Central Bank Gold Agreement No Longer Necessary in Europe

Commodities / Gold & Silver 2019 Jul 30, 2019 - 02:22 PM GMTBy: Submissions

Last Friday, July 26, 2019 - the spot gold price got what should be the opposite of a “Friday News Dump” using a longer gold price history perspective.

Last Friday, July 26, 2019 - the spot gold price got what should be the opposite of a “Friday News Dump” using a longer gold price history perspective.

Effectively the significant bank power of Europe (ECB) and 21 other national central banks publically agreed that no gold bullion sale coordination is needed this September 2019 and after.

These +20 central 'gold holding' banks likely agree, that to sell sovereign gold bullion currently, is the exact opposite of what any prudent central bank should be doing.

Perhaps this ECB gold-related press release is because gold bullion owned direct without encumbrances is now deemed a top tier one asset?

Gold now considered real money, without risk on a financial institution's balance sheet.

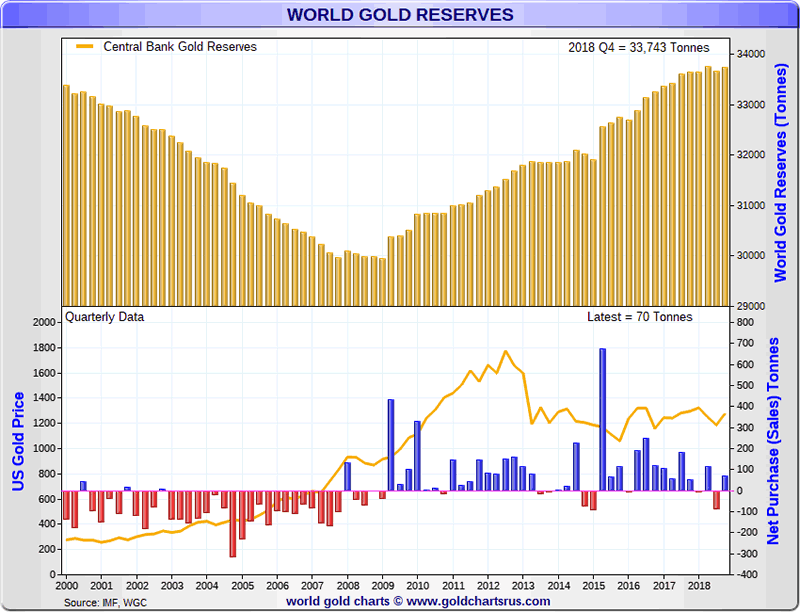

At the end of 2018, government central banks publicly acknowledge holding over 1 billion troy ounces of gold bullion or more politely put 33,743 tonnes (mostly in 400 oz gold bars like these).

Growing central bank gold hoard piles are close to around one-fifth of all the physical gold ever mined, and nearly half of all the investment-grade .999 gold bullion humans currently hold.

Current official bank gold holdings still show a highly concentrated position in the advanced economies of Western Europe and North America. While perhaps a legacy of the days of the gold standard gone by, to now an almost fifty-year running, fully fiat currency monetary-based system.

Central banks still maintain immense pricing power in the physical gold markets (along with growing gold buying eastern nations like India, China, and Russia).

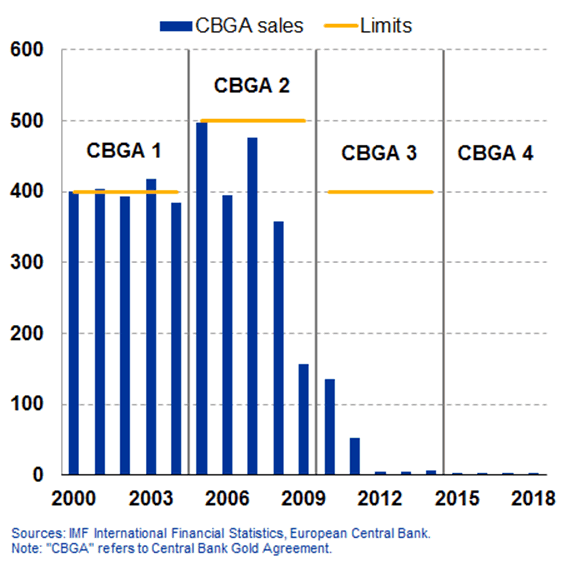

Major European central banks first signed a Central Bank Gold Agreement (CBGA) in 1999. Which then effectively limited the amount of gold bullion that signatories could collectively sell in any given year. Since 1999, there had been three further agreements, in 2004, 2009 and 2014.

The following chart illustrates that gold bullion sales by CBGA signatories effectively went to zero the year following the still standing 2011 gold price record high in fiat US dollars.

Central Bank Gold Agreement - ECB Gold Bullion Sales (2000-2011)

Two of the most revealing aspects of this beginning 21st Century gold bullion selling phenomenon by mostly European central banks is attainable by gold market research.

#1)

Where did much of that physical gold bullion likely flow?

Physical gold flow data shows it mostly went to the eastern world. Here is a swiss gold refinery director, admitting as much in 2015.

#2)

Even by collectively selling over one year of physical gold bullion supplies (in just over a decade's timeframe).

How did all this gold bullion selling do so little to dampen the fiat currency gold price run-ups from the early 2000s to the years following the global financial crisis in 2008?

Perhaps as Kiril Sokoloff, the well-respected chairman and founder of 13D Global Strategy & Research, stated point-blank in an interview on Real Vision published the same day as this ECB gold bullion policy news.

Watch the one minute clip below as he and Raoul Pal discuss solutions to the fiat debt-fueled crisis building.

While we agree with his statement that the gold price has gotten suppressed since 2011, we would argue this has been the case for far longer than merely the last eight years to time.

Even the founding US Treasury cables for COMEX gold derivative trading in 1974 speak to this point.

Mr. Sokoloff did not get pressed as to why he made such a supposedly bold statement. Admittedly he may have pointed out that the current gold price discovery mechanism is mostly a show of representative contracts, not physical gold bullion itself.

-

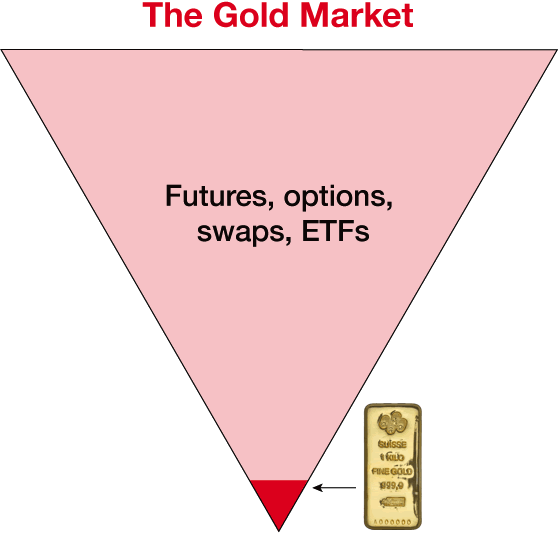

The gold price discovery market currently remains a highly leveraged, fractionally reserved, derivative contracts via COMEX / LBMA gold derivative trading markets.

On a leveraged basis, hundreds of representative ounces of gold get notionally traded daily. All the while, only one comparative underlying troy ounce of gold bullion moves physically for delivery somewhere in the world. In other words, outsized derivative contract trading still wags the price of gold bullion daily.

We do not know where the gold price might be if physical supply-demand fundamentals for a physically led gold price discovery mechanism took hold.

For the past 11 years, central banks the world over have been collectively buying gold bullion, effectively since the 2008 global financial crisis.

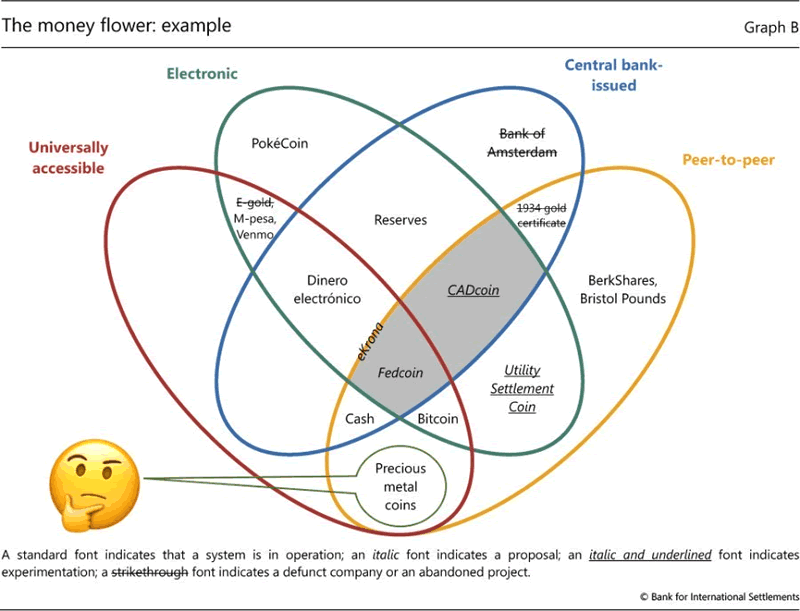

The Bank for International Settlements (BIS), what many refer to as the central bank of central banks, in their Money Flower illustration below give us something to ponder regarding gold bullion.

A picture as to why gold bullion is one of the most often saved monetary tier-one assets of fiat currency custodians today. Anyone who has done the research knows historically, aside from precious metal monies, all currency proxies fade away in time.

Central banks now buy more gold bullion per year than they did since the last gold price suppression scheme failed (e.g., London Gold Pool failure, post-1968).

Are we again on the road to eventually finding a fair market value for physical gold at valuations far higher than they currently are?

Here is a bit of history has played out for gold vs. US dollar values prior. Even the gold vs. Greenback Era can give insights about gold price manias after both monetary and fiscal abuse over long durations of time.

Recent formal and informal recognitions that gold bullion is a tier-one riskless asset on a balance sheet, that no prudent central bank would be selling it in mass, and that its price has been artificially suppressed for many years now.

These are all trends which the crowd, most likely still years from now, will eventually nod in agreement over.

Before this 21st Century gold bullion mania gets valued in earnest. Learn further best practices for gold bullion buying and selling, pick up our free SD Bullion Guide by email.

As well see a backtest and data study, for how prudent gold investment allocations have performed for the vast majority of this current full fiat currency era (1968-2016).

Thanks for visiting us here at SD Bullion.

By SD Bullion

https://sdbullion.com

SD Bullion - is a major 'Top 5' online physical silver and gold bullion dealer in the USA. Having now served over 100k customers worldwide with, "The Lowest Price. Period."

© 2019 Copyright By SD Bullion - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.