Money Printing Fuelled Stocks Bull Market Hurtling Towards Financial Crisis 2.0

Stock-Markets / Stock Markets 2019 Oct 24, 2019 - 04:58 PM GMTBy: Nadeem_Walayat

The stock markets so far have confounded expectations for a deeper October correction by dutifully rallying for an assault on resistance, with the Dow trading to barely 0.5% of its all time high, all whilst the Trump and the Brexit chaos shows continue in the US and the UK. So how can this be? To once more iterate the general indices are on an exponential upwards curve, where deviations from the highs being buying opportunities for the fundamental reason of exponential money printing by whatever names it may go, QE, government bonds etc.. Governments of the world continue to print money that drives the exponential inflation mega-trend to which stock and other asset prices are leveraged.

The stock markets so far have confounded expectations for a deeper October correction by dutifully rallying for an assault on resistance, with the Dow trading to barely 0.5% of its all time high, all whilst the Trump and the Brexit chaos shows continue in the US and the UK. So how can this be? To once more iterate the general indices are on an exponential upwards curve, where deviations from the highs being buying opportunities for the fundamental reason of exponential money printing by whatever names it may go, QE, government bonds etc.. Governments of the world continue to print money that drives the exponential inflation mega-trend to which stock and other asset prices are leveraged.

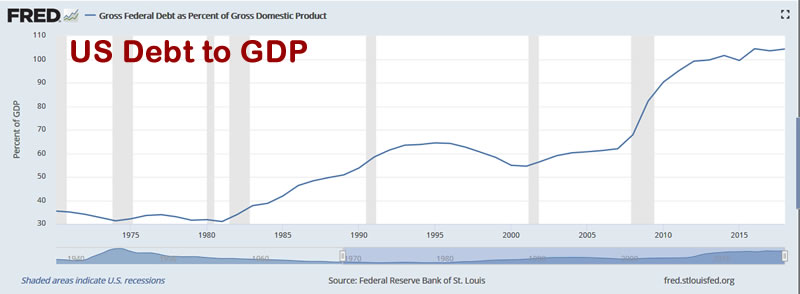

A look under the US economies hood soon reveals that Trump for all his bluster has acted as an accelerant to the United States money printing binge by running a budget deficit of $1 trillion per year that looks set to mushroom to $1.5 trillion that puts the US economies $22+ trillion debt mountain on 106% of GDP! 106% of GDP!

I recall not so long ago a debt to GDP ratio north of 80% was deemed as being dangerously high, now most of the western economies are gravitating towards 100% as being 'normal' (except Germany). Of course it's not normal! Even if the US has the worlds reserve currency the effect is to introduce greater financial instability making the world markets more prone to experiencing wild gyrations in response to credit crisis events.

And don't think that a Democrat administration would change this trend trajectory, not when one incorporates the WAR WITH CHINA MEGA-TREND!

- 27 Dec 2016 - The Trump Reset - Regime Change, Russia the Over Hyped Fake News SuperPower (Part1)

- 28 Dec 2016 - US Empire's Coming Economic, Cyber and Military War With China (Part 2)

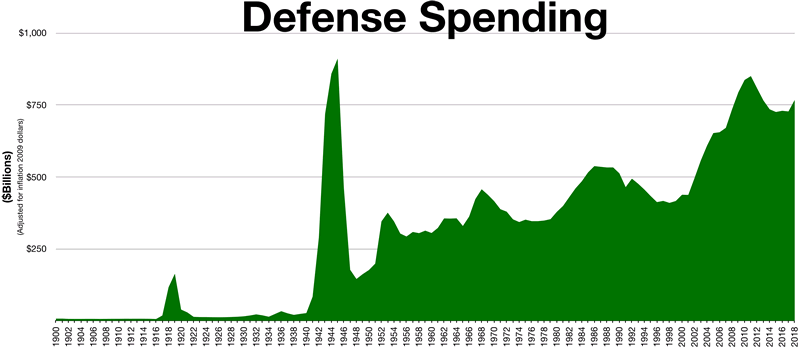

Wars, even cold ones COST MONEY! Look to see an expensive cold war battle between the US and China unfold as both continue to ramp up defence spending which is why I have been strongly suggesting to invest in the Defence sector since December 2016 as a major beneficiary of the War with China Mega-trend.

Here's what the Defence spending mega-trend looks like -

(adjusted for inflation)

The United States is on WAR footing, spending on par with that during WW2 as a consequence of the War with China Mega-trend. Now it remains to be seen who will go bankrupt first (maybe both)?

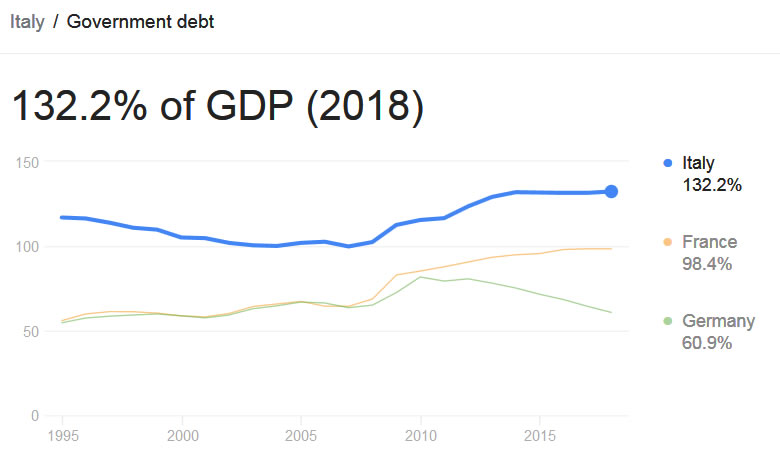

And whilst all eyes in Europe are on Britains continuing Brexit crisis, the ticking time bomb that is the euro-zone continues to hurtle towards Financial Crisis 2.0. With Italy sat on a debt mountain at 133.4% of GDP being the prime candidate for triggering Europe's next financial crisis event with Spain and Portugal not far behind, and all it would likely take is a relatively mild recession to see these nations debt ratios explode much higher triggering credit panic and German tighter control over it's euro-zone empire.

So whilst we invest in stocks leveraged to government money printing debt binge inflation mega-trend consequences, we are rumbling towards a day of reckoning, a bigger financial crisis than 2008 that perhaps climate change will act as a trigger towards i.e. that we can no longer rape and pillage the environment without consequences. Until then, as stock investors in 'good growth stocks' we enjoy the benefit of being leveraged to the actions of fools that run our governments and central banks who effectively continue to hand out free money to stock investors.

So be under no illusions we are on the train to Financial Crisis 2.0, a global government debt induced crisis. 106% of GDP AND INCREASNG is NOT sustainable! Where when the CRASH happens (not imminent) we will first get some DEFLATION followed by a massive surge in INFLATION as the governments double down on money printing in QE 4 EVER! So remain invested in 'safe' assets that are leveraged to the exponential inflation mega-trend that includes stocks leveraged to the AI mega-trend.

(Charts courtesy of stockcharts.com)

The Dow last closed at 26788 after retreating from its most recent high of 27,100 in recovery from the nosebleed plunge at the start of October.

Dow Stock Market Trend Forecast October Update

The rest of this analysis that concludes in a detailed trend forecast into the end of 2019 has first been made available to Patrons who support my work. Dow Stock Market Trend Forecast October Update

- Stock Market Trend Forecast Current State

- Short-term Trend Analysis

- Long-term Trend Analysis

- MACD

- Elliott Waves

- Formulating a Stock Market Forecast

- Dow Stock Market Forecast Conclusion

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- Gold / Silver Updates

- US Dollar Index

- NASDAQ

- EuroDollar Futures

- EUR/RUB

Recent Analysis includes:

- Dow Stock Market Trend Forecast October Update

- Dow Stock Market Trend Forecast Oct to Dec 2019

- Bitcoin Price Analysis and Trend Forecast

- British Pound Trend Forecast vs "Dead in a Ditch" BrExit Civil War General Election Chaos

- Stock Market Trend Forecasts When Mega-Trends Collide

- How to Invest in AI Stocks with Buying Levels

- China SSEC Stock Market Fundamentals and Trend Analysis Forecast

- Silver Investing Trend Analysis and Price Forecasts 2019 Update

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

By Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.