Gold, Silver and Copper The 3 Metallic Amigos and the Macro Message

Commodities / Gold & Silver 2019 Nov 08, 2019 - 06:39 PM GMTBy: Gary_Tanashian

This morning in pre-market the Amigos’ futures charts update the macro story…

…which goes something like this…

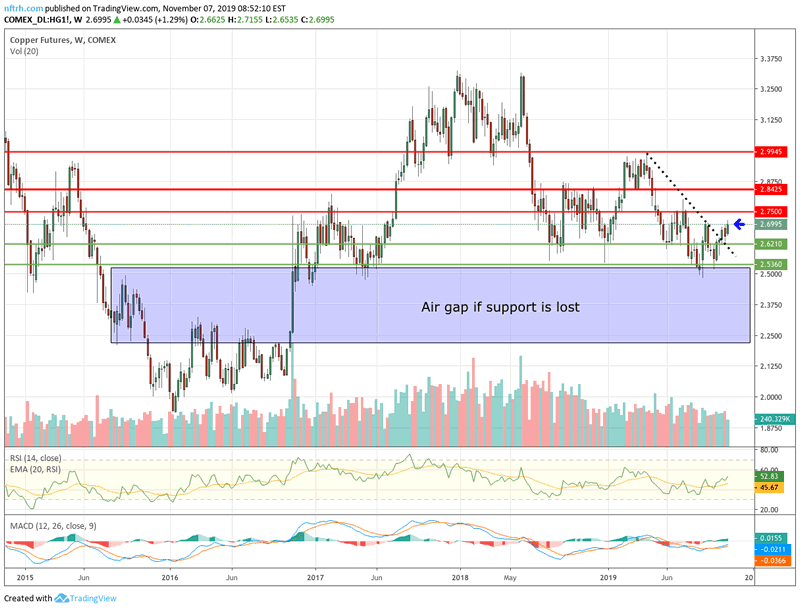

Copper, the cyclical Amigo (weekly chart) has furthered the intermediate trend line break we noted on October 25th. This is in line with the rally in US and global stock markets and even more so, the global macro reflation theme. It does not look so impressive yet on this weekly chart, but other components of the macro trade are starting to look impressive, especially on daily charts. So… steady as she goes.

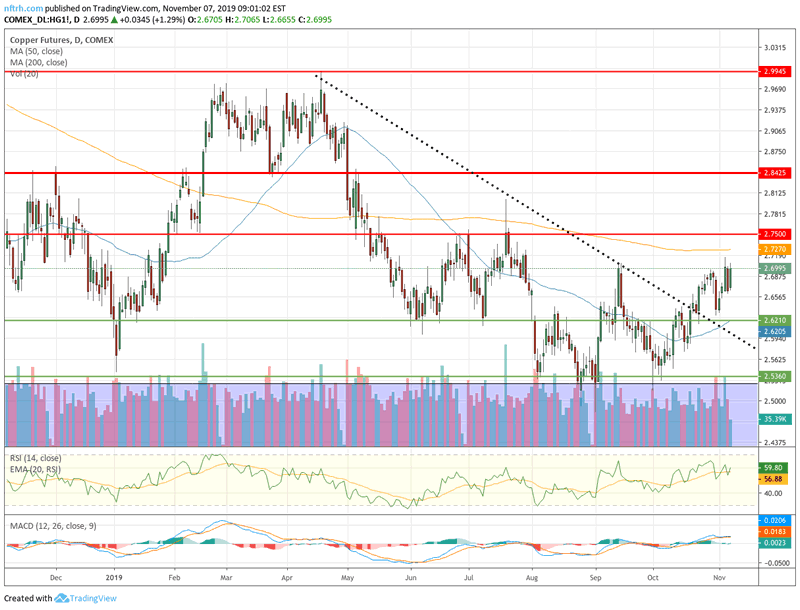

Here is daily Copper, for reference. The trend is still gently down but it’s rising to test the SMA 200. Take that and 2.75 resistance out and the good Doctor will be in business. Also of note, Doc’s Industrial bros (GYX) are looking better as a group.

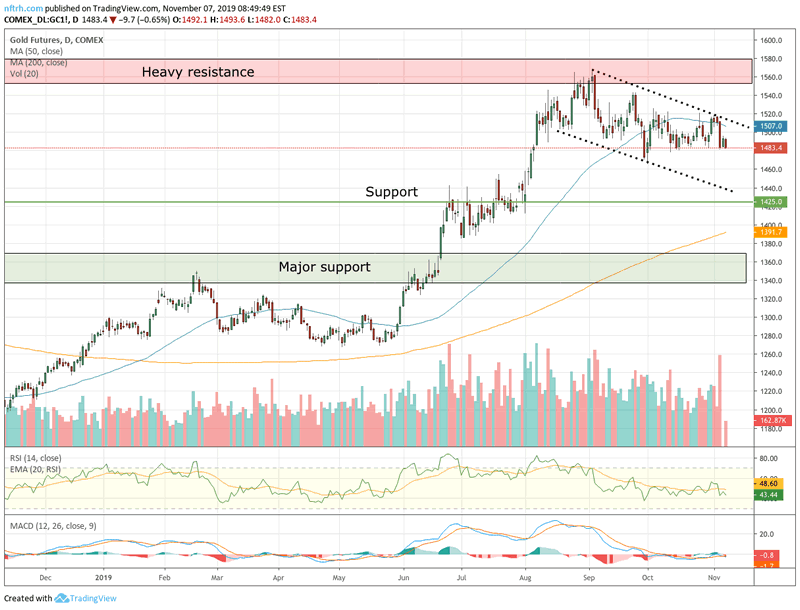

Gold, the counter-cyclical Amigo is in something of a consolidation channel as opposed to the minor topping pattern I’d previously thought it was. 6 of one, half a dozen of the other. It’s correcting as it should during the initial phase of the macro trade. Why? Well several reasons, but a major reason was viewable well ahead of time, and view it we did… Bond Yield Continuum and Gold, on August 8th.

If/as the global macro reflation bid keeps up gold is likely to at least test initial support at 1425. I think that the world would have to get very bullish and risk would have to slam to full ‘on’ in a global punch-drunk party for gold to test major support, but there it is anyway. Respect it. That was the breakout area that indicated a new cyclical bull.

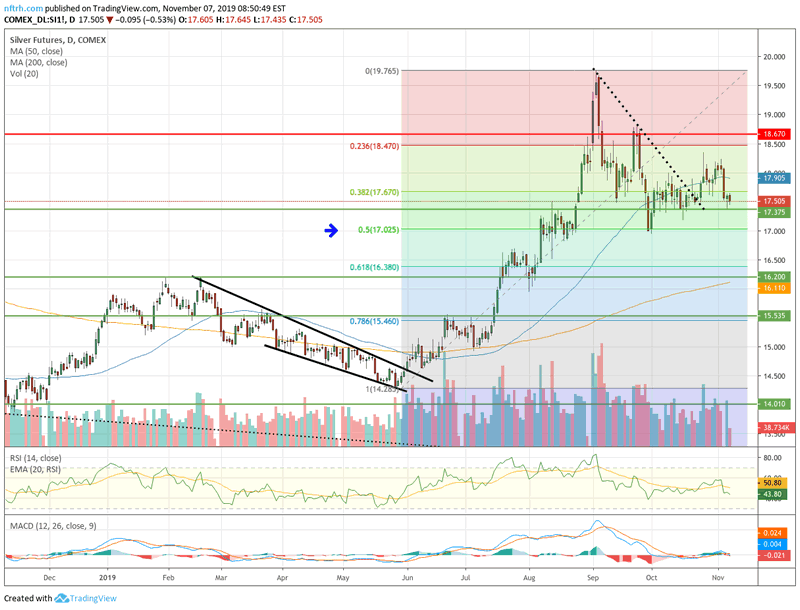

After the cyclical and counter-cyclical metals above of course we have the cross-dresser metal. He of the commodity (cyclical) and precious (counter-cyclical/monetary) characteristics.

Silver did great work to Fib a 50% retrace to 17 after dynamically exceeding the NFTRH upside resistance target and promptly diving back below it. But in dropping back below the SMA 50 it continues to hold open a deeper (62%) retrace potential, which would generally correspond with a healthy test of the rising SMA 200 and very significant lateral support. That’s what they call a buying opportunity if it comes about.

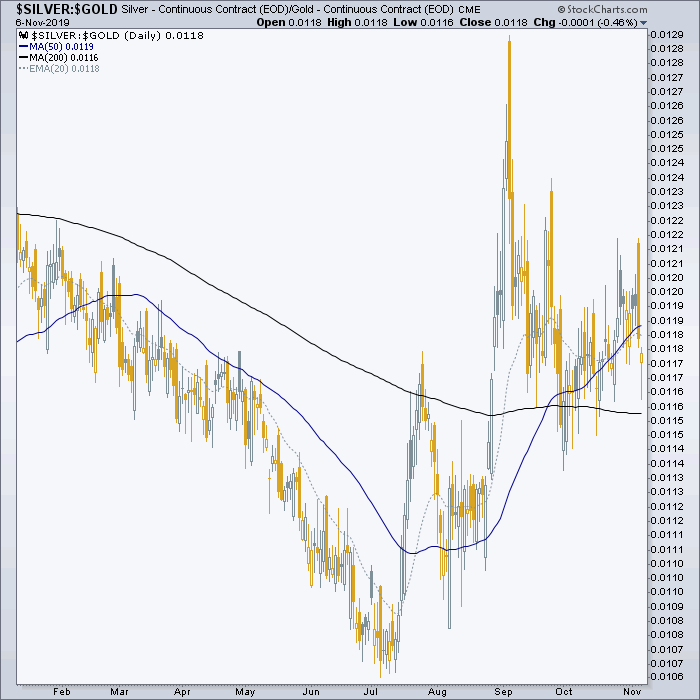

As to what’s ahead in 2020, my plan has been ‘global macro inflation/reflation’ and bullish. But the Silver/Gold ratio has been clinging to an intermediate uptrend (tested fairly harshly yesterday) and as such, is macro (and inflation) positive, lately guiding us to pull in that prospect to Q4 2019.

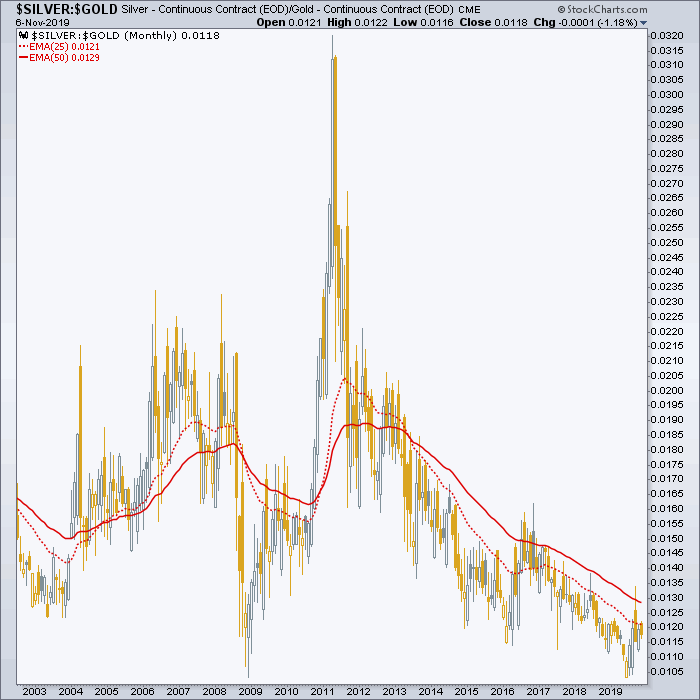

Unfortunately, the big picture remains far from a positive signal.

So it is possible that the Q4 2019 party atmosphere could unwind into a bearish first half of 2020. If however, yield curves continue to steepen, inflation gauges continue to bounce (along with nominal long-term yields), global markets firm their up-trends and the picture directly above breaks out for real (unlike 2016’s head fake) then a global macro trade in 2020 could be something to behold.

So say Cu, Au and Ag; the 3 Metallic Amigos… plus a whole raft of other indicators we cross-reference each week in NFTRH (because it would be foolhardy to just use one silly shtick with 3 characters from a goofy 1980s movie with metallic chemical symbols painted on their sombreros as your entire macro analysis, now wouldn’t it?).

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.