Stock Market Rig is Ending… Next Leg Down is About to Begin

Stock-Markets / Stock Markets 2019 Jan 17, 2019 - 10:20 AM GMTBy: Graham_Summers

This week is options expiration week… Wall Street’s favorite time to ramp the markets in order to insure the maximum number of options contracts expire worthless.

This week is options expiration week… Wall Street’s favorite time to ramp the markets in order to insure the maximum number of options contracts expire worthless.

THIS, nothing else, is why the markets rallied this week. Tweets from the President or some statement by a Fed official were simply the excuse Wall Street used to engage in this game.

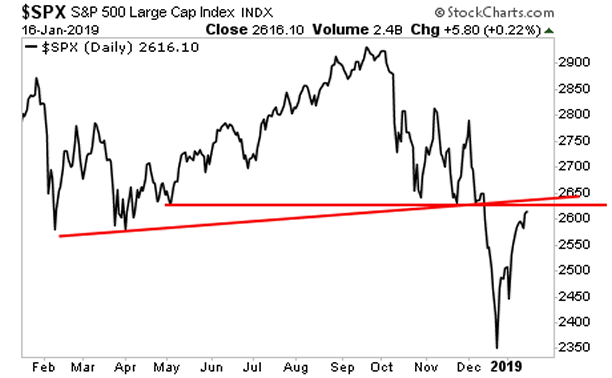

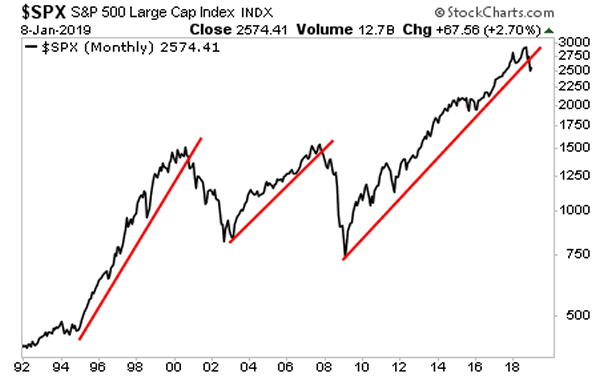

And that game is now ending. Stocks face TREMENDOUS overhead resistance here.

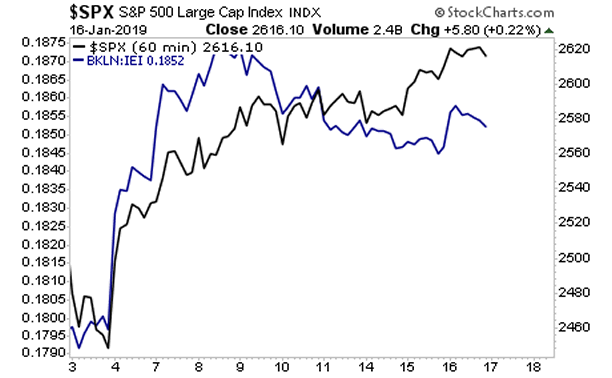

The debt markets have already figured this out and are moving into “risk off” mode.

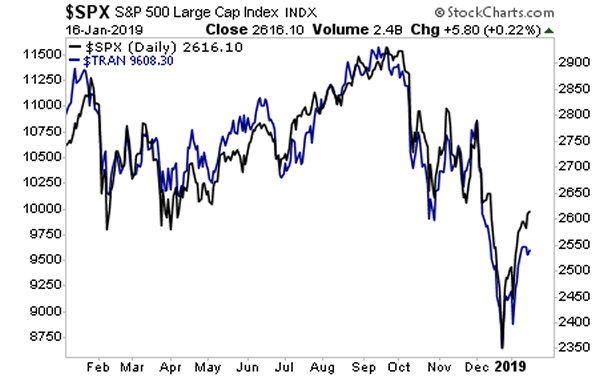

So have Transports.

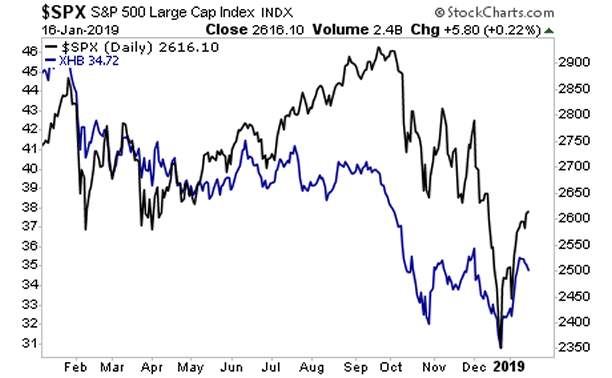

And Homebuilders.

You can ignore those internals all you like, but what has actually changed since the end of December? Is the Fed going to start loosening monetary policy? Is the economy suddenly going to start roaring again? Are earnings going to reverse and stop declining?

Or are we actually at the end of the credit cycle and moving into the next crisis shortly?

A Crash is coming… and 99% of investors will panic when it hits… but not those who have downloaded our 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.