The Four Steel Men Behind Trump’s Trade War

Economics / Protectionism Sep 13, 2018 - 03:17 PM GMTBy: Dan_Steinbock

In few months, the Trump administration has undermined more than seven decades of U.S. free trade legacies. Who are the policymakers behind this reversal. Wat is their agenda? And why is steel their common denominator?

In few months, the Trump administration has undermined more than seven decades of U.S. free trade legacies. Who are the policymakers behind this reversal. Wat is their agenda? And why is steel their common denominator?

Recently, the Trump administration hammered a revised North American Free Trade Agreement (NAFTA) by pressuring Mexico and then strong-arming Canada to the tentative deal. The White House’s objective is either to redefine the terms on the basis of U.S. economic leverage and unipolar geopolitics or - if that is not acceptable to other parties - to withdraw the U.S. from such FTAs. It is not “either you are with us or against us,” as in the Bush years, but “America First - or nothing.”

Today, Trump’s tariff wars are led by Peter Navarro, Director of Trade and Industrial Policy, and Director of the White House National Trade Council, as well as his ally and Trump trade advisor Dan DiMicco, former CEO of the U.S. steel giant Nucor.

The two are supported by Robert Lighthizer, U.S. Trade Representative and former Reagan administration trade hawk, and Secretary of Commerce Wilbur Ross, a bankruptcy expert who made his fortune from restructured and offshored US jobs.

Last year, the trade hawks were still contained by mainstream policymakers, such as former Secretary of State Rex Tillerson, Director of the National Economic Council Gary Cohn and Treasury Secretary Steve Mnuchin.

After Tillerson lost his job and particularly when the tree-trader Cohn resigned, things changed. Cohn’s Goldman Sachs companion Mnuchin proved weak, and Ross leans on winners, regardless of the cause. As free-traders were out, protectionists stepped in. That was more in line with Trump’s 2016 campaign promises, when he threatened to use 35%-45% import tariffs against nations that have a significant trade surplus with the U.S.

The Uncompromising but Compromised Navarro and DiMicco

In the protectionist camp, the key player is Peter Navarro, the author of sensationalist China-bashing books, and his longtime friend DiMicco, a vocal free trade critic. For years, the two have been determined to prioritize steel industry, even at the expense of other American industries that offer more jobs, profits, or both.

With Navarro, the path to notoriety began with great political aspirations and failures. In the ‘90s, he lost five elections in San Diego; for mayor in 1992, city council in 1993 and 2001, county supervisor in 1994, and Congress in 1996. As politics did not work, he scribbled half a dozen business books, including If It’s Raining in Brazil, Buy Starbucks (2001), When the Market Moves, Will You Be Ready? (2003), What the Best MBAs Know (2005), The Well Timed Strategy (2006) and Always a Winner (2009). Intriguingly, all of them were typical feel-good-win-the-world business staple, and none of them focused on China. But then came the global crisis. This was a problem to Navarro and others who mistook short-term bubbles for sustained growth. That’s when China became a convenient scapegoat.

So a repackaged Navarro hit the market with The Coming China Wars (2008), which claimed that America was facing battles with China over everything from decent jobs, and advanced technologies to strategic resources. Surprisingly, these hateful ramblings that smacked of simple China basing were given legitimacy by the reputable FT Press, the “world’s leading educational publishing company.” As Navarro realized he had found a gold mine, he released the more extreme Death by China (2011), which was published by Pearson Prentice Hall, the parent of the FT Press. Paradoxically, the more Sinophobic he got, the more he was rewarded.

Even stranger was Navarro's debacle that resulted from efforts to fund a documentary based on his book, which went hand in hand with suspected “financial irregularities”, a subpoena by an FBI agent, and a charge for document destruction. Like the over-driver Energizer Bunny, Navarro did not let such hindrances stop him. Even during the debacle, he co-authored a book on America’s economic ruin in cooperation with R. Glenn Hubbard, the heavy-weight economic advisor of Mitt Romney’s presidential campaign. But unlike former Fed chief Alan Greenspan who got caught for glorifying laissez-faire policies that led to the 2008 crisis, Hubbard had a lower public profile which allowed him to capitalize on the crisis via excessive consulting fees.

Ironically, Death by China accused China for environmental pollution worldwide, whereas Nucor, one of America’s largest corporate contributor to U.S. air pollution, had already in 2000 paid almost $100 million to half a dozen U.S. states in the largest environmental settlement ever with a steel manufacturer. Death by China was co-authored with Greg Autry, an economist who represents Coalition for a Prosperous America and the American Jobs Alliance, which believes that U.S. trade policies have severely harmed the nation’s economy, security and people.

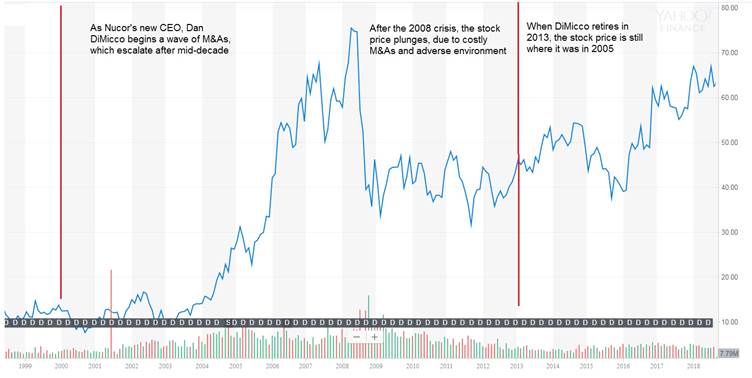

That is how China became a convenient scapegoat for Nucor’s dramatic fall. As long as free markets, deregulation and globalization boomed, Nucor soared. As Dan DiMicco took over in 2000, its stock price more than doubled to $31 in half a decade. But thereafter it more than doubled again to a peak of $75 in fall 2008. How did DiMicco do it? The simple answer is: the fastest possible way, via mergers and acquisitions (M&As).

First DiMicco took over Auburn Steel (2001), Nucor’s first acquisition in 36 years, the came Birmingham Steel (2002). Smart CEOs got more cautious by 2005, when U.S. subprime market first tanked, but not DiMicco. After the mid-decade, he got hungrier acquiring even bigger targets, such as Connecticut Steel, Verco Decking and Harris Steel (2006). And even as U.S. real estate sector began to sink into recession, DiMicco bought Magnatrax (2007), and David J. Joseph Co. (2008). That's when the $20 billion steel giant posted a loss of $293 million, its first loss since 1966. Unsurprisingly, in the aftermath of the financial crisis, Nucor lost all those gains by early 2009, within a few months as Nucor’s stock plunged back to $34 (Figure 1).

Figure 1 Nucor’s Stock Price, 2000-2018

The punchline of the story is how DiMicco explained the fall of Nucor after 2008. It was not the excessive M&A wave. Nor was it the lack of foresight after the mid-decade, when many signs surfaced that Nucor’s growth was untenable. Instead, and once again, China served as a scapegoat. In the past, DiMicco had endorsed Navarro’s books. Now the two began to co-write op-eds bashing China.

Despite their more recent stated reservations about Navarro, Wall Street Journal, Barron’s and others highly-regarded business publications were glad to give him space at the time. In April 2009, the two argued that China’s currency manipulation accounted for U.S. trade deficits with China (Wall Street Journal). In October 2009, they decried China’s “weapon of mass production,” which they claimed was fueled by currency manipulation, unfair trade practices and gutting U.S. manufacturing (San Francisco Chronicle). (For a sanity check, it should be recalled that during this period Chinese economy accounted for almost half of global growth, which spared the world economy from Great Depression 2.0.)

To the two, these financial op-eds were but a stepping-stone to Capitol Hill's kingmakers. In September 2009, DiMicco gave testimony on Chinese currency to the House Ways and Means Committee. By early 2010, they proclaimed China an emerging global threat and that it was time to “get tough” with the mainland (Barron’s); that is, assertive slogans that somehow found their way to the official U.S. 2017 National Security Strategy, after Trump was willing to see America's ailing steel industry as a national security issue, at par with Pentagon's rearmament.

Navarro's Death by China had a simple solution to America: it urged business executives to be like Nucor, America’s largest steel producer, and Dan DiMicco, its chairman. “If American corporate executives want to better understand the art of fighting back against Chinese mercantilism and protectionism, they need look no further than Nucor…and the example set by its [chairman], Dan DiMicco [who] spends considerable time in the public arena lobbying for real trade reform with China.”

Lighthizer’s Tariffic Republican Party

Neither Lighthizer nor Ross have the public profile of Navarro and DiMicco. Yet, neither is without controversies. When Lighthizer arrived in the White House, he spent nearly $1 million on new furniture alone, attributing the costs to the Obama administration. But his ambitions went far beyond subsidized furniture – and they, too, were sparked by the eclipse of U.S. steel industry.

Growing up in Ashtabula, Ohio, near the steel mills that used to be the bedrock of the little Lake Erie port city, he saw them shutter one after another. Today, Ashtabula is known as one of the poorest places in America. Like Navarro and DiMicco, Lighthizer believes that the loss of good-paying manufacturing jobs in his home place has nothing to do with the erosion of low-margin, high-polluting steel industry and the proliferation of steel factories around the world and thus intensified competition. He grew of age in the postwar age of ‘American Century,’ not in the multipolar era of 21st century. As far as he was concerned, Ashtabula’s fall was triggered by unfair competition from cheap, foreign imports, particularly from China.

That’s the story Lighthizer likes to tell to U.S. journalists. The problem with the story is that he left his hometown more than four decades ago in the ‘70s, when Deng Xiaoping was only initiating China’s economic reforms and opening-up policies. Second, America’s trade deficits started in 1971, with Western Europe, then Japan and the ‘Asian dragons’; that is, Taiwan, South Korea, Singapore and Hong Kong. Third, U.S. deficits with China began only in the 2000s, decades after the fall of the Ashtabula of Lighthizer’s youth.

In reality, Lighthizer was a trade hawk already in the Reagan administration when he served as Deputy US Trade Representative and the White House targeted Japan for alleged trade and currency abuses and then forced Tokyo to agree to the Plaza Accord (1985), to depreciate the U.S. dollar in relation to the Japanese yen and German Deutsche mark by intervening in currency markets. It was that deal - signed in a hotel that would soon become known as the Trump Plaza – that effectively broke Japan’s economic rise, paved the way to its asset bubble and lost decades.

During those years, Ambassador Lighthizer claims to have negotiated over two dozen bilateral international agreements, including agreements on steel, automobiles, and agricultural products. As Deputy USTR, he also served as Vice Chairman of the Board of the Overseas Private Investment Corporation (OPIC). Indeed, OPIC had begun to serve as the US government’s development institution after 1971, when it insured IT&T in Chile thus ensuring de facto US government support to a company that was meddling in Chilean elections which led to General Pinochet’s violent coup.

Just as Lighthizer in the Reagan administration sought to contain Japan’s rise with new trade and currency policies, he now hopes to use tariffs against China and, truth to be told, against any country that is perceived to stand in America's way. It is what he believes to be the true tradition of the Republican party: “The icon of modern conservatism, Ronald Reagan, imposed quotas on imported steel, protected Harley-Davidson from Japanese competition, restrained import of semiconductors and automobiles, and took myriad similar steps to keep American industry strong. How does allowing China to constantly rig trade in its favor advance the core conservative goal of making markets more efficient?”

To Lighthizer, tariffs are as American as apple pie; a way to promote American industry and a key Republican tenet originating from the pro-business politicians who created the party. Already in 2011 - five years before the Trump election triumph - Lighthizer argued that Trump’s “get-tough views on China" recall the roots of the party: “For most of its 157-year history, the Republican Party has been the party of building domestic industry by using trade policy to promote U.S. exports and fend off unfairly traded imports. American conservatives have had that view for even longer.”

Like Trump, Lighthizer sees China as a problem, along with the U.S. NAFTA partners, Canada and Mexico, Germany and the EU, Japan and South Korea, and the WTO itself. America is on the right track; the other countries aren’t. So they have to be transformed by America.

Ross, “the Greatest Gifter in American History”

While Navarro and Lighthizer flex their muscles behind the TV cameras, the 80-year old Secretary of Commerce Wilbur Ross has been the trade war’s public face. Nicknamed the “King of Bankruptcy,” Ross made his estimated $700 million in assets by buying bankrupt companies, especially in manufacturing and steel, and then selling them for a great profit after restructuring.

The prime examples include the International Steel Group (ISG), which he founded in 2002 after purchasing the assets of several bankrupt steel companies and which was followed by International Textile Group (ITG), International Automotive Components Group (IAC) and International Coal Group (ICG). Ironically, he made his fortunes by doing everything Trump claims is wrong with America.

In the Trump administration, Ross presumably is going after the kind of offshoring of U.S. jobs that gained him with a fortune. Nevertheless, charges of conflicts of interest, including possibly illegal failures to divest from financial holdings (violating a pledge to the Office of Government Ethics), and to disclose financial ties to Russian interests in confirmation hearings (according to the Paradise Papers) keep haunting the semi-billionaire.

Worse, a recent Forbes in-depth report indicates that “allegations [against Ross] — which sparked lawsuits, reimbursements and an SEC fine—come to more than $120 million. If even half of the accusations are legitimate, the current United States secretary of commerce could rank among the biggest grifters in American history.”

As Forbes’s Dan Alexander sees it, the timing of Trump's job offer was economic manna from heaven: “From Ross’ vantage point, Trump offered the perfect exit. The future cabinet secretary’s private equity funds were underperforming— one on track to lose 26% of its initial value and another two dribbling out mediocre returns— and the accusations were starting to pile up.”

Four Steely Men

So these are the not-so-fabulous four: an idea peddler haunted by fraud allegations, a senior executive willing to promote steel industry at the expense of American innovation; a trade hawk who would like to re-create the Republican Party and the WTO in the image of America; and a bankruptcy wizard and grafter extraordinaire who made his millions by offshoring those jobs that Trump claims to want back.

In each case, protectionism has been less an intellectual matter of correcting the wrongs in international trade. In each case, it has served as an opportunist career enhancer, profit-maker and ideological pretext.

In the U.S. industrial landscape, the four steely men seek a return to the past ‘American Century’ by boosting artificially old and low-margin industries, at the expense of new and profitable ones. Steel is their common denominator.

Since the postwar era, employment in manufacturing has fallen in most major manufacturing countries. Due to the emerging economies’ low-cost advantage and offshoring, advanced economies focus more on higher value-added, that’s their comparative advantage. In contrast, Trump hopes to facilitate US growth with re-negotiated or rejected trade deals to “bring good-paying jobs to our shores and support American manufacturing, the backbone of our economy.” In reality, the reliance on controversial policy instruments (lower taxes, aggressive deregulation, new energy exports), may boost U.S. economic fortunes in the short-term but contribute to broader deterioration in the long-term (deeper income polarization, social costs of misguided deregulation, environmental hazards associated with shale extraction).

Paradoxically, the Trump administration seeks progress in secondary priority areas where it is destined to generate minimal or transient progress, while ignoring viable advances in those areas of competitiveness and innovation, where it could thrive.

In the view of the steely trade hakws, even the reversal of postwar global economic cooperation is fully legitimate - as long as it is seen to serve the America First doctrine rather than each one's private agenda.

NOTES

1 Once again,Navarro turned to Nucor, but he wanted the deal done through Utility Consumers’ Action Network (UCAN), a San Diego non-profit, led by his friend Michael Shames. So, UCAN deposited Nucor’s checks to Navarro’s production company. Perhaps the hope was that this would be easier to explain to Nucor’s shareholders. In February 2012, UCAN, Navarro’s production company, Navarro and his wife were subpoenaed by an FBI agent to testify before a federal grand jury, due to suspected financial irregularities. Soon thereafter UCAN was charged for document destruction. By fall 2012 Shames was replaced. But the debacle is not over. The following year, UCAN and Shames sued each other.

2 In Inside Job (2010), the Oscar-winning documentary on the 2008 Great Recession, Hubbard was questioned on his support for deregulation, lucrative consulting, and conflict of interest. Hubbard was dean of Columbia’s School of Business and formerly deputy assistant secretary at the US Treasury (1991-93), chairman of the Council of Economic Advisors (2001-2003).

3 The Coalition promotes a harder line against China. It represents agriculture, manufacturing and organized labor associations and small exporters. In turn, the American Jobs Alliance is dedicated to fostering U.S. system of free enterprise. The leaders of these two organizations are well-known trade hawks and include a former commissioner of U.S.-China Economic and Security Commission, president of Economic Strategy Institute, Ross Perot’s economic advisor, and Reform Party candidates.

4 Just months before his successor John Ferriola took over as the CEO in January 2013, DiMicco still bought the $605 million Skyline Steel, which boosted Nucor’s price to almost $45 thus making his departure look a bit more respectable.

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2018 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.