Stop Feeding the Chinese Empire - ‘Belt and Road’ Trojan Horse

Politics / China US Conflict May 02, 2019 - 04:01 PM GMTBy: Richard_Mills

“Whoever has an army has power.” - Mao Zedong

“Whoever has an army has power.” - Mao Zedong

In March Italy broke ranks with its EU partners in joining China’s Belt and Road Initiative, known also as One Belt, One Road or the New Silk Road.

Students of history know the original “Silk Road” refers to the ancient network of trading routes between China and Europe, which served as both a conduit for the movement of goods, and an exchange of ideas, for centuries.

The “New Silk Road” is the term for an ambitious trade corridor first proposed by the Chinese regime under its current president, Xi Jinping, in 2013. The grand design also known, confusingly, as the Belt and Road Initiative (BRI), is a “belt” of overland corridors and a “road” of shipping lanes.

It consists of a vast network of railways, pipelines, highways and ports that would extend west through the mountainous former Soviet republics and south to Pakistan, India and southeast Asia.

So far over 60 countries, containing two-thirds of the world’s population, have either signed onto BRI or say they intend to do so. According to the Center for Foreign Relations, the Chinese government has already spent about $200 billion on the growing list of mega-projects projects including the $68 billion China-Pakistan Economic Corridor. Morgan Stanley predicts China’s expenditures on BRI could climb as high as $1.3 trillion by 2027.

The Belt and Road Initiative is seen by proponents as an economic driver of proportions never seen before in human history. It would not only allow Asia to relieve its “infrastructure bottleneck” ie. an $800 billion annual shortfall on infrastructure spending, but bring less-developed neighboring nations into the modern world by providing a growing market of 1.38 billion Chinese consumers.

Opponents argue that is naive and the real intent of BRI is to carve new Chinese spheres of influence in Asia that will replace the United States, in-debt poor nations to China for decades, and restore China to its former imperial glory.

This article leans heavily towards the latter interpretation of BRI, particularly its linkages between China’s industrial and military build-up. It explains why Belt and Road is really a dangerous trojan horse hiding behind China’s territorial ambitions, that should be resisted, especially by vulnerable countries that are risking long-term debt servitude.

The New Silk Road

The “silk routes” connected China, India, Tibet, the Persian Empire, the Mediterranean countries and parts of North and East Africa. The 7,000-mile Silk Road begins at the Chinese city of X’an(formerly Chang’an). When it reaches Dunhuang the Silk Road splits into three routes - the Southern Route, Central Route and and Northern Route. These trade routes spread throughout the Xinjiang Uygur Autonomous Region, and extended as far as Pakistan, India and even Rome.

The Silk Road routes were established during the Han Dynasty, which opened trade to the West in 130 BC, and they lasted until 1453 AD, when the Ottoman Empire boycotted trade with China and closed them. The Han extended the Great Wall of China to protect the movement of Chinese goods along the Silk Road.

The Maritime Silk Road was a network of shipping lines from the Red Sea to East Africa, India, China, and Southeast Asia. The network consisted of ship routes in two general directions: the East China Sea routes and the South China Sea routes.

The East China Sea routes connected the Chinese mainland to the northeast Asian regions of the Liaodong peninsula, the Korean peninsula, and the Japanese islands. The South China Sea route heads down, then up, through the Malacca Straits into the Bay of Bengal, opening up China to the coasts of the Indian Ocean, the Red Sea, the Persian Gulf and the African continent.

These shipping lanes are still in use.

As mentioned the “Belt” part of the Belt and Road Initiative, introduced by President Xi Jinping in 2013, refers to a network of overland road and rail routes and oil/ natural gas pipelines planned to run along the major Eurasian land bridges: China-Mongolia-Russia, China-Central and West Asia, China-Indochina peninsula, China-Pakistan, Bangladesh-China-India-Myanmar. They’ll stretch from Xi’an in Central China through Central Asia, reaching as far as Moscow, Rotterdam and Venice.

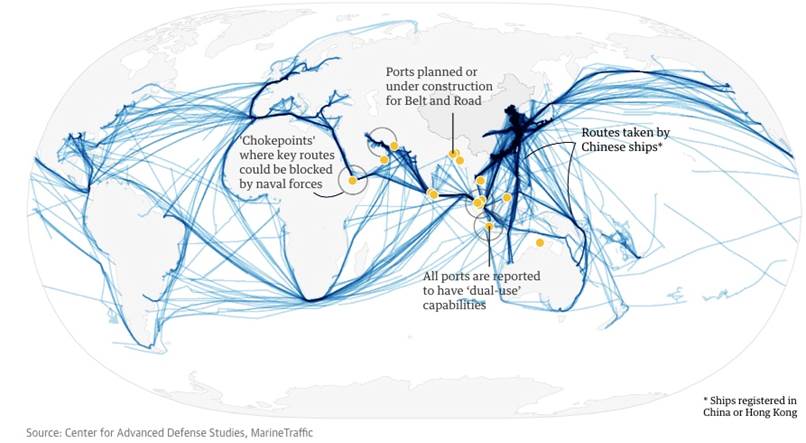

The “Road” is a network of ports and other coastal infrastructure projects from South and Southeast Asia to East Africa and the northern Mediterranean Sea.

China is already the world’s largest consumer of commodities. Why does it need to build a belt and road? There are a few reasons. The first as mentioned is to construct physical infrastructure such as railways, roads and bridges that will help the region to meet its $800 billion annual infrastructure shortfall estimated by the Asian Development Bank. China would also build 50 “special economic zones” modeled after the Shenzhen Special Economic Zone, first launched in 1980 under economic reformer, President Deng Xiaoping.

Less benevolently, BRI would allow China to expand the use of the Chinese currency, the yuan, something we have written about, as the global influence of the US dollar as the world’s reserve currency wanes.

According to the Centre for Foreign Relations, BRI is also a central tenet of Xi Jinping’s pushback against Obama’s “pivot to Asia” (contain China by extending US ties to southeast Asia), and distancing himself from his predecessors who followed Deng’s philosophy “bide your strength, bide your time.”

For Xi, the waiting is over: the time for imperialist expansion is now.

Political aspirations

An Asia geopolitical expert says that, while the New Silk Road satisfies a number of economic goals for China - including expanding its supply chains, accessing overseas labor, and preventing massive layoffs when companies run out of domestic infrastructure to build - the over-riding goal is regional influence.

Richard Javad Heydarian, author of ‘Asia's New Battlefield: The USA, China, and the Struggle for the Western Pacific’, writes:

“Above all, however, it allows China to lock in precious mineral resources and transform nations across the Eurasian land mass and Indian Ocean into long-term debtors. A leading credit rating agency recently warned that the OBOR is "driven primarily by China's efforts to extend its global influence", where "genuine infrastructure needs and commercial logic might be secondary to political motivations".

The result is what one observer aptly described as "debt-trap diplomacy", since some nations end up piling up unsustainable debts to China…

Meanwhile, larger nations such as India have raised concerns over China's geopolitical intensions, since the project runs through the disputed Kashmir region.

Other countries, from Indonesia to the Philippines and Nigeria, have raised concerns over the quality of Chinese infrastructure investments, their compliance with good governance and environmental regulations, and Beijing's tendency to employ not only Chinese technology and engineers, but also Chinese labourers for overseas projects.

Debt trap

So far we have learned the 5Ws of the Belt and Road Initiative. It’s easy to see how the trillion-dollar infrastructure network benefits China, but what about the 60-odd nations who have said they want in? What’s in it for them?

The huge projects need to be paid for somehow. China’s idea is for Chinese state-owned firms to build the infrastructure, paid for by participating countries. Those who can’t afford it, and that is most of them, would be offered inexpensive loans and credit. It’s no different from banks offering rock-bottom interest rates to homeowners whose incomes are below that needed to support a mortgage.

Chinese state-owned banks and China-led international financial institutions, like the Asian Infrastructure Investment Bank (AIIB), would shoulder the debt burden. China has set up an initial $40 billion Silk Road Fund, while the AIIB is allocating an additional $50 billion. But the loans come with huge risks.

In 2017, when Sri Lanka couldn’t pay off its Chinese creditors, Beijing took control of Colombo, a strategic port, through a 99-year lease. By the end of 2018, nearly a quarter of Sri Lanka’s foreign debt was owed to China - the money accepted for around $8 billion worth of ports and highways planned through BRI.

Some countries have scaled back or canceled BRI projects due to the specter of unsustainable debt burdens, states Al Jazeera. Hopefully Italy is aware of the risks. The southern European country is heavily in debt and went into recession last year; it reportedly wants to re-balance Sino-Italian trade by exporting more to China.

It is the 13th EU member country that has signed an MOU with China regarding BRI, but the first G7 nation to do so, sparking condemnation from the United States which is engaged in a trade war with China; and the EU, which earlier this year branded China a “systemic rival” and wants to restrict Chinese investment in Europe, Al Jazeera said.

Military buildup

Is it a coincidence that the Chinese president, Xi Jingping, is racing around trying to sign countries onto BRI while at the same time posing for photos in full military uniform saluting Chinese soldiers? We don’t think so.

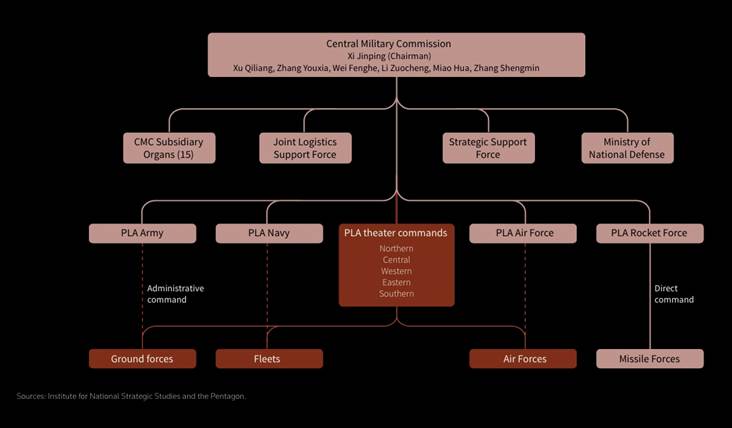

Tuesday was the 70th anniversary of the founding of the People’s Liberation Army (PLA) and the Chinese navy did not squander the opportunity to show its latest show of power - a stealth destroyer.

According to a Reuters story the combat-ready 10,000-ton Nanchang (101) is armed with 113 vertical-launch sales able to fire HHQ-0 surface-to-air missiles, YJ-18 anti-cruise missiles and CJ-10 land-attack cruise missiles.

We have written extensively on the escalating tensions between the US and China in the South China Sea, where China holds historical claims despite international treaties to the contrary (ie. the UN Convention on the Law of the Sea). China has been dredging seabed and building islands, on which it has constructed outposts including missile batteries, despite claims of ownership by Vietnam, Malaysia, Philippines, Taiwan and Brunei.

Ongoing maneuvers demonstrate that Beijing is willing to flex its muscles in a region it sees as strategically and economically important. China is increasing its military drills around Japan, with Japanese interceptors scrambled 638 times within a year, against Chinese aircraft, according to Japan’s annual military White Paper.

There are also frequent tensions in the Taiwan Strait, the body of water separating China and Taiwan, a US ally.

The United States supplies weapons to Taiwan despite not having diplomatic relations with the island and its government. China sees Taiwan as a breakaway territory that must be re-united with the Chinese mainland; its independence is not recognized by Beijing. A forced reunification between China and Taiwan would almost certainly cause a war between China and the US.

Meanwhile China continues to expand its military. A year ago it was reported that China planned to boost military spending by 8.1% in 2018, compared to a 7% increase in 2017.

A Reuters in-depth report on how China is displacing America as the world’s predominant military power in Asia, is required reading for anyone interested in how the geopolitical balance of power in the North Pacific is shifting.

It details how Xi Jinping is overhauling the PLA (which includes the navy), by pouring more resources into the navy and ridding the PLA’s ranks of corruption:

In just over two decades, China has built a force of conventional missiles that rival or outperform those in the U.S. armory. China’s shipyards have spawned the world’s biggest navy, which now rules the waves in East Asia. Beijing can now launch nuclear-armed missiles from an operational fleet of ballistic missile submarines, giving it a powerful second-strike capability. And the PLA is fortifying posts across vast expanses of the South China Sea, while stepping up preparations to recover Taiwan, by force if necessary.

For the first time since Portuguese traders reached the Chinese coast five centuries ago, China has the military power to dominate the seas off its coast. Conflict between China and the United States in these waters would be destructive and bloody, particularly a clash over Taiwan, according to serving and retired senior American officers. And despite decades of unrivaled power since the end of the Cold War, there would be no guarantee America would prevail.

“The U.S. could lose,” said Gary Roughead, co-chair of a bipartisan review of the Trump administration's defense strategy published in November. “We really are at a significant inflection point in history.”

Industry-military connection

We know that China is planning a huge infrastructure buildout in its trillion-dollar BRI involving some 60-odd countries. And we know that Beijing is at the same time bulking up its military. What we don’t know is if the two are related. Is China covertly funneling money from BRI into its military?

In December 2018 the New York Times reported on a secret proposal to expand a program by the Pakistani Air Force, by building Chinese military jets, weaponry and other hardware. There would also be increased cooperation between China and Pakistan in space, where rocket-propelled technology often overlaps with the military. According to the article, the military projects were designated as part of China’s Belt and Road Initiative.

In response to that claim, CNBC quoted Michael Fuchs, a senior fellow at the Center for American Progress, and a former U.S. deputy assistant secretary of state for East Asian and Pacific affairs from 2013 to 2016:

That doesn’t necessarily mean the Chinese military will use the entire BRI to its advantage, but it will certainly tap into a number of projects, he added. BRI infrastructure schemes in member countries such as Pakistan, Sri Lanka and Djibouti “are all about giving access to China’s military,” he said.

A 2018 report by C4ADS, a US-based research group, sought to tease out whether China’s portrayal of BRI as strictly economic is true. As explained by South China Morning Post, the report looked at 15 Chinese-funded port projects in Bangladesh, Sri Lanka, Cambodia, Australia, Oman, Malaysia, Indonesia, Djibouti and elsewhere in the Indo-Pacific region.

It found that the projects were not “win-win” for China and the host countries, as China claimed. “Rather, the investments appear to generate political influence, stealthily expand China’s military presence and create an advantageous strategic environment in the region,” the report stated.

Resource raids

Of course none of this should come as a shock, if we look at how China has repeatedly sought raw materials necessary to feed its resource-ravenous economy.

We’ve covered How China is locking up critical resources in the US’s own backyard.

We also know that BRI, whatever China’s motivations, is going to require a hell of a lot more mined commodities it doesn’t have an abundance of, like copper, zinc, iron ore, etc.

MINING.com reported in under 10 years, the number of China-headquartered mining companies with assets in Africa went from just a handful in 2006, to 120 in 2015. Two high-profile examples are the acquisition, by China General Nuclear Power Corporation, of the Husab uranium project in Namibia, and Zijin Mining’s involvement (39.6%) in the massive Kamoa-Kakula copper deposit in the DRC.

While iron ore and copper have been the hot targets of overseas acquisitions by Chinese firms, the Chinese have also gone after gold, nickel, tin and coking coal.

More recently the most desired metals are those that feed into the tectonic global shift from fossil fuels to the electrification of vehicles.

China Molybdenum bought the Tenke copper and cobalt mine in the Democratic Republic of Congo for $2.65 billion in an effort to secure a supply of cobalt for EV batteries.

Last summer China’s Ganfeng Lithium paid Chilean state lithium miner $87.5 million for SQM’s 50% stake in the Cauchari-Olaroz lithium project in Argentina. The purchase means China now effectively controls half of the world’s lithium production necessary for lithium-ion batteries.

Conclusion

China’s ascent from an economic backwater to a 21st century superpower is nothing short of incredible. Within 30 years the country whose citizenry was oppressed, impoverished, and riding around on bicycles, is now the world’s biggest consumer of mined commodities, influences real estate markets worldwide (just look at Vancouver), and has obscenely rich people driving $100,000 luxury cars.

Except for its horrible air quality, China is now the envy of many poorer countries.

But that doesn’t mean they should roll over and let China take advantage of its weaker brethren. The Belt and Road Initiative is not some modern-day, Asian version of The Marshall Plan. The United States had obvious economic motivations in giving $12 billion to help rebuild Western Europe, but there was also the strategic imperative of helping Europe to get back on its feet, in order to contain a rising USSR.

No such threat exists with BRI. China has no reason to come to its neighbors’ aid with multi-billion-dollar infrastructure loans other than to gain economic and political influence over them.

Sure, there may be some programs where it’s a win-win, but it appears the deck is way stacked against BRI host nations where the outcome will almost certainly leave China the clear winner.

As Uncle Ben in ‘Spider-Man’ said, “With great power comes great responsibility”. That assumes that the one wielding the power doesn’t have an ulterior motive. With China, though, we can be pretty much certain it does.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.