Stock Market $SPY Expanded Flat, Déjà Vu All Over Again

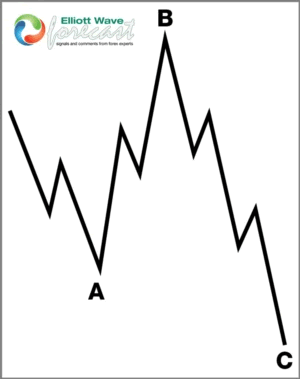

Stock-Markets / Stock Markets 2019 Nov 04, 2019 - 09:10 AM GMT A Flat is one of the corrective structures in the Elliott Wave Theory. It is in our opinion the most dangerous and also less reliable structure. The reason is because a Flat allow analysts and traders to force a bias against the trend. Many times the market fails to reach traders’ correction target. When the market reacts different to the expectation and breaks into new highs or lows, analysts like to call an expanded flat as a way out. This is the last resource to prove they are not wrong in their original forecast. The structure of expanded flat looks like the following chart below:

A Flat is one of the corrective structures in the Elliott Wave Theory. It is in our opinion the most dangerous and also less reliable structure. The reason is because a Flat allow analysts and traders to force a bias against the trend. Many times the market fails to reach traders’ correction target. When the market reacts different to the expectation and breaks into new highs or lows, analysts like to call an expanded flat as a way out. This is the last resource to prove they are not wrong in their original forecast. The structure of expanded flat looks like the following chart below:

As the above chart shows, Expanded Flat structure allows the B wave to break above the beginning of the A wave. This let analysts call an expanded Flat and force the downside when in reality the instrument has broken the previous high and may start a new bullish move. This is the last resort for analysts who do not want to accept that the correction has ended and that the trend has resumed higher.

At EWF, we have added new rules to the Elliott Wave theory. One of them is that we never call a Flat against the trend unless it is supported by sequence or Market correlations. At this moment, this exception does not apply to $SPY or any World Indices. As we said earlier, the Expanded Flat is a very dangerous structure. It is one of the reasons the Elliott Wave Theory gets a bad reputation.

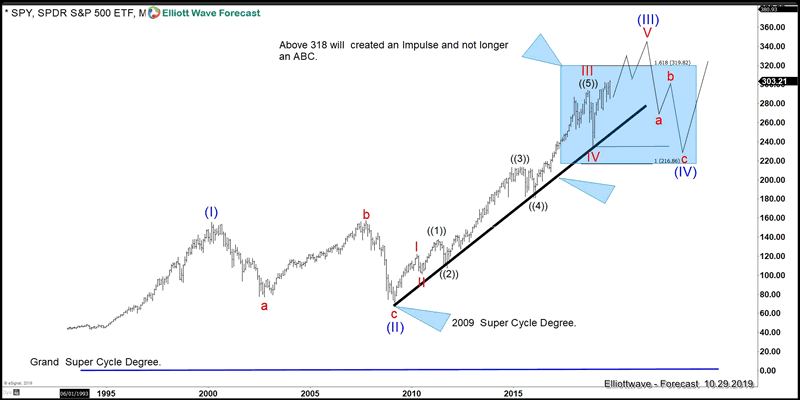

Back in 2010-2012 many analyst around the world were calling the $SPY to break 2009 lows as the move lower from 2008 peak is impulsive. Despite the subsequent rally, analysts forced a flat until 2014, when another 3 waves lower can happen. Today, many analysts also call for another expanded Flat. But first, below is what we believe happen in $SPY:

The Index will extend within the wave V and 340.00-360.00 area will be seen by the Summer of 2020. We believe the Index is nesting and should be breaking with acceleration higher sometimes next month before the powerful wave (III) within the Super cycle degree ends.

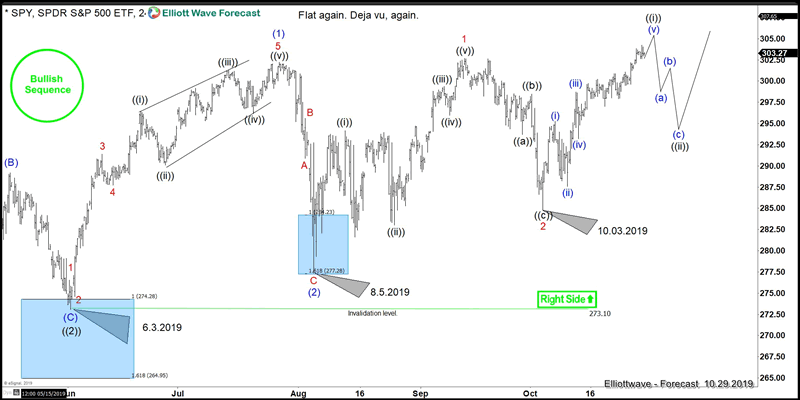

4 Hour $SPY Elliott Wave Chart

The chart above shows $SPY 4 Hour view which is a nest or series of 1-2. If we count the swings from 6.2019 low, it has 5 swings which is bullish. However, analysts can force the view of an Expanded Flat from May 2019 high or from July 2019 high. The Elliott Wave Theory allows analysts to call an Expanded Flat without violating any of the rules and that is what makes the Expanded Flat very dangerous because traders and analysts feel like nothing is wrong with the Flat count.

We look at the market correlation like $SEKJPY, $XOM, $CL_F among others and understand that the trend is higher. Based on the holistic view of the market, we think an extension higher in SPY and thus the World Indices is the more probable path. More importantly, we follow the rule of never call a Flat against the obvious trend. At the end, déjà vu all over again with the Expanded Flat.

The Following video explain the idea.

By EWFEric

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2019 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.