Five Feet High And Rising - Stock Market Bulls False Sense of Security

Stock-Markets / Stock Markets 2019 Sep 08, 2019 - 01:53 PM GMTBy: Richard_Mills

How high's the water, mama?

How high's the water, mama?

Five feet high and risin'

How high's the water, papa?

Five feet high and risin'

Well, the rails are washed out north of town

We gotta head for higher ground

We can't come back till the water comes down,

Five feet high and risin'

Johnny Cash, “Five Feet High and Rising”

US stock markets on Tuesday were like a teenager forced back to school after a summer of fast cars and girls - insolent and bad-tempered. Snapping a three-day winning streak, the Dow and the S&P 500 both fell after US and Chinese tariffs took effect over the long weekend. The sell-off was also influenced by weak US manufacturing data, and more worries over the UK crashing out of the European Union, after the governing Conservative Party lost its majority in the House of Commons due to a Tory member crossing the floor to the Liberal Democrats.

The US manufacturing index for August was just 49.1, marking the first time in three years that America’s manufacturing sector shrank, stoking fears that the slowdown in Europe - Germany is already in recession - has crossed the Atlantic.

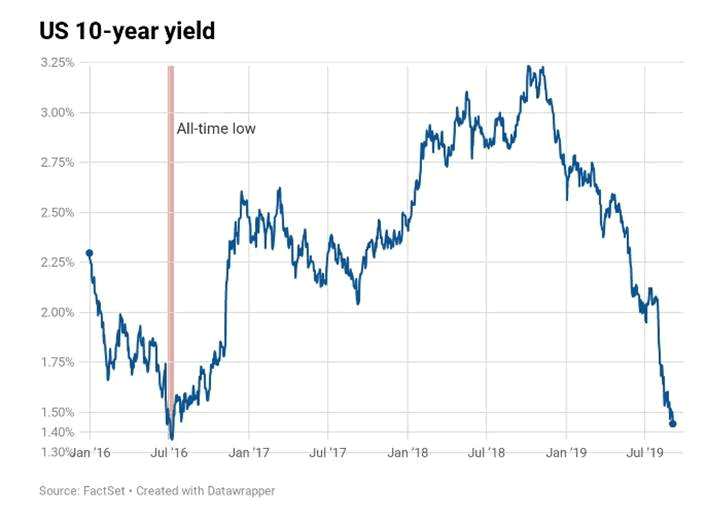

The benchmark 10-year Treasury yield slid to 1.47%, from Friday’s close of 1.50%. Two weeks ago the 2-year Treasury note was higher than the 10-year, a worrying signal that investors are less willing to risk their money on a long-term debt instrument. Known as a yield curve inversion, this phenomenon has been a near-perfect recession indicator for the past 60-odd years.

The last two Treasury auctions saw the 10-year and the 2-year offering the same rate of interest, not exactly a vote of confidence.

At least US Treasury yields are still holding above zero percent. At last count the amount of global sovereign debt floating around at negative yields was valued at close to $17 trillion.

Putting it all together, the trade war is showing no signs of a cease fire, we have record amounts of negative-yielding sovereign debt, key yield curves inverting for the first time since the Great Recession, manufacturing activity has slackened across the Group of Seven countries, and the US corporate sector is eyeing a horrible third quarter.

According to Refinitiv, a financial data provider, Q3 profit growth is expected to drop to -1.9%, a hard fall from the 12.1% forecast a year ago.

A reading of Zero Hedge finds many more signs of economic gloom and doom. I cherry-picked 13:

#3 Yield curve inversions have preceded every single U.S. recession since the 1950s, and the fact that it has happened again is one of the big reasons why Wall Street is freaking out so much lately.

#4 We just witnessed the largest decline in U.S. consumer sentiment in 7 years.

#5 Mortgage defaults are rising at the fastest pace that we have seen since the last financial crisis.

#6 Sales of luxury homes valued at $1.5 million or higher were down five percentduring the second quarter of 2019.

#7 The U.S. manufacturing sector has contracted for the very first time since September 2009.

#8 The Cass Freight Index has been falling for a number of months. According to CNBC, it fell “5.9% in July, following a 5.3% decline in June and a 6% drop in May.”

#9 Gross private domestic investment in the United States was down 5.5 percentduring the second quarter of 2019.

#19 Global trade fell 1.4 percent in June from a year earlier, and that was the biggest drop that we have seen since the last recession.

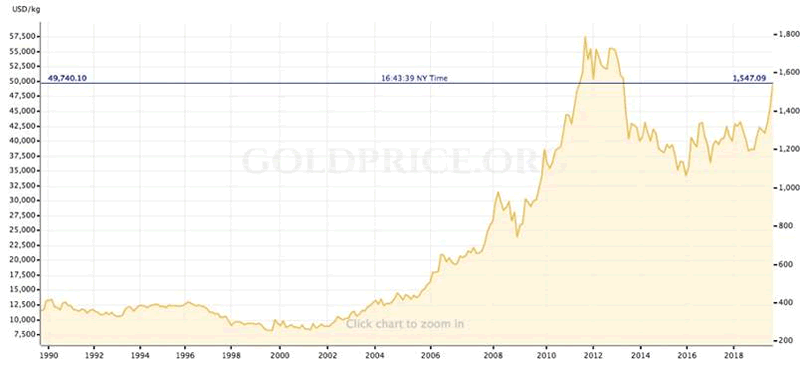

#12 When it looks like an economic crisis is coming, investors often flock to precious metals. So it is very interesting to note that the price of gold is up more than 20 percent since May.

#21 According to CNBC, the S&P 500 “just sent a screaming sell signal” to U.S. investors.

#23 Corporate insiders are dumping stocks at a pace that we haven’t seen in more than a decade.

#24 Apple CEO Tim Cook has been dumping millions of dollars worth of Apple stock.

#25 Instead of pumping his company’s funds into the stock market, Warren Buffett has decided to hoard 122 billion dollars in cash. This appears to be a clear indication that he believes that a crisis is coming.

Yet equity investors appear unfazed. Despite global chaos blamed in large part on the Trump administration’s trade spat with China, 2019 is shaping up to be one of the best years for stocks since the financial crisis. Year to date, the S&P 500 index of companies is up 15.7%, the Dow has barreled along at 11.8%, and the technology-heavy Nasdaq has gained an impressive 18.1%.

Also out of kilter is the gold price which usually moves down when stocks are up (gold and the US dollar also have an inverse relationship). Yet instead of plummeting to earth, bullion’s one-year chart resembles a StairMaster, from a lowly $1,200.30 on the last day of August, 2018, to Tuesday’s $1,548.12, as of 6:12 pm in New York.

Among the factors fueling gold’s run (for more reasons read Golden consequences and Gold as bubble hedge), are negative real interest rates. Gold is favored among investors when long-term Treasury yields offer negative rates of return ie. when the yield minus the rate of inflation, currently 1.8%, falls below zero. Why buy a negative-yielding bond when you can catch the wind in the sails of a gold price knifing through the water at 20% year to date?

So what’s going on? Why is gold doing so well when stocks are heading higher, and how come stock markets haven’t been smacked harder by all these global headwinds?

The answer lies in stock buybacks and insider selling. Allow me to explain.

Stock buybacks

When Ronald Reagan became president in 1981, he appointed John Shad to head the Securities and Exchange Commission - the body that polices US stock markets. Shad’s appointment was the first time in 50 years that a financial executive headed up the SEC.

The SEC’s role since the stock market crash of 1929 was to regulate stock markets and especially to prevent another Great Depression from happening. The 1934 Securities Act didn’t ban stock buybacks but it barred companies from doing anything to manipulate their stock prices. Companies therefore stayed away from the practice of buying their own stock, fearing it would put the company on the SEC’s radar.

Under Shad’s leadership the SEC in 1982 adopted rule 10b-18, which allowed stock buybacks as long as certain guidelines were adhered to, such as not purchasing more than 25% of its average trading volumes in a single day.

Vox quotes William Lazonick, an economics professor at the University of Massachusetts, who said Shad’s appointment to the SEC and the passing of rule 10b-18 brought about a major shift in the agency:

“Everything they did from that point forward … was turning the SEC from a regulator of the stock market to a promoter of the stock market,” he said.

US lawmakers on both sides of the aisle have spoken against stock buybacks.

So what are stock buybacks and why are they controversial?

Buybacks have been a popular tool for management to stuff cash back into the company, indirectly, by reducing the share float (outstanding shares). Purchasing company stock generally inflates the share price and boosts earnings per share – a key metric on which CEO bonuses are calculated.

After the SEC changed the rules to allow buybacks, hundreds of companies starting using them. In 1997 buybacks surpassed dividends as the main way companies redistribute funds to investors.

Are share buybacks good or bad for shareholders? The answer is, in my opinion, cut and dried - the few positives do not outweigh the many negatives.

On the positive side of the ledger, reducing a company’s outstanding shares makes each dollar of earnings more valuable on a per share basis, which is good for investors.

Another plus for shareholders: corporate executives seemingly know how much their company is worth so if they are buying back shares, it's a signal that the stock is undervalued – otherwise, why would they buy high?

Bloomberg states that buybacks can contribute to bull markets, noting that in some years, shares bought in buybacks outnumbered shares purchased by mutual funds by six to one. Really though, the most insightful thing to say about share buybacks is that they’re good for management, not necessarily shareholders.

Why? Buybacks make it easier for executives to hit targets by reducing the number of shares. Management receives compensation - usually in the form of stock options - that is tied to the company's stock price. The higher the stock price the more they make cashing out their options. When a stock buyback occurs the short-term implications on the stock price are positive. If a company’s stock is suffering from low earnings per share (EPS) and price earnings ratio (PE), buying back stock can give the company a temporary boost because these ratios are based on the number of outstanding shares. Earnings don’t change but the EPS looks better because the firm has reduced the number of shares outstanding, so management meets goals for profit growth and earns bigger bonuses.

There are plenty of negatives to share buybacks, with the most obvious being that buying back shares means that executives are foregoing the opportunity to put that extra cash back into the business instead, which could potentially grow the company. Studies have linked increased spending on buybacks to decreased corporate investment – such as expansion plans, more hiring or raises. Buybacks have been used as a punching bag for Democrats in particular who argue that buybacks enrich companies and wealthy shareholders at the expense of workers, who miss out on companies spending their excess profits on hiring more employees or issuing raises.

Share buybacks are therefore thought to exacerbate inequality. A Gallup poll quoted by Vox shows only half of Americans own stocks, with the richest 10% owning 80% of all shares and the bottom 80% of income earners owning just 8%.

As for how share buybacks fit into the current financial paradigm, they have become exceedingly popular as companies look for ways to stash their extra cash brought about by pro-business tax legislation.

In December 2017 the Trump administration passed the Tax Cuts and Jobs Act. The legislation slashed the corporate tax rate from 35% to 21% and the top individual tax rate shrunk to 37%.

But the most important change concerned the repatriation of profits that US corporations were holding overseas. Under the act, companies were incentivized to bring their overseas profits to the United States, where they would be taxed at a one-time rate of 15.5%, which is lower than the regular corporate tax rate of 21%. Previously, companies would “defer” (really, avoid) US tax on profits held in low-tax jurisdictions like Switzerland and Ireland, until they brought their profits into the US, where they would be taxed at 35%.

In 2018, US multinationals took full advantage of the “tax holiday”, sending home over half a trillion dollars held overseas, to be taxed at the lower rate.

Suddenly these companies found themselves flush with cash, and they needed to find a way to spend it. The options are typically to: Plough funds back into the company via capital expenditures like new buildings, products or equipment; distribute the money back to shareholders in the form of dividends; share buybacks which don’t go directly to shareholders, but reduce the number of outstanding shares, thereby making the share float less diluted.

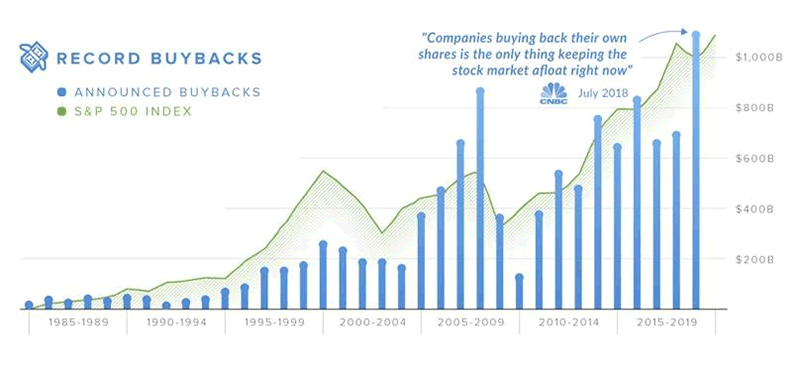

In 2018 US companies set a record $1.1 trillion in stock buybacks. Apple is the biggest re-purchaser, having poured a quarter trillion dollars into buying its own stock over the last decade, according to CNBC.

Since 2012, Apple’s buyback program cut its outstanding shares by one quarter, doubled its earnings per share, and ended up with a 150% increase in its share price.

Other FANG stocks have jumped on the buyback train.

Since Alphabet launched its buyback program in 2015, Google’s parent company has repurchased $17 billion worth of stock, thereby helping to reduce its total share count and, like Apple, double its per-share earnings. Over the past four years, Alphabet's stock has run up 123%.

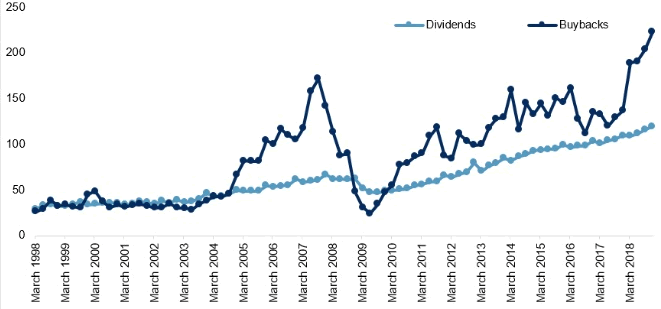

The data shows share repurchases have increased at a higher pace than the more direct means of rewarding loyal shareholders - dividends. As shown in the graph below, while cash dividends have risen gradually since 1988, buybacks are a lot more volatile. From the Indexology blog: “The amount of buybacks jumped significantly right before the 2008 global financial crisis and dropped drastically in 2009. Since 2010, the amount of buybacks has continuously grown and exceeded the amount of dividend distributions.”

There is clearly a strong connection between repatriation, stock buybacks, and higher-than-normal corporate earnings. Is it any coincidence that half a trillion dollars worth of overseas profits were brought home in 2018, during which time the United States saw the most share buybacks in history, along with sky-high corporate earnings (data firm Refinitiv estimates profit growth among S&P 500 companies at 23% in 2018) and a booming stock market? I don’t think so.

Even though repatriation has run its course, buybacks are still popular on Wall Street. In the first quarter of 2019, S&P 500 share repurchases totaled a record $223 billion. And even though the second quarter saw a decrease, it was still the second highest quarter, ever, for buybacks, which rose for four consecutive quarters prior to Q2.

+ Insider selling

If all these top companies are buying their own shares, boosting their earnings per share, padding their bottom lines and inflating their stock prices, their leadership must be brimming with confidence that all is well with the economy, right?

In fact, nothing could be further from the truth. A little research shows that executives have actually been dumping their own company’s stock, capitalizing on the price bump resulting from torrid buyback programs.

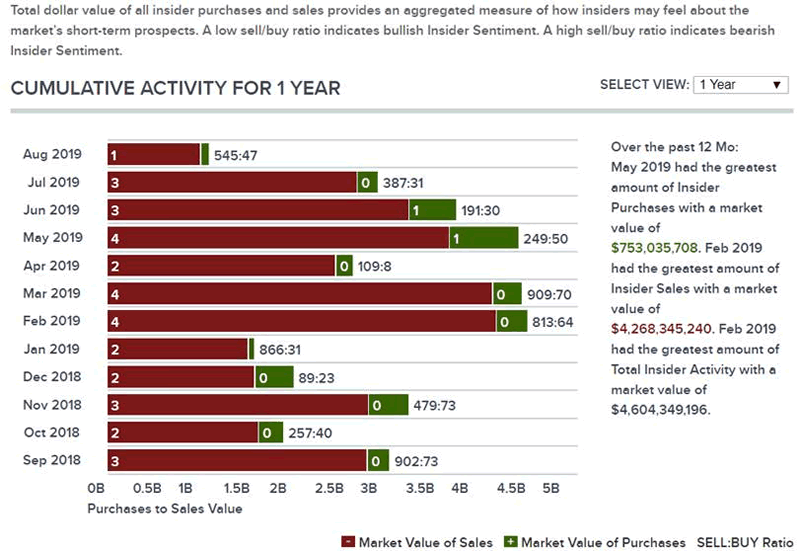

A recent report from TrimTabs shows many more CEOs are selling shares. CNN Business reports corporate insiders sold an average $600 million of stock per day in August - making it the fifth month in a row that insider selling topped $10 billion. The last time that happened was in 2006-07. Among the stock dumpers are top executives from Salesforce, Visa and Home Depot.

Why would an executive sell his/ her shares if they didn’t see bad news on the horizon? The answer is, they wouldn’t. While some try to defend the practice as “portfolio diversification” or some malarkey, the reality is, no-one purposefully dumps shares if they have faith in the company and its stock price. The only reason to sell is to cash out. Here is SEC Commissioner Robert Jackson disparaging insider selling:

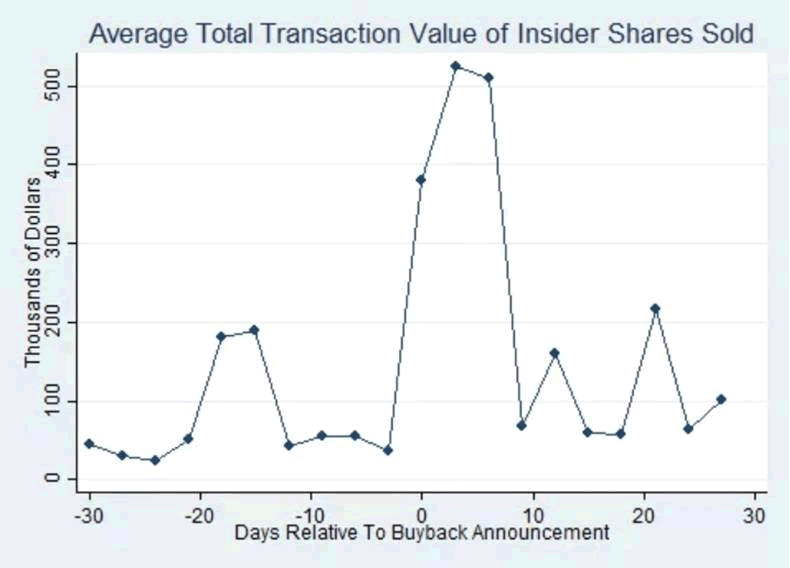

“When executives unload significant amounts of stock upon announcing a buyback, they often benefit from short-term price pops at the expense of long-term investors,” he said in a letter quoted by CNN, adding that “insider selling on buybacks is associated with worse long-term performance.” He added:

“CEOs don't sell valuable things cheaply. Executives are using buybacks as a way to cash out.”

Vox notes that the recent trend of “activist investors” who buy large blocks of shares to get seats on a company’s board, is another distasteful way for such investors to influence the direction of a company through buybacks.

The publication states that billion hedge fund manager Carl Icahn in 2013 convinced Apple to increase its stock buybacks in 2013, the same year he bought into the company. Three years later he sold his stock and made $2 billion.

Check out openinsider.com for a real-time record of who’s cashing out. On August 29 and 30, for example, Facebook’s CEO Mark Zuckerberg unloaded two lots of 125,600 shares each totaling about $23 million.

= Rising gold price

The really interesting comparison is between share buybacks, insider selling and the gold price. Could it be that these corporate insiders, who really are “the smartest guys in the room” with knowledge nobody else has regarding the future of their companies, be selling because they see the big red sign flashing ‘R’ for recession? That the time to sell is now, before the next Trump tweet sends stock markets into a downward spiral, before all those yield-curve inversion chickens come home to roost? And that it’s also a good time to be buying gold?

We think so, and we can prove it. The historical gold price chart below shows gold bumping along at around $400 an ounce from the 1990s to 2002. The buybacks chart courtesy of Visual Capitalist reveals a similar chart pattern to gold except for a peak in 1999 and a decline from 2001-04. That makes sense, because tech companies in particular likely had the most excess cash to buy their own stock at the height of the bubble, in 2000, before it burst in 2001 causing a recession, indicated by the blue bars heading down until 2004.

The mining supercycle that started around 2000 is reflected in the gold price chart, with bullion on an upward trajectory for over a decade, peaking at around $1,900/oz in September 2011. Stock buybacks also gather momentum during this period, peaking in 2007 just before the financial crisis, falling to under $200 billion at the bottom of the recession in 2009, then heading back up to reach above $1 trillion in 2018.

It’s tougher to find a correlation between the gold price and insider stock sales but we do know that stock repurchases correspond closely to insider selling. Research by the SEC, in a team led by Commissioner Jackson, showed that executives often use buybacks to cash out their holdings of company stock. Vox reports the 2017 study looking at 385 buybacks since 2017 found that in half, at least one executive sold shares in the month after the buyback announcement. Twice as many companies had insiders selling stock within eight days after the announcement, as they would on as normal trading day.

An increase in executive stock selling also closely matches the bump in the number of share repurchases since the above-mentioned repatriation of profits that came with the $1.5 trillion in tax breaks passed by the Trump administration in 2017, according to Politico.

Conclusion

The continued stock market bull we are seeing playing out week after week has lulled many an investor into a false sense of security. Returning to the Zero Hedge article mentioned at the top, we know there are many recessionary signals that we as smart commodity-focused investors need to pay attention to.

We also know that a big surge in stock buybacks occurred in 2007, a year before the Great Recession. Looking at Visual Capitalist’s historical buyback chart is instructive because we see the same pattern emerging, of a dramatic rise in buybacks, in line with high corporate profits amid the stock market bull. In 2009 those buybacks fell off a cliff, as companies saw earnings drop while global growth stagnated. Are we riding the rapids towards another waterfall?

Meanwhile company insiders are using the opportunity of buyback programs to cash out their holdings. Investors are challenged as to when is the best time to buy and sell their stocks. Timing the market is hard, but a major red flag should be when a key insider dumps their shares. Ignore these share sales at your own peril. The current insider share selloff is the best indication that I’ve seen to get out of equities (at worst you’ll be taking profits too soon) and, in my opinion, into the protection offered by the best safe haven for these troubling times: gold and junior gold stocks.

How high's the water, papa?

Five feet high and risin'

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.