Bank of England’s Carney Delivers Dollar Shocker at Jackson Hole meeting

Commodities / Gold & Silver 2019 Sep 11, 2019 - 04:49 PM GMT Bank of England governor Mark Carney, in something of a shocker, told the recent Jackson Hole central bankers’ conference that the world’s reliance on the US dollar ‘won’t hold’ and needs to be replaced by a new international monetary and financial system based on many more global currencies,” according to a Financial Times report. The greatest impact of Carney’s bombshell, though, came not from his opinion on the look and feel of some futuristic global monetary system. It came instead from his seeming tacit approval of the escalating movement to dethrone the dollar as the world’s reserve currency in the here and now. A good many in that audience were no doubt surprised – even rattled – by Carney’s remarks.

Bank of England governor Mark Carney, in something of a shocker, told the recent Jackson Hole central bankers’ conference that the world’s reliance on the US dollar ‘won’t hold’ and needs to be replaced by a new international monetary and financial system based on many more global currencies,” according to a Financial Times report. The greatest impact of Carney’s bombshell, though, came not from his opinion on the look and feel of some futuristic global monetary system. It came instead from his seeming tacit approval of the escalating movement to dethrone the dollar as the world’s reserve currency in the here and now. A good many in that audience were no doubt surprised – even rattled – by Carney’s remarks.

“Something is going on,” said St. Louis Fed President James Bullard in a Financial Times report, “and that’s causing I think a total rethink of central banking and all our cherished notions of what we think we’re doing. We just have to stop thinking that next year things are going to be normal.” To which FT added: “Interest rates are not going back up anytime soon, the role of the dollar is under scrutiny – both as a haven asset and as a medium of exchange – and trade uncertainty has become a permanent feature of policymaking.”

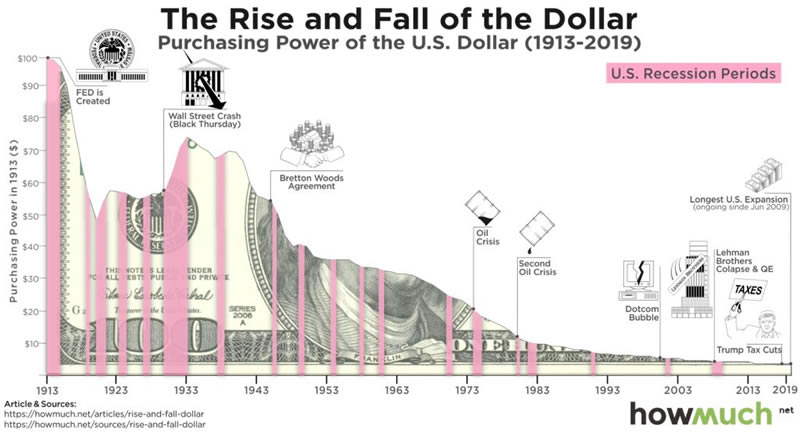

That about sums it up. The dollar at the moment is something of a Humpty Dumpty in the global monetary system – sitting on his wall oblivious and seemingly immune to all that goes on around him. Whether or not there will someday be a Great Fall remains to be seen, but increasingly, as Carney’s speech illustrates, forces are lining up against it.

“[H]istory,” Carney concludes, “teaches that the transition to a new global reserve currency may not proceed smoothly. Consider the rare example of the shift from sterling to the dollar in the early 20th Century – a shift prompted by changes in trade and reinforced by developments in finance. The disruption wrought by the First World War allowed the US to expand its presence in markets previously dominated by European producers. Trade that was priced in sterling switched to being priced in dollars; and demand for dollar-denominated assets followed. In addition, the US became a net creditor, lending to other countries in dollar-denominated bonds.” In other words, it laid the foundation for the so-called American Century that followed.

A similar transition now could impact the dollar and dollar-denominated assets just as it did sterling and sterling-denominated assets at the turn of the 20th century. Though few believe the dollar can be fully replaced with something else at this juncture, many believe that its influence could erode – or that the old could gradually give way to something new and different. In fact, as you are about to read, some see it as a process that has already begun.

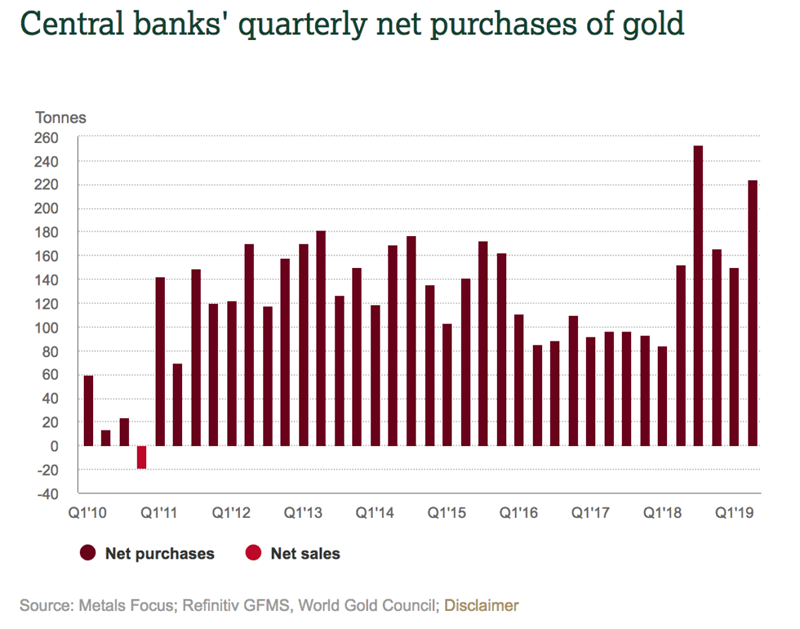

De-dollarization boosts central bank gold purchases

Among the broad effects of the nascent de-dollarization movement has been to significantly boost central bank demand. The World Gold Council reports 651 metric tonnes in new gold purchases during 2018 – the highest level since the Bretton Woods Agreement was abandoned in 1971. China, Russia, Poland, and Hungary head the list of central banks adding gold to their central bank reserves in 2018 and 2019.

In a recent interview with the World Gold Council, Dr. Duvvuri Subbarao, former governor of the Reserve Bank of India, explains the connection between “de-dollarization” and central bank gold acquisitions. “In the immediate aftermath of the crisis,” he says, “we had to sell dollars to prevent our currency going into freefall. During Quantitative Easing, we had to buy dollars to protect our financial stability. And when the Federal Reserve began to taper QE, exchange rates slumped again and we had to defend ourselves with our reserves. All these events prompted one obvious question – is there an alternative to the dollar?”

“It is clear,” he goes on, “that gold is a risk diversifier – a hedge against not just financial risk but also political risk. It is also a long-term store of wealth. As such central banks, especially those from emerging markets, can increasingly see the merits of adding gold to their reserves. Over time, therefore, I am confident that gold’s role will increase among central banks.”

Chart courtesy of the World Gold Council

Currency problems stoke Asian physical gold demand

McKinsey & Co, the global consulting firm, warned in late August that a new Asian debt crisis might be in the making. Not surprisingly, gold is priced at all-time highs in a number of Asian currencies including the Japanese yen, India rupee and the Chinese yuan. It is also at all-time highs against the Malaysian ringgit and the Indonesian rupiah. Jayant Bhandari, the founder of Capitalism and Morality, provides some thought-provoking insights on the origins and sustainability of Asian gold demand. “Most of these people don’t really understand what is happening outside their boundaries,” says Bhandari, “so they have no option but to buy gold, silver, and currencies of Western countries. And that is why I think support for precious metals will continue to increase going forward. I don’t know what influence it will have in pricing, but really, if I had to suggest to someone on how to preserve his wealth, my suggestion would primarily be focused on gold and silver.”

Mobius, Soros take seats on the gold bandwagon

Question: What do Jeffrey Gundlach, Ray Dalio, Mark Mobius, Stanley Druckenmiller, Paul Tudor-Jones, David Einhorn, Naguib Sawiris, Paul Singer, and Thomas Kaplan – some of the greatest financial minds of a generation – all have in common?

Answer: An attachment to gold and its presence in their personal financial holdings as a safe-haven hedge.

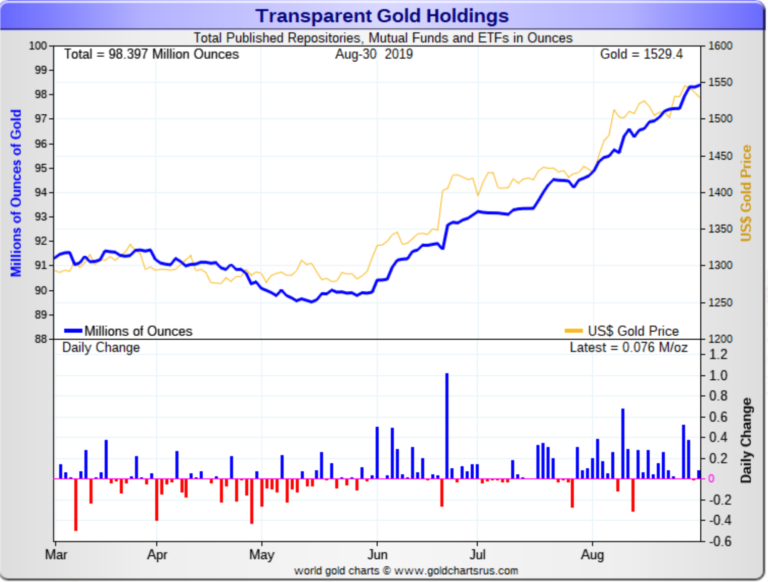

Well-known emerging market analyst Mark Mobius is a recent addition to the list. “Investors,” he says in an interview posted at NewsMax, “should allocate about 10% of their assets in physical gold. The reason is that gold maintains its status as a currency – a currency that has stood the test of time.” George Soros, according to Sharps Pixley’s Lawrie Williams, is another new addition to the list having made “a very substantial investment in the yellow metal.” Gold ETFs, the favored ownership vehicle for the hedge funds, have grown 24% since May and are at their highest level since 2013.

Chart courtesy of GoldChartsRUs

“If I had to pick my favorite for the next 12 to 24 months, it would be gold. If it goes to $1400, it goes to $1700 rather quickly. When you break something like that [the 75-year expansion of globalization and trade], a lot of times the consequences won’t be seen at first. It might be seen one year, two years, three years later. . . So that would make one think that it’s possible that we might go into a recession or make one think that it would make rates go back toward the zero bound level and of course in a situation like that gold is going to scream.” – Paul Tudor Jones, Tudor Investment Corporation (Bloomberg interview)

Alan Greenspan says gold surging because “people are looking for hard assets”

In a recent CNBC interview, former Fed chairman Alan Greenspan predicted that negative interest rates will reach the United States. “You’re seeing it pretty much throughout the world. It’s only a matter of time before it’s more in the United States.” Greenspan, a long-time advocate of gold ownership, went on to say that “gold prices have been surging because people are looking for ‘hard’ assets they know are going to have value as the population ages.”

NotableQuotable

“Markets have changed a lot since the 1970s. Back then the U.S. stock markets as a percentage of GDP was only 20 to 30 percent. Today markets are 150 percent of GDP and they have a rather large effect on overall economic activity. Gold is again rising but how high it will go, Marc, does not know but to him, it seems inexpensive when compared to negatively yielding bonds. Gold should stay above 1400 and investors should hold it as insurance in varying amounts depending on their confidence in the financial system.” – Marc Faber, Palisade Radio interview

“I actually think the Fed has triggered hyperinflation, but it’s not in consumer goods. It’s in asset prices and luxury goods. If a company’s share price increases without an underlying increase in its profits, we call it multiple expansion, but in reality, it’s inflation. With QE, central bankers put vast sums of money into the hands of financial investors, who in turn went and bought financial assets and luxury goods driving up the prices.” – Ron Stoferle, Incrementum

“Gold is often thought of as a relatively pedestrian real asset, the returns from which are equally conservative. In fact, while there are periods in which this may be true, over the long term, gold has proved itself an investment to compete with the best. While the Dow Jones Industrials Average increased by 25.8x from 1967 to 2018, for example, the price of gold has increased by 36.3x.” – Edison Investment Research

“If we observe the empires of the world that have existed over the millennia, we see a consistent history of collapse without renewal. Whether we’re looking at the Roman Empire, the Ottoman Empire, the Spanish Empire, or any other that’s existed at one time, history is remarkably consistent: The decline and fall of any empire never reverses itself; nor does the empire return, once it’s fallen.” – Jeff Thomas, International Man

“I never really ‘invested’ in gold. I didn’t trade in gold. I used it as a savings account. I used it as a reserve always thinking this is my backup. So I did that systematically over the years. So I bought gold over the years, but I never sold gold.” – Ron Paul, Liberty Report

“. . . I’ve never wavered from the view that this would end badly. Never have I believed that manipulating and distorting markets would achieve anything but epic Bubbles and inevitable terrible hardship. I’ve not seen evidence to counter the view that the longer the global Bubble inflates the greater the downside risk (moreover, such risk grows exponentially over time). And not for one minute did I believe zero rates and QE would resolve deep financial and economic structural issues. Indeed, I have fully expected reckless monetary mismanagement to ensure a global crisis much beyond 2008. From my analytical perspective, the global Bubble has followed the worst-case scenario.” – Doug Noland, Credit Bubble Bulletin

Image courtesy of HowMuch.net

“Cash over the long run is the worst-performing asset class and therefore the riskiest asset class. So where do you go? To me, going to any one asset increases risk. So the best way to deal with the challenging environment I foresee is by diversifying well. . . [G]old is just an alternative currency to fiat paper currencies. If your portfolio is likely to perform poorly in the adverse environment I’ve been describing—less effective monetary policy, the need to run larger fiscal deficits and monetize them, and challenging politics—the behavior of gold as alternative cash has some diversifying merit.” – Ray Dalio, Bridgewater Associates (Please see Paradigm Shifts)

“What a difference a few years makes. Back in the summer of 2015, a WSJ op-ed writer, who somehow was unaware of the past 6,000 years of human history, infamously and embarrassingly said ‘Let’s Be Honest About Gold: It’s a Pet Rock.’ Fast forward to today, when with every central bank once again rushing to debase its currency in what increasingly appears to be the final race to the debasement bottom, when even BOE head Mark Carney recommends that it is time to retire the dollar as the world’s reserve currency, pet rock gold has emerged as the second best-performing asset of the year… and at the rate it is going – 4th in 2017, 3rd in 2018, 2nd in 2019 – gold will be the standout asset class of 2020.” – Tyler Durden, ZeroHedge

“There’s nothing magical about gold. It’s just uniquely well-suited among the 92 naturally occurring elements for use as money… in the same way aluminum is good for airplanes or uranium is good for nuclear power. There are very good reasons for this, and they are not new reasons. Aristotle defined five reasons why gold is money in the 4th century BCE (which may only have been the first time it was put down on paper). Those five reasons are as valid today as they were then.” – Doug Casey, Casey Research

“What comes next? The answer, I believe, is very likely to be a synchronised global recession, punctuated by a step-by-step market downturn — one in which there may be the odd rally, but the general direction is down. This could last for some years. In the next few weeks, I would expect new lows in bond yields, a deepening of the yield curve inversion, higher prices for ‘safety’ assets like the yen and Swiss franc, and a continued bull market in gold.” Rana Forooha, Financial Times

“I have a theory that computers started to suck when dumb people started to use them. The same is also true of precious metals, which turned into a speculative football in 2011. Those geeks are gone, and only the die-hards are left — the shiny rocks passed from weak hands to strong hands.” – Jared Dillian, NewsMax Finance

“The strange persistence of the strong dollar with the rising gold price has puzzled many participants this year. Some are even beginning to suggest that the dollar’s inverse relationship with gold has been broken. In this report, I’ll make the case that what we’ve seen so far this year has been an exception to the rule. The evidence I’ll show here implies that we’re likely to see a divergence between the U.S. currency’s value and the gold price in the coming months. And while the dollar remains strong right now, gold will likely continue to outperform the greenback due to the threats facing the global economy.” – Cliff Droke, Seeking Alpha

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.