Gold Price Chart Feast

Commodities / Gold & Silver 2019 Mar 11, 2019 - 05:24 PM GMTBy: readtheticker

If the central economic planners (CEP) lose control and the fiat monetary balance is broken, where do you hide! In the most recent years the pendulum as held firm on the side of the CEPs and central bank put (Greenspan Put, Bernanke Put, Yellen Put, Powell Put [just]) was (and is) a real thing. Now in 2019, after being sold the story the easy monetary policy can end and return to normal. The current Fed Chairman Powell even suggested this would see the US 10 yr bond near 4% while they sold down the $4T FED balance sheet at $5OBN a month, while suggesting the US economy would not even notice.

If the central economic planners (CEP) lose control and the fiat monetary balance is broken, where do you hide! In the most recent years the pendulum as held firm on the side of the CEPs and central bank put (Greenspan Put, Bernanke Put, Yellen Put, Powell Put [just]) was (and is) a real thing. Now in 2019, after being sold the story the easy monetary policy can end and return to normal. The current Fed Chairman Powell even suggested this would see the US 10 yr bond near 4% while they sold down the $4T FED balance sheet at $5OBN a month, while suggesting the US economy would not even notice.

Well 2019 is not even half done, and the CEPs have arrived at their Little Big Horn moment and fell like General Custer. Things started to go wrong around the US 10 yr bond 3.25% mark, and this followed with a plunge of 20% in the SP500. Now CEPs are back to injecting monetary juice into the markets. Proof the new normal of never ending monetary stimulus can never be unwound. Little Big Horn is marked where an arrogant and ambitious plan fell apart.

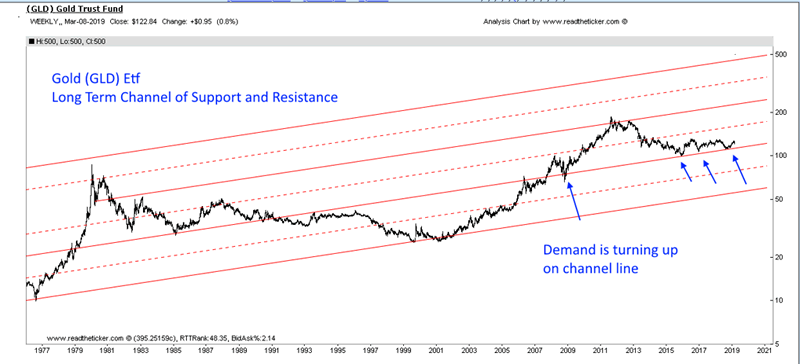

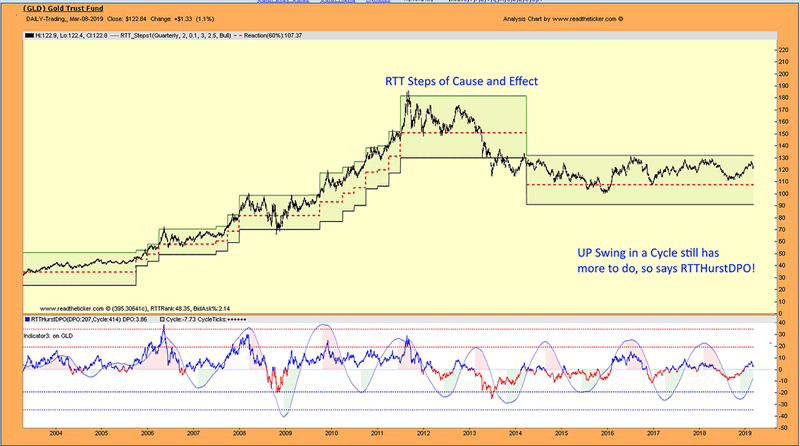

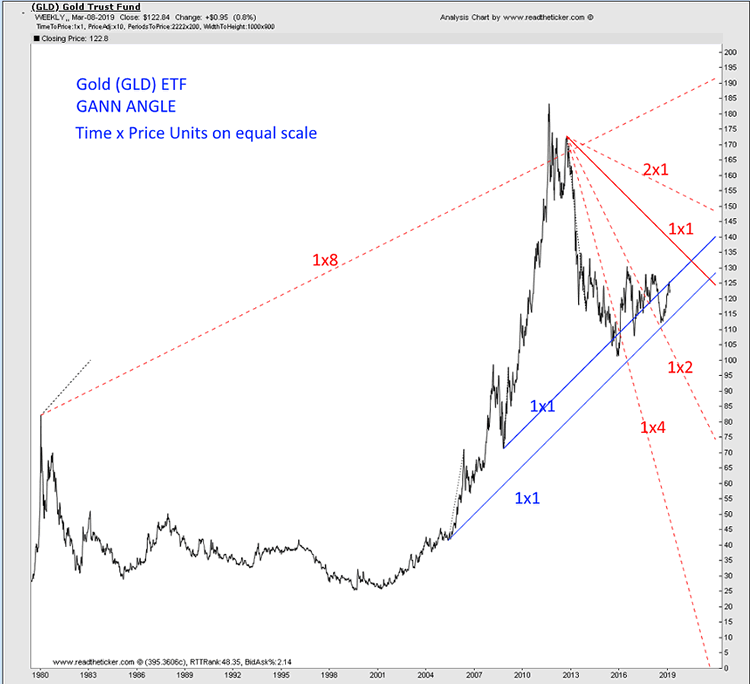

Will the CEPs monetary power ever fail? If it does what happens to Bob the Builder, Stacy the Hair Dresser, and Joe the Plumber. Us! Well it seems those who are informed are putting the money where their mouths are. Billionaires who can afford the best research like Stan Druckemmiller, Sam Zell, David Einhorn, Ray Dalio and John Paulson have begun to hedge themselves against the CEPs failure to maintain power over inflated and fragile asset prices by investing in hard assets. Maybe masses should do so as well. Below are some of readtheticker.com favorite gold charts. Gold with the big parallel channels.

Two things the CEPs have ruined the middle class with: Globalisation and monetary debasement. Protect your self from the great unwind.

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combination of Gann Angles, Cycles, Wyckoff and Ney logic is the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logic a wealth of knowledge is available via our RTT Plus membership. NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net Investing

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticker

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2019 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.