Gold Looking Back, Looking Ahead 2019 – How Low Can Gold Price Go?

Commodities / Gold & Silver 2019 Jan 02, 2019 - 03:42 PM GMTBy: Kelsey_Williams

Each year we are treated to calls for gold’s next big move. We heard it last year; and the year before, too. And the year before that. It may not be a broken record , but it is the same song.

Each year we are treated to calls for gold’s next big move. We heard it last year; and the year before, too. And the year before that. It may not be a broken record , but it is the same song.

Predictions for gold’s price are more than guesses, but they might as well be just guesses. That’s unfortunate, because no small amount of time is spent trying to analyze gold. And it is time wasted.

The analysis is faulty. Not only is it faulty, it is sometimes overly complex. The complexity exacerbates the problem. How do you analyze something that cannot be analyzed?

“This type of investment (…assets that will never produce anything…) requires an expanding pool of buyers, who, in turn, are enticed because they believe the buying pool will expand still further. Owners are not inspired by what the asset itself can produce — it will remain lifeless forever — but rather by the belief that others will desire it more avidly in the future.” — Warren Buffett Feb2012

Buffet is both right and wrong. He is wrong in characterizing gold as an investment. But then, of course, so is nearly everybody else. Gold is not an investment. But he is right “that (it) will never produce anything” and that “it will remain lifeless forever”.

The claim that owners are inspired “by the belief that others will desire it more avidly in the future” is more telling. It points up the critical flaw in nearly all analysis about gold.

Even those who recognize gold’s role as money, miss the boat on this one. No matter how much others “desire it more avidly in the future”, gold’s value will not increase. The value of gold is stable and unchanging.

Gold is not subject to traditional laws of supply and demand. Its value is in its use as money. As money, it is the measure of value which has been used historically to price other goods and services.

Analysts and investors who expect to profit from large increases in the price of gold do not understand this. If they did, they would temper their expectations.

A higher gold price is a reflection of a weakening U.S. dollar. It does not mean that gold is more valuable. That is because as the dollar continues to weaken over time, it requires more and more dollars to pay for goods and services. For owners of gold, the higher price compensates for the higher cost of living.

But what if gold prices were to decline? What could bring that about? And how low could gold go?

There is only one reason for declines in the price of gold. And it is the exact opposite of the only reason that gold prices go up.

Declines in the price of gold are a reflection of increasing strength in the U.S. dollar. In other words, the price of gold reflects inversely the strength or weakness of the U.S. dollar.

Some people assume that somewhat higher gold prices over the past several weeks are at least partially attributable to money fleeing stocks and moving into gold. It is possible that some investors may have acquired gold with proceeds from the sale of stocks. But there is no correlation between lower stock prices and higher gold prices. (see Gold vs. Stocks: Ratios Do Not Imply Correlation)

Some think that a weakening economy will somehow translate to higher gold prices. It won’t.

And regardless of the direction of interest rates, there is no impact on the price of gold.

Trade tariffs? No. World War III? No.

It is all about the U.S. dollar.

Fear of a credit implosion is another reason that some expect higher prices for gold. Wrong again. A credit collapse would wipe out trillions of dollars of worthless debt and clip asset prices of stocks, bonds, real estate, commodities, and gold by anywhere from fifty to ninety percent.

There would be less dollars available for use – to have and to hold – and with which to purchase the goods and services that we need and want. But the remaining dollars would be more valuable. They will purchase more than they would before the collapse. However, there will be less of them to go around.

Do you think the dollar is about to tank? Fine. Then move your dollars into gold. But don’t expect to get rich. The worse it gets for the dollar, the more you will need gold just to survive.

On the other hand, if you think the U.S. dollar will remain relatively stable, or even increase in value as a result of deflation, then don’t expect higher prices for gold. So, if the dollar were to increase in value significantly, just how low might the price of gold go?

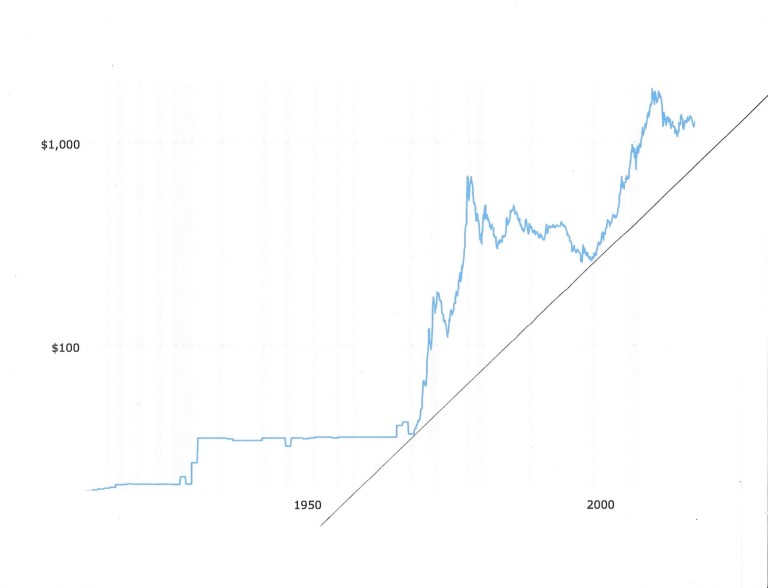

Gold Prices – 100 Year Historical Chart

As you can see in the chart above, there is a long-term, forty-eight year uptrend in gold’s price dating back to December 1970 when gold was priced at $36.00 per ounce. If gold’s price were to decline back to that uptrend line within the next couple of years, then the price range indicated is roughly between $850-1000.00 per ounce.

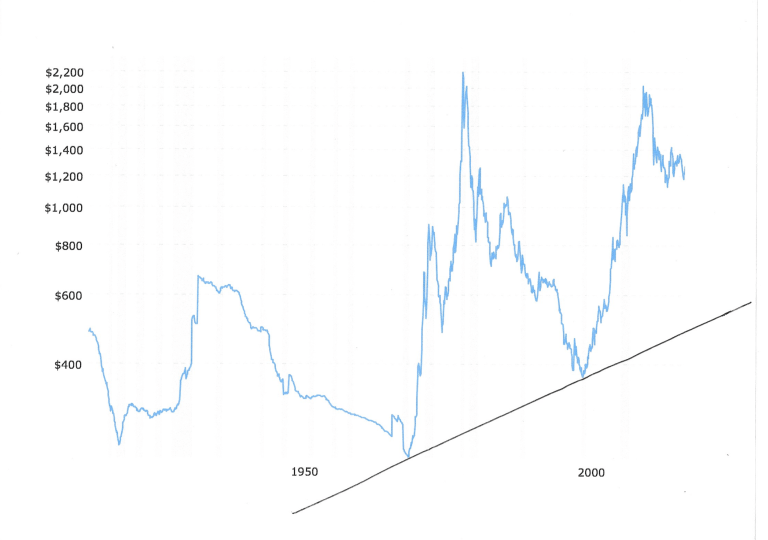

That may sound distressing to some, but it could be a lot worse. The chart below is the same one-hundred year history on an inflation-adjusted basis.

The possible downside target changes to somewhere between $550-600.00 per ounce.

How low can gold go? A lot lower than most want to admit. Under reasonably normal conditions, maybe $850.00-900.00 per ounce. ($850.00 was the January 1980 high point.)

There is the possibility that it could go lower. Or, it might find a floor at $1000.00 per ounce. There are several scenarios but there is only one thing you need to focus on – the U.S. dollar.

If the dollar heads lower and accelerates its long-term decline, then the price of gold will reflect that by moving higher. If, on the other hand, the dollar continues to stabilize and strengthen, then gold’s price will reflect that by moving lower.

My best guess for 2019 – stronger dollar, lower gold prices.

(also see: Gold And The Need To Explain Price Action)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2018 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.