Watch These Key Levels in Precious Metals

Commodities / Gold & Silver 2019 Jul 30, 2019 - 02:36 PM GMTBy: Jordan_Roy_Byrne

The precious metals sector appears to have started a correction.

The precious metals sector appears to have started a correction.

It was roaring higher until natural resistance kicked in and the US Dollar grinded its way higher, towards its 2019 high. Factor in the Fed decision this week and it has created a natural “buy the rumor, sell the news” event.

We cannot know for certain what the Federal Reserve will do or even more importantly, how the market will react. But we can take note of key levels in these markets.

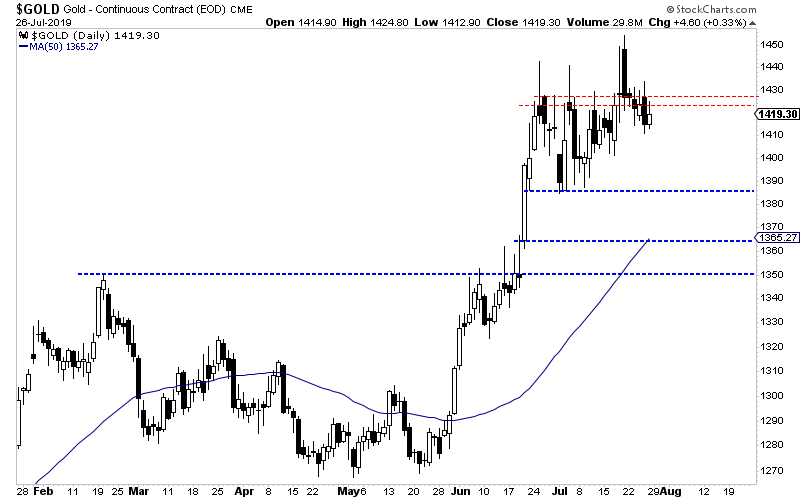

Gold has held above $1400/oz but has been unable to break past resistance at $1420-$1425/oz. A retest of $1385/oz is quite possible and so is a test of $1365/oz.

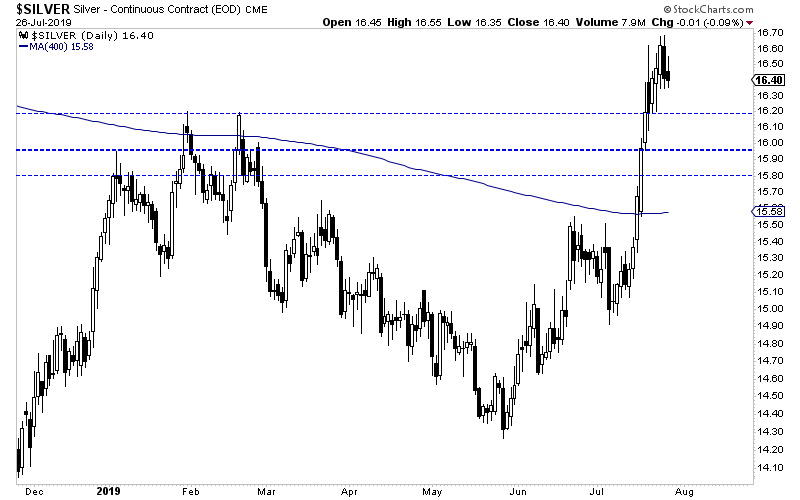

Silver has outperformed Gold since it broke above its 400-day moving average, which provided strong resistance dating back to the end of 2017.

Silver encountered resistance at $16.60-$16.70/oz and could test initial support at $16.20/oz. Below that is strong support at $15.95/oz.

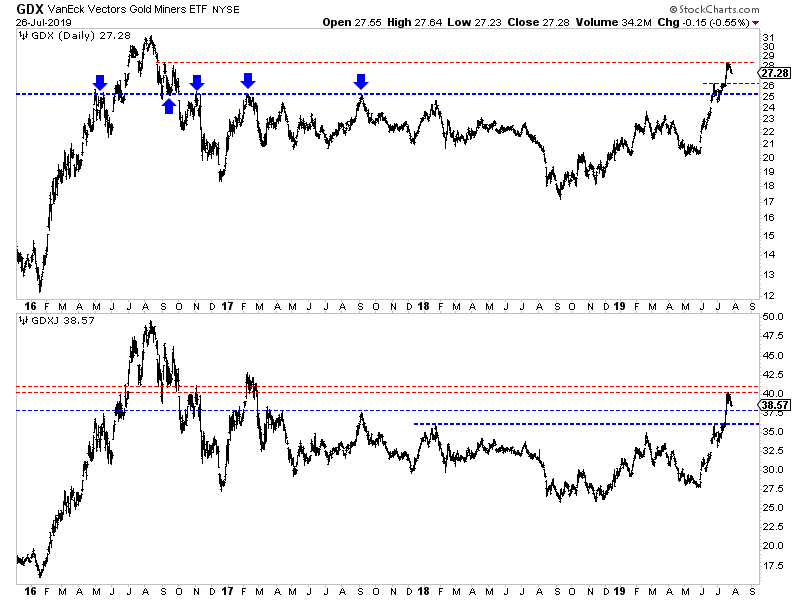

Turning to the gold stocks, we find a clear setup between support and resistance.

GDX, the ETF for large gold producers has resistance at $28 but good support above $25.00, which was previous resistance for nearly three years. Look for initial support around $26.00.

GDXJ, the ETF for the “senior” junior companies, faces resistance at $40-$41. It has initial support around $37.50 with strong support at $36.00.

Regardless of what the Fed does or says, my expectation is precious metals will test these levels and ultimately hold them. The Fed and global central banks want to ease policy and this figures to be more than a one-off.

Precious metals became overbought and a correction is in order.

Investors who smartly positioned in recent months should continue to hold their winners. If the sector continues to correct then look to be a buyer at the aforementioned support levels.

Look to focus your capital on fresh opportunities and value plays that are not very overbought or extended.

To find out the best buys right now and our favorite juniors for 2018 consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.