Will Fed’s New Balance Sheet Policy be a Reason to Buy Gold?

Commodities / Gold & Silver 2019 Apr 26, 2019 - 05:47 PM GMTBy: Arkadiusz_Sieron

As always, most analysts focus not on what they really should. After March FOMC meeting, everyone was talking about the more dovish dot-plot. But the Fed also announced that it will end the unwinding of its balance sheet in September. As these changes are revolutionary and may entail potentially huge consequences for the precious markets, we invite you to read our today’s article about the new Fed’s balance sheet policy and find out whether it will be positive for the gold prices.

As always, most analysts focus not on what they really should. After March FOMC meeting, everyone was talking about the more dovish dot-plot. But the Fed also announced that it will end the unwinding of its balance sheet in September. As these changes are revolutionary and may entail potentially huge consequences for the precious markets, we invite you to read our today’s article about the new Fed’s balance sheet policy and find out whether it will be positive for the gold prices.

Most analysts focus on the recent revision of the Fed’s dot-plot. This is of course very important – so we have analyzed them in the previous part of the April edition of the Market Overview – but we should not forget about very substantial changes in the US central bank’s balance sheet policy. We have described these modifications in the March 21 edition of the Gold News Monitor, but let’s now dig into the new Fed’s normalization plan.

The main change is that the Fed will end its balance sheet’s normalization sooner than expected. The reduction will end in September. And in May, the US central bank will start tapering the “runoff” of Treasury securities, as it will halve the cap on monthly redemptions from the current level of $30 billion to $15 billion.

It implies that the Fed will end the quantitative tightening at higher level of assets than it was previously expected. Remember when Ben Bernanke implemented the quantitative easing in the aftermath of the Great Recession? Remember all these assurances that the asset purchase program is temporary and that the Fed will shrink its balance sheet as soon as the economy stands on its own feet? Well, it has just turned out that this was not true.

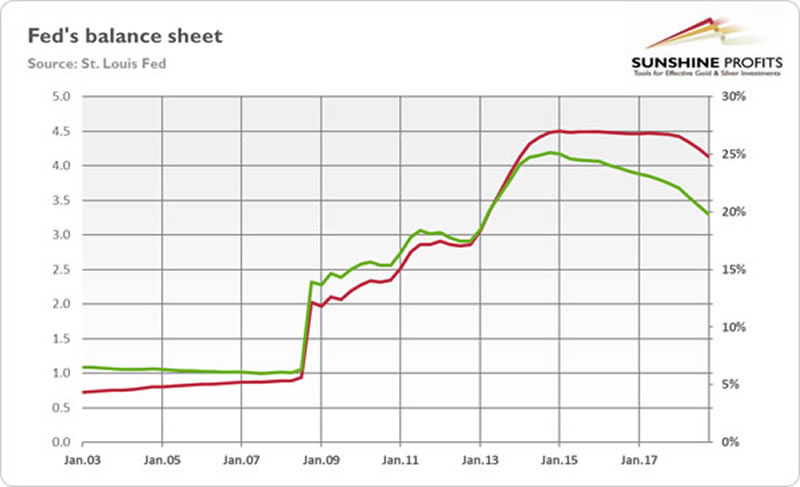

Indeed, the Fed’s balance sheet was about $0.9 trillion before the financial crisis. Then, it ballooned to staggering $4.5 trillion, as the chart below shows. Now, it amounts to around $4 trillion and the Fed plans to reduce it ultimately to around $3.7 trillion. So much when it comes to the reversal of the quantitative easing. We have repeated for a long time that “the U.S. central bank is not going to reduce its balance sheet to the pre-crisis level,” but we expected a slightly lower level. After all, according to the Fed’s own projections, $2.5 trillion would be the optimal size of the balance sheet in the long-term.

Chart 1: The level of the Fed’s balance sheet (red line, left axis, in trillion of $) and the Fed’s balance sheet to US GDP (green line, right axis, in %)

OK, it is true that the real GDP has grown in the meantime. And that the balance sheet will remain constant for a while after September 2019 even as the economy grows, thus slowly shrinking in relationship to GDP. But it still will be much higher than before the economic crisis of 2008, as one can see in the chart above.

Hence, the modification of the Fed’s balance sheet policy demonstrates clearly the US central bank’s dovish bias. It slashes the federal funds rate and increases the balance sheet much more during bad times that it hikes the interest rates and reduces the level of owned assets. The dovish bias is actually gold’s friend, as it creates a downward pressure on real interest rates.

The Fed’s dovish bias is clear. But the sudden about-face may damage the US central bank’s credibility in the long-run, which is good news for gold as the traditional beneficiary of vanishing confidence in the Fed.

The second important thing is that the Fed will change the composition of its assets. The US central bank wants to get rid all of its mortgage-backed securities (MBS). So, since October 2019, the Fed will reinvest principal payments received from them in Treasury securities, subject to a maximum amount of $20 billion per month. It implies a few interesting things.

First, the runoff of the MBS holdings will create the upward pressure on mortgage interest rates, which could create some problems in the real estate market. If these troubles become serious, gold may shine.

Second, the maturing MBS will be reinvested across the Treasury yield curve (“in Treasury securities across a range of maturities”), not towards the front end as it was expected. It means that there will be no reversal of the Operation Twist. It means that the yield curve will not steepen, but will remain flat, which is possibly positive for gold. This is because the banks prefer steeper curve that flat one, and because the risk of a sustained inversion is higher.

Third, and perhaps the most importantly, reinvesting MBS in Treasuries means that the Fed will become soon the net buyer of government bonds once again. The purchases of Treasuries by the US central bank will help the government to finance its budget deficit, enhancing its ability to ease the fiscal policy even further. It also prepares the Fed to increase its balance sheet, also in a form of the fourth round of quantitative easing, later in the future.

The bottom line is that the Fed will end normalization of its balance sheet earlier and with larger balance sheet than previously thought. It may reflect just a new framework for implementing monetary policy. The Fed decided that it is more effective to manage the short-term interest rates not by open market operations with small balance sheet, but by varying the interest rate it pays banks on their reserves with larger balance sheet.

Fair enough, but why the Fed does not want to vary the IOER with small balance sheet? The answer might be that the US central banks do not want to take a punch away and spoil the Wall Street’s party. If the Fed knows something the precious metals investors do not know, it might be a good moment to consider buying gold (not necessarily right away, but to make sure that gold stays one one’s radar). We do not predict economic slump this year, but, as the old adage says, “don’t fight the Fed” – especially that 2019 should be better for the gold market than 2018, even without the recession. Perhaps not until the second half of the year, though.

Thank you.

If you enjoyed the above analysis and would you like to know more about the link between the U.S. economy and the gold market, we invite you to read the August Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.