Record-Low Unemployment and Trump’s Message to China: Implications for Gold

Economics / US Economy May 07, 2019 - 08:17 AM GMTBy: Arkadiusz_Sieron

The US unemployment rate dropped in April to 3.6 percent, a level not seen since December 1969. So, everything must be great. With the exception of the renewed worries about the U.S.-China trade deal. On Sunday, President Trump surprised the markets again. What did he write exactly and how could his tweets affect the gold market?

US Economy Adds More Than 250,000 new jobs in April

America created 263,000 jobs last month, following a strong rise of 189,000 in March (after an downward revision). The number surprised again on a positive side, as the economists polled by the MarketWatch forecasted 213,000 created jobs.

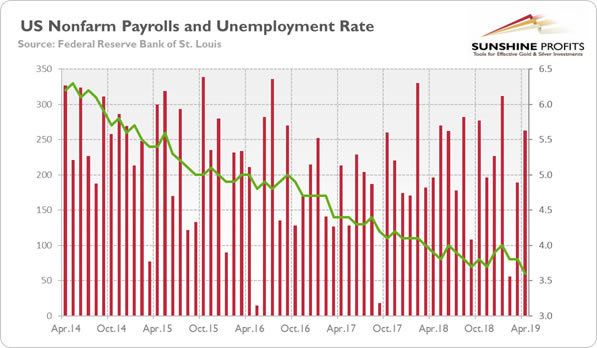

Moreover, the strong headline number was accompanied by generally positive revisions in March and February. Counting these, employment gains in these two months combined were 16,000 higher than previously reported. Consequently, job gains have averaged 169,000 per month after revision over the last three months, which is lower than several months ago. So, the pace of hiring has slowed, but it should not be surprising at this stage of the business cycle. What is important is that it remains at a healthy level, as the chart below shows.

Chart 1: Monthly changes in employment gains (red bars, left axis, in thousands of persons) and unemployment rate (green line, right axis, U-3, %) from April 2014 to April 2019.

What is more, the chart above shows that the unemployment rate declined in April from 3.8 to 3.6 percent, the lowest number since December 1969. Hence, the newest edition of the Employment Situation Report indicates that the current economic expansion still has plenty of room to run despite growing worries about the slowdown or even an upcoming recession. It is not a good news for the gold bulls.

However, investors should take the news about the drop in the unemployment rate with a pinch of salt, as it partially resulted from nearly a half-million workers dropping out of the labor force. The labor force participation rate declined from 63 to 62.8 percent in April. And the increase in pay in the past 12 months was unchanged at 3.2 percent, which means that the strong job gains did not accelerate the increase in wages. Overall, the US labor market remains solid, which supports the current economic expansion, whether gold investors like it or not.

Indeed, the unemployment rate is often a leading indicator of the business cycle. We mean here that the unemployment rate tends to reach a trough several months before a recession. But it is still declining! It means that the recent yield curve inversion (which is already gone) has not been confirmed by the second most important recession indicator. Of course, the unemployment rate can bottom out soon, but even if it does, the economic crisis should not come this year, to the despair of gold bulls.

Trump Strikes Back on Twitter

Unless, of course, Trump’s tweets trigger the new financial turmoil. On Sunday, President wrote that that talks with China about trade deal continue but too slowly. So, Trump announced that he would increase tariffs on $200 billion of Chinese imports on Friday from 10 to 25 percent. He also suggested extending a new 25 percent duty on another $325 billion of imports not already covered.

For 10 months, China has been paying Tariffs to the USA of 25% on 50 Billion Dollars of High Tech, and 10% on 200 Billion Dollars of other goods. These payments are partially responsible for our great economic results. The 10% will go up to 25% on Friday. 325 Billions Dollars of additional goods sent to us by China remain untaxed, but will be shortly, at a rate of 25%. The Tariffs paid to the USA have had little impact on product cost, mostly borne by China. The Trade Deal with China continues, but too slowly, as they attempt to renegotiate. No!

That is a radical shift from previous rhetoric. The administration, including Trump himself, have been sending signals that the agreement was close. This about-face raises worry how close we really are and could send the stock market lower. After all, a deal with China has already been essentially priced in.

What does it imply for the gold market? Well, the renewed uncertainty about the trade policy can increase the safe-haven demand for gold in the short-term. However, investors should remember that the trade wars have been positive for the greenback, the main competitor of the yellow metal. And we cannot exclude that the recent Trump’s tweets were just a negotiating tactic ahead of a new round of talks this week. We will see how China responds – stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the link between the U.S. economy and the gold market, we invite you to read the August Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.