3 Dividend Paying Stocks to Ride the New Housing Boom

Housing-Market / Housing Stocks Jan 27, 2021 - 05:14 PM GMTBy: Robert_Ross

Dear Reader,

The Cleveland Browns are playing in the postseason for the first time since 2002. But this almost didn't happen because of a COVID-19 outbreak at their training facility.

The Browns didn't miss a moment of practice time. Rather than hit the field, players and coaches huddled over Zoom (ZM). And they went on to win their matchup with the Pittsburgh Steelers that made this 17-years-in-the-making victory possible.

Even if the Browns don't make it to the Super Bowl on February 7, their MVP moves will go down in history as a sign of these unusual times.

The Remote Work Revolution Is Here to Stay

Remote work isn’t ideal for pro footballers, whose jobs require extreme physical contact. But in the offseason, they can live virtually anywhere.

Because of the pandemic, other companies have become more willing to let workers keep some virtual skin in the game for the foreseeable future.

That's given technology stocks—including video conferencing, cloud software, and hardware-upgrade trades—a good run.

For the next round of big profits, look to the "home" team…

Working from (Someone Else's) Home

Since they can work from anywhere with an internet connection, many millennials—those 26 to 40 years old—are fleeing expensive cities like New York City, San Francisco, and Chicago.

But not everyone is buying a bigger house in the suburbs. Instead, some workers are renting short-term furnished housing.

San Francisco-based furnished apartment renter Sonder says stays of longer than 14 days now account for 60% of the company’s business. That’s up from less than 25% pre-pandemic.

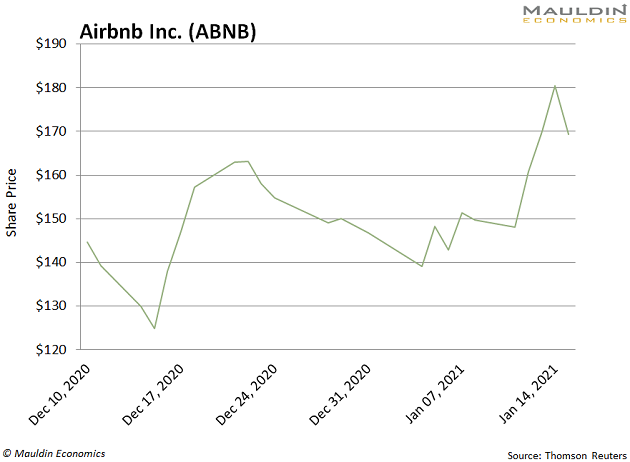

While Sonder is still private, the largest company in the furnished apartment space, Airbnb Inc. (ABNB), recently went public:

The company’s platform hosts 5.7 million active listings and booked nearly 250 million guests in 2019. As the remote work boom continues, I expect Airbnb to continue to profit.

If You Build It, Profits Will Come

There are still plenty of people buying real estate. And they are paying top dollar to do it.

While housing prices typically fall during recessions, the opposite happened in 2020.

Source: Federal Reserve Bank of St. Louis

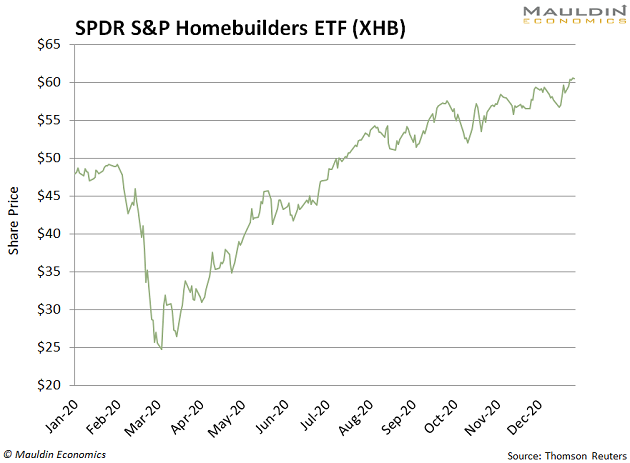

That fact has sent housing stocks through the roof. For instance, the SPDR S&P Homebuilders ETF (XHB) is up 86% since March.

And this trend is being driven by millennial home buying…

For years, this generation has struggled with homeownership. High student loan debt, soaring housing prices, and a weak jobs market have restricted home buying.

That’s especially true since many millennials lived in big cities (where most high-paying jobs are located). And buying a home near a big city is near impossible.

Now that millennials can keep their jobs but work remotely, they are moving their growing salaries to less competitive housing markets.

This Growing Trend Pays Big Dividends

My proprietary Dividend Sustainability Index (DSI) helps me separate the “safe” from the “unsafe” dividend payers. After 2020 saw the most dividend cuts since the global financial crisis, it’s more important than ever to know your dividend is safe.

And any of these stay-at-home stocks would be worthy of a spot in your long-term portfolio…

- Whirlpool (WHR) is at the top of my home "buying" list.

The company is one of the largest home appliance companies in the world, making everything from washing machines to freezers.

But even better is the company’s dividend yield.

WHR pays a rock-solid 2.4% yield on a low payout ratio.

When you add in solid free cash flow and low debt, WHR earned a 96/100 on the DSI.

- Home Depot (HD) serves a dual purpose as a real estate and technology play.

The company is the world’s largest home improvement retailer. While it has a solid physical footprint with 2,300 warehouses, HD is also the fifth-largest ecommerce company in the US.

The company has increased its dividend payout every year since 2009.

And since my DSI gives HD’s 2.1% dividend yield a 100/100 score, there’s little doubt management will keep raising the payouts over the coming years.

- Leggett & Platt (LEG) should remain in style for a good long while.

While the company is known for its engineered components and furniture, I know it as a Dividend Aristocrat. That means it has increased its dividend for more than 25 years in a row.

I don’t expect that trend to end anytime soon. The company’s strong free cash flow and dividend history earned it a 90/100 on the DSI. That means that LEG’s 3.6% dividend yield is suitable for any income investor’s portfolio.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2021 Copyright Robert Ross - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.