The Stock Market Has Called the Fed’s Bluff, What’s Next?

Stock-Markets / Stock Markets 2019 Mar 11, 2019 - 01:29 PM GMTBy: Graham_Summers

The Fed is truly in a panic.

The Fed is truly in a panic.

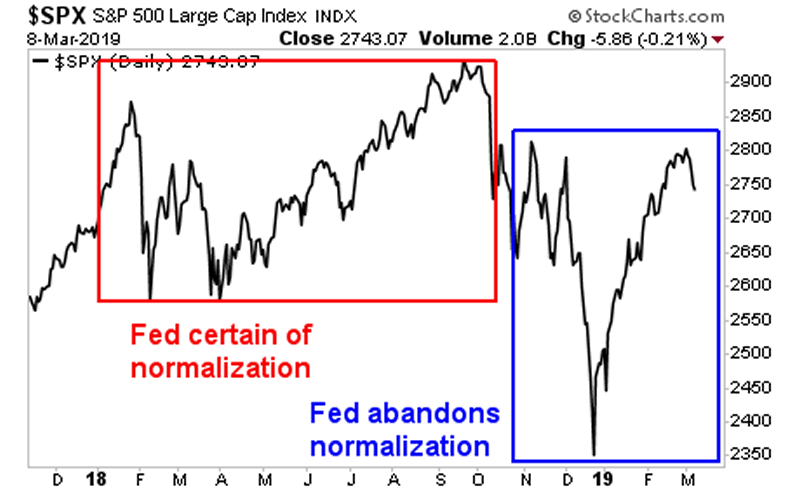

Let’s take a big picture perspective of the last year or so.

Throughout 2018, the Fed claimed it could normalize policy (raise rates and shrink its balance sheet). Heck, the Fed didn’t just claim this, it was supremely confident of it.

Indeed, the Fed was still pushing this narrative as late as August, when most of the Emerging Market space and many economically sensitive asset classes had already collapsed 30%.

US stocks finally joined in the carnage in October, dropping 20% from peak to trough into late December. The Fed then suddenly came out an abandoned ALL of its talk of normalization. And stocks bounced.

In chart form, we’re talking about the following:

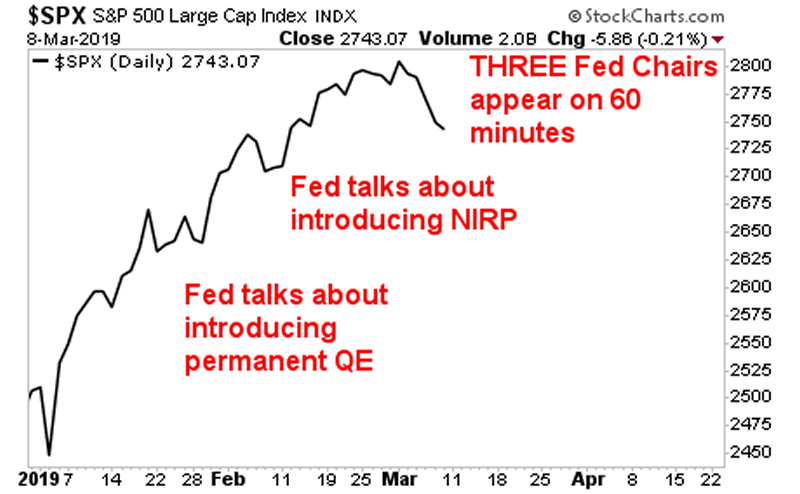

Now, here’s where it gets interesting… despite the bounce in stocks and the recovery in the credit markets starting in December, the Fed didn’t start talking about normalizing policy again… instead it started talking about introducing EMERGENCY monetary policies.

If the issue was really just about stocks dropping… and if things were really just fine “behind the scenes” with the US financial system, why is the Fed talking about doing things like making QE a REGULAR (not emergency) policy or introducing NEGATIVE interest rates?

Even more bizarre… current Fed Chair Jerome Powell appeared on 60 Minutes last night along with former Fed Chairs Ben Bernanke and Janet Yellen… in a clear an obvious PR move to provide assurance to the markets.

So, in chart form, we’re talking about the Fed doing all of this while the markets are doing the following:

Again… if everything is fine and dandy, WHY is the Fed panicking like this?

I suspect it’s because the Fed has realized what I’ve been warning about for years… that you CANNOT normalize an Everything Bubble. And worse still, its attempts to do so have already triggered the beginnings of the next crisis.

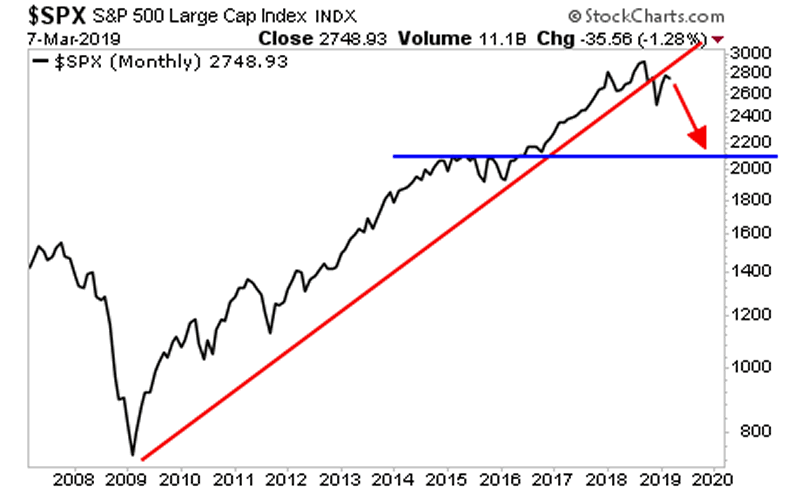

Indeed, the stock market telling us that the bull market is OVER.

The fact is that the long-term monthly S&P 500 chart shows a CLEAR rejection at its former bull market trendline. There’s really not much but air between here and 2,050 or so on the S&P 500.

That’s a 25% drop from here… so we’re talking about a literal CRASH.

If you aren’t actively taking steps to prepare for this, you need to start NOW.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.