Exceptional Times for Gold Warrant Special Attention

Commodities / Gold & Silver 2019 Jun 18, 2019 - 06:13 PM GMTBy: The_Gold_Report

Technical analyst Clive Maund charts gold and explains why he believes this is a good time to build positions.

Technical analyst Clive Maund charts gold and explains why he believes this is a good time to build positions.

With things shaping up so well for gold, we can certainly take any short-term correction in our stride, and more than that, we can seize upon it as an opportunity to build positions further across the sector, whether by means of ETFs, stocks or options, and of course, gold itself.

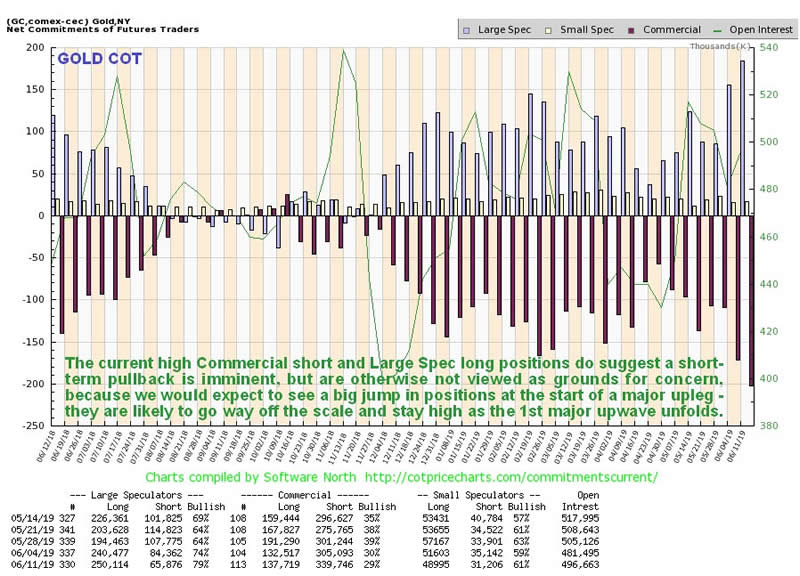

Several factors suggest that a modest short-term correction is likely before the major breakout occurs. Gold is overbought after its recent run-up and is rounding over beneath the major resistance approaching $1400, as we can see on its latest 6-month chart below. Thus, the appearance of a short-term bearish "shooting star" candlestick on its chart on Friday coupled with its latest COTs showing Commercial short and Large Spec long positions hitting rather extreme levels suggests that it is likely to react back over the next week or two to allow things to cool for a bit before the major breakout occurs. The current COT structure IS NOT regarded as bearish overall, because we would expect speculators to pile in at the start of a big move—positions can be expected to get much more extreme once the big breakout occurs, flying off the charts and staying high as the first major upleg of the new bull market unfolds.

Fundamentally, the compelling reasons for a major gold bull market are coalescing fast. After putting a sticking plaster on the system for the past 10 years by means of "Quantitative Easing"—stop and think about this term for a minute, someone was obviously charged with the task of "putting lipstick on a pig" by coming up with it, what they really mean is state counterfeiting—if you did what they have been doing in your backyard, printing money, you would risk ending up in jail—they have done it on a much grander scale and are still free to walk the streets—that plaster is now coming off and things are now unravelling fast.

The Fed's attempt to return to relative normality by raising rates and scaling back their bloated balance sheet quickly came off the rails, leaving them as impotent bystanders. They have abandoned ship and we are now staring at the prospect of QE on an even grander scale than hitherto coupled with NIRP (Negative Interest Rate Policy), as the masters of the system move from pillaging the populace by means of interest rates way below the real rate of inflation to outright grand larceny in the form of bail-ins (theft of funds from bank accounts) and negative interest rates.

Needless to say, negative interest rates just by themselves are going to make gold look like a very attractive alternative to stashing cash in the bank and getting fleeced, and quite obviously, the trend towards zero and even negative interest rates will remove support for the dollar which will tank, providing a powerful tailwind for gold which has been held in restraint over the past year or so (at least against the dollar) partly by the dollar's rally on the back of rising rates.

The combination of QE and NIRP are just one factor, albeit a big and important one, that will drive gold higher. There are others, like the fact that central banks are buying gold at a record rate. They know that the writing is on the wall for the doomed fiat system and that gold will hold its real value no matter what. That's why they are stashing gold away as fast as they can.

In addition, there is a larger geopolitical reason for bigger, more powerful countries like China and Russia to accumulate gold, which is that if they are to push the dollar off its perch as the global reserve currency, then they are going to have to find alternatives to trading in dollars, and to the SWIFT system, etc., and be able if they wish to back their currencies with gold. Their move in this direction is what makes the current situation so dangerous, because the U.S. Neocons are not going to take this lying down, which is why they are trying to a stoke a war with Iran—they reason that they have better odds of tipping the geopolitical scales in their favor if they get a conflict going now than if they leave it until China has become a lot stronger. This also explains the trade war with China, which is a blatant attempt to "throw a spanner in the works" of the Chinese economy.

Another reason why the U.S. wants to attack Iran becomes clear when you understand that China has created a system whereby it can buy oil outside of the U.S. dollar system, by making direct payments in yuan convertible into gold and this is already a reality because a Yuan denominated crude oil futures contract started trading last year—and where does China get a lot of its oil from?—you guessed it, Iran. This move by China is a serious and direct threat to both the dollar and the Treasury market, especially as China is the world's biggest oil importer so a lot of oil money is going to go into the yuan and thence to gold, instead of dollars, which will be a massive driver for higher gold prices. The Neocons have a compelling geopolitical reason for attacking Iran, as they see it, which is to both punish Iran for trading outside of the dollar system and to shut off its oil supplies to China, enabling them to damage China further. If conflict with Iran erupts then it will be difficult if not impossible to ship oil through the Straits of Hormuz, which will cause a cathartic spike in the oil price because a third of the world's oil passes through these straits—and in the gold price—and the U.S. won't mind this so much because it is now a big oil producer.

Another factor that will be a big driver for more QE on an epic scale will be political pressure from the Millennial generation in the U.S. When times get a lot tougher they are going to DEMAND that the government takes action and prints a lot more money, and when we combine this with the dollar's looming crash caused by the loss of its reserve currency status, it is easy to see how the economy of the U.S. could end up one day like Venezuela or even Zimbabwe.

Worldwide, fiat is now in serious trouble as its endgame nemesis approaches, with the outlook for the dollar actually being worst of all, because of the magnitude of dollar-based debt and its impending loss of reserve currency status. The coming panic and chaos will force a return to fiscal prudence, and that must mean a reset and return to a gold standard. This is another reason that countries that see this coming, like China and Russia, are stashing away gold as fast as they can.

Finally, we will end by reviewing again the increasingly fascinating—and indeed awesome—long-term 10-year chart for gold. This shows that, notwithstanding any minor short-term reaction over the next few weeks, gold is about ready to break out of its gigantic 6-year long base pattern, which has taken the form of a complex Head-and-Shoulders bottom / Saucer, into a bull market that is expected to be spectacular and dwarf all previous ones, for the compelling reasons set above.

The expected near-term minor precious metals sector correction will be the occasion for us to focus on more specific investments across the sector, in ETFs, stocks and some options for those looking to leverage gains.

Originally posted on CliveMaund.com at 3.15 pm EDT on 16th June 19.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure: 1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure: The above repr0esents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.