Will the Markets Explode One Last Time?

Stock-Markets / Stock Markets 2019 Jan 23, 2019 - 07:38 AM GMTBy: Harry_Dent

Look… the crash of a lifetime ahead is inevitable.

Look… the crash of a lifetime ahead is inevitable.

But, it’s looking increasingly like we’ll see a last-hurrah short boom of a lifetime first. Something I like to call the Dark Window because it’s unexpected and most miss it.

Will you?

I hope not.

I hope you’ll be ready for it because, today I’m going to give you a few insights into what to watch for…

First, a Warning…

Most analysts see a deep correction here and then modest gains and only slight new highs in 2019.

Jeremy Siegel, the perma-bull, sees a “good” 2019 for stocks if we don’t have a recession, which neither he or I think is likely in the near term. By good, he means a 5% to 15% rally. But 15% wouldn’t even retest the markets’ recent highs.

Expect the Unexpected…

In the January Boom & Bust newsletter that we published yesterday, and the Economy & Markets email I plan to send you tomorrow, I show the most bullish scenario for the Nasdaq in 2019. You’ll be surprised.

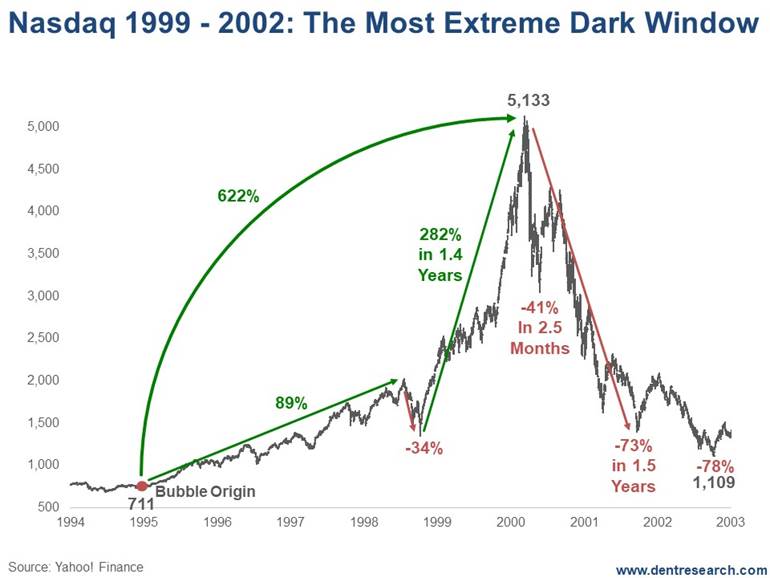

But it doesn’t compare to the most extreme topping pattern we saw in 1999 to 2000. Look at this…

The whole bubble from late 1994 into early 2000 was up 622% in 5.2 years; then investors endured a 78% crash in 2.6 years, taking the index back near to its bubble origin, classic for my bubble model.

Look at that 34% flash crash in mid-1998. Painful. Ten percent more painful than the current crash thus far for the Nasdaq, at 24%.

The thing is, look what happened next…

The Greatest Surprise of All

When everyone was expecting the see their asses handed to them, the markets turned around and produced a blistering 282% rally into March of 2000 in 1.4 years…

Hello Dark Window!

That didn’t occur in 1929 or any other bubble of the last century. The only other time we’ve seen that was in the Tulips bubble and the South Seas final run into 1720.

And from the looks of the way markets are behaving now, there’s a good chance we’re about to see a similar Dark Window open again.

This means there’s the chance to make unimaginable gains before that inevitable crash sets in. And like I started out today by saying, there WILL BE a soul crushing crash, very likely worse than what we saw on the Nasdaq into 2002 and more like the Dow from late 1929 to 1932.

When the fat lady eventually stopped singing in early 2000, Nasdaq investors lost 41% in just 2.5 months (one of the biggest reasons you shouldn’t wait until a bubble is definitively over before you try to get out).

Within a year and a half, they’d given up 73%!

By the time the bottom was in, they’d bled to the tune of 78%.

And this wasn’t even the most extreme crash investors have had to endure because it didn’t happen into a “Great Depression” like the next crash will and 1929 to 1932 did.

Still, it was by far the most extreme for that final Dark Window, blow-off rally.

And if this Dark Window occurs again exactly 90 years after the infamous 1929, on my most powerful Bubble Buster Cycle, even the most bullish forecasters on Wall Street won’t see it coming.

Tomorrow, I’ll show you how high the Nasdaq could go this time around, if we don’t break some critical support levels in the next several weeks.

Harry

Follow me on Twitter @HarryDentjr

P.S. Another way to stay ahead is by reading the 27 simple stock secrets that our Seven-Figure Trader says are worth $588,221. You’ll find the details here.

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2019 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.