Stock Market Dow Trend Forecast - April Update

Stock-Markets / Stock Markets 2019 Apr 27, 2019 - 03:58 PM GMTBy: Nadeem_Walayat

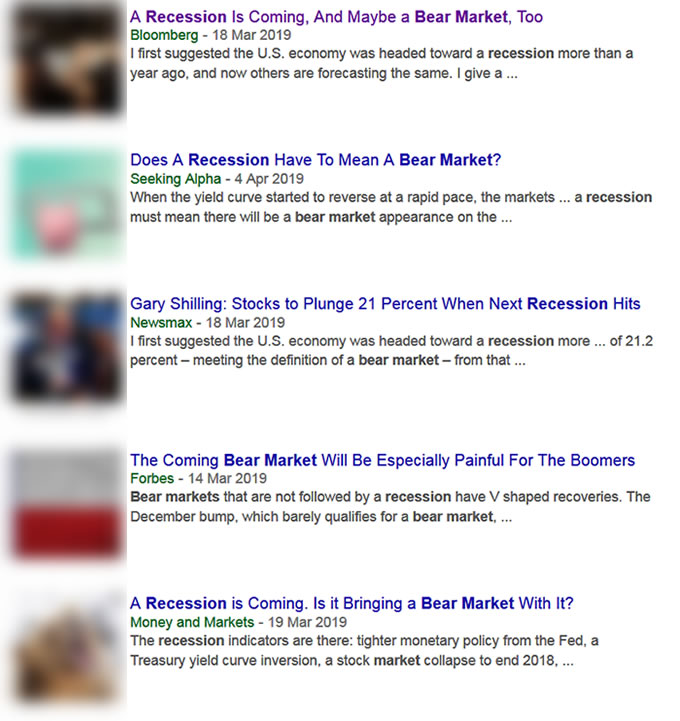

Yield curve inversion panic, brexit panic, US economy in a downwards death spiral, bear market this that and the other. The mainstream media's doom and gloom expectations of a recession these past few weeks to resolve in an bear market has instead had stocks clambering towards achieving new all time highs! Though many bears technically or rather delusionally continue to cling onto stocks being in a bear market until they break to new all time highs.

Which is what one would expect from those who have rarely if ever understand the big picture, that of exponential inflation and for which the driver for the next few decades will be the machine intelligence mega-trend as I illuminated in my most recent in-depth analysis concluding in the Top 10 AI stocks to invest in, most of which have proven themselves worthy over the past 3 years or so and likely to continue trending towards gains unimaginable today i.e. even a ten fold increase over the coming decade by number of the AI stocks.

So in terms of the big picture, last months, this months, next months, even this years stock market gyrations are basically noise. So if you haven't already jumped onboard the machine intelligence gravy train then you should do so sooner rather than later as the AI stocks have in large part passed my own Turin test some 2.5 years on. And remember folks we are still only at the beginning of this mega-trend.

Dow Stock Market Trend Update

This analysis was first been made available to Patrons who support my work: https://www.patreon.com/posts/stock-market-dow-25930920

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My in-depth analysis posted on the of 1st March 2019 Stock Market Trend Forecast March to September 2019 concluded in the following trend forecast for the Dow to achieve at least 28,000 by Mid September 2019, though stating that I would not be surprised if the Dow managed to go significantly beyond 28k i.e. by targeting 29k.

This is the updated graph some 5 weeks on.

The stock markets performance has been remarkably strong these past few weeks, barely pausing to catch it's breath during March, definitely a different in character to December's collapse that resulted in much confusion in it's wake with fears that the next correction would to some degree replicate the December collapse. That has NOT happened and so the stock market is currently showing relative strength against my original forecast that after a mild March has resumed its bull run which if it continues to persist would suggest a Dow target of 29k by mid September.

However, with stocks approaching resistance at previous all time highs I consider the most probable outcome is for the Dow is to converge towards my trend forecast during the remainder of April.

Your analyst wondering at what point do the bears give up and go long?

For immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.