Dow Stock Market Trend Forecast Current State

Stock-Markets / Stock Markets 2019 Jul 12, 2019 - 10:59 AM GMTBy: Nadeem_Walayat

Most market commentators remain confused, flirting between being bearish or bullish usually AFTER the fact, AFTER the market has risen or fallen. Take when I last looked at the Dow and the market was in a downtrend eyeing an assault on Dow 25,000. At the time the reasoning was 'surprise' failure to resolve the US China trade war for why stocks had fallen. All without understanding the underlying mega-trend drivers that remain constant regardless of what Trump announces or tweets or threatens, which are the trends towards war with China, Climate Change, the Inflation mega-trend (money printing), AI mega-trend and Africa's population explosion amongst others that come to mind. All of which were in motion BEFORE Trump came to office and will remain so for decades after Trump leaves office.

Most market commentators remain confused, flirting between being bearish or bullish usually AFTER the fact, AFTER the market has risen or fallen. Take when I last looked at the Dow and the market was in a downtrend eyeing an assault on Dow 25,000. At the time the reasoning was 'surprise' failure to resolve the US China trade war for why stocks had fallen. All without understanding the underlying mega-trend drivers that remain constant regardless of what Trump announces or tweets or threatens, which are the trends towards war with China, Climate Change, the Inflation mega-trend (money printing), AI mega-trend and Africa's population explosion amongst others that come to mind. All of which were in motion BEFORE Trump came to office and will remain so for decades after Trump leaves office.

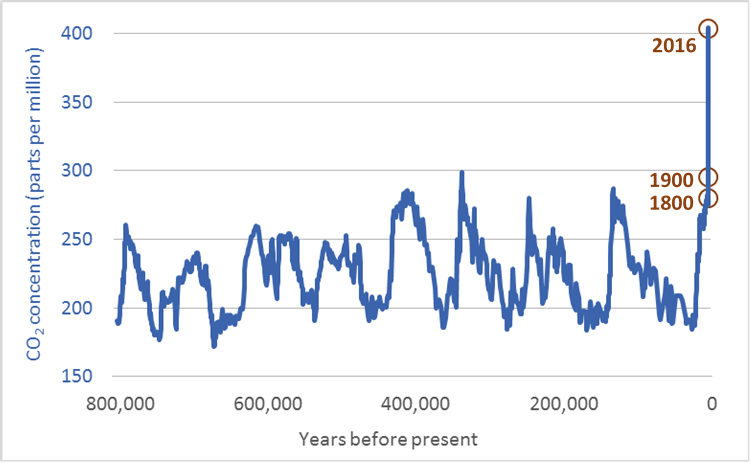

With several added risks that are more likely than not such as a global pandemic, even perhaps a limited nuclear war where even the detonation of 100 nukes could trigger a nuclear winter, though don't take that as a solution for climate change as our finely balanced equilibrium could swing sharply in the other direction, let alone the consequences of radiating the planet.

So letting off 100 nukes would be NO solution to climate change! However, a simulated nuclear winter through controlled injection of particles into the stratosphere could be a possible solution to run away climate change currently underway. Of course the best solution would be to suck about 40% of co2 out of the atmosphere which is probably the solution the worlds major economies will settle on and implement once climate change starts to really bite, so should prove to be a good stocks sector to start looking to invest in ahead of the curve that I will take a close look at in future analysis.

Thursday saw the Dow close at a NEW ALL TIME high of 27,088. Remember folks this bull market began in March 2009 that's over 10 years ago! But no ones asking the question why are we experiencing the Longest running bull market in history. Anyway, the latest bull market setting milestone reason was that the Fed is going to start lowering US interest rates THIS month. However, if you understand the mega-trends then you know that's just what's on the surface and not the primary driver for the mother of all stocks bull markets that I concluded over 5 years ago could run for literally DECADES to come! Yes we will have corrections and technical bear markets i.e. 20% drops, but ALL of these will just amount to BUYING opportunities. Which is why as an investor ones No1 task is to have a LIST of STOCKS to accumulate whenever the opportunity presents itself!

In this respect I provided my Patrons with an updated list of stocks in the KEY Mega-trend stocks driver of our age - Artificial Intelligence, at the start of April 2019. Top 10 AI Stocks for Investing to Profit from the Machine Intelligence Mega-trend

So there was no excuse not to take the buying opportunity presented as the stocks traded at a discount as I suggested at the time.

10th May 2019 - Stock Market US China Trade War Panic! Trend Forecast May 2019 Update

At the end of the day look for opportunities in this correction to accumulate into the machine intelligence mega-trend stocks,

With even more AI sub sector stocks to add to ones list in my more recent article - Investing to Profit and Benefit from Human Life Extension AI Stocks and Technologies

US Interest Rates

So today's market focus is on the Fed giving signals of lowering US interest rates by at least 25 basis points and perhaps as much as 50 basis points this year starting with a 0.25% cut THIS month to take the Fed Funds target range down to 2% to 2.25%.

“Economic momentum appears to have slowed in some major foreign economies, and that weakness could affect the US economy. Moreover, a number of government policy issues have yet to be resolved, including trade developments, the federal debt ceiling, and Brexit. And there is a risk that weak inflation will be even more persistent than we currently anticipate,” said Fed Chair Powell.

So why move to cut interest rates now?

Well pushing down short-term interest rates will have the effect of reversing the dreaded recessionary bond market signal of an inverted yield curve that the US has been in since Late June (10 year minus 3 month).

(Charts courtesy of stockcharts.com)

So cutting US interest rates by 0.5% should end the inversion and lessen the risks of a recession during election year.

Dow Stock Market Trend Forecast 2019

My in-depth analysis of 1st March 2019 Stock Market Trend Forecast March to September 2019 concluded in the trend forecast for the Dow to achieve at least 28,000 by Mid September 2019.

At the update of April 7th (https://www.patreon.com/posts/stock-market-dow-25930920) the stock market was running ahead of the forecast by some 700 points.

When I warned to expect the stock market to converge towards my trend forecast rather than continue trending higher.

However, with stocks approaching resistance at previous all time highs I consider the most probable outcome is for the Dow is to converge towards my trend forecast during the remainder of April.

The stock market was taking a tumble at my last update of 10th May (Stock Market US China Trade War Panic! Trend Forecast May 2019 Update) which the mainstream media had attributed to Trump Trade war chaos based on their preceding consensus view that the Trade war would soon be resolved instead the opposite happened to widespread expectations. Whatever the actual cause and effect as I have long seen a full spectrum war with China is an inevitable mega-trend that I have covered at length over the years, the stock market saw SELL in MAY and GO AWAY kick in a couple of weeks earlier than original anticipated.

At the time I concluded to expect the stock market to resolve to meet the forecast trend trajectory (red line) by Mid June and then embark on a trend towards new all time highs and thus to take stock market weakness as an opportunity to accumulate AI mega-trend stocks trading at a discount.

Conclusion : The Dow is overall likely to trade within a tight trading range of 26,500 to 25,200 for the next month or so as the Dow converges towards the trend forecast by Mid June. In plain English, I expect the Dow to meet the forecast trend (RED line) by the Mid June low before resuming the bull market to new all time highs.

At the end of the day look for opportunities in this correction to accumulate into the machine intelligence mega-trend stocks, though be wary of those with significant exposure to China, Apple, Baidu etc as they will exhibit greater price volatility. Though will take a closer look at the prospects for the SSEC this month.

Which brings is to the present:

The rest of this analysis was first made Patrons who support my work. Dow Stock Market Trend Forecast July 2019 Update

- Trend Analysis

- Elliott Wave

- MACD

- Seasonal Analysis

- Forecast Conclusion

- Mists of Time

- AI Stock Investing

- Quantum Computers

So for First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis :

- Gold and Silver Trend Analysis Update

- China Stock Market SSEC

- NASDAQ

- EuroDollar Futures

- Bitcoin Update

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- EUR/RUB

- Investing to Profit and Benefit from Human Life Extension AI Stocks and Technologies

- Silver Investing Trend Analysis and Price Forecast 2019

- Next British Prime Minister Tory Leadership Betfair Betting Markets

- Gold Price Trend Forecast Summer 2019

- Stock Market US China Trade War Panic! Trend Forecast May 2019 Update

- US House Prices Trend Forecast 2019 to 2021

- Bitcoin Price Trend Forecast 2019 Update

- Top 10 AI Stocks for Investing to Profit from the Machine Intelligence Mega-trend

And ensure you are subscribed to my FREE Newsletter to get my public analysis in your email in box (only requirement is an email address).

Your analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.