What Commodities and Transportation Stocks Telling Us - Part2

Stock-Markets / Stock Markets 2019 Mar 07, 2019 - 01:11 PM GMTBy: Chris_Vermeulen

In Part I of this report we talked about and showed you what commodities and transports where doing in relation to each other. Here in Part II, we show you in detail what we expect to take place.

In Part I of this report we talked about and showed you what commodities and transports where doing in relation to each other. Here in Part II, we show you in detail what we expect to take place.

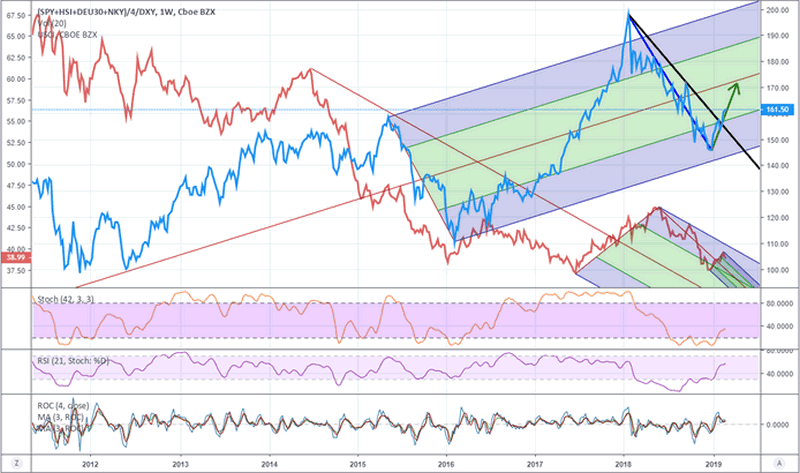

This final chart highlights our Custom Smart Cash Index (in BLUE) as well as the CBOE Commodity Index pricing levels (in RED). This data goes all the way back to 2012 and highlights a number of key pricing rotations. First, we can see that Commodities have been decreasing in total value from 2012 till mid-2017. We can also identify a key support level that was established in the Commodities Index near the beginning of 2016 – coinciding just a month or so before the bottom in the Smart Cash Index.

We believe this Key Bottom in both the Commodities Index and the Smart Cash Index reflect a dramatic pricing shift that took place at that point in time. Although Commodities have yet to rally beyond upper high ranges, we can see the Smart Cash Index rallied to incredible new all-time highs. The rally that started near the end of 2016 in the Smart Cash Index was likely the result of a “Capital Shift” that we have discussed extensively in the past. With commodity prices staying historically low and an increase in economic optimism, capital shifted away from “commodity-based sectors” and into “technology and biotech sectors”. Now, it appears this rally has run its course and a new capital shift is taking place.

Until Commodities begin to break out of the downward price channels we’ve highlighted on this last chart, global capital will be searching for two primary objectives; safety and hedged returns. By this, we mean to say that global capital and investment will be seeking out strong Blue Chip and Mid-Cap performers that can produce safety in growth, dividends and hedge against currency swings or further eroding commodity price levels. Think of this as a move to “key elements supporting the global economies”.

Heavy equipment, support services, and retailers, tool suppliers, and mid-level equipment suppliers, transportation services for these items and the repair parts and services to keep these tools running efficiently. Human services, labor, labor services, medical services, and entertainment services are likely to do well over the next 12~24 months. In an economy where commodity prices are relatively low and Transportation and Capital is flowing quite well, one could easily identify that Capital will seek out and identify the strongest opportunity for safety and growth as sectors continue to shift. After a massive rally in Technology and Bio-Tech, we believe a continued shift towards Blue Chips and Mid-Caps is taking place right now. Technology and Bio-Tech will likely find some support in the near future and become “opportunistic investments” eventually. But right now, we believe global investors are focusing on different targets to hedge the risks that are associated with certain technology stocks.

In closing, our research highlights that Commodities are not increasing as one would expect in an expanding global market/economy. We believe this is one core factor that will continue to drive a “capital shift” toward opportunity and performance in the Blue Chips and Mid-Caps. Global investors will re-enter the Technology and Biotech sectors when pricing levels become more opportunistic – at some point in the future. This means we have a very strong likelihood of the US and global Blue Chips, Banks, Industrial Supply, Basic Materials and Human Services (Entertainment, basic human essentials, regional human services, and utilities) will continue to perform well.

The US and the global economy is growing, just not as one would expect in a “total growth” environment. We believe the global economy has shifted to support “fundamental growth elements” that are related more closely to the types of industry and market sectors that support the fundamental growth components. We’ve discussed our theory that the global economies operate in a “growth or protection mode” many times before. We believe the current global economic stance is more in tune with “moderate growth while still being overly protective”. Watch Commodities and the Transportation Index for signs of when the global economy enters a larger growth phase and when more opportunity for a broader capital shift will take place.

This concludes this two-part series and how we identify market opportunities for us to trade. Analysis like this has allowed us to generate substantial profits in the past 30 days with UGAZ 30%, NIO 21.6%, ROKU 18%, GDXJ 10.5%.

If you want to learn how we can help you find success throughout this shifting market and throughout 2019 and beyond, then visit www.TheTechnicalTraders.com

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.