Warning… Sub-Prime 2.0 Is About to Blow Up

Interest-Rates / Financial Crisis 2019 Jun 05, 2019 - 12:20 PM GMTBy: Graham_Summers

For those how pay attention, the Fed has already broadcast what the next crisis will be…

For those how pay attention, the Fed has already broadcast what the next crisis will be…

Corporate bonds…

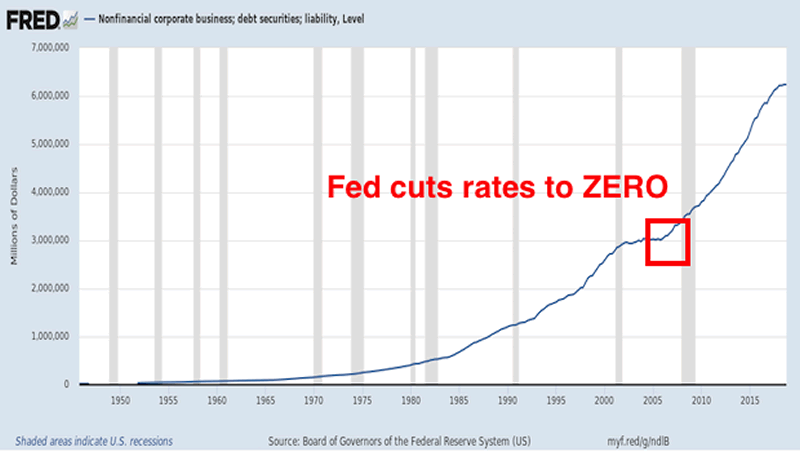

When the Fed cut interest rates to zero in 2008… and held them there for even years straight… it gave the “green light” to corporations to go on massive borrowing spree.

After all… if you’re the CEO of a company… and taking on debt suddenly costs NOTHING… why wouldn’t you start borrowing?

It took US corporates 50 years to hit $3 trillion in debt… they DOUBLED that in eight years thanks to the Fed’s Zero Interest Rates Policy (ZIRP).

All of this new debt was based on the idea that interest rates would stay near zero forever…

Put another way, the entire US corporate sector has become one gigantic leveraged bet on interest rates staying low.

If you don’t believe me, the NY Fed admitted this in a piece published last week…

After falling in the initial recovery from the Great Recession, corporate debt to GDP has increased to its highest level in fifty years…

…An economy with 50 percent highly levered companies and 50 percent unlevered companies has the same aggregate leverage as an economy with 100 percent companies at a medium leverage level, but is likely more vulnerable to a negative shock.

Source: Liberty Street Economics

In simple terms, the Fed is admitting that the concentration of highly leveraged corporations has opened the door to a crisis…

So we know what’s going to cause the next crisis… now the question is “when will it hit?”

The market is telling us “soon.”

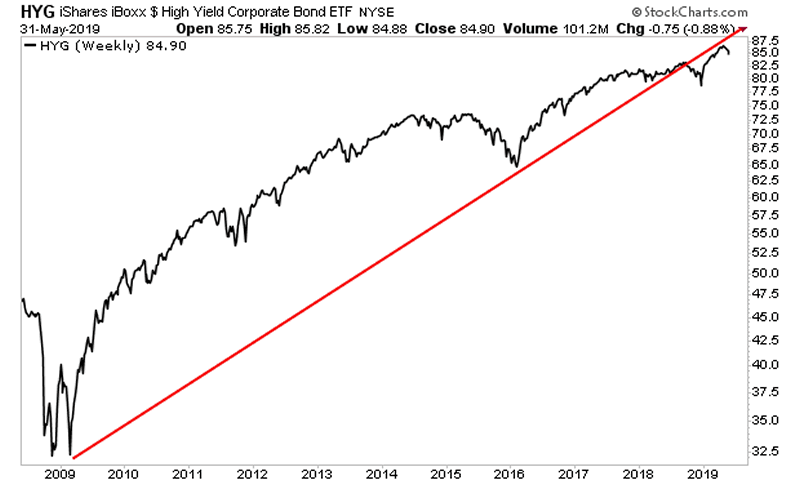

The Junk Bond ETF has broken its bull market trendline… AND been rejected by former support.

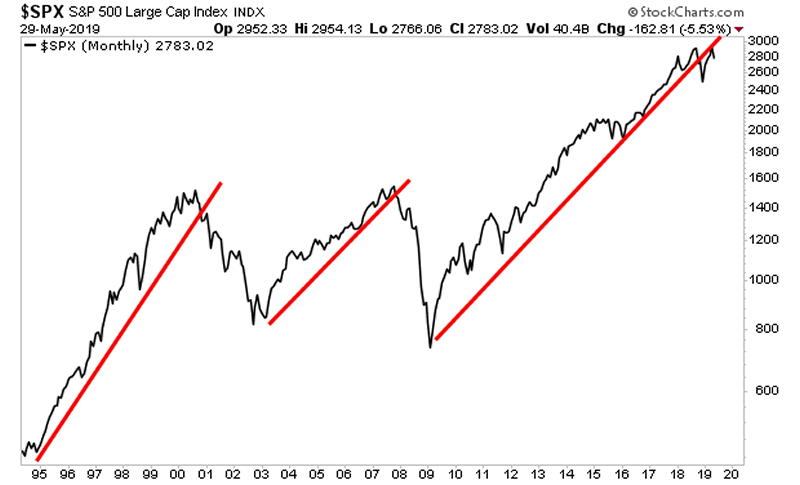

So what happens to stocks, once this bubble bursts?

We’re going to find out soon…

A Crash is coming…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

As I write this, there are only 11 copies left.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2019 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.