Gold Leads, Will the Rest Follow?

Commodities / Gold & Silver 2019 Sep 21, 2019 - 09:51 AM GMTBy: The_Gold_Report

Fund manager Matt Geiger provides his overview of the resource market and shares some principles he is using to invest in today's market. The natural resource landscape has shifted dramatically since the end of 2018. At the time, we were still nursing our wounds from an unexpectedly vicious 2018 and hoping to avoid a repeat performance in 2019. I did speculate that "we may have already exited the bear market as of late December 2018. The nickel price is up roughly 25% YTD, the gold price is up roughly 10% since early December, the TSXV is up 15% since mid-December, and the MJG partnership itself was up 20.5% in January alone."

Fund manager Matt Geiger provides his overview of the resource market and shares some principles he is using to invest in today's market. The natural resource landscape has shifted dramatically since the end of 2018. At the time, we were still nursing our wounds from an unexpectedly vicious 2018 and hoping to avoid a repeat performance in 2019. I did speculate that "we may have already exited the bear market as of late December 2018. The nickel price is up roughly 25% YTD, the gold price is up roughly 10% since early December, the TSXV is up 15% since mid-December, and the MJG partnership itself was up 20.5% in January alone."

In hindsight, it looks like we did indeed exit the bear market as of late December 2018. The nickel price is now up 54% YTD. The price of gold is now up 25% since earlier December. The MJG partnership was up 42% in the first half of the year. The major diversified miners have hit 52-week highs within the past 60 days. The major precious metal royalty names have hit either multi-year or all-time highs recently. The same applies to the GDX and GDXJ. These are the types of moves you'd expect to see in a mining bull market.

While other metals such as nickel and iron ore have also seen sharp price increases this year, the stars of the show have been gold and its sister metal silver. In June, the gold price rallied sharply above $1370—breaking through a stiff technical resistance level that had existed since mid-2013. The gold price has since continued its ascent to above $1500 and currently sits at $1505 per ounce. This move has been driven primarily by generalists re-positioning into precious metals after nearly eight years of neglect, though it should be noted that the big Wall Street institutions remain largely on the sideline (as demonstrated by the GLD Inventory to Price ratio often cited in the IKN Newsletter). This lack of Wall Street participation is a positive as far as I'm concerned and indicates that this move may be more sustained that the short-lived, euphoric rally that we experienced in 2016.

The most devastating argument used against owning gold is that the metal sits in a safe deposit box and generates no interest. The opportunity cost of holding gold is too high, argues its critics, given that there are plenty of other safe haven instruments in which to shelter capital and still earn interest. To be fair, this anti-gold stance was the correct call for much of the past eight years.

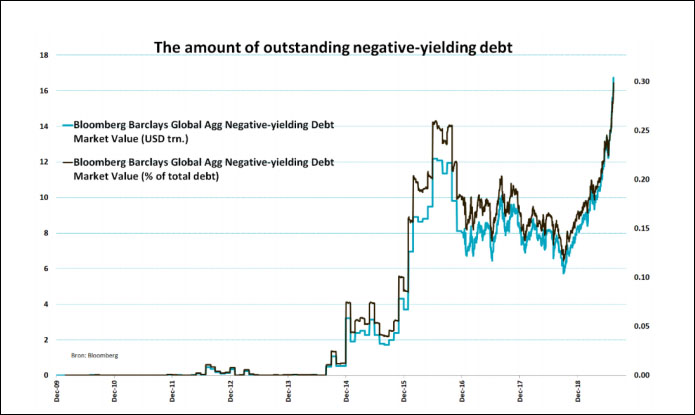

However, this argument has been flipped on its head over the past nine months due to a global surge in negative-yielding debt. The market value of global negative-yielding debt has surpassed $16 trillion for the first time in history. A staggering 30% of investment grade bonds globally now yield below zero. (This includes government, corporate, and securitized.) As seen in the chart below from Bloomberg, there was virtually no negative-yielding debt as recently as five years ago. This is a very new phenomenon.

Source: Bloomberg. 1 August 2019. https://www.bloomberg.com/news/articles/2019-08-01/sub-zero-debt-pile-hits-record-14-trillion-as-fed-cuts-rates

This is astounding when you think about it. Why would an investor pay somebody else to hold their money? It simply doesn't pass the smell test. Suddenly, a shiny rock sitting in a safe deposit box paying 0% interest looks very attractive relative to this alternative. The strongest argument against gold has now become the chief justification for owning the metal.

As one would expect in a bull market, silver has outperformed gold over this recent period. It is possible, if not likely, that we saw a peak in the gold to silver ratio at just above 93 in early July. Assuming that this bull market continues apace, we can expect this ratio (now sitting at 85) to trend lower over the months ahead. The historical average during the 20th century was a 47:1 ratio; we have been due for some time for a significant mean reversion.

While the immediate future looks bright for precious metals, the outlook is murkier for much of the rest of the commodities complex. U.S. farm income remains roughly 50% below its 2013 peak and, while farmland is due for a multi-year bull market, the immediate future depends more on U.S./China trade war dynamics than anything else. Industrial metals like zinc have struggled mightily over worries of a global slowdown, despite record low inventories and limited expected supply growth. Energy metals such as uranium, vanadium, lithium and cobalt are particularly hated as investors have cooled for the moment on the electrification narrative.

My expectation is that the rest of the metals complex will begin to play catch up sometime within the next 12 months. This scenario hinges on the global economy holding together and not dipping into a sustained recession. If I'm wrong on this account and we do see a sustained global recession, then precious metals equities will surge from current levels—to the detriment of base metals, energy metals and much of the rest of the natural resource arena aside from farmland. In a worst-case scenario, we see another 2008-like financial panic where all risk assets are sold off indiscriminately. Even though the price of physical gold would likely skyrocket during such a panic, this would not be to the benefit of those invested in precious metal equities—at least until the initial panic subsides.

Given the variability in potential outcomes, the best course of action is to stick to the basics. Continue to back experienced, well-incentivized management teams—irrespective of whether they are focusing on precious metals, base metals, energy metals or any other commodity. Prioritize high quality "in the money" projects over optionality plays, even when temptation exists to bet on $2,000 Au and $30 Ag. Avoid stocks with less than twelve months of working capital and mercilessly sell holdings that deviate from their stated plans. Average down when a company's share price falls but the investment thesis remains intact. Take profits when a company's share price doubles without a fundamentally positive development. The list goes on. None of this is particularly complex or groundbreaking, but by doing these simple things we set ourselves up for long-term success—irrespective of how the rest of 2019 unfolds.

Matt Geiger is Managing Partner at MJG Capital, a limited partnership specializing in natural resource investments. The partnership is long-only and holds a concentrated portfolio of resource equities. Investments include explorers, developers, and producers of energy metals, industrial metals, precious metals and ag minerals. Geiger is a graduate of the Wharton School at the University of Pennsylvania and previously founded a venture-backed technology company recently valued at $150 million.

Disclosure: 1) Statements and opinions expressed are the opinions of Matt Geiger and not of Streetwise Reports or its officers. Matt Geiger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts courtesy of Matt Geiger.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.