What If Stocks Are Wrong About Interest Rate Cuts?

Stock-Markets / Stock Markets 2019 Jun 11, 2019 - 02:42 PM GMTBy: Graham_Summers

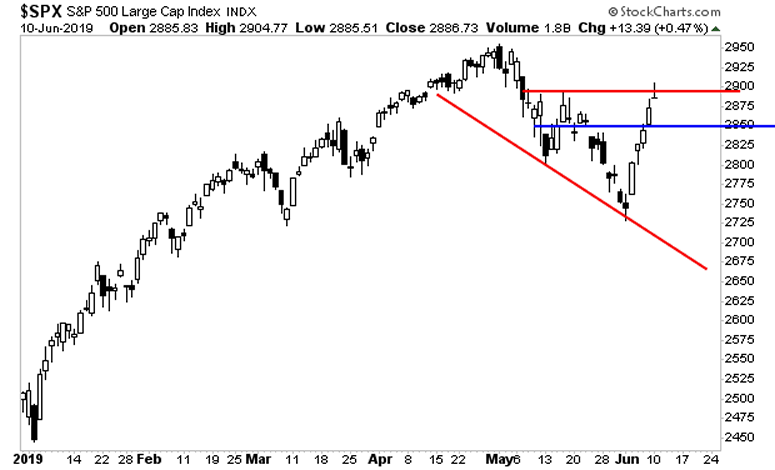

Stocks have now cleared the all-important level of 2,900 on the S&P 500. The index just peeked above critical resistance (top red line in the chart below).

Stocks have now cleared the all-important level of 2,900 on the S&P 500. The index just peeked above critical resistance (top red line in the chart below).

Overbought and overextended, stocks are now due for a correction/ consolidation. It would be completely normal to see the S&P 500 fall to retest support at 2,850 here (blue line in the chart below).

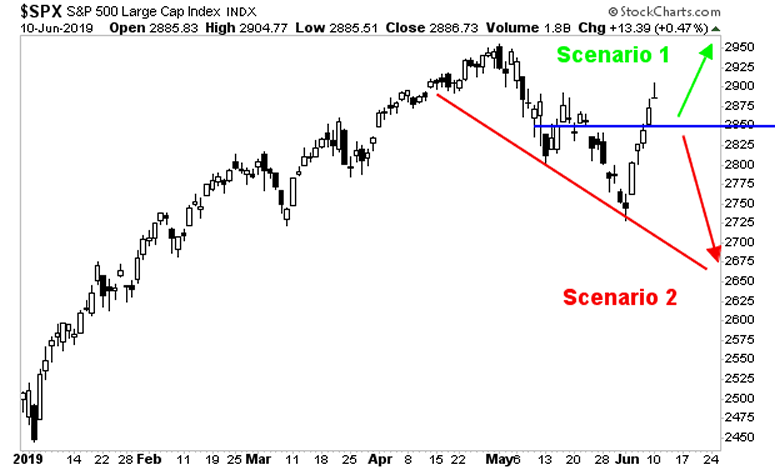

After this, the issue becomes… do stocks explode higher to new highs… or was this entire rally just a dead cat bounce. What happens at that blue line will be the answer.

If the blue line holds… it’s new highs. If it doesn’t we’re going to the 2,600s.

A lot of this hangs on the Fed, which meets June 18th-19th (next Tuesday and Wednesday). The stock market has rallied based on the notion that the Fed will cut interest rates… AND that doing so is a good thing.

Unfortunately for the bulls… there is the chance that the market interprets a rate cut as a BAD thing… because it would signal that the US economy has rolled over.

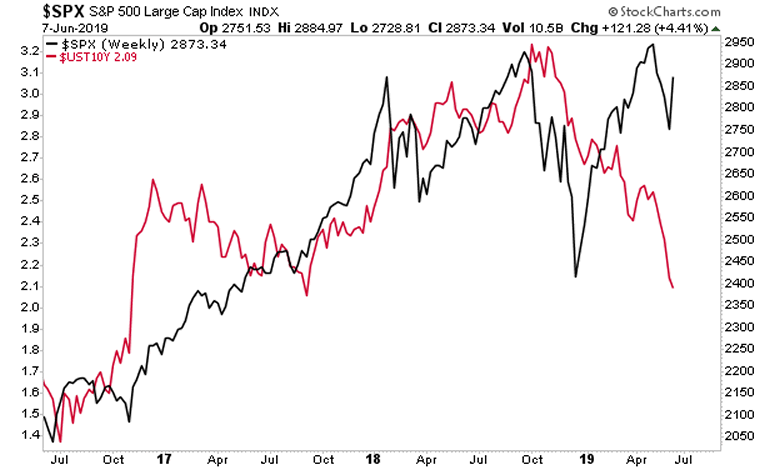

Bonds have already suggested the latter situation is the case… the yield on the 10-Year US Treasury has COLLAPSED… suggesting that the real economy is in BAD shape.

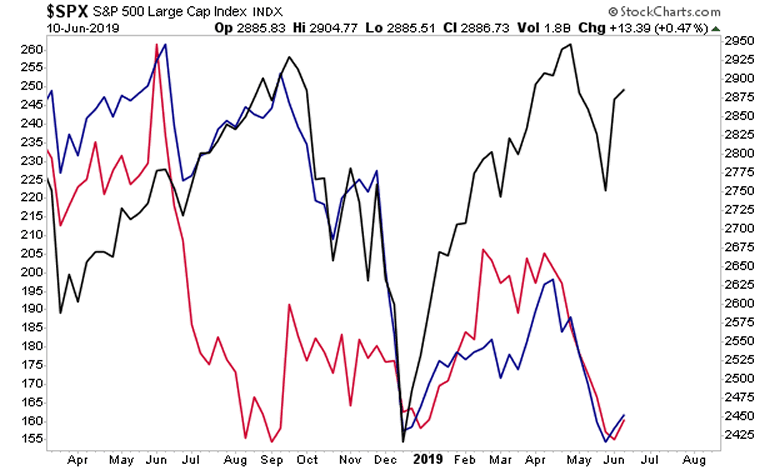

This alone is a problem… but when you consider that Copper, Fed Ex, and other assets that are closely associated with the real economy are saying the same thing (S&P 500 at 2,400s) it becomes REALLY WORRISOME…

A Crash is coming…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2019 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.