The Inverted Yield Curve as a Harbinger of Higher Gold Prices

Commodities / Gold & Silver 2019 Apr 10, 2019 - 07:03 AM GMT During the course of the past few weeks, we have heard much about the inverted yield curve in three-month and ten-year Treasuries as a harbinger of recessions. Missed in the press reports is the fact that it has also been a harbinger of higher gold prices. In the chart above, please note the upward surges in the price of gold in the five-year periods following the two most recent yield inversions in 2000 and 2006. The first occurred with gold trading in the $300 range. It subsequently rose to the $600-650 level in 2006. The second occurred with gold priced in the $600-650 range. It subsequently rose to over $1900 per ounce in 2011 – its all-time high.

During the course of the past few weeks, we have heard much about the inverted yield curve in three-month and ten-year Treasuries as a harbinger of recessions. Missed in the press reports is the fact that it has also been a harbinger of higher gold prices. In the chart above, please note the upward surges in the price of gold in the five-year periods following the two most recent yield inversions in 2000 and 2006. The first occurred with gold trading in the $300 range. It subsequently rose to the $600-650 level in 2006. The second occurred with gold priced in the $600-650 range. It subsequently rose to over $1900 per ounce in 2011 – its all-time high.

(Grey vertical bars indicate recessions.)

“Ominously,” writes Robin Wigglesworth and Joe Rennison in a recent Financial Times editorial, “the US yield curve has now inverted once again, with the 10-year Treasury yield on March 22 dipping below the three-month T-bill yield for the first time since 2007. Combined with the length of the post-crisis expansion — this summer it will become the longest growth spurt in US history — and deteriorating economic data, the inverted yield curve has stirred fears that the countdown to the next downturn has already begun.”

Peter Fisher, formerly head of fixed income at BlackRock and currently a professor at Tuck School of Business at Dartmouth, puts it succinctly in that same Financial Times editorial. “The mistake,” he says, “is to think it [an inverted yield curve] is a predictor of recessions. I think it causes recessions.” The rise in the price of gold following the two prior instances of yield inversion, it is now well understood, came in response to aggressive central bank monetary easing and the sudden emergence of credit-related systemic risks.

Fed and White House go to war over monetary policy

In an ideal world, the Fed would be above politics. The American political landscape these days, however, is far from ideal. Fed Chairman Powell migrated to a more dovish stance on monetary policy following the December stock market scare, but from President Trump’s perspective, that stance is not dovish enough. “I personally think the Fed should drop rates,” Mr. Trump recently told White House reporters. “I think they really slowed us down. There’s no inflation. I would say in terms of quantitative tightening, it should actually now be quantitative easing. You would see a rocket ship.”

Such a statement by itself would be enough under ordinary circumstances to motivate some judicious position adjustments on Wall Street’s trading desks. Mr. Trump, though, has upped the ante by offering up two Federal Reserve Board nominees – Stephen Moore and Herman Cain – known more for their hardened political sympathies than economic policy objectivity. That shift could send Wall Street speculators into overdrive as we enter the election season and simultaneously heighten gold’s safe-haven appeal.

The Federal Reserve Board of Governors looks to be on a path to becoming not just more politically inclined as the presidential election cycle draws near but highly politicized. The Fed’s reaction to the market retreat of last December has made it look indecisive and confused. The White House, for its part, seems all too eager to shift the blame for any imminent slowdown to the Fed. The nation, as a result, finds itself in the unprecedented situation of witnessing the executive branch of government in outright conflict with its central bank.

China is on a big gold-buying spree

“China’s on a bullion-buying spree,” says Bloomberg’s Ranjeetha Pakiam. “The world’s second-largest economy expanded its gold reserves for the fourth straight month, adding to optimism that central banks globally will continue to build holdings. The People’s Bank of China raised reserves to 60.62 million ounces in March from 60.26 million a month earlier, according to data on its website. In tonnage terms, last month’s inflow was 11.2 tons, following the addition of 9.95 tons in February, 11.8 tons in January and 9.95 tons in December.”

Keep in mind that China, the world’s leading mine producer, keeps most its domestic gold production (roughly 450 tonnes per year) within its borders. Though China does not officially claim that production as part of its national reserves, many gold market experts believe it ends up in the coffers of either the national government or the central bank – acknowledged or not. Last year central banks purchased a record 650 tonnes of gold in the aggregate according to the World Gold Council. Add China’s production and official sector offtake vaults to 1100 tonnes – 70% higher than the WGC’s widely-touted number and a little over one-third of global mine supply.

Latest Q ratio illustrates overvalued the stock market

“The Q Ratio,” writes Lorimer Wilson at Munknee.com, “the total price of the market divided by the replacement cost of all its companies, is a popular method of estimating the fair value of the stock market… and it shows that the stock market is overvalued by 50% compared to its arithmetic mean and by 62% compared to its geometric mean. This article explains the Q Ratio more fully complete with illustrative charts.”

Those percentage valuations, we believe, are worth noting. . . . .

Gold still suitably undervalued in 2019

“The price of a fine suit of men’s clothes,” says the U.S. Geological Survey, “can be used to show anyone who is not familiar with the price history of gold just how very cheap gold is today. With an ounce of gold, a man could buy a fine suit of clothes in the time of Shakespeare, in that of Beethoven and Jefferson, and in the depression of the 1930s.”

So where do we stand in 2019 with respect to the Quality Man’s Attire-Gold Ratio? At Brooks Brothers, a top quality, off-the-rack suit ranges between $2625 and $3122 without a vest. Brooks Brothers carries a less expensive suit at about $1250, but the ratio requires a top (not lower or middle) quality man’s suit. On London’s Saville Row – the standard for quality men’s attire – a hand-tailored men’s suit ranges in price from £3500 ($4620) at Huntsman to £4950 ($6534) at Kilgour (as published in Gentleman’s Quarterly). By any of those measures, gold at $1300 per ounce is suitably undervalued.

Economic insecurity is becoming the new hallmark of old age

“In the United States,” writes Katherine S. Newman and Rebecca Hayes Jacobs for The Nation, “economic security in old age was seen, for a long time, as both a social issue and a national obligation. From the birth of Social Security to the end of the 20th century, the common assumption has been that we have a shared responsibility to secure a decent retirement for our citizens. Yet that notion is weakening rapidly. Instead, we have started to hear echoes of the mantra of self-reliance that characterized welfare ‘reform’ in the 1990s: You alone are in charge of your retirement; if you wind up in poverty in your old age, you have only your own inability to plan, save, and invest to blame.”

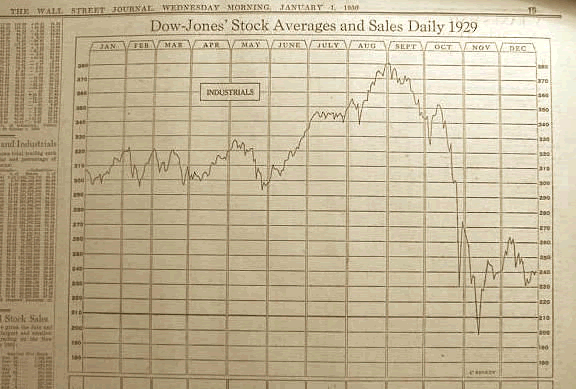

Some compare today’s stock market psychology to the period just before 2008. Others compare it to the 1920s when everything was hunky-dory until suddenly it wasn’t – perhaps a more apt comparison. Too many are “all-in” with respect to stocks in their Individual Retirement Accounts hoping to accumulate as much capital as possible without regard to the potential downside. The stock market did not recover from the losses accumulated between 1929 and 1933 until the mid-1950s, almost 25-years later – a fragment of stock market history lost to time.

Some will rely on the fact that stocks recovered nicely once the Fed launched the 2009 bailout. We should keep in mind though that many prominent Wall Street analysts have warned that the Fed no longer has the firepower now it did then. The financial markets and economy are much more vulnerable as a result – all of which brings us back to the notions of self-reliance and taking personal responsibility for our retirement plans. If you find yourself among the group that thinks hedging a stock market downturn to be in your best interest, we can help you easily and effectively structure a gold and silver diversification as part of your retirement plan to hedge that possibility.

American Eagle coin sales up sharply over last year

The U.S. Mint reports sales of American Eagle gold and silver bullion coins running well ahead of last year’s pace at the end of March. Gold Eagle sales were up 33.3% over last year’s first quarter performance while Silver Eagle sales were up 37.9% over the same period. Month over month, Gold Eagle sales were more than three times higher than sales from March of last year. Silver Eagle sales were down 7% when compared to March of last year. The strong uptick indicates increased activity among American investors interested in including gold and silver in their holdings as safe-haven hedges and as an underpriced asset class.

Tech analyst: Gold could go to $1800 to $2200 in long run

A number of technical analysts have reverted to a more bearish forecast over the past few weeks with the $1250 area once again being touted as the downside support area. Many of those same technical analysts, though, have a significantly more positive outlook for the longer term.

Among that group is Gary Wagner of the Wagner Financial Group who sees $1267 or even $1247 as possibilities in the short run, but also forecasts the possibility of $1800 to $2200 in the longer run. “Our research,” he explains in an article published recently at the Singapore Bullion Market Association website, “suggests that gold is in the final phase of a major long-term impulse cycle. This model also provides a look-back at the final major bullish wave could be traced back to end of 2015, following a correction to $1,040. This corrective fourth wave developed from the all-time high at $1,900 in 2011. The model suggests that gold could re-test the record highs that, if taken out, could see an extensive surge to between $1800 and $2200 per troy ounce.”

At USAGOLD, it bears repeating, we have always advocated the ownership of both gold and silver coins and bullion for long-term asset preservation purposes rather than short-term speculative gain. Though we report on the short-term, we do so with the caveat that anything can happen. The analyst who forecasts a short-term downside today can quickly change his or her outlook to the upside tomorrow – or vice versa. The long term charts for gold and silver, though, reveal a consistent upward trend that has served investors well in the period since 1971 when the global monetary system departed the gold standard and entered the fiat money era.

Is Warren Buffett wrong about gold?

“While I very often agree with Warren Buffett’s views regarding, for example, the level of cash in portfolio or migration from growth to value stocks,” says Independent Trader for ETF Trends, “I absolutely can not agree with what he wrote in the letter to shareholders about gold, once again showing how badly it performs in comparison to the US shares.”

The article goes on from there to debunk Buffett’s latest attack on gold – one of many he has conducted over the years – while drawing on cyclical analysis to lay out a solid longer-term future for the metal. It concludes with the opinion that Buffett’s stance on gold is “part of a deal with the establishment of the United States.” That could be true, but it could also be little more than an old professional bias going back decades. We counter with a single chart that refutes Buffett’s argument at a glance. It tells the story of gold and stocks in the time in which we live – the historically distinct fiat money era that began in 1971 – not some other timeline that carries little relationship to the present. To make a very long story short, gold has appreciated 3,399% since January 1971. Stocks have appreciated 2,884%.

“I cannot stress enough how important it is for everybody to really take it upon themselves to read as much as they can and try and understand what’s going on,” says Real Vision-TV’s Grant Williams in an interview at GoldPrices.biz. “Don’t rely on the mainstream media, don’t rely on short soundbite information, really dig into this and seek out the people who can help you understand it because it’s incredibly important right now.” We couldn’t agree more. At USAGOLD, we have always geared our content to what we believe our clientele would like to know or learn. The centerpiece to that endeavor is our popular Live Daily Newsletter which offers a variety up-to-the-minute gold market news, opinion and analysis posted as it happens.

NotableQuotable

“I grew up in a purely urban family. We had no relatives in the country. I’m born in 1944. When I was a baby, my mother could only buy food because she still had some gold coins. Without gold, I would have starved. She always told me that. Therefore, this generation already has a certain gold affinity. In extreme times of crisis, this is one of the few things left to be accepted. Gold was the only thing left to the people of the city at that time. Before the silver cutlery was also traded at the farmer.” – Ewald Nowotny, European Central Bank governor

“It’s all about relative supply curves – the supply curve for bullion is far more inelastic than is the case for paper money. It really is that simple.“ – David Rosenberg, Gluskin Sheff

“Stuck close to $1,300 an ounce in 1Q, gold is set to head for resistance at $1,400 instead of continuing to consolidate and revisit $1,200. It’s been six years since gold traded above $1,400 vs. just a few months ago when it was below $1,200, yet headwinds are dropping fast, with a lofty dollar the primary remaining holdout. The unlikely is necessary for gold not to resume the rally it began about two decades ago, in our view. Gold is in a similar extreme coiled-spring condition as in 1997, but with the dollar at multiyear highs such as in 2002. Unless the greenback can manage further appreciation, gold should, which is what we expect.” – Mike McGlone, Bloomberg Intelligence

“For we have reached a critical point. In a sense, it is true that the mists are lifting. We can, at least, see clearly the gulf to which our present path is leading. Few of us doubt that we must, without much more delay, find an effective means to raise world prices; or we must expect the progressive breakdown of the existing structure of contract and instruments of indebtedness, accompanied by the utter discredit of orthodox leadership in finance and government, with what outcome we cannot predict.” – John Maynard Keynes, The Means to Prosperity (1933)

“Gold is money – a rather rock-steady type of money, at that – and it cannot be debased by central banks’ money printing. Thus it stands in sharp contrast to bank deposits and short-term debt. Gold also does not carry any default or credit risk. It cannot go bankrupt, so to speak. For thousands of years, gold has already served as ‘premium money’. It would be surprising if gold were not to withstand the ‘Sword of Damocles’ (in the form of unbacked paper money) that central banks have hung over the economies.” – Thorsten Polleit, Degussa Market Report

“This is the cave in which inflation hides … our Fiat Lifestyle, where we simply declare into existence the manner in which we deserve to live. Declared into existence exactly like everything else in the Fiat World. Pulled into the present from our future selves and our children. Without a second thought.” – Ben Hunt, Epsilon Theory

“This is an Alice in Wonderland world. It’s one that Japan has long been familiar with, and Europe may be getting used to. In the U.S., it’s prompting policymakers to reconsider how public finances and interest rates should be managed. Possible results include even bigger government deficits and debt, and faster inflation — all anathema to Econ 101.” – Olivier Blanchard, former International Monetary Fund chief economist at Bloomberg

Editor’s note: It is hard to imagine how the principles of the Mad Hatter Modern Monetary Theory can gain credence in the public debate without encouraging a large, consequent flight out of the dollar and into gold and silver.

“The figure (below) shows that the uncertainty shocks that hit the economy in the fourth quarter of 2018 and in the first quarter of 2019 (January) have been the largest during our sample period. Based on the framework we use, this finding has potentially ominous implications for the U.S. economy.” – Laura E. Jackson, Kevin L. Kliesen, and Michael T. Owyang, St. Louis Federal Reserve, A Bad Moon Rising? Uncertainty Shocks and Economic Outcomes

“Even though USD still accounts for 39.9% of international payments according to SWIFT, its market share has declined, as the global economy has become less U.S. and USD-centric. We believe that de-dollarization is an important factor behind the addition of gold to central bank gold reserves.” – Bank of America Merrill Lynch

“Most serious accidents have multiple causes. A series of mistakes or pieces of bad luck line up to allow disaster. The Torrey Canyon was hampered by an unforgiving schedule, barely adequate charts, unhelpful winds and currents, confusion over the autopilot, and the unexpected appearance of fishing boats in the intended course. But reading Richard Petrow’s contemporary account of the Torrey Canyon disaster, a clear lesson is that Capt Rugiati was too slow to adjust. He had a plan, and saw far too late that the plan was doomed to failure — and with it, his ship.” – Tim Hartford, Financial Times columnist

“Of course, the name is something of an oxymoron; there is really nothing modern about this monetary theory. Confusing money creation with wealth creation was at the core of the debate between John Law and Richard Cantillon 300 years ago. For Law (a Scot who fled British justice, took refuge in France, and within a few years managed to drive what was then the leading economic power of the day into near bankruptcy), increases in the supply of money would lead to the employment of unused land and labor, which in turn would lead to higher productivity. Meanwhile, Cantillon explained in his Essay On Commerce that mistaking money for wealth always leads to disaster.” – Charles Gave, Evergreen/Gavekal

Editor’s note: At the risk of sounding cynical, it would not be difficult to imagine the Federal Reserve – make that the world central banks – proceeding with some version of MMT even while railing against it and saying they would never engage in such a thing. How far from MMT was quantitative easing? Not far, we would venture.

“In modern times the lessons of Zimbabwe and Venezuela point to the catastrophic effects that can follow when a corrupt or incompetent government finances its lavish spending by printing more of its currency. The Gold Standard favors the countries that have gold deposits, but it has the advantage of making it difficult for governments to inflate prices by expanding the money supply. It engenders long-term price stability because the money supply can only grow at the rate at which gold is produced. Inflation can come, though, if a major new source of gold is developed, as happened with Spanish gold from the New World, or with various ‘gold rushes.’” – Adam Smith Institute

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.