PE stocks should see upwards pressure especially for dividend paying stocks such as IBM, Intel, GPN, LMT and so on into the biotech's.

However, it is not all doom and gloom for the fundamental fact that our Quantum AI Tech stocks are NOT ARK garbage stocks, our tech stocks are GOOD stocks and THUS TIME means EARNINGS will play CATCHUP TO PRICES! So yes all those trading above a PE of 30 most certainly are going to get punished. However at the end of the day the declines should prove TEMPORARY.

INVESTORS SEDUCED BY STOCK CHARTS COMPLETELY MISS THE THE BIG PICTURE!

Given some of the comments I tend to get, (without mentioning anyone) illustrates that many people are STILL failing to fully grasp what we are dealing with here, the AI stocks are NOT NORMAL CORPORATIONS! THEY ARE ON AN EXPONENTIAL TREND TRAJECTORY!

And that exponential reality is QUANTUM AI!

Instead investors are getting seduced by standardised charts of every stock, throwing random names about just because they have fallen x%, perhaps buoyed by one of the more useful metrics, a low PE ratio to entertain thoughts of investing. All of which acts to dilute what is actually taking place as most investors focus is usually in the wrong place, permanently hinged on a few droplets of water that are the quarterly earnings reports at the expense of ignoring the ocean that is the Quantum AI mega-trend.

Asking if one should sell a stock after it has gone up 10% or 20% since one bought it is NOT INVESTING!

So for a realty check go watch my video on the Machine Intelligence AI mega-trend so that we are all reading from the same page!

IT DOES NOT MATTER IF STOCK PRICES FALL BY 10% OR EVEN 50% FROM THEIR HIGHS! AS IT WILL HAVE NO BEARING ON THE QUANTUM AI MEGA-TREND IN PROGRESS - IF YOU CANNOT GRASP THIS IMPORTANT POINT THEN DO NOT INVEST IN ANY STOCKS! BECAUSE YOU WILL ONLY SELL THAT WHICH YOU HAVE JUST BOUGHT ON FEARS THAT THE STOCK WILL FALL AGAIN! AND THUS YOU WILL ONLY BE LEFT HOLDING LOSERS THAT HAVE FAILED TO RISE.

So the first order of business is to quickly go over my recent article on how to invest, 17 rules / methods to get one in the right mindset for investing.

HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

QUANTUM COMPUTERS

Most of 14 AI tech stocks on my list also give varying exposure to quantum computing, supplemented by the 3 AI funds for broader exposure to a myriad of smaller cap stocks.

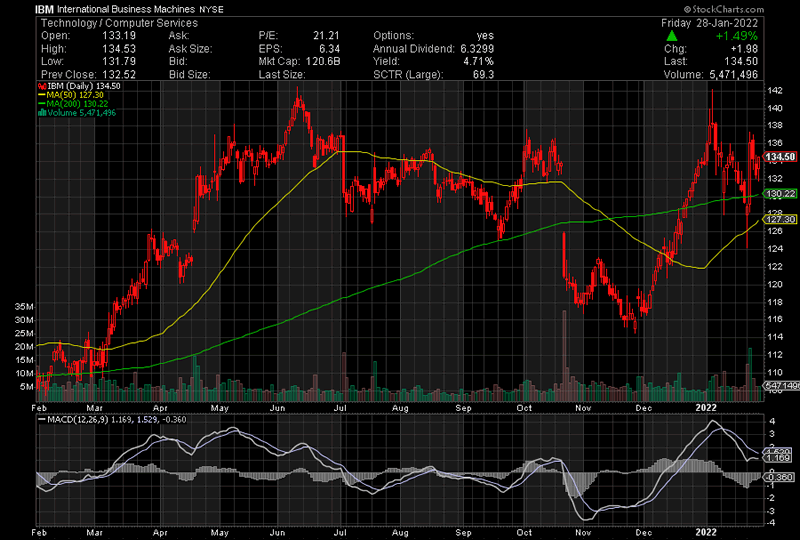

Ask yourselves why IBM a supposed dog stock that many fund managers and so called analysts have written it off is just point blank refusing to follow the rest of the tech herd sharply lower.

Whilst we did get a brief dip to $125 ahead of IBM earnings report on close of 24th Jan as the lemmings thought this was THE ONE stock to short into earnings only for IBM to give the short sellers a punch in the face because IBM is one of the LEADING Quantum Computing stocks that one can gain access to i.e. many others are privately held such as Quantinuum that was spawned by HoneyWell which in itself is a Quantinuum Computing contender, a $130 billion corp trading on a PE of 26, that pays a 2% dividend, though I have no plans to invest in HON given that in valuation terms IBM is the MUCH better buy, pays twice the dividend coupled with a lower valuation..

Simply the name of the game is the number of entangled qubits they can muster, where today's figures are generally in the low 100's, i.e. IBM stands at 127 super conducting qubits that might not sound like a lot but IBM seeks to double this every 6 months along the lines of Moores law for Quantum Computers. Do the math it would imply 1 million qubit systems by the end of this decade! Critical Mass for error corrected Quantum Computers to start to deliver that which they promise by pealing away at what we perceive to be reality, for one can only truly model the quantum space through use of quantum computers!

Looking at my AI list the two quantum stocks that stand out right now are -

- IBM

The bottom line is contrary to the garbage that spews out of the likes of ARK, Quantum Computers will turn out to be THE REAL DISRUPTIVE TECHNOLOGY towards the end of this DECADE! Which continues to fly under most investors radar hence why we can pick up the likes of IBM for near peanuts! And when the world starts to wake up to Quantum Computers we will see a Quantum Computing bubble BEFORE the technology reaches maturity as I laid out in my extensive analysis of June 2020. So literally my Patrons have received 6 years ADVANCE warning of where the NEXT BIG STOCKS BUBBLE will be and when it will likely pop!

12th June 2020 - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

THIS IS what I am investing in, not the blaring noise that we get from MSM and the blogosfear! Inflation, rate hikes, tapering IT'S ALL NOISE that has no baring on the unfolding Quantum AI mega-trend. The good thing about the noise is that we are getting STOCK DISCOUNT EVENTS to accumulate into the Quantum AI mega-trend!

The fact that IBM has GONE UP whilst virtually everything else has plunged is a HUGE BUY SIGNAL! So I plan to DOUBLE my exposure to IBM at the earliest opportunity at $125 and more at $118 maybe amidst a panic event, if we ever get so lucky! I would not be surprised if IBM becomes the poster child of the future Quantum AI bubble, the Nvidia of it's day, X10 even! For it is definitely is possible for a $120bn corp to X10 to $1.2 trillion! Until then it continues to fly under the radar.

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Saber rattling, troop build ups, mis-information, clutching at peace straws, clueless journalist suggesting it's not going to happen because Putin's best buddy in China is in the mood for an omicron spreading sporting event.

Clearing away the fog - The Russians ARE going to invade Ukraine as soon as weather permits! Why? Because Russia is a dictatorship! Dictatorships seek out that which can exaggerate their power and Ukraine in those terms is the only obvious bordering target for Putin.

Russia's pinhead dictator wants the world to perceive RUSSIA in the same terms as they used to perceive and fear the USSR! Instead of a past it's sell by date super power with a midget economy that produces nothing of significance reliant wholly on exporting oil and gas for foreign currency.

The great irony is that UKRAINIANs ARE the REAL russians for that is where Russia began in the UKRAINE! So for many Russians including Putin Ukraine being independent is a bit like London being Independant of England. And that is how Putin perceives Ukraine, and why Putin wants the WHOLE of the Ukraine! Something most in the West fail to grasp, he doesn't want the Donbas, he wants the whole of Ukraine lock stock and smoking barrel!

Meanwhile the West threatens sanctions, but Russia holds many of the trump cards as past sanctions have made the Russian economy more resistant to sanctions, and much of Europe especially Germany relies heavily on Russian Gas so if there was an opportune time for Russia to go to war then that time is now.

And so could begin a chain reaction of actions and reactions that ultimately risks leading to World War 3! As what came to be known as WW2 sprung from the Japanese attack on Pearl Harbour trying to capitalise on Germanys War in Europe, so in 2022 it could be China's attack on Taiwan trying to capitalise on Putin's war in Europe.

I intend to buy the panic as I usually do, where I have an eye on accumulating JRS. L at £5.46 or better. Yes it could fall further but I have been trading in and out of this fund for decades so I know we will see £8.00+ again some day.

Pandemic Rear View Mirror - Next Potential Catastrophe?

We are fast leaving the pandemic behind in the rear view mirror where as expected the Omicron wave despite shrill cries from the vested interests barely resulted in a bump than a wave.

But what's next? What could be the next big real life global disaster movie that we are largely unprepared for.

Top of the list is - CLIMATE CHANGE!

Despite all of the noise, we actually are facing a CLIMATE CHANGE CATASTROPHE!

As you can see with the storms and fire's it's not a steady trend but the regular unleashing of Environmental CHAOS!

Couple that with the potential for catastrophic events, such as the collapse of the Antarctic Thwaites Glacier that is being warmed from underneath by temperatures 2 degree ABOVE freezing! I suspect this glacier is heading for a catastrophic breakup that would send sea levels soaring in months not decades! Worse still it acts as a plug to the mile deep antarctic ice sheets that would accelerate their journey into the ocean thus triggering relentless sea level rise where human response will always be one step behind.

So if you live near the coast then you bloody well better start thinking about selling up and moving to higher ground whilst some lemming is prepared to pay top dollar for your property because climate change is going to bite coastal communities hard on the arse! It's coming for you! Probably sooner than later! Whilst the other consequences of climate change will take decades to unfold, it's the coastal impacts of flooding that will be felt THIS decade, maybe even as soon as next year!

Another is what I have already covered in-depth - Coronal Mass Ejection that knocks out the power grids from weeks to possibly several months. There's little ordinary folk can do, it's upto the governments, power companies and the energy grids to build in redundancy so that a CME event does not result in the chaos that would follow sustained loss of power.

BIO-TERRORISM

With each passing year it becomes ever cheaper and easier to manipulate DNA the to point someone in their bedroom with say $5k of kit can start sowing the seeds of the next pandemic!

So I think we are in for a future where testing and localised lockdown's are going to increasingly become the norm in response to detected threats that presents a permanent growing income stream for big pharma and the biotech sector.

The rest of this extensive analysis has first been made available to Patrons who support my work -

AI Stocks Multi Buying Levels to Capitalise on the Stock Market Panic of 2022

THE VALUATION RESET

INVESTORS SEDUCED BY STOCK CHARTS COMPLETELY MISS THE THE BIG PICTURE!

QUANTUM COMPUTERS

AI Tech Stocks 2022 Correction

Stock Market Trend Forecast Current State

Dow Max Draw Down 2022

ACCUMULATE DEVIATIONS FROM THE HIGHS IN GOOD STOCKS!

NEW STOCKS

The Fishes that Have So Far Gotten Away

AI Tech Stocks Funds Revision

QUANTUM AI STOCKS MULTI BUYING LEVELS

NEW Investors

NETFLIX - You Cannot Say You Weren't Warned!

ARKK MATHS

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Pandemic Rear View Mirror - Next Potential Catastrophe?

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Stock Market Trend Forecast Mid Feb to End 2022

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

A Stock Market Top for the Ages" Video

FREE Access FOR our readers to Robert Prechters 20 minute video presentation with 28 charts that give a birds eye view of todays markets, FREE access to the video worth $99 with this coupon code: STOCKTOP. Simply click the link and enter the code,

Free, watch "A Stock Market Top for the Ages" with code STOCKTOP now >>

Best Stock Investing Platforms

In response to patron requests here are what I consider 2 good 'investing platforms' for the primary reason that both allow tiny position sizes, including fractional shares and do not charge a trading commission instead make their profits off the buying and selling spread.

ETORRO

NO fees, no commission for regular stock investing, platform is US dollar based so when someone from the UK deposits funds they get converted to a dollar balance, unless one deposits dollars directly via the likes of paypal. The platform is fairly straightforward to get to grips with and offers limit orders right off the bat.

The coverage of stocks is good, for instance one can invest in other than US stocks i.e. UK and Hong Kong listings.

The only negative as far as I am concerned is that there is no ISA, or other tax free wrapper, so my exposure to Etorro is limited for tax reasons.

Follow this link to get started.

FREE TRADE

This is the best for me and likely most UK investors for the primary reason that it is basically ETORRO within an ISA tax free wrapper.

As is the case with ETORRO, no commission when trading, fractional shares, and no minimum buy.

However, there is an 0.45% fx fee when buying US stocks of which is a lot lower than most other UK brokers such as ii.co.uk and AJ Bell.

Note that for the ISA one needs to PAY a monthly fee of £3 or £10 for ISA plus LIMIT orders. However, this £10 fee can be wholly offset by depositing at least £4k as Free trade pays 3% interest on balances upto £4k thus the £10 monthly fee is fully returned as interest. Also the interest is paid on the total cash balance regardless of whether funds are committed to limit orders or not.

Free Trade also give a free share worth between £3 and £200 when signing up and depositing your first £1. Okay so they say 'upto £200" but in my experience the upto is more like £10, so keep ones expectations grounded between £3 to £10 then you won't be disappointed by FREE TRADES over inflated sales pitch.

HOW to Get the FREE SHARE FROM FREETRADE

To get the FREE SHARE then you must sign up using my referral link , then we both get 1 free share worth upto '£200' (£3 to £10). However you must follow the link as just downloading the app from the app store won't work, you wont get a free share that way it has to be by way of referral.

Steps to Get a free Share

1. Click this link that takes you to he Free Trade Free Share web page

2. Follow instructions to download the Free Trade App

3. Deposit at least £1.

4. Get your free share worth between £3 and £200 £10 within 7 to 10 days.

I use both of these platforms. Etorro for trading in and out of small positions, as that is what it encourages one to do. And FREE TRADE for accumulating positions for the long-run.

Also note that UK FSCS investor protection is upto £85k so I would not go over that limit with Free Trade.

Your analyst contemplating his net big buys during the next stretch of panic selling.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.