Pound Falls 2.5% Against Gold as UK Government in Turmoil Over Brexit

Commodities / Gold and Silver 2018 Nov 16, 2018 - 04:38 PM GMTBy: GoldCore

The pound plunged against the euro, the dollar, gold and all leading currencies today as Theresa May’s UK government appeared vulnerable to collapsing and political turmoil risked creating a hard Brexit.

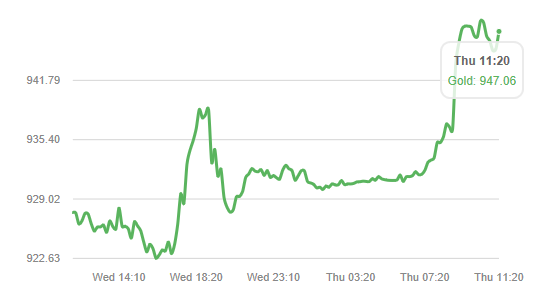

Gold in GBP (24 Hours)

The pound has fallen 2.6% against gold in less than twenty four hours seeing gold rise from £923 to £947 per ounce in sterling terms.

The pound slumped the most in more than 17 months as several U.K. ministers resigned less than 24 hours after Prime Minister Theresa May said she had won cabinet approval for a deal with the European Union.

Brexit Secretary Dominic Raab handed in his resignation to Theresa May over the controversial Brexit proposal.

Mr Raab said he could not support the Prime Minister’s withdrawal agreement from the European Union. He wrote: “It has been an honour to serve in your government as Justice Minister, Housing Minister and Brexit Secretary. I regret to say that following the Cabinet meeting yesterday on the Brexit deal I must resign.”

Financial analysts are concerned about the more ‘extreme’ outcomes to Brexit talks and that potential worst case Brexit risks may now come about.

This makes the pound vulnerable to further falls into year end and in 2019. Longer term, the pound is likely to weaken further as Brexit uncertainty and fallout impacts the slowing UK high street, prperty market and wider economy.

Gold’s record nominal high in sterling terms over £1,120 per ounce looks like being surpassed in 2019 with gold prices just 20% below that now.

Gold Prices (LBMA AM)

13 Aug: USD 1,204.40, GBP 944.85 & EUR 1,058.19 per ounce

10 Aug: USD 1,211.65, GBP 947.87 & EUR 1,056.44 per ounce

09 Aug: USD 1,215.50, GBP 944.08 & EUR 1,048.13 per ounce

08 Aug: USD 1,212.35, GBP 939.57 & EUR 1,045.17 per ounce

07 Aug: USD 1,215.40, GBP 937.32 & EUR 1,048.77 per ounce

06 Aug: USD 1,212.00, GBP 934.94 & EUR 1,048.26 per ounce

03 Aug: USD 1,207.70, GBP 928.60 & EUR 1,042.97 per ounce

Silver Prices (LBMA)

13 Aug: USD 15.18, GBP 11.91 & EUR 13.35 per ounce

10 Aug: USD 15.37, GBP 12.04 & EUR 13.41 per ounce

09 Aug: USD 15.48, GBP 12.01 & EUR 13.35 per ounce

08 Aug: USD 15.35, GBP 11.93 & EUR 13.24 per ounce

07 Aug: USD 15.47, GBP 11.93 & EUR 13.34 per ounce

06 Aug: USD 15.35, GBP 11.86 & EUR 13.30 per ounce

03 Aug: USD 15.36, GBP 11.81 & EUR 13.26 per ounce

02 Aug: USD 15.45, GBP 11.78 & EUR 13.29 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.