USD/JPY Forex Trend Forecast

Currencies / Japanese Yen Aug 26, 2018 - 03:44 PM GMTBy: Austin_Galt

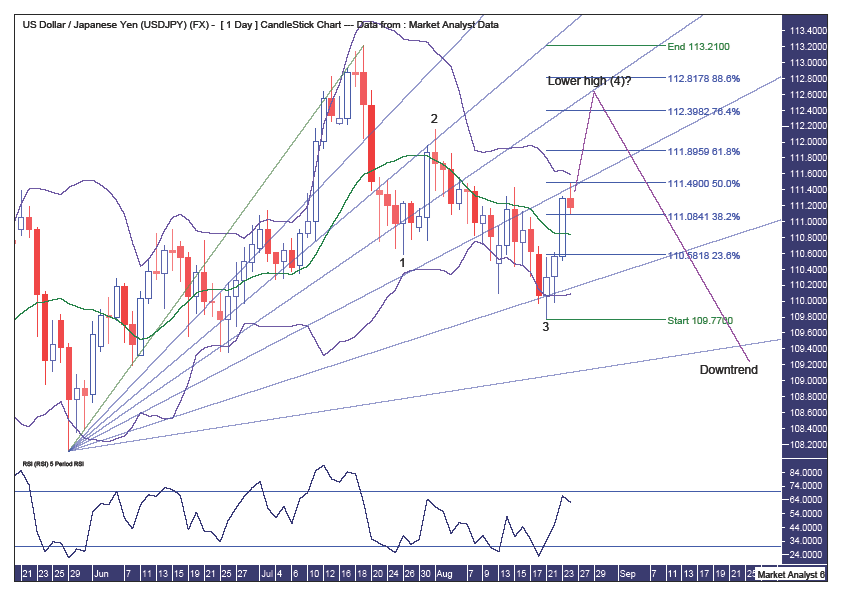

Pattern – I believe a top is in place at 113.21 and a new downtrend has begun with price in the process of putting in a lower high. While it is possible that the first lower high is already in place, it is my belief that is not the case and a 5 point broadening low formation is in play with price currently on its way up to a point 4 high which will be the lower high. Considering the likely point 5 low is much lower, I am essentially viewing this formation as just a continuation pattern. The point 2 highs is at 112.50 and price turning back down at that lower would set up a bearish lower double top and that is certainly a very valid possibility.

Pattern – I believe a top is in place at 113.21 and a new downtrend has begun with price in the process of putting in a lower high. While it is possible that the first lower high is already in place, it is my belief that is not the case and a 5 point broadening low formation is in play with price currently on its way up to a point 4 high which will be the lower high. Considering the likely point 5 low is much lower, I am essentially viewing this formation as just a continuation pattern. The point 2 highs is at 112.50 and price turning back down at that lower would set up a bearish lower double top and that is certainly a very valid possibility.

Daily Chart

Bollinger Bands – price looks headed for the upper band and I expect price to push up into this band.

Fibonacci – the recent low was at support from the 76.4% angle and is not back at the 61.8% angle which has provided some resistance. I favour price to overcome this resistance and eventually top out around resistance from the 50% angle. The 76.4% retracement level of 112.39 looks achievable while the 88.6% retracement level at 112.81 looks a touch too far. Perhaps around the 112.60 mark??

RSI – price is nearing overbought territory and I favour this indicator to get up and into that territory before price turns down.

Monthly Chart

Pattern – we can see a double top, denoted by the horizontal line, is in place and given that I expect a big reaction down. I believe and ABC correction is playing out with price currently tracing out its way to a wave C low.

Bollinger Bands – price is currently around the middle band and I doubt it will be able to overcome resistance from this band and make its way up to the upper band. Instead, I expect price to trade down from here and hug the lower band.

Fibonacci – price looks to be encountering resistance from the 61.8% angle while I am targeting the 88.6% angle to bring in the wave C low. The 76.4% retracement level at 87.50 is my minimum target and it would not surprise to see price give this level a good test.

Moving averages – in a bearish position.

RSI – in strong territory but it looks bearish overall as moves down are now getting into oversold territory while moves up seem unable to get into overbought territory.

Summing up – after one last little rally in the coming days, I expect a large move to the downside.

By Austin Galt

Austin Galt has previously worked as a stockbroker and investment banker while studying technical analysis for over two decades. He is also the author of the book White Night: A Colombian Odyssey

Email - info@thevoodooanalyst.com

© 2018 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Austin Galt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.