Total Debt and Leveraged Loans to the Rescue of Gold Bulls?

Commodities / Gold & Silver 2019 May 10, 2019 - 09:05 AM GMTBy: Arkadiusz_Sieron

The Fed has just published the newest edition of its Financial Stability Report. It covers what the most powerful central bank in the world perceives as risks to the financial system stability. Is it time for the gold bulls to uncork champagne?

The Fed has just published the newest edition of its Financial Stability Report. It covers what the most powerful central bank in the world perceives as risks to the financial system stability. Is it time for the gold bulls to uncork champagne?

Financial Sectors Appears Resilient, But…

The Fed’s assessment of the financial vulnerabilities in the latest Financial Stability Report has little changed since November 2018 when the report was inaugurated. The financial sector appears resilient, with low leverage and limited funding risk. It seems that gold will have to wait longer for a crisis that could push its prices out of the comfort zone.

However, there might be a glimmer of light at the end of the tunnel. The report point out two red warning signs. First, asset price valuations. Although some pressures have eased a bit since the latest report in November 2018, asset price valuations “remain elevated in a number of markets, with inves¬tors continuing to exhibit high appetite for risk.”

Indeed, equity prices relative to forecast earnings remain above the median value over the past 30 years. Similarly, real estate prices are high relative to rents. And spreads on leveraged loans have widened recently to level above the historical median, which reflects high demand for leveraged loans.

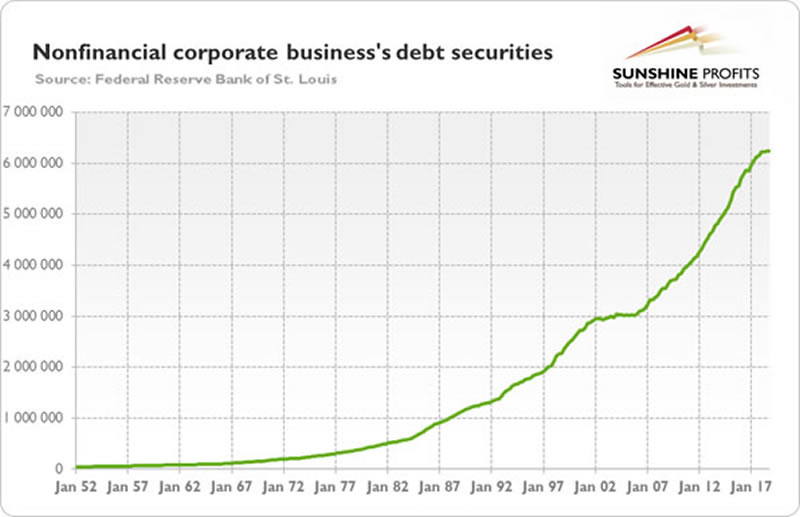

This is related to the second biggest threat for the financial stability noted by the Fed – the debt. As the chart below shows, the corporate debt has been on the rise.

Chart 1: Nonfinancial corporate business; debt securities; liability; millions of dollars, quarterly, not seasonally adjusted, from Q1 1952 to Q3 2018.

The problem is that, although household borrowing remains at a modest level relative to incomes, leverage in the business sector is high by historical standards, while the credit standards for some business loans have deteriorated further.

borrowing by businesses is historically high relative to gross domestic product (GDP), with the most rapid increases in debt concen¬trated among the riskiest firms amid signs of deteriorating credit standards.

What a surprise! Who would havethought that ZIRP may encourage excessive indebtedness? Or that low interest rates may draw in marginal borrowers and the most riskiest firms that would not get credit at higher rates?

So far, thanks to the easy monetary policy, the corporate indebtedness has not been very problematic. However, even the Fed acknowledges that “the elevated level of debt could leave the business sector vulnerable to a downturn in economic activity or a tightening in financial conditions.”

Elementary, my dear Watson. This is actually why the Fed is a hostage to the Wall Street. The tightening in financial conditions could indeed prove very harmful. This is because the share of bonds rated at the lowest investment-grade level has reached near-record level as more than 50 percent of investment-grade bonds outstanding are rated triple-B (just above the junk status), amounting to about $1.9 trillion. Thus, a slowdown in the global economy or tighter financial conditions would trigger downgrades of these bonds to specu¬lative-grade ratings, possibly cascading through the financial markets.

Implications for Gold

The Fed is ringing the alarm over the increase in leveraged loans and corporate debt. That’s a big risk. If it materializes, the gold prices should go up. However, ringing the alarm does not equal to the economic crisis on our doorstep. The leveraged loan buildup is not a simple replay of the last financial crisis. One important difference is that before the Great Recession, loans made out to highly indebted businesses were chiefly the preserve of banks, but now they are mainly funded by hedge funds and other non-bank lenders. The banking sector’s balance sheets are stronger now than they were before the liquidity crunch of 2008.

Hence, the financial sector seems to be resilient. But the key world here might be “seems”. When interest rates are low, and the Fed is always ready to accommodate the needs of financial sector, everything looks great. But it might be an illusion. We still bet that the current expansion may still last for quite a while longer and thus not provide tailwind for gold. As they say, hope for the best but prepare for the worst. We will keep monitoring closely the corporate debt and leveraged loans – join us and check the June edition of the Market Overview!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.