Gold and Silver, Precious Metals: T-Minus 3 Seconds To Liftoff!

Commodities / Gold & Silver 2019 Jun 14, 2019 - 06:14 PM GMTBy: Chris_Vermeulen

We take great pride in our research team’s ability to make accurate predictions and calls in the markets. In addition to the many predictions and calls we’ve made over the past few years, our Gold prediction from October 2018 continues to astound many industry professionals. We receive emails from people asking how we were able to make such an incredible call in Gold 6 to 8 months before these price moves? We politely tell these people that our research team and our proprietary predictive modeling tools assist us in finding and making these incredible predictions. The simple answer is it takes hard work, specialized tools and a lot of skill and research.

We take great pride in our research team’s ability to make accurate predictions and calls in the markets. In addition to the many predictions and calls we’ve made over the past few years, our Gold prediction from October 2018 continues to astound many industry professionals. We receive emails from people asking how we were able to make such an incredible call in Gold 6 to 8 months before these price moves? We politely tell these people that our research team and our proprietary predictive modeling tools assist us in finding and making these incredible predictions. The simple answer is it takes hard work, specialized tools and a lot of skill and research.

Please take a minute to review some of our research from January 2019 that highlighted this incredible prediction for Gold and the supporting, more recent, research posts suggesting Silver is the real sleeper trade.

January 28, 2019: MULTI YEAR BREAKOUT IN METALS

June 7, 2019: ADL PREDICTIVE MODELING SUGGESTS A BIG MOVE IN SILVER :

June 2, 2019: IS SILVER THE SLEEPER RALLY SETUP OF A LIFETIME?

Today, we are highlighting what we believe is the momentum impulse move in Gold that will become the catalyst for the future move in Gold & Silver throughout the rest of this year and likely all of 2020. The key element to launch Gold and Silver beyond current resistance levels is bound by two factors and could be boosted by a third. The first two factors are “fear and greed”.

Investors are continually searching for suitable investments with healthy returns and moderate risk. As we have learned from the past, capital will flow into any investment, even instruments that include incredible long term risk factors, when the opportunity exists for gains and risk is mitigated. The current upside price move in Gold is just such an event.

The recent news items add additional fuel to the Precious Metals rally because they foster increased fear related to the global economy and potential military action or increased uncertainty. This fear translates into the action of “protect my investments that may be exposed to greater risk and find an investment that reduces this risk and provides for greater returns/gains”. That is the question Gold investors are asking themselves all over the world right now.

The booster fuel, which would drive Gold and Silver into another galaxy is the US Dollar. If the US Dollar were to weaken, even by 4% to 7%, while a global uncertainty event continued to unfold, we believe this valuation pressure would push Gold and Silver well above our current expectations.

When we think about the current environment for precious metals, one has to understand that fear and greed don’t have to be tangible or overwhelming. This process is almost like a perpetual motion machine. Once the process gets started where investors pile into Gold because of the fear and greed factors, the price of gold rises. Because the price of gold rises, traders start to pay closer attention to what is happening in gold and the greed factor starts to increase. Once they are convinced this is a bigger opportunity and their fear levels are still valid, the conclusion is “I don’t want to miss this move in Gold, so I’ll get it now – before the big move happens”.

It is as simple as that. And this is why we are saying “T-Minus Three Seconds” before the big breakout move really takes shape. That is our way of saying, it could happen any day now. The breakout move and the momentum base appear to be ready to go.

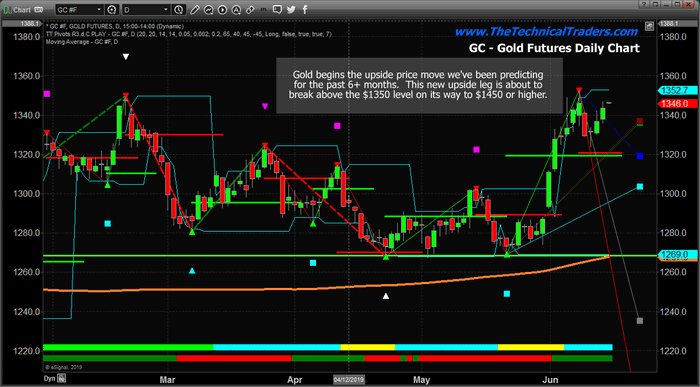

This Gold daily chart highlights the recent upward price move and shows just how quickly price can rally. This resulted in a $75 price rally (+6%) in a matter of 10+ days. Imagine what that will look like after Gold breaks above $1650 on the fear/greed move.

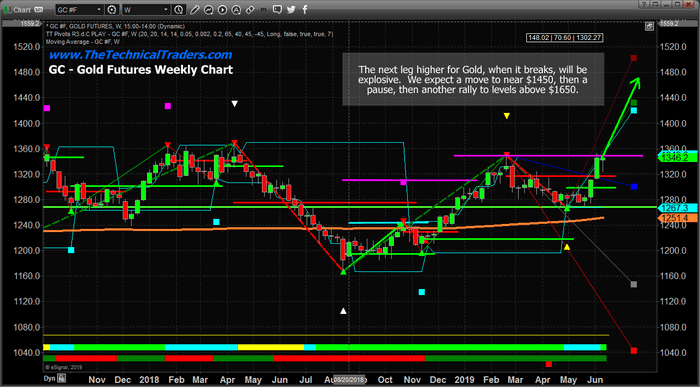

This Gold Weekly chart highlights what we expect to be the first upside leg – the move to $1450. After that, we expect a brief pause in the rally (possibly 7 to 21+ days), then another big move higher where the price will rally above $1650. That bigger move should solidify the focus of global investors and, much like the big move in Bitcoin, should attract a large number of investors not wanting to miss the rest of the upside move.

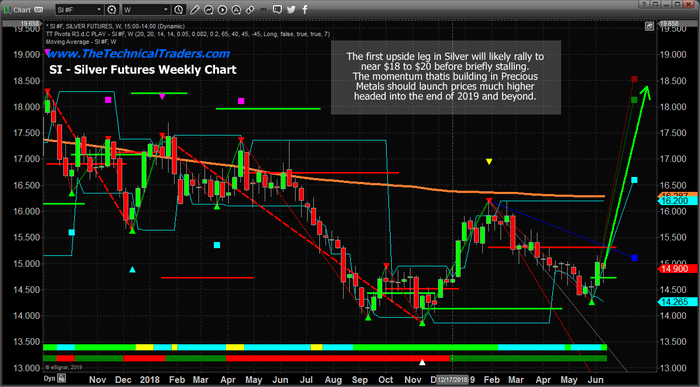

Silver is what we are calling the “sleeper trade” for precious metals bugs. Sure, Gold has all the action right now because it is the leading metal to offset this fear/greed factor. Silver always lags behind gold because it is the “little brother” to the bigger players in gold. As our research has shown, when the move begins, Silver is actually a better trade than Gold because it will likely increase in price by a factor of 1.4 to 1.8 compared to the rally in gold prices.

We believe the next move in Silver will target $18 to $20. These price levels below $15 are a gift for anyone willing to take the trade.

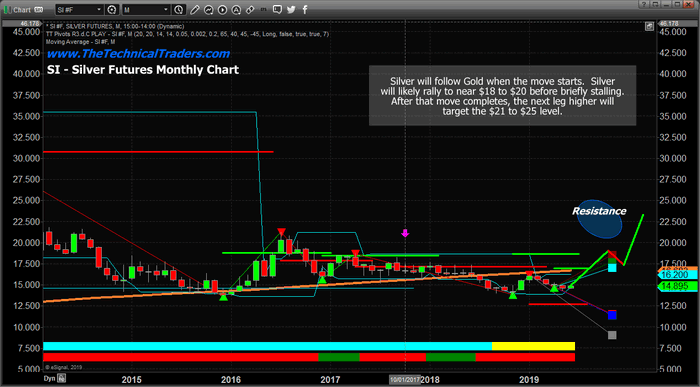

This Monthly Silver chart shows what we believe will be the upside price waves as silver advances past $22. Read the research posts, above, again to learn more about our more detailed expectations. It is all right there for you to see and understand.

T-Minus Three And Counting. We believe this setup is about to break to the upside and there is not much time left to see prices near these levels. Below $1400 in gold and below $15 in silver are about to end. When this really does begin to lift off as we’ve been predicting, we may never see these price levels again. Well, at least in the foreseeable future.

CONCLUSION AND UNIQUE OPPORTUNITY

Its been an incredible year and a half for many reasons. We and our Subscribers portfolios are up over 91%. We called forecasted each and every move in gold 8 months before it all unfolded right down to the week for the low/bottom.

This May we said it was a sell in May set up and we profited from the rally leading into May and traded and inverse ETF to profit from the correction. We then profited from the safe haven money flow into the utility sector which rallied while the stock market fell. And to top it off we shorted the vix spike for a quick 25% gain during a time when everyone else was panicking.

So what does this all this mean? It means we have a good pulse on the major markets and can profit during times when most others can’t.

I can tell you that huge moves are about to start unfolding not only in metals, or stocks but globally and some of these super cycles are going to last years. These super cycles starting to take place will go into 2020 and beyond which we lay out in our new book/guide: 2020 Cycles – The Greatest Opportunity Of Your Lifetime

I am going to give away and ship out silver rounds to anyone who wants to trade and invest with me for the next 1-2 years through my Wealth Trading Newsletter. You can upgrade to this longer-term subscription or if you are new, join one of these two plans listed below, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE (Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE (Could be worth a lot in the future)

I only have 27 silver rounds I’m giving away so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS TO GET YOUR FREE SILVER!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.