Stock Market SPX and Dow in BREAKOUT but this is the worrying part

Stock-Markets / Stock Markets 2019 Jul 13, 2019 - 05:29 PM GMTBy: QUANTO

SPX and Dow are in BREAKOUT mode. There are things that are worrying even as markets climb to new highs. The new highs need to be confirmed via volume and market internals. We take a look at some of them.

SPX and Dow are in BREAKOUT mode. There are things that are worrying even as markets climb to new highs. The new highs need to be confirmed via volume and market internals. We take a look at some of them.

Our Twitter feed has all the feed news as they release. Follow us on twitter

Fed Chair Jerome Powell testified before Congress yesterday and effectively communicated that the Fed would lower rates at the end of this month. However with data not yet supportive of a rate cut and inflation starting to rear its head again, capital outflows remain a key risk for the US in case of a rate cut. Sensing the dilema, bond markets have started

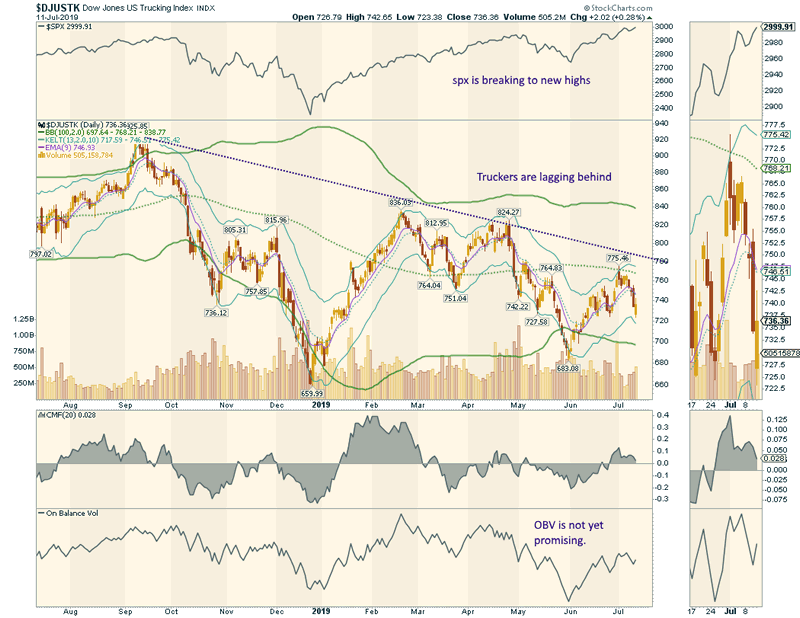

A key confirm for a sustanability of a rally is truckers index. This continues to lag the broader index. GOLD

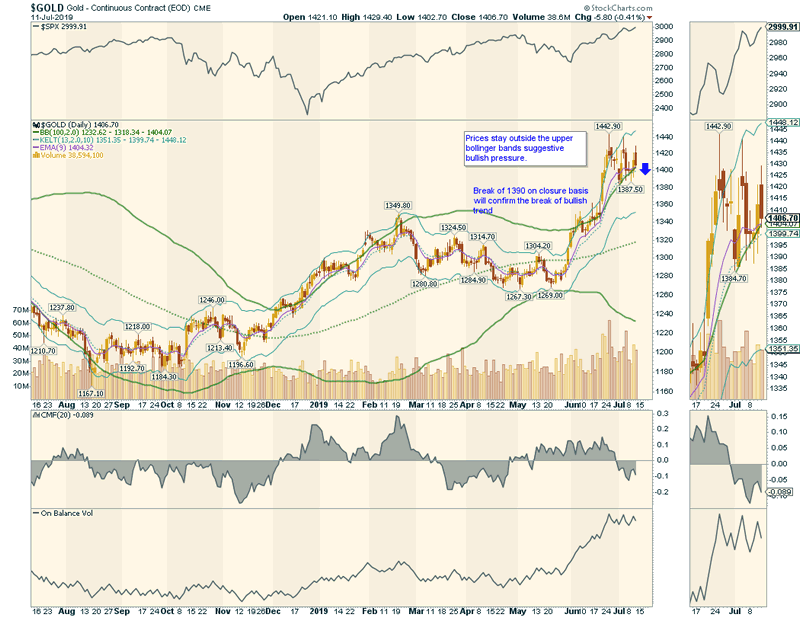

GOLD prices are well supported at 1400 and can mount anothe rally to 1450. However a break of 1390 on a closure basis could mean more downside and a high in for the intermediate.

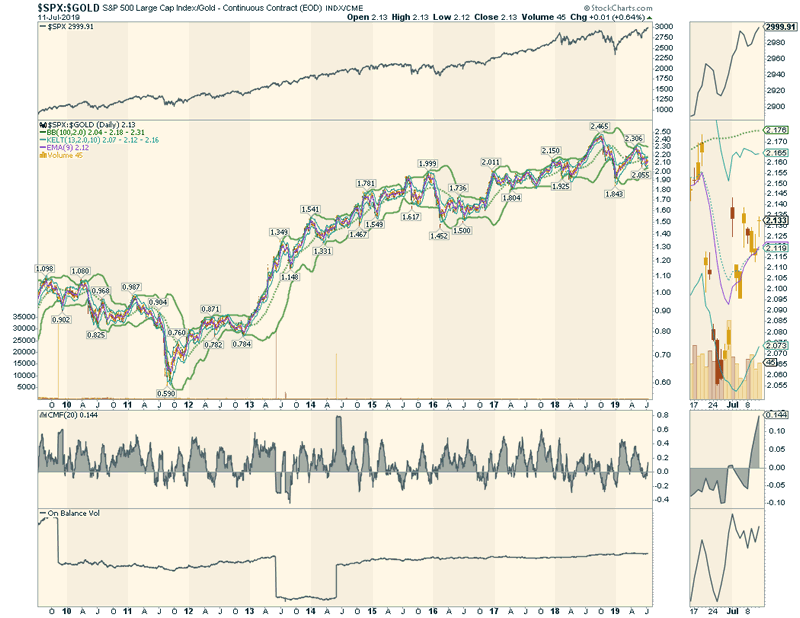

SPX:GOLD

Even with SPX at 3000, money seems to be chasing zero yield gold. The ratio is well below its highs even with equities breaking tok new highs.

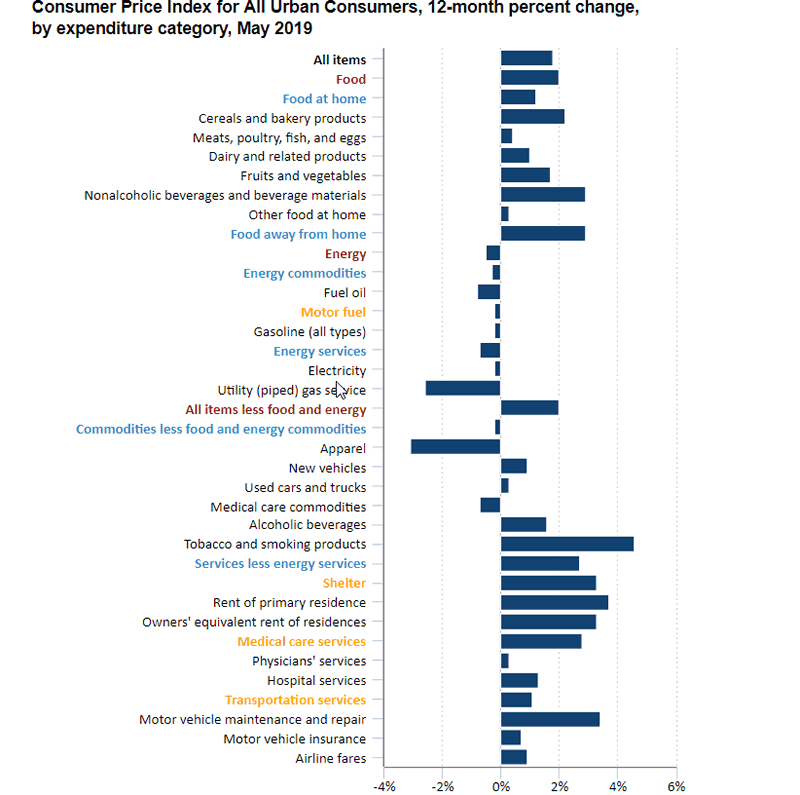

US Inflation

U.S. underlying consumer prices increased by the most in nearly 1 1/2 years in June. The rise comes amid solid gains in the costs of a range of goods and services, but will probably not change expectations the Federal Reserve will cut interest rates this month. The overall CPI edged up 0.1% last month, held back by cheaper gasoline and food prices. Food prices rose 2.0 percent from May 2018 to May 2019, with prices for food at home increasing 1.2 percent. Prices for all six major grocery store groups increased over the past 12 months, with prices for nonalcoholic beverages (2.9 percent) and for cereals and bakery products (2.2 percent) increasing the most. Prices for food away from home rose 2.9 percent over the past year. From May 2018 to May 2019, energy prices decreased 0.5 percent. Over that period, gasoline prices decreased 0.2 percent, natural gas prices declined 2.6 percent, and electricity prices fell 0.2 percent.

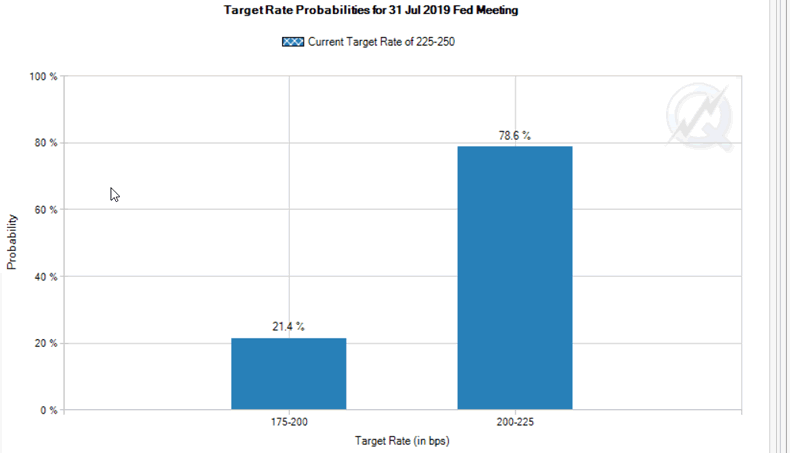

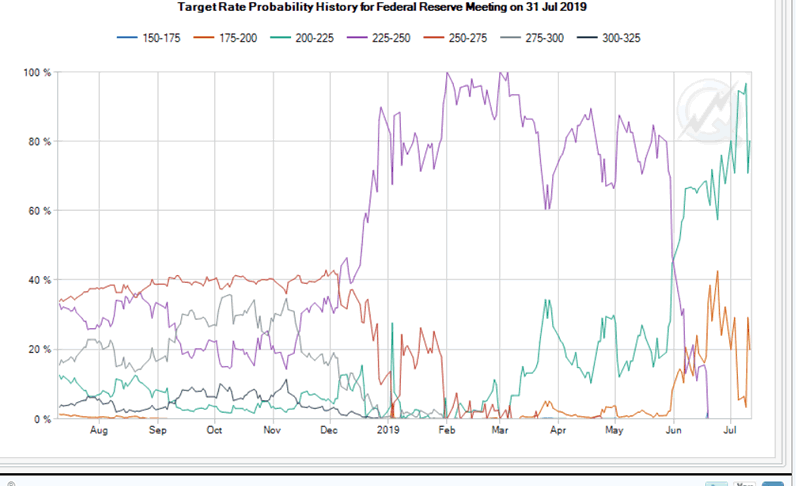

Fed probablity of a rate cut

The rate cut probablity stands at 75%. However this was at 95% just about 5 days back. Suddenly market is having doubts about Fed ability to cut rates.

See the line indicating 2% to 2.25% as nearly 95% and now dropping to 75%. This is a remarkable fall in probablity as we approach fed decision. Even if fed wants to cut, they may not be able to do much given. If they do end up cutting even as inflation is starting to pickup, they risk a major outflows from the US markets. This is going to be a real tight one. Even if they do cut to keep the government at bay, they will follow it up with dovish commentary.

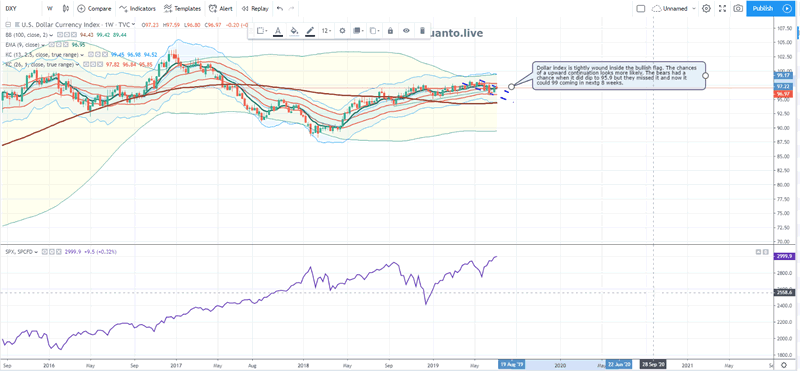

Dollar Index: Bullish flag

The weekly dollar chart shows a bullish flag formation. The support at 95.9 held and after brief dip below 97, the index looks very well supported to go higher.

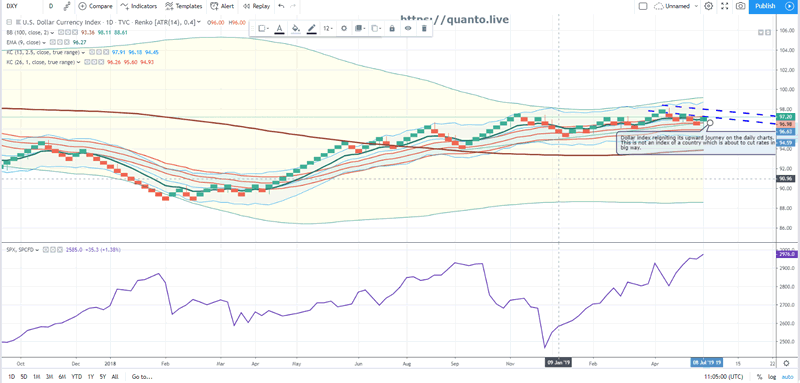

Dollar daily renko chart shows the restart of a broken uptrend. We could be headed higher.

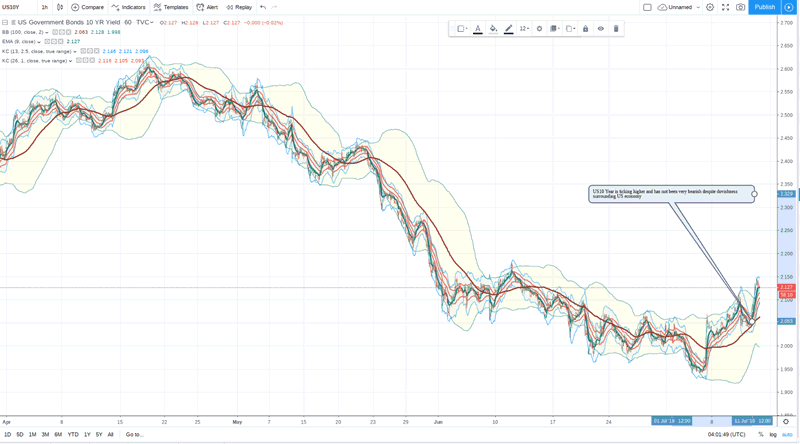

Bond Markets

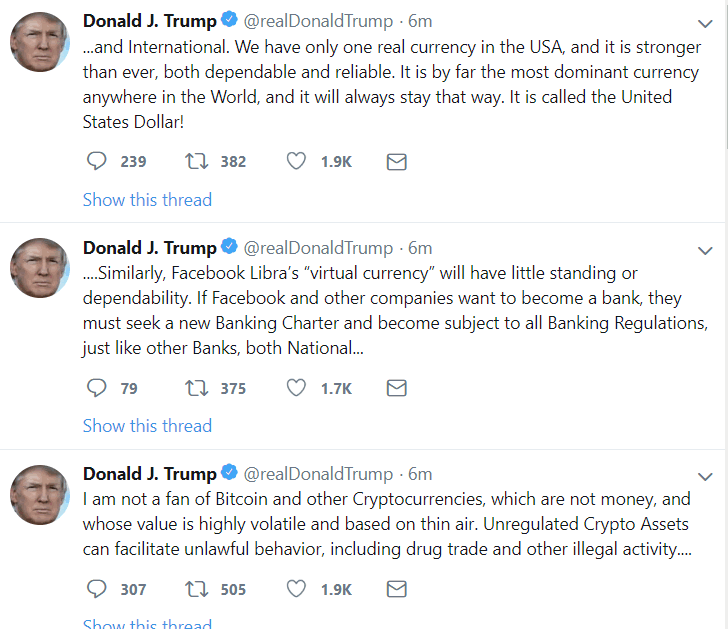

The 10 year yield has risen above 2.1% in asian session. Investors are starting to get worried with inflation. The rally was prompted by a tweet from Trump about dollar attractiveness.

This tweet by trump seems to be more panicky than it seems at first. There is genuine worry that there is going to be severe outflows give dollar not rising in value for extended period despite underlying reporting good numbers. This may be all that is needed for dollar to start to breakout of its consolidation at 97 and race to 100.

QUANT Trade Copier Given how complex the world is and the forces that are acting upon financial instruments, we suggest you trade a well funded account with the QUANTO trade copier which will copy our trades to your account. Our system has generated +22% in May, 10% in June and now its up +9% in July. Historically the system has demonsrated returns since 2012. Current monthly performance.

More information on how to start can be had here: Reach us

You can also freely register to get all our research. Register

Please email us at partners@quanto.live

Last but not the least: Our Twitter feed has all the feed news as they release. Follow us on twitter

About QUANTO.LIVE Team

Trading Performance

QUANTO is a trading system which combined Market Profile Theory and Kletner channels. It is hugely profitable. There was a trader back in If you would like to start right away, please contact us. Our email: Partners@quanto.live

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.