Gold and Silver Bad Moon Rising

Commodities / Gold & Silver 2019 Aug 30, 2019 - 03:23 PM GMTBy: The_Gold_Report

Precious metals expert Michael Ballanger discusses trends in the market and his recent trades. For those of you that have followed my raves and rants over the years, you are undisputedly aware of all of my biases when it comes to almost everything: bankers, politicians, invasive species, free market suppression, entitled Millennials, and finally, the utility of precious metals in a "financial order gone wild," which is precisely where we reside today.

Precious metals expert Michael Ballanger discusses trends in the market and his recent trades. For those of you that have followed my raves and rants over the years, you are undisputedly aware of all of my biases when it comes to almost everything: bankers, politicians, invasive species, free market suppression, entitled Millennials, and finally, the utility of precious metals in a "financial order gone wild," which is precisely where we reside today.

I sat on the stern platform of my boat looking at the moon you see rising in the photo above and over a number of well-oiled glasses of Pinot Grigio, I snapped the photo thinking that soon the sound of lamenting loons would be replaced by the torturous howl of timber wolves, a sound vivid in my memories from boyhood excursions in Algonquin Park. It is said that the most beautiful sound in all of nature is the final wail of the black swan in its dying moments, a sound so powerful that the ultra-famous rock band "Led Zeppelin" named their "Swan Song" record label after it.

Well, while financial events do not normally involve sounds, the haunting specter of seeing over 65% of all bonds issued around the world paying a negative return evokes memories of a "bad moon rising" of which ancient folklore of the lunar omen has filtered down through generation after generation. The problem here in 2019 is that NO generation has EVER encountered a financial instrument paying a negative yield because if you buy one, you have to pay the issuer to hold it. This absolute insanity is the nuclear torpedo in that is heading for the starboard side of the Good Ship "Modern Monetary Theory" as she steams headlong into the abyss becoming rapidly known as the "Japanification" of all things financial.

It began in Japan, where the deification of the American system of finance began shortly after Hiroshima and Nagasaki, whereby the lesson thereof taught a generation of Japanese investors that, when it comes to the Yanks, copy whatever they do but do it in triplicate. When the stock market crashed in 1987 and was rescued by the U.S. Fed and Treasury, those actions were absolutely revered by the Japanese such that five years later, they embarked on a market-rescue campaign that put the Greenspan/Reagan Working Group on Capital Markets to shame. In 2008, the Great Financial Crisis – er – bank bailout – sanctioned by the U.S. Congress had such an astoundingly positive superficial effect that not only the Japanese took notice, but another lurking leviathan called the People's Republic of China took the baton, increased its size by ten feet, weaponized it with a laser beam, and not only ran with it, they strapped jet engine turbines to their backs and rocketed into the ionosphere of unprecedented credit creation and monetary reflation.

So today, we not only have the Great American Military Machine kept alive by life support mechanisms designed to keep the U.S. dollar strong and in demand as the world's reserve currency, we have the major global economic regions all run by governments that have a coordinated and comingled commitment to total currency debasement and the complete annihilation of the purchasing power of their respective currencies. Saving money is archaic and reckless; debt management is avant-garde and prudent. The beguiling dying moan of the swan is the sound reverberating through the walls of central banks and houses of parliament or congress because the global financial system is drowning, choking, asphyxiating on its regurgitant debt load and there is absolutely nothing that anyone can do to prevent its mortal demise. And you wonder why gold just hit a six-year high?

The gold miners smell better times ahead and for those of you too young (or too old) to remember the gold old days of 2002–2011, the HUI (NYSE Arca Gold BUGS Index)-to-gold ratio peaked in the 0.55–0.60 range in the 2006–2008 period, and that was with gold bullion under $1,000. Today at $1,548, the ratio is one quarter of that level, having risen since the late 2015 lows at 0.091 to the current 0.15 level. The point I make is that the gold miners that choose to live or die by the sword of unhedged production carry enormous leverage to rising gold (and silver) prices. Secondly, the gold miners as represented by the HUI, are leading, not lagging, indicators for gold and silver prices and are confirming indicators for the major trend in gold.

Looking to silver (the "divorcee-maker"), it is much the same story with silver stocks still well below the highs of August 2016. What is compelling is that the gold-to-silver ratio (GSR)(I used to call it the "GTSR" but have since shortened it because the really important gurus use only three letters…), it now carries an 83 handle down from 93 where I shorted it last July after taking profits (prematurely would be an understatement) on my leveraged gold miner ETFs, both Senior (NUGT [Direxion Daily Gold Miners]) and Junior (JNUG [Direxion Daily Junior Gold Miners]). These ratios of gold and silver stocks to their underlying metal prices as well as the GSR's dramatic plunge to 83.64 are compelling testimonials to the power of this bull. GATA's co-founder Bill Murphy and I are both in undaunted agreement that the action in the silver market is finally, after six years in the dentist's chair undergoing root canal surgery sans Novocain, the kind of action that resembles, at the very least, a "normal" market, and at best, a very young but raging baby bull. I should point out that lemetropolecafe.com is my "GO-TO" site still after over ten years as a paid subscriber.

This morning I tweeted out a trading idea whereby, in total contradiction to the words printed above, I took profits on half of the SLV (iShares Sliver Trust) October $15.50 calls at $1.80 having paid $0.48 on July 23rd. 3.75 times your money is not to be sneezed at and far too many times have I failed to turn ring the register while in the throes of self-adulation and believing one's own bullshit. I am also still sitting on only ½ positions in the GDX (VanEck Vectors Gold Miners ETF) and GDXJ (VanEck Vectors Junior Gold Miners ETF), having erred in not buying them back late last week when they were $2 and $4 lower into the pullback.

I also am delighted with the action in Aftermath Silver recommended here and on Twitter in the $0.095-$0.10 range on July 11th. That it has absolutely exploded to $0.28 is not surprising to me in the slightest; what is surprising is how quickly it has reacted, proving once again that those companies sitting on a gold or silver resource are perfectly correlated to any movement in the underlying commodity versus the grass roots explorcos that have yet to establish any type of resource. For those that acted on my suggestion back around July 11th, good on you. $30 per ounce silver by year-end could easily see AAG at $0.50 so trade smartly. Silver bull markets are ridiculous with the silver juniors acting like weed and cryptostocks a few years back; ten-baggers are not uncommon…

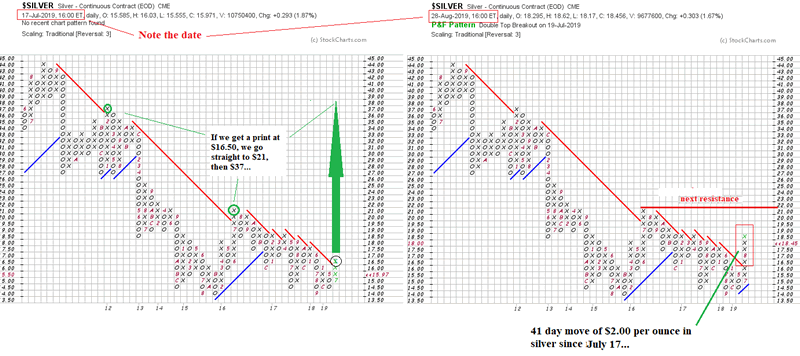

Lastly, I put out a point-and-figure diagram a few weeks ago (July 17th) and as the chart below displays, that $16.50 print did actually occur a day or two after it was posted and sure enough, you can see how silver popped almost as if shot out of a cannon. The P&F says "$21 is coming, then $37!" BUT, you have to understand that P&F's involve rudimentary price analysis and have zero utility as to timing. So trade accordingly. (No short-term call options advised based on this study…)

Finally, as we move forward into the final months of 2019, there will be corrections and there will be surprises but I am taking the approach that we are now officially ensconced in the biggest, wildest, scariest bull market EVER in the precious metals. If gold and silver prices were viewed as monetary beach balls being held underwater by the invisible hand of covert government suppression, they did so with the waters of monetary debasement rising around them such that by last June the waters were fifty meters deep and the upward pressure on those hands was at once both excruciating and unstoppable. At no time in history have so many invisible hands, operating in tandem and in urgency conspired to suppress the prices of gold and silver while at the same time through inverted yield curves, spiraling debt clocks, and negative yield financial instruments allowing the tidewaters of government and central bank incompetence to rise. This precious metals beach ball is exploding toward the surface with unparalleled force and momentum and when it finally reaches escape velocity, the public will be screaming to switch quadrillions of dollars of paper (stocks and bonds) into billions of dollars of physical gold and silver and the associated mining shares in a cacophony of panic and greed. And the sad thing for them and the wondrous thing for us is that there just won't be enough "product" to go around when that occurs.

Too bad, so sad.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.