Large Drop in Stocks, Big Rally in Gold and Silver

Commodities / Gold & Silver 2019 Sep 09, 2019 - 01:42 PM GMTBy: Brad_Gudgeon

The week ahead, looks treacherous for the stock market, but should be a boon for gold, silver and share mining stocks. The cycles, waves and astro aspects are coming together nicely for a possible quick 6% drop on the S&P 500.

The week ahead, looks treacherous for the stock market, but should be a boon for gold, silver and share mining stocks. The cycles, waves and astro aspects are coming together nicely for a possible quick 6% drop on the S&P 500.

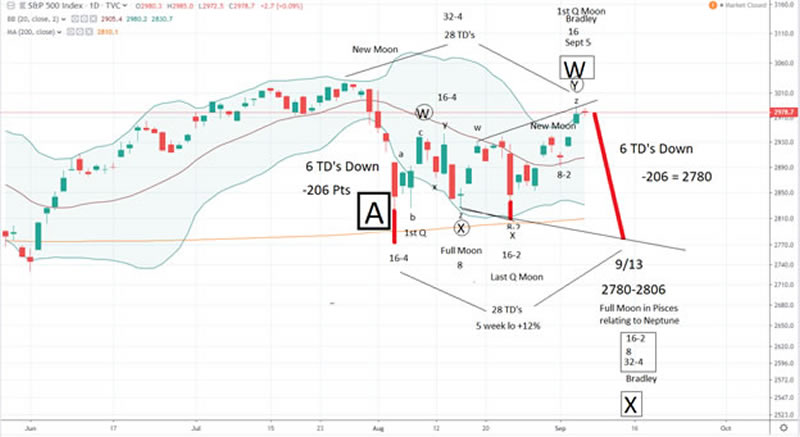

The SPX chart below shows the 16 TD top on Sept 5, along with a first quarter moon and Bradley turn. We are going into the 5/35 week cycle low in a 4 year cycle low from late 2015 due Monday-Friday (9/9-13). These usually go lower than the previous 10 week low that occurred on Aug 5. I don’t believe we go much below 2780 as an extreme target, perhaps as much as 42 points below the August 5 low of 2822.

The astro biggie of the week, has the Sun square Jupiter while forming a negative aspect along with Mars to the Jupiter/Neptune Square all week. It looks to get crazier as the week wears on. We also have Sun trine Saturn, Venus trine Pluto, Mercury opposite Neptune and Mars trine Saturn this weekend. These signatures along with the previous aspects I mentioned look exhaustive and ready to drop the stock market.

Sun/Mars conjunctions (Sept 2) warn us of an impending 8-20% drop just ahead (I believe the big one will be Oct 15-Nov 4). The current pattern can support a 6% drop and still be within the bear flag pattern. These patterns often times form a downward sloping bear flag.

The cycles are running a 32-4 TD top to top and bottom to bottom. 28 TD’s work within the framework shown on the chart below. It is basically a 5-6 week cycle.

Charts of GDX and silver explain why I believe a blow off top will likely happen this week. Gold is in an upwardly skewed, counter trend rally. The precious metals complex is telling us by GDX and silver that this rally is doomed, for now….

Gold could drop 20% plus and the other trading vehicles like silver and the miners even more. The cycle bottom is due in February. I believe we see a huge rally next year from a bear market bottom.

Gold is in a strange running correction of sorts, but is due to fall back nonetheless!

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look atwww.blustarmarkettimer.com

Copyright 2019, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.