Recession 2020 Forecast : The New Risks & New Profits Of A Grand Experiment

Economics / Recession 2020 Sep 14, 2019 - 12:07 PM GMTBy: Dan_Amerman

There is a very good chance that there will be a recession within the next 1-2 years, and this could even occur within the next few months.

There is a very good chance that there will be a recession within the next 1-2 years, and this could even occur within the next few months.

As explored in this analysis, if there is a recession, the means by which that recession will be contained and exited will necessarily be an unprecedented experiment. This means that there is an unusually high risk that it will not be a normal recession - which could knock the foundations out from underneath many conventional retirement investment strategies that blithely make the assumption that we can somehow know in advance that a "normal" mild and short recession is the downside scenario.

Once we accept the reality of the "grand experiment" - that means that we are likely to see investment prices changing in ways that are also quite unusual. Indeed, we are likely to see amplified profits to go along with the new risks. Crucially, what we also know right now (based upon the Federal Reserve's public plans) is that some of these profits will not be in the usual places or from the usual sources.

Many people believe that we have returned to normal times from an economic and investment perspective - and therefore, if there is a recession, it will be "normal" (by the standards of the last half of the 20th century), with "normal" investment results.

This series and book have been developing a quite different perspective - we are not in anywhere close to normal economic and investment times. Because a side effect of this abnormality has been (and could continue to be) abnormally high asset prices for stocks, bonds and real estate, this produces a surface placidity that can indeed seem both desirable and "normal", for potentially years at a time.

Where the two versions of reality diverge is when stress hits the system - such as with a new recession. At such a point - apparent placidity can vanish in an instant, and financial and economic systems that are based upon such abnormalities as extremely low interest rates, quantitative easing and many negative interest rates around the world, can be forced to abruptly go places that simply can't be anticipated when someone views our current situation as being "normality".

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

The Next Recession Will Be An Unprecedented Experiment

Whether we are looking at slowing economic growth around the world, or the trade and currency conflicts, or the growing yield curve inversions in the United States - there are increasing signs of imminent recession, that are appearing on the front pages of the financial media on a more or less daily basis. And yes, there are still numerous signs of economic strength as well, so we can't say that recession is guaranteed at this point - but the signs pointing in the direction of recession have clearly been multiplying.

As explored in the previous analysis "Will Fed Actions Create Dow 40,000 - And Triple Gold Prices?" (link here), the Federal Reserve is not passively accepting the possibility of a new recession, but has preemptively been going into "dovish" mode. As it happens, this same situation has happened before, when it comes to the combination of 1) plunging long term bond yields, 2) yield curve inversions and near inversions, and 3) a fearful Federal Reserve going into "dovish" mode in the attempt to prevent such a recession.

One result was that the NASDAQ effectively tripled in the next 26 months, going from 1,570 at the end of December of 1997, to 4,697 at the end of February of 2000.

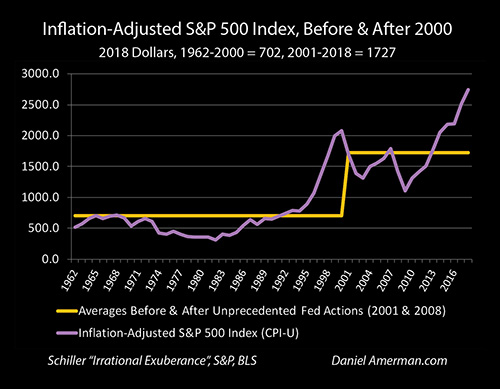

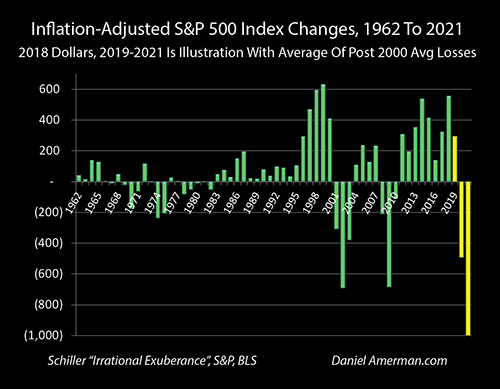

The broader S&P 500 did not move nearly as much, particularly when we look at it in inflation-adjusted terms as shown above, but from an already elevated base (much like today), the market still moved up another 50%, and created more wealth in those three years than the entire (inflation-adjusted) value of the S&P 500 in any year prior to 1991.

The Fed going dovish and helping to move stock prices up to sharply higher levels, from an already historically elevated base, is today known as the tech stock bubble.

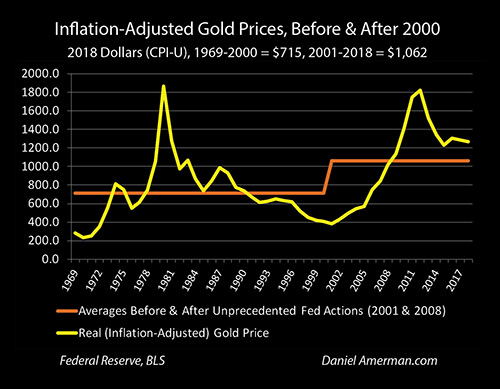

When the tech stock bubble collapsed, it not only created the largest stock losses in history, but it also set off another 3X tripling of asset prices. This second tripling was in the inflation-adjusted price of gold, and as can be seen in the graph above, it occurred over a much longer time period - stretching forward to the (quite historically abnormal) elevated prices of gold today.

While there are some intriguing parallels between 1997 and the situation today, much else has changed - and that includes both our economic situation, and the related financial fundamentals supporting our current elevated asset prices.

The Grand Experiment

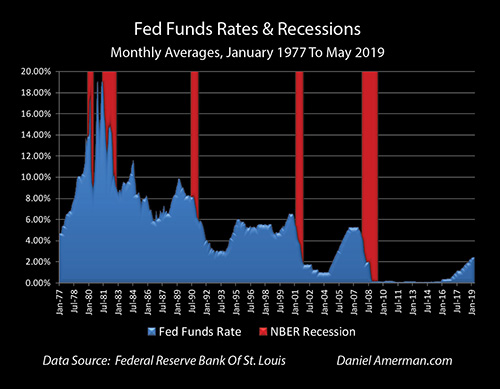

To see why this recession will necessarily be an unprecedented experiment, we need to start with the graph above. The previous recessions over the last little more than 40 years are shown in red, and the level of Fed Funds interest rates is shown in blue.

Notice that every time there is a recession - the Fed Funds rate plunges. This happens every time, without exception, because it is policy - and the primary recessionary tool in the Federal Reserve policy playbook is smashing down short term interest rates. There are no proven backups or alternatives.

Now, let's go to the right side of the graph above, and see why the next recession will be unprecedented in the modern era. The Fed had pursued seven years of a previous unprecedented experiment - zero percent interest rates - making the blue area almost disappear between late 2008 and late 2015. Then the Fed started slowly increasing short term interest rates, but had to stop in late 2018 - because of fears that any future interest rate increases would bring about the next recession.

This leaves the Fed - and all of us - stuck between "a rock and a hard place". There is no proven method of shortening and containing recessions without slamming down Fed Funds rates. In the aftermath of zero percent interest rate policies, interest rates were unable to get to even half the height traditionally needed to exit recession, before the cycle had to be stopped in order to avoid triggering the next recession.

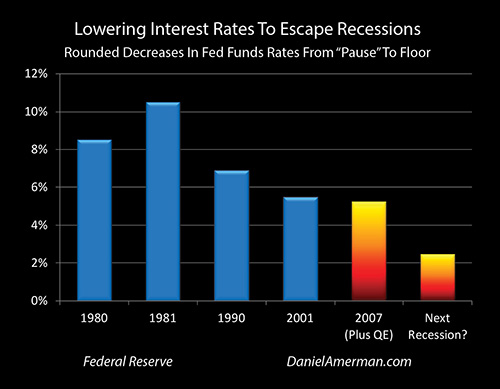

This relationship can also be seen in the graph above, where the height of the bars show sthe power of the interest rate interventions used by the Federal Reserve in order to contain and exit each recession. For the five recessions between 1980 and 2007, the Federal Reserve slammed down interest rates by an average of 7.25% per recession (as developed in Chapter Four).

Looking at the bar on the right - the current starting level of interest rates is less than a third of the historic average for what has been used. So, even if the Federal Reserve immediately moves interest rates all the way back down to zero percent - which is indeed its plan in the event of a recession - it only has about 29% of the available firepower for the only proven method for containing and exiting recessions in the modern era. (And if the Fed drops rates another 0.25% at the September meeting, then it will be down to only 26% of the average firepower used to exit previous recessions.)

More than seventy percent of the proven firepower needed to contain and exit recessions is missing. And whether the Federal Reserve can actually contain and exit another recession in the way most investors take for granted - will all be a grand experiment, albeit a forced experiment that the Fed would strongly prefer to avoid.

Nobody knows what will happen if this experiment is attempted. This has never happened in the United States.

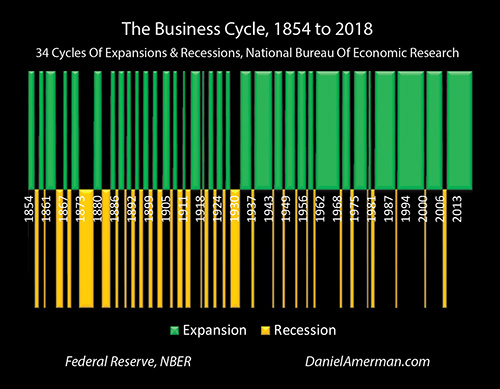

When we look back beyond the modern era, when the Fed was not using this ammunition - recessions were much more frequent, and they lasted longer. As explored in Chapter 2, the long term averages for economic downturns - which can be seen in the golden bars on the left side of the graph above - is that they occurred about 40% more often, and they lasted an average of 50% longer each time.

For some reason there is widely encouraged belief that the Great Recession was a "once in a hundred year event". However, as far as I can tell this is simply a round number that was just made-up out of thin air, because it cannot even remotely be supported by an examination of actual economic history.

Events like the Great Recession used to be routine, they were the norm, and much worse events were not uncommon, if we use those 160+ years of actual economic history.

Now, does this mean that something catastrophic is necessarily on the way? Not at all - assuming that the worst is inevitable would just be another form of false certainty.

The Fed coming into a recession while missing 70%+ of its only historically proven source of recession fighting firepower just means that we genuinely don't know. With its back against the wall, the Fed will be forced to attempt a grand experiment for the economy, for the markets, and for future investment performance.

This has critical implications for decision making across all the major investment classes, including stocks, bonds, real estate and precious metals. We simply cannot blithely assume (as so many are) that the historically mild and abnormally short recessions of the post WWII era will be repeated in the next round, with a relatively quick recovery of stock and real estate prices in particular.

Now, again - that very positive scenario could happen. However, there is at least as good of chance that it won't, given the lack of a track record. (And if we want to know why the Fed is doing what it is right now, as covered in detail in the most recent workshop - it is because it views the safest way out of this uncertainty as being to preemptively intervene in order to keep the recession from happening in the first place.)

Genuine and deep uncertainty is just that - you don't know, I don't know, nobody knows for sure.

The Next Recession Will Bring Unprecedented Investment Price Changes

While we don't know whether it will ultimately work or not, we do know what the Federal Reserve has in mind for how it will make up the missing 70%-75% of its firepower. As reviewed in earlier chapters, it plans on making one of the most aggressive market interventions in history - something new - in the attempt to pull the United States out of a potential recession.

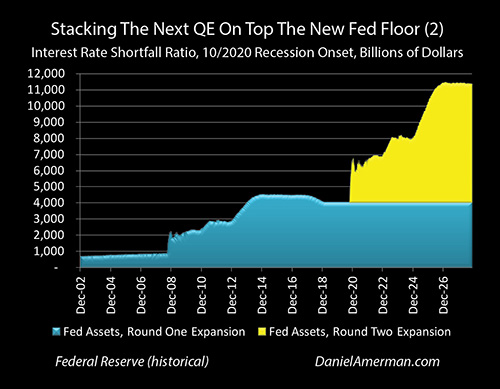

The first step is immediate monetary creation via quantitative easing (QE), on a potentially massive scale that will likely involve trillions of dollars of new money. One illustration of how this could occur is shown in the graph above from Chapter 8, with our current still outstanding Federal Reserve balance sheet being shown in blue, and a potential new round of QE being "stacked on top".

Now, this next step is one of the places where I'm currently seeing the greatest difference between sophisticated institutional investors, and the many millions of individual investors who don't have any education in this area.

Many people seem to think that things like "quantitative easing" and "monetary policy" are either: A) theoretical abstractions that aren't really important for the concrete application of the settled science of investment decision making; or B) are high risk gambles involving running the printing presses that are virtually guaranteed to lead to an imminent monetary and financial meltdown.

The purpose behind creating trillions of new dollars is 1) to spend trillions of new dollars; to 2) radically change investment prices in a very short period of time; and to do this 3) for the intended purpose of creating economic stability.

This currently planned 1-2-3 combination is the direct opposite of a theoretical abstraction - it is an active, real world intervention that can hand hundreds of billions of dollars of quite spendable cash profits to investors who understand what the Fed is doing. If it works, the end result will be the direct opposite of a meltdown scenario (at least for a while, and possibly for a number of years).

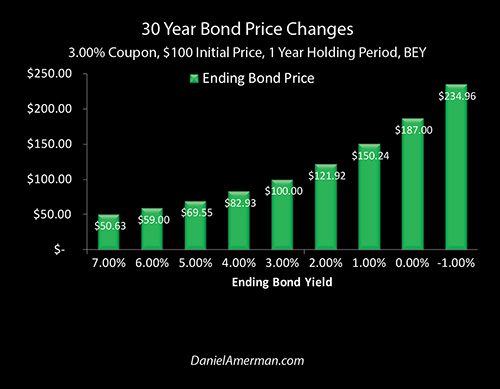

As covered in much more detail in Chapter 13, the Fed intends to use its trillions of dollars in new money to fund a maturity extension program (MEP). Another way of phrasing this is that the Fed may create a massive sum of money as shown in the yellow area of the "stacking QE" graph, and spend it to rapidly shift the green bars of the bond prices to the right in the graph immediately above.

By using immediate and massive purchases of medium and long term bonds to force medium and long term interest rates to new lows, the Fed intends to overcome the limitation of not having enough short term interest rate firepower to work with.

That's the grand experiment.

The planned strategy is to create trillions of new dollars, use them to pay outrageously high prices for medium and long term bonds (handing huge gifts to what is primarily a select group of insider investors in the process, all in the national self-interest of course), and then use the resulting much lower short, medium and long term interest rates in combination to shock the United States out of recession.

Will it work? Nobody knows - we have no idea. It is all an experiment. There are theoretical reasons to believe it could work, but economic theory is often wrong, and we are lacking in real world proof.

If it does work, we could have another typical recession for the post WWII era, that is shorter and shallower than the long term average.

If the experiment doesn't work - then numerous popular retirement investment strategies may all fail again, with potentially devastating losses for stocks and real estate, even while shell-shocked investors rationalize their losses by saying "who could have possibly seen two 'once in a hundred year' recessions in a row?"

The Central Question

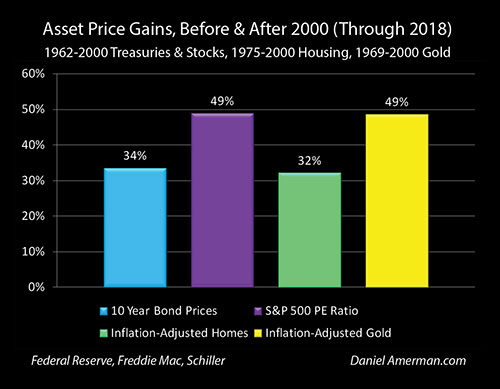

The graph below compares average valuations for the core investment categories of stocks, bonds, real estate and gold, over two different periods. The 100% base is the long term averages prior to 2001. The bars representing the increase above the base, are the averages from 2001 to 2018 - including both the collapse of the tech stock bubble and the Financial Crisis of 2008.

What does the above graph mean? That is the central question, isn't it?

Many people - perhaps most - would say that what the graph shows is a prosperous normality. There is no need for a recession, but if one were to occur, it would be just a temporary "divot" in the path to a place where future wealth and prosperity are more or less locked in, so long as one follows the disciplined rules of the solved science of long term financial planning and wealth creation.

Developing a logical alternative answer was my main objective in Chapter One (link here), where I showed why extraordinary Federal Reserve interventions that were being used to contain crisis ever since the collapse of the tech stock bubble, would lead to the abnormally elevated and at least temporarily stable asset valuations shown in the graph above.

For where we are right now and have been for the last few years - the two paradigms can coexist simultaneously.

Where a divergence could be forced is with either a new recession - or with major interventions being deployed by the Fed in the attempt to prevent a new recession. Either way, the divergence could happen very quickly, with very little advance warning.

One possibility (though far from a certainty) is that there is a recession and the stock market reacts much like it did the last two times around, only the losses occur from the starting point of a far higher base. As shown above and developed in Chapter 15, this simple repetition of the past from current levels, could lead to by the largest stock market losses in history, equaling perhaps a $12 trillion loss in household net worth.

This could produce a truly nasty recession, something that would take everything the Fed has when it comes to the needed firepower. But that wraps back around to the Fed missing something in the range of 70%-75% of its proven firepower for containing and exiting an average recession, and planning to make the rest up with the unproven experiment of using QE to fund an MEP (as explored in Chapter 13).

So, the years of extremely low interest rates producing abnormally high asset prices, leads (again) to abnormally high losses with a simple 35th iteration of the business cycle, the theory behind the planned grand experiment turns out not to be up to the particularly difficult task of handling a severe recession in practice, and how deep the recession goes and how long it lasts is then anybody's guess.

Is that such a far-fetched scenario? I suppose that those fond of making up round numbers would call that a "once in a millennium" possibility, instead of the purported "once in a century" occurrence of 2008. However, each of those steps is not all that unreasonable, and if someone wanted to be pessimistic or go full-on "gloom & doom", then a case could be made for much worse.

That said - just assuming doom and going into a bunker mentality could be a major mistake. Indeed, understanding how Fed actions to avert and/or contain a new round of recession and crisis could lead to new asset highs in multiple categories is a key part of Chapters 3, 5, 7, 9, 11, 13 and 14 (so far).

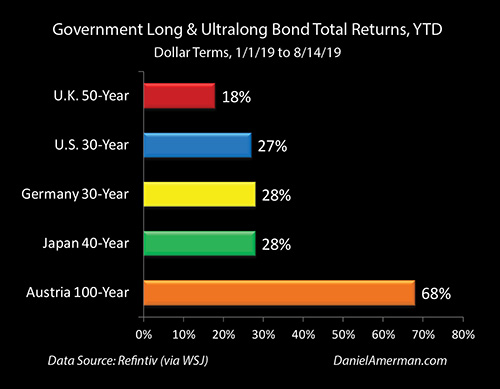

As one instance, whether it works or not, the Fed openly intends use an unprecedented program to create trillions of dollars to directly override free market forces, with a specific goal of creating record setting long term bond prices - and therefore, record setting long term bond capital gains.

The graph above shows long term and ultralong term total bond returns around the world in 2019, through the middle of August. What created those returns was sophisticated institutional investors anticipating recession, and trying to profit from what the Fed plans to do in the event of recession. Indeed, there is a very strong case to made (as I have writing about over this last year) that it is this profit-seeking behavior by sophisticated investors that creates yield curve inversions.

Keep in mind that according to the Merrill Lynch survey of fund managers, buying long bonds was the single most crowded trade among fund managers in both June and July of 2019 - much of the market was trying to get a piece of that action.

This situation creates an interesting divergence. The plan is known - and investing for the execution of that plan is enormously popular among sophisticated institutional investors, even while most of the millions of average individual investors seem to have no idea of what is happening. So there is a rather major redistribution of wealth in process between different categories of investors.

At the same time - whether the planned experiment will ultimately work or not, and shorten or contain the next recession is a complete unknown (and may be more or less irrelevant for the bond price movements and the massive redistribution of wealth that occurs before then).

So the more sophisticated and "insider" portions of the markets understand that the Fed intends to hand them some rather huge gifts as part of what will be an unprecedented experiment to shorten and exit the next recession. Meanwhile, for many millions of average investors, they understand neither the gifts nor the risks that will be coming with this new grand experiment, but instead continue to invest for a world that is long gone.

The playing field is quite uneven, and perhaps there should be no surprise there. Hopefully this and the related chapters and analyses have given the reader something to think about in that regard.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2019 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.