These Two Charts Virtually Scream “Buy Silver”

Commodities / Gold & Silver 2019 Jun 18, 2019 - 09:22 AM GMTBy: Hubert_Moolman

The Amount of Dollars in Existence

The Amount of Dollars in Existence

Silver is currently trading around $14.84 an ounce. This is around 30% of its 1980 all-time high of $50. However, this is an incomplete representation of what silver is really trading at, relative to US dollars.

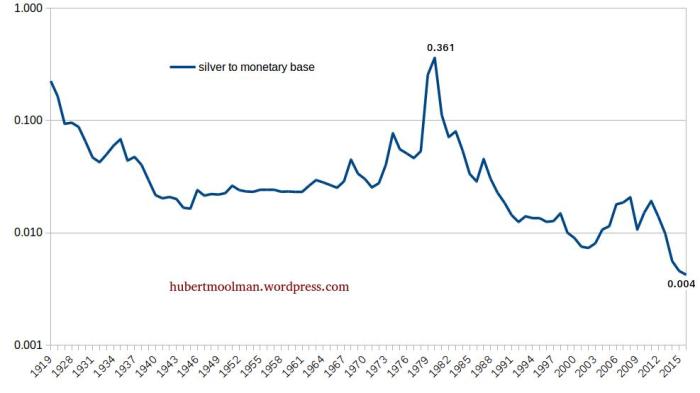

When you look at the silver price, relative to US currency (the amount of actual US dollars) in existence, then it is at its lowest value it has ever been (see chart below).

Also, it is ridiculous that one ounce of silver cost $50 in 1980 when there was about 132 billion dollars in existence, whereas today it is only $14.84 at a time when there is 3 304 billion dollars in existence (note that I have used rounded numbers which created some distortion).

The US monetary base basically reflects the total amount of US currency issued. Originally, the monetary base is supposed to be backed by gold available at the Treasury or Federal Reserve to redeem the said currency issued by the Federal Reserve. This is not the case any more, therefore, the amount of dollars have grown exponentially over the years.

Below, is a long-term chart of the silver price relative to the US monetary base (in billions of dollars)

Note that the ratio, or price of silver, in terms of US dollars in existence, is indeed at its all-time 100-year low.

In 1980, the all-time high was 0.361, whereas the ratio is currently at around 0.004. The US monetary base is currently around 3 304 billion dollars (or 3.304 trillion). Therefore, if silver was today at its 1980 value, relative to the monetary base, it would be around $1 193 (3304*0.361).

So, in terms of US dollars in existence, silver is trading at 1.24% (14.84/1193) of its 1980 high – it is the bargain of the century.

Silver Long-Term Channeling

On the chart, the first phase of the silver bull market was from 1993 to the end of 2001, and the second phase is potentially from 2001 to the end of 2015.

It appears that there is a similarity between the two phases. I have drawn some lines, and marked some patterns to show how the two phases are interwoven and could be similar.

The first phase is marked 1 to 3, in black, and the second 1 to 3, in blue. Both of the phases appear to occur within a broadening channel, from which they both broke down (out of the channel), after point 2.

Outside of the channel there was a triangle-type consolidation. The first phase managed to get back inside the broadening channel after breaking out of the triangle-type consolidation. If the current pattern follows, then we could have a big rally, after breaking out of the triangle consolidation.

Based on this comparison, buying silver now is like buying silver back in 2003 when it was under $5 per ounce.

For more on this, and similar analysis you are welcome to subscribe to my premium service. I have also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report.

Warm regards,

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2019 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.