Why a Second Depression is Possible but Not Likely

Economics / Economic Depression Mar 20, 2020 - 10:35 AM GMTBy: Submissions

Almost everyone who deals in stocks and shares possesses at least a cursory knowledge of the 1929 stock market crash and subsequent Great Depression that crippled the US and sent economic shock waves across the entire globe. With markets tanking on fears of an extraordinarily serious coronavirus event, some are asking if the late 1920s and early 30s could repeat themselves in short order.

The short answer is this: while a second depression is entirely possible, it is not very likely. There are several systemic differences in the financial systems of 1929 and 2020. Moreover, the Great Depression cannot be blamed entirely on the stark market crash. The crash was but a symptom of a much bigger problem. It was also just one factor that went into creating what was arguably the largest financial crisis in modern history.

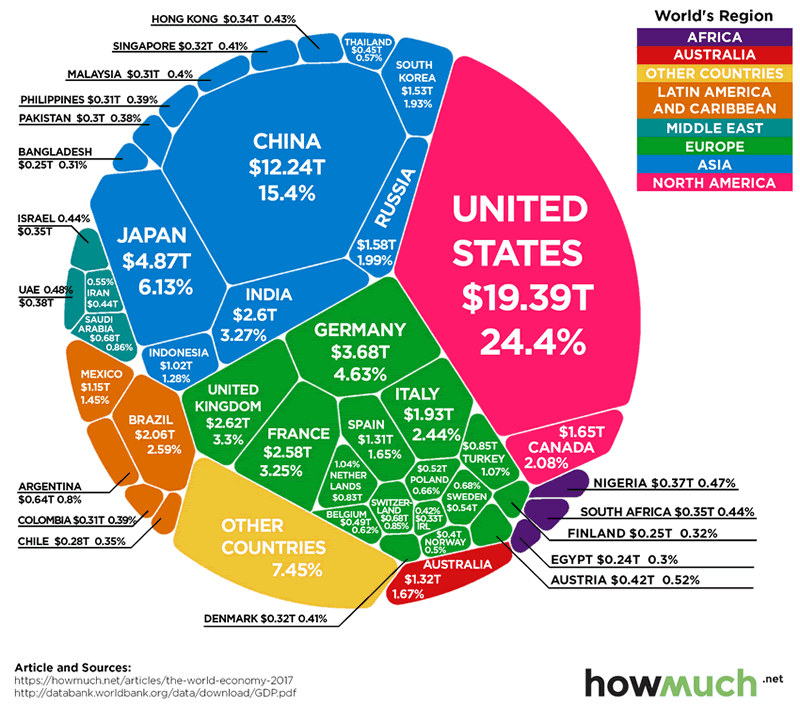

It is true that world markets have been dealt a substantial blow by fears of what coronavirus has in store. But they come in the midst of an otherwise strong global economy. That wasn't the case in 1929. But even a strong economy does not fully explain where we are at. So, let us look at the reasons why a second depression is possible but not likely.

Why It's Possible

Stock market volatility is always an economic risk. For an individual trader with a small share dealing account that handles only a dozen or so trades yearly, volatility doesn't go much beyond how it affects his portfolio. Volatility is a much bigger problem for institutional investors. As such, any time you have big swings in the market you have the potential for trouble.

There is no doubt that world stock markets are now closely dangerous to bear territory. This could be enough to spook institutional investors and cause massive sell-offs that would put a lot of big corporations in serious financial trouble. Yet stock market volatility is not the only thing to be concerned about. There are other factors that could contribute to a second depression:

- Reduced Economic Output – The best antidote to a large-scale economic downturn is increased economic output. Right now, we have been forced into reduced output due to industries shutting down and social distancing being recommended. If economic output falls far enough, there could be problems.

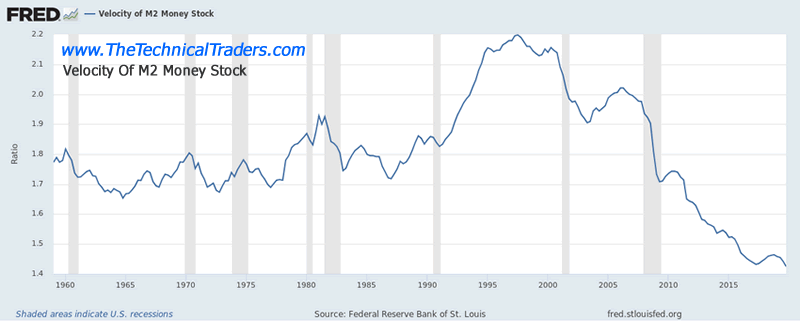

- Government Interference – Central banks tend to rely on quantitative easing programmes to keep markets liquid during times of economic distress. However, the government can only borrow and print money for so long before damaging inflation kicks in. Just ask Venezuela.

- Artificial Deflation – Deflation is normally considered a good thing for consumers. However, when it is the result of artificial influences, deflation damages the economy by making it harder for businesses to raise prices and pay their workers more.

These are just four of the reasons it is reasonable to say that a second depression is possible. Now let's look at the other side of the coin.

Why It's Not Likely

For all of the devastation the 1929 crash and subsequent Great Depression caused, at least we learned from the mistakes of the past. So first and foremost, markets now have built-in controls that prevent them from losing too much value over a given amount of time. These controls should prevent an all-out market collapse.

Here are some other reasons a second depression is not likely:

- Monetary Policy Changes – Central-bank monetary policies prior to the 1929 crash were largely contractionary. Today, it's just the opposite. As long as everyone plays by the same rule book, expansionary monetary policies are designed to limit the damage of economic downturns.

- Strong Housing – At the end of the day, real property is the stuff that personal wealth is built on. The current housing market is as strong as it's been since the last financial crisis began in 2008. Provided the coronavirus scare is over within a couple of months, there's no reason to believe that housing will crash.

- Strong Employment – The world went into the coronavirus outbreak with very strong employment numbers. Likewise, there is still work to do and people to do it. The amount of work that will need to be done after all of this is over will be significant as well. In essence, productivity is just chomping at the bit to get going again.

At the heart of all of this are the nervous investors with the most twitchy of fingers. This entire discussion would not even be necessary if investors would just sit tight and do nothing during events like the coronavirus outbreak. There is simply no reason to panic. There is no reason to pull every last pound out of the markets and put it into bonds and treasury bills instead.

Unfortunately, that is not what happens. Nervous investors pull out at the very first sign of discomfort. Strangely enough, all it takes is a few sentences uttered by a politician and the same investors will get right back into the markets the following day. Hence the volatility. It is foolish and completely unnecessary.

Thankfully, we are not likely to fall victim to nervous investors as happened in 1929. A second depression, while possible, is not likely.

By Russell Fenton

© 2020 Copyright Russell Fenton - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.