Upside Targets for Gold, Gold Stocks & Silver

Commodities / Gold and Silver 2018 Sep 01, 2018 - 10:21 AM GMTBy: Jordan_Roy_Byrne

After a vicious selloff precious metals have stabilized. Its not a surprise given the breadth and sentiment extremes we noted and had predicted earlier. Although recent gains have met some resistance, the immediate path of least resistance should be higher. Let’s take a look at the key support and resistance levels for the metals and the miners.

After a vicious selloff precious metals have stabilized. Its not a surprise given the breadth and sentiment extremes we noted and had predicted earlier. Although recent gains have met some resistance, the immediate path of least resistance should be higher. Let’s take a look at the key support and resistance levels for the metals and the miners.

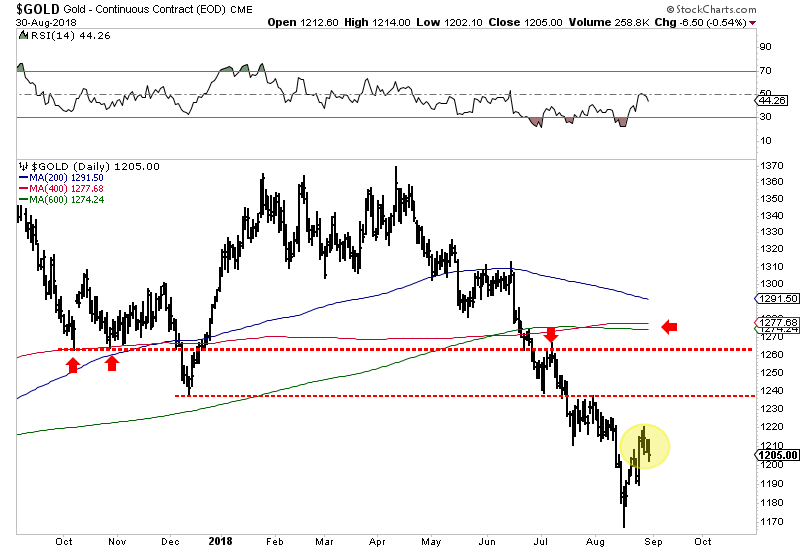

Gold has retreated after hitting $1220/oz a few days ago. That was the first area of resistance for this rebound. The next resistance level would be around $1235. If Gold can surpass $1235 then look for a move up to $1260. There is very strong resistance above $1260 while $1180 should be strong support.

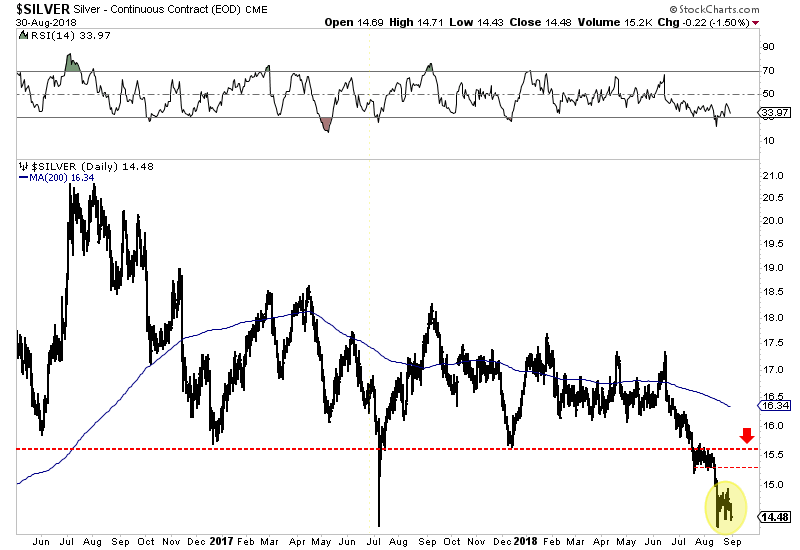

Silver’s recovery has been very weak as it closed Thursday near its low from a few weeks ago. If Silver can gain some traction and close above $14.85 then it should be able to approach resistance at $15.50-$15.60. That level was former support and is now strong resistance.

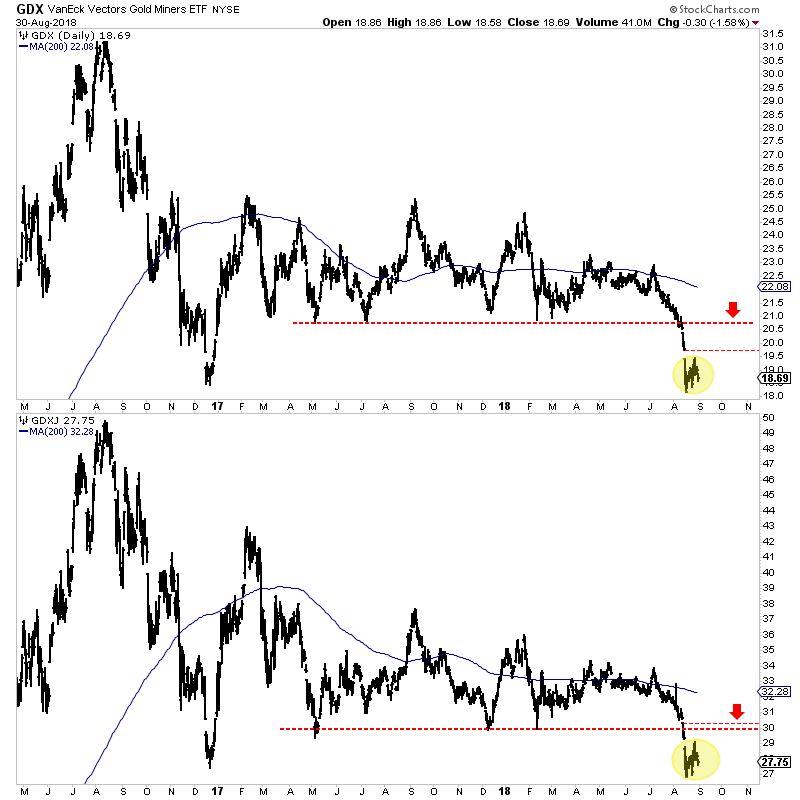

Turning to the stocks, we see that like Silver they have shed their gains over the past few days. If the recovery has more upside then look for GDX to reach $20 and for GDXJ to approach $30. Those targets if met, represent a retest of the recent technical breakdown. The lows from a few weeks ago are immediate support.

Although Silver and the gold stocks have trailed off in recent days, they remain very oversold and its difficult to imagine an immediate break of the recent lows. In that scenario the break would be temporary and lead to a stronger rebound. Otherwise, look for the miners and metals to at least consolidate or grind higher to those targets. Our plan is to let the rally run its course and when the time is right, go short again. To navigate the volatility ahead and prepare for an epic buying opportunity in 2019, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.