Fed’s Cut Puzzle and Gold

Commodities / Gold & Silver 2019 Sep 07, 2019 - 02:17 PM GMTBy: Arkadiusz_Sieron

At the end of July, the Fed trimmed the federal funds rate. However, the dovish U-turn within the FOMC amid solid US economy remains a mystery. We invite you to read our today’s article about the Fed’s cut puzzle and its find out what does it mean for the gold market.

At the end of July, the Fed trimmed the federal funds rate. However, the dovish U-turn within the FOMC – just half a year after an interest rate hike – remains a mystery. After all, the data indicates that the labor market remains strong – unemployment rate is still at the record low – while the GDP has been rising at a moderate rate. While the inflation rate is below the target, it’s still significantly above the deflation zone. So why the heck did the Fed cut rates? The answer to this question is of great importance as long-term implications for gold differ depending on the possible reason.

First, the U.S. central bank could lower interest rates because Powell could not stand the pressure of the White House and the merciless tweets of Donald Trump. The Fed is, of course, nominally independent, but investors should not be naïve. The past presidents and policymakers also applied pressure on the Fed. The most famous example is the story how in 1965, President Lyndon Johnson summoned William McChesney Martin, the Fed Chairman, to his Texas ranch where Johnson physically shoved him around living room, yelling in his face, “Boys are dying in Vietnam, and Bill Martin doesn’t care.” The only difference is that past presidents tended to stick to creating pressure behind closed doors, while Trump is simply more public. If true, it would be a very positive scenario for gold prices. The politicians love low interest rates, and Trump is a particularly vocal supporter of cheap money.

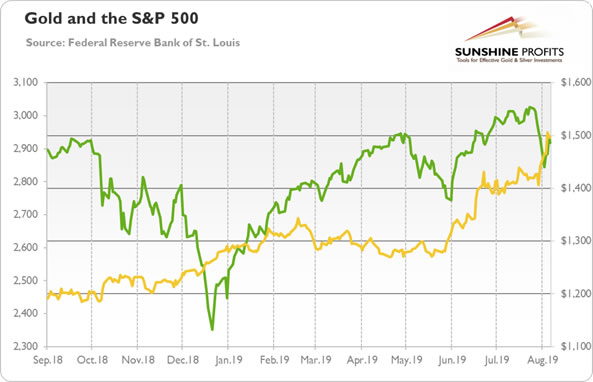

Second, the Fed could reduce the interest rates because of the pressure of the Wall Street. Since Greenspan, investors know that they can count on the central bank’s support in case of trouble. The Fed officials believe that higher stock prices are beneficial for the economy through the wealth effect, while Trump treats them as a measure of his success. This scenario could be neutral for the gold bulls. On the one hand, the Wall Street also loves low interest rates. However, the Greenspan’s put increases risk-appetite, diminishing the safe-haven demand for gold. The problem with this explanation is that the stock market was not collapsing prior to the Fed’s decision, as the chart below shows. Actually, the S&P 500 tumbled after the move, amid the renewed trade war witch China. And the Fed hiked interest rates in December 2018, despite the plunging stock market.

Chart 1: Gold prices (yellow line, right axis, London P.M. Fix, $) and the S&P 500 Index (green line, left axis) from September 2018 to August 2019.

Third, maybe the Fed’s decision stemmed from the global outlook worries, having little to do with the American economy as such. The Fed has paid in recent years significant attention to international considerations, acknowledging its status as the world’s central bank. Given the significance of the U.S. dollar and the dollar-denominated liquidity for the global economy, this is actually what we should expect. This scenario is positive for the gold prices. Given the recent economic slowdown in China and the collapse of industrial production in Germany, the Fed would have to adopt more dovish stance than U.S. domestic conditions justify. Not realizing the Fed’s full hawkish potential implies weaker greenback and stronger gold.

Last but not least, it is possible that the U.S. economy is simply not in such a good shape as it seems. In a sense, it has been obvious for years. After all, the Fed was telling us for a decade that the recovery is solid, but it was reluctant to normalize its monetary policy. It started hiking interest rates only in 2015, reaching mere 2.5 percent in December 2018. But it turned out that even such historically ridiculously low level was too high for the economy to stomach. It might be also the case that the U.S. economy remains solid, but the Fed sees the slowdown in its crystal ball. The yield curve has already inverted (both 10-year/3-month and 10-year/2-year spreads are already negative) and even the Fed’s models have shown elevated risk of recession. This scenario would be very good for the gold prices. Weak American economy should translate into low interest rates, rising public debt, higher risk premium and more intense buying of gold.

Our take is that the Fed cut interest rates because of the all the above factors. However, it doesn’t matter which reasoning was the dominant one, because practically all of them are positive for gold prices. Indeed, the case for another cut has strengthened since July. Trump renewed trade war with China, which rattled the financial markets (however, the U.S. later backtracked a bit). And, with the elections approaching, the President will continue to exert his pressure on the Fed. The global economy slowed down further, while the spread between long-term and short-term bond yields fell more deeply into negative territory. In such an environment – and with very dovish expectations of the markets – the Fed could be forced to provide yet more stimulus. Gold should shine then (at least to the extent that the Fed surprises the markets by beating dovish expectations) – if the Fed cut the interest rates under relatively good conditions, Gold only knows what it could do, when a true economic crisis arrives.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.