S&P 500 Correction – No Need to Hold Onto Your Hat

Stock-Markets / Stock Market 2021 Feb 21, 2021 - 04:12 PM GMTBy: Submissions

Yesterday‘s bearish price action in stocks was the kind of shallow, largely sideways correction I was looking for. Not too enthusiastic follow through – just rocking the boat while the S&P 500 bull run goes on. Stocks are likely to run quite higher before meeting a serious correction.

As I argued in yesterday‘s detailed analysis of the Fed policies, their current stance won‘t bring stocks down. But it‘s taking down long-term Treasuries, exerting pressure on the dollar (top in the making called previous Monday), and fuelling commodities – albeit at very differnt pace. The divergencies I have described yesterday, center on weak gold performance – not gaining traction through the monetary inflation, instead trading way closer in sympathy with Treasury prices.

Gold has frontrunned the other commodities through the corona deflationary shock, and appears waiting for more signs of inflation. It didn‘t make a final top in Aug 2020, and a new bear market didn‘t start. It‘s my opinion that thanks to the jittery Treasury markets, we‘re seeing these dislocations, and that once the Fed focuses on the long end of the curve in earnest, that would remove the albatross from gold‘s back.

I can‘t understate how important the rising yields are to the economy (and to the largest borrower, the government). Since 1981, we‘ve been in one long bond bull market, and are now approaching the stage of it getting questioned before too long. The rates are rising without the real economy growing really strongly, far from its potential output, and characterized by a weak labor market. Not exactly signs of overheating, but we‘ll get there later this year still probably.

It‘s like with generating inflation – the Fed policies for all their intent, can‘t command it into happening. The Treasury market is throwing a fit, knowing how much spending (debt monetization) is coming its way, and the Fed‘s focus is surely shifting to yields at the long end. Bringing it under control would work to dampen the rampant speculation in stocks, and also lift gold while not hurting commodities or real economy recovery much. Sounds like a reasonable move (yield curve control), and I believe they‘re considering it as strongly as I am talking about it.

Let‘s quote yesterday‘s special report on gold, inflation, and commodities:

(…) the wave of new money creation (we‘re almost at double the early 2020 Fed‘s balance sheet value - $4T give or take then vs. almost $7.5T now – and that‘s before the multiplier in commercial banks loan creation kicks in) keeps hitting the markets, going into the real economy, predictably lifting many boats. It‘s my view that we have to (and will) experience a stock market bubble accompanied by the precious metals and commodities one – to a degree, simultaneously, for the stock market is likely to get under pressure first. Again, I am talking the big picture here – not the coming weeks.

Let‘s examine the bear market is gold – some say that the late 2015 marked bottom, I‘m of the view that the 2016 steep rally was a first proof of turning tide. But the Fed got serious about tightening (raising rates, shrinking its balance sheet), and gold reached the final bottom in Aug 2018. Seeing through the hawks vs. dove fights at the Fed in the latter half of 2018 (December was a notable moment when Powell refused to the markets‘ bidding, remained hawkish in the face of heavy, indiscriminate selling across the board – before relenting).

Since then, gold was slowly but surely gathering steam, and speculation in stocks was on. The repo crisis of autumn 2019 didn‘t have a dampening effect either – the Fed was solidly back to accomodative back then. These have all happened well before corona hit – and it wasn‘t able to push gold down really much. The recovery from the forced selling, this deflationary episode (which I had notably declared back in summer 2020 to be a one-off, not to be repeated event), was swift. Commodities have clearly joined, and the picture of various asset classes taking the baton as inflation is cascading through the system, is very clear.

Let‘s get right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook and Its Internals

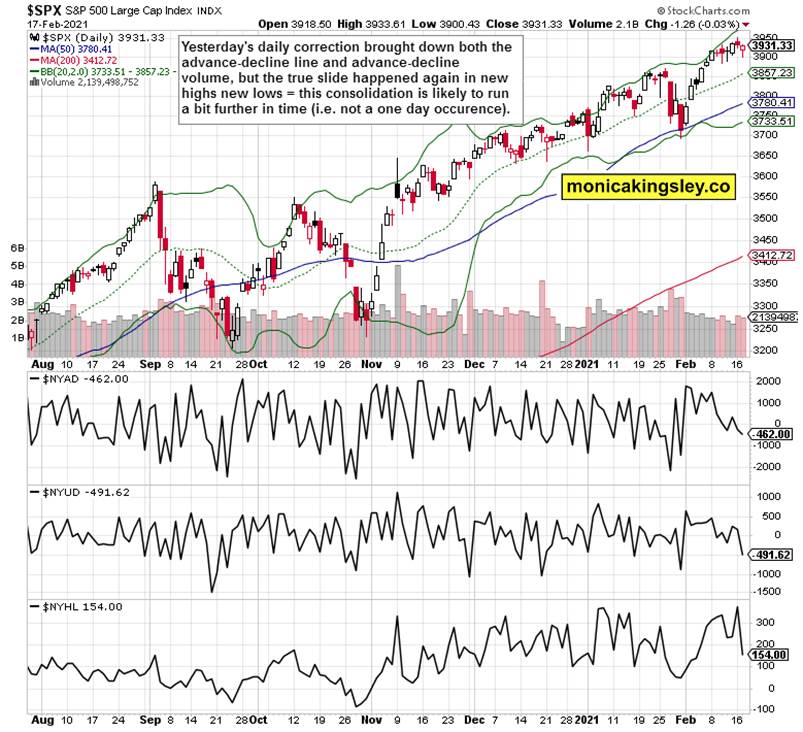

Finally, a daily downswing – not meaningful, but it‘s as good as it gets. The slightly lower volume though shows that there is not a raging conviction yet that this sideways move is over.

The market breadth indicators aren‘t at their strongest. Both the advance-decline line and advance-decline volume dipped negative, which isn‘t worrying unless you look at new highs new lows as well. While still positive, $NYHL is showing a divergence by moving below the mid-Feb lows. Seeing its decline to carve a rounded bottom a la end Jan would be a welcome sight to the stock bulls. Before then, nothing stands in the way of muddling through in a shallow, corrective fashion.

Credit Markets and Treasuries

The divergence in both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – show the bond market strains. HYG:SHY clearly supports the S&P 500 rally, while LQD:IEI isn‘t declining in tandem with long-term Treasuries. Instead, it‘s carving out a bullish divergence as it‘s trading well above the Sep and Oct lows – unlike the TLT.

Speaking of which, such were my words yesterday, calling for a Treasury reprieve to happen soon:

(…) Long-term Treasuries (TLT ETF) are the key chart on my radar screen right now. The rise in yields is accelerating, and if progressing unmitigated, would throw a spanner into many an asset‘s works. Even though it‘s not apparent right now, there is a chance that we‘ll see a slowdown, even a temporary stabilization, over the coming sessions. The larger trend in rates is higher though, and in the dollar to the downside.

The dollar is still topping out, and a new daily upswing doesn‘t change that – I look for it to be reversed, and for the new downleg reasserting itself.

Gold, Silver and Commodities

The encouraging, budding short-term resilience of gold to rising Treasury yields, got a harsh reality check yesterday. While the latter ticked higher, gold declined regardless. Closing at the late Nov lows, it‘s still relatively higher given the steep rise in long-term Treasury yields since. A bullish divergence, but a more clear sign of (directional) decoupling (negating this week‘s poor performance) is needed.

Let‘s look again at gold, silver, and commodities in the medium run. Silver decoupled from gold since the late Nov bottom in both, while commodities haven‘t really looked back since early Nov. Till the end of 2020, gold wasn‘t as markedly weak as it has become since, and actually tracked the silver recovery from the late Nov bottom. And the reason it stopped, are the long-term Treasury yields, which quickened their rise in 2021. It looks like an orderly decline in TLT is what gold would appreciate – not a rush to the Treasury exit door.

Summary

The bearish push in stocks has a good chance of finally materializing also today. How strong will its internals be, will it entice the bulls to step in again? Signs are for this correction to run a bit longer in time – but the stock bull run is firmly on, and there are no signals thus far pointing to an onset of a deeper correction right away.

The gold bulls recovered a little of the lost ground, but that doesn‘t flip the short-term picture their way in the least. While the yellow metal is leading silver today, its overall performance in the short run remains disappointing, and the silver-gold spread trade I introduced you to a week ago, a much stronger proposition. Still, given the miners‘ signals, unprecendented monetary and fiscal stimulus, unfolding real economy recovery, inflation making its way through the system, and the dollar struggling to keep its head above water, the new PMs upleg is a question of time.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.