Trade Wars Propelling Stock Markets to New Highs

Stock-Markets / Stock Markets 2019 Jun 11, 2019 - 05:55 AM GMTBy: Submissions

The title may seem a contradictory in nature. Investors understand the current US administration better than many of the main stream media have been portraying. Trump administration will make sure markets will get well over 3000 points before he hits the campaign trail. A minor pull back in trade tensions is all that is needed.

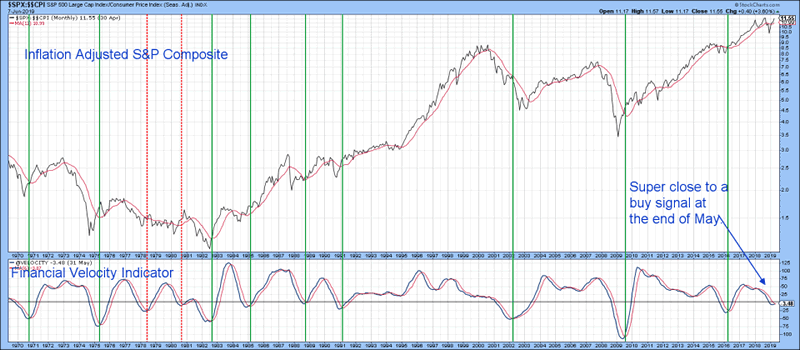

The SPX:CPI ratio is near its all time highs. Any slow down in inflation will propel SPX to new highs. FED stands ready to further push inflation in case if it drops below 1.5% and thus will give an impetus to SPX.

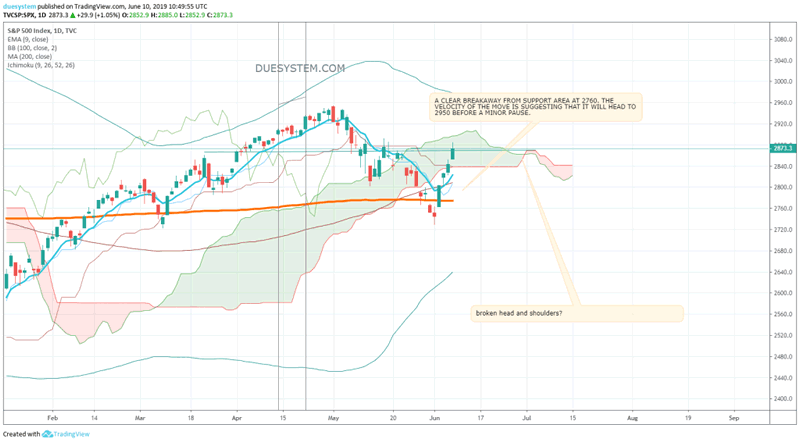

Broken Head and Shoulders for SPX

The index has pulled back from strong support at 2760. A close above 2900 will confirm a broken head and shoulders. Its powerful continuation pattern.

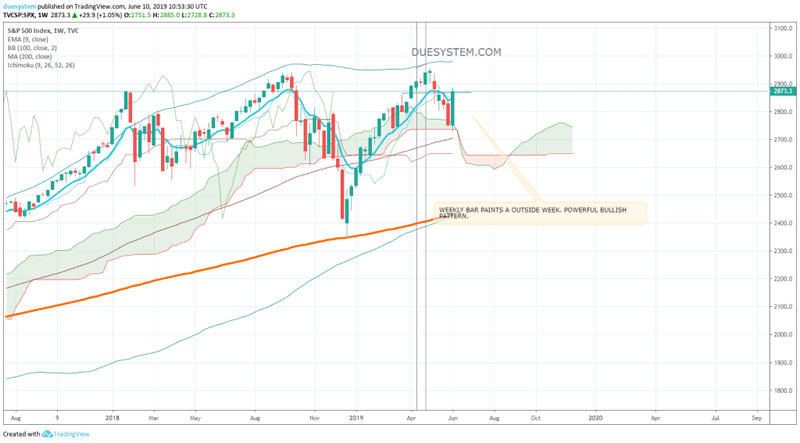

SPX: OUTSIDE WEEK PATTERN

WEEKLY BAR PAINTS A OUTSIDE WEEK. POWERFUL BULLISH PATTERN.

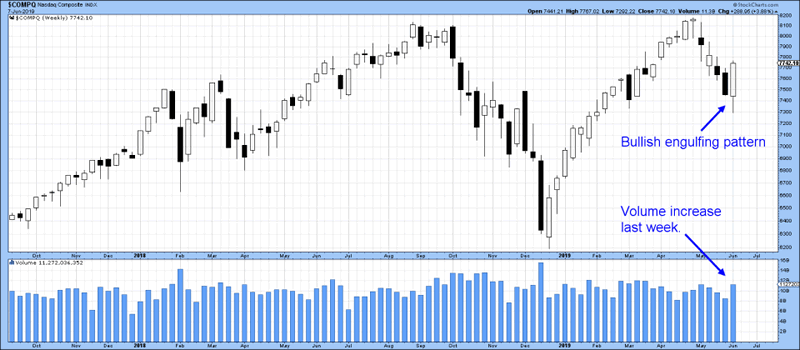

NASDAQ : OUTSIDE WEEK WITH RISING VOLUMES

John Murphy points out the above chart. The NASDAQ shows strong rising volume with a outside weekly candle.

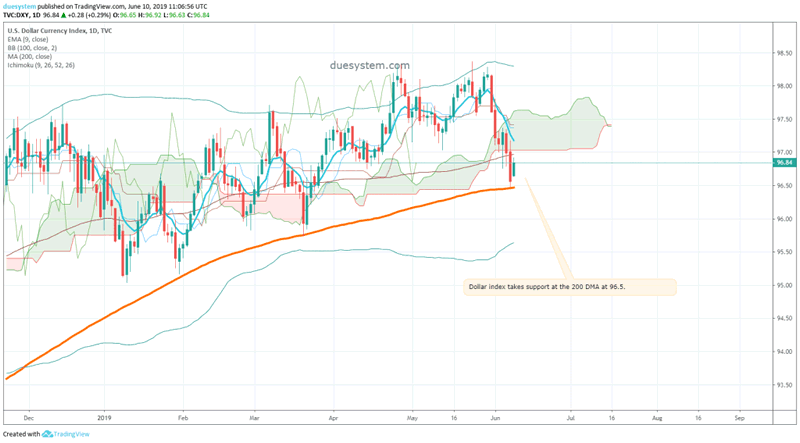

Dollar Index

Dollar index drops to the 200 DMA at 96.5 but has rebounded today. A break and close under 96.4 will lead to further weakness.

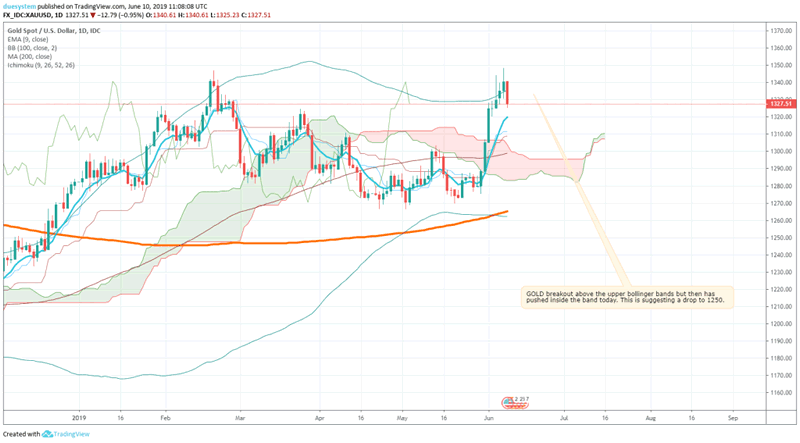

GOLD: Bearish pattern forming at overbought levels

GOLD has been rallying and closed above the upper bollinger bands of the 100 DMA. However it has failed to continue higher and today has dropped inside the bands. A close below 1330 will mean uptrend seen in May is at risk. This could trigger falls to 1250.

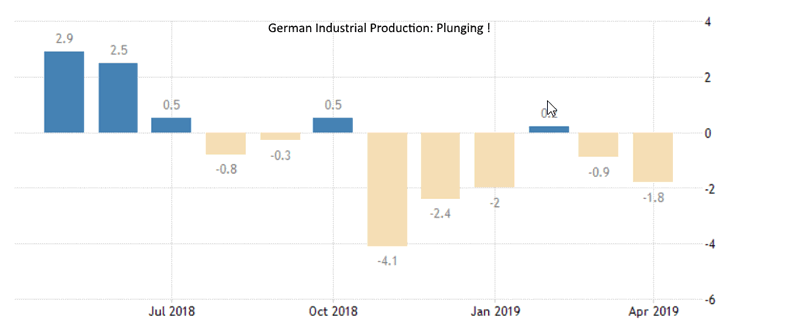

German Industrial Production

Industrial production in Europe´s powerhouse economy Germany fell back in April, official data showed on Friday, in the latest sign manufacturers are suffering from global uncertainty and trade wars.Output at producer firms fell 1.9 percent compared with March, federal statistics authority Destatis said in figures adjusted for price, seasonal and calendar effects — the first drop since January.

As always we wish all clients, safe trading. We are living in uncertain terms with new normals being established. Nationalism and Right wing economics is continuing to push and pull the old order. In times like these, one needs extreme care and sophisticated risk management to protect and growth their capital.

About Us Duesystem operates the ULTIMA trading system. If you wish to be updated about research posts from us which may help you trade well, do subscribe to us by filling the form here: Lets connect

Copyright 2019 © Duesystem - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.