Stocks Can’t Even Rally on a Trade War “Cease Fire”

Stock-Markets / Stock Markets 2019 Jul 04, 2019 - 06:24 AM GMTBy: Graham_Summers

Yesterday’s market action was a MAJOR wake up call.

Stocks erupted 1.5% higher on announcements that the US/ China reached some form of a trade deal…

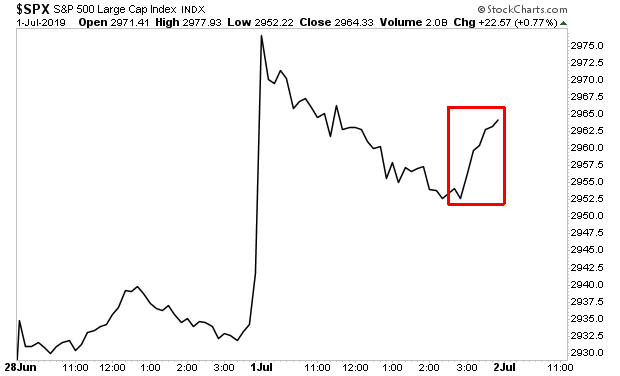

However, the rally barely lasted, giving up most of its gains by mid-day. It was only through a desperate end of the session manipulation (red box in the chart below) that stocks didn’t end the day flat.

Let’s be clear here… if the stock market cannot stage a major breakout on the prospect of the US/ China trade war entering a “cease fire”… the bull market is in major trouble.

I wrote about this yesterday…

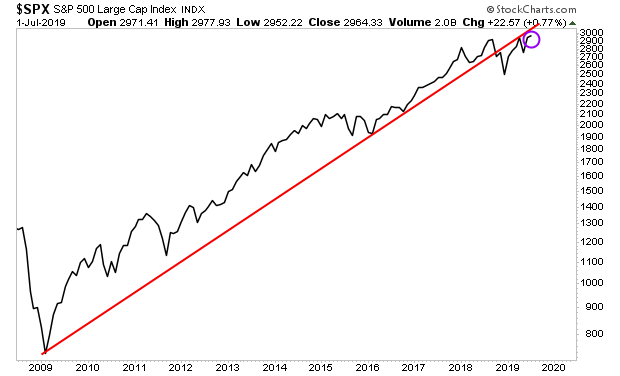

In the big picture, the stock market’s rally did nothing more than retest its broken bull market trendline.

And despite the clear attempts to induce another bull market, stocks were just rejected by this line for a second time last month (purple circle in the chart below)

Let’s be clear here… the stock market needs to ERUPT higher NOW, or we’re in major trouble.

As in “it’s CRASH TIME” trouble.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2019 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.