Two Key Events Will Unleash Gold

Commodities / Gold and Silver 2018 Jun 05, 2018 - 12:29 PM GMTBy: Jim_Willie_CB

TIMBER!! That is the standard cry in the forest industry among loggers who cut down giant trees, the warning to step aside for the great impact. GET READY FOR THE SIMULTANEOUS BANKING CRISIS IN THE THREE BIGGEST EUROPEAN ECONOMIES: GERMANY, FRANCE, ITALY. The United States and the London Centre will not be able to avoid the crisis.

TIMBER!! That is the standard cry in the forest industry among loggers who cut down giant trees, the warning to step aside for the great impact. GET READY FOR THE SIMULTANEOUS BANKING CRISIS IN THE THREE BIGGEST EUROPEAN ECONOMIES: GERMANY, FRANCE, ITALY. The United States and the London Centre will not be able to avoid the crisis.

Try that again. TIMBERRRR !! An event of monumental importance and impact is on the verge of occurrence. The largest bank in Europe is Deutsche Bank. Its credit default swap is rising in cost, while its stock price has entered single digits in a powerful decline. The great D-Bank, site of the European office in management of the multi-$trillion derivatives, is on the verge of financial failure. It is the largest bank in all of Europe. All of its business segments are impaired and losing money in a hemorrhage. Furthermore, it is a big bond holder for Italian Govt Bonds. The Italian banking system is in the death throes, which has finally been recognized. Their recent elections openly debated pathways in the face of banking system failure, which the Jackass has been expecting for over a year in steady coverage with analysis. However, the bigger bond holder for Italian debt is France. Expect a massive bank crisis to emerge very soon that wrecks Societe General and BNP Paribas, its two largest banks.

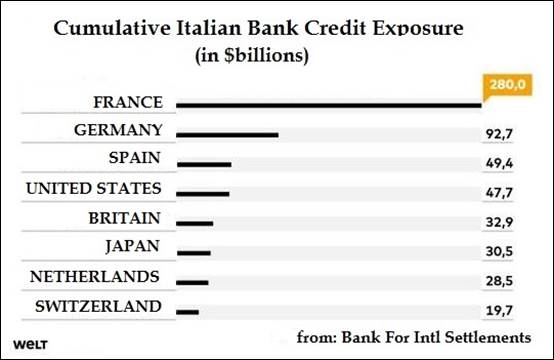

Back in 2016, the Hat Trick Letter warned of very high Non-Performing Loans among the Italian banks. The HTLetter warned of rising government bond credit defaults swap rates. It is the insurance rate on a standard government bond, in coverage for default of the bond. It was this CDSwap rising rate which warned at least three months in advance of the Lehman Brothers failure (killjob by JPM and GSax). But the contagion for the Italian banking failure is the main point. Notice that back two years ago, the French big banks had triple the size of exposure to Italian debt, versus the German banks. The Spanish and US banks will also suffer from the impact. The graph below is from July 2016.

GLOBAL CURRENCY RESET

The Global Currency RESET has begun, hardly with fanfare and parades, or even formal public statements by the main players. Many are the events and steps toward the planning and execution of the RESET, which will be very disruptive, and make the Lehman failure seem rather minor by comparison. The Jackass has consistently called what comes to be the Systemic Lehman Event, since major sovereign bonds have become subprime in quality, kept sustained by central banks with their QE. Another better name for Quantitative Easing is hyper monetary inflation with debt monetization of the unsterilized type. See Zimbabwe and South America for the wondrous outcomes in national economic wreckage, poverty, and bank insolvency, just two examples. The Jackass has been preaching for several years that the QE monetary policy has saved the big banks, or at least through bolstered official liquidity having bought them some time. But the consequence has been to render severe damage to the tangible economies. QE has essentially killed the economies. The feedback loop has struck the banks, which suffer great damage from the chronic recession which has never stopped since the year 2006. Business failures have combined with lower energy prices to cause a wrecking ball to hit the big banks. They also have been hurt by the rising bond yields for the USTreasurys. The lie on economic growth has been about 5% to 7% every year, from severely gimmicked price inflation. See Shadow Govt Statistics with John Williams for proof. Therefore, the true inflation adjusted GDP has been minus 2% to minus 4% every year since before the Lehman failure.

The RESET is in progress. Many are its elements. Like the Gold-Oil-RMB futures contracts in Shanghai. Like the Cross-Border Interbank Payment System (CIPS) which will function as the SWIFT alternative for Eastern nations. The entire Belt & Road Initiative forms a massive $6 to $8 trillion conference table of projects, mostly construction, all in the Eastern Hemisphere, and none conducted in USDollar terms. Many are the non-USD platforms under development, some of which have been around for a while like the BRICS Development Bank. Lately, a new piece has been put in the picture, with the BRICS Gold Platform. My suspicion is that Turkey might soon play a role with it, in conversion of sovereign subprime (toxic) bonds like the USTreasurys and EuroBonds. Keep in mind that Italian Govt Bonds deserve a 10% yield, like the Greek Govt Bonds, except that the Euro Central Bank has been subsidizing these toxic (in)securities.

TWO KEY EVENTS

An astute and very well-informed source with solid connections has provided important direction on the development. Timing is always difficult. He looks toward two key events that soon will trigger a global financial crisis, complete with a wave of reforms and solutions sought, all amidst great changes in financial markets. Expect a complete restructuring of the financial world we know it, as in debt restructure. The result will be a gold-centric financial structure, with central banks honoring finally the Gold Standard and the gold asset in banking reserves. The shift will be seen toward not only implementation of the Gold Standard, but also the Chinese RMB and possibly a key role for crypto-currencies. Confirmation is coming from the mainstream media. During the Systemic Lehman Event, otherwise called the bust of the Everything Bond Bubble (from QE squared), some sovereign bonds will be defaulted upon, with painful consequences from the failures. During the upcoming bust, certain entire national banking systems will collapse.

At the same time, next-generation technology will be unleashed. It will be both disruptive to monopoly corporations, and society also. It will act as a wrecking ball to many energy companies who have suppressed the technology. In the RESET expect some hardline rules (if not games) exerted by the banker cabal, with respect to war on cash and negative rates. They will attempt to maintain their centralized power and absent transparency. The Elders of China are driving the RESET process, after having abandoned support for many key institutions of power in the West. A gold-backed Chinese Yuan is anticipated as part of the new framework.

In the upcoming chaos, tremendous changes will come, as part of the Global Paradigm Shift. In the reforms and much needed solutions, the suppression controls and shackles for Precious Metals will be shoved aside. The source has expectations of key events unfolding rapidly, with no prospect of much delay or favorable outcome for the USDollar, since Gold cannot hold back any longer. Bear in mind the gigantic Egyptian gold investor, where something like 50% of his wealth was invested in gold bullion metal. The shrewd investors expect only PM to survive the big burn that comes, and not much else, surely not paper assets when the King Dollar suffers its fate. The source is not certain how much longer the suppression of price and news can be maintained. It surely will not last another year, more like at most several months. Events are picking up in accelerated speed and breadth for the non-USD platforms. By the way, the source is not Santa himself, Mr Sinclair.

Then the source emphasized this. He awaits two key globally important events, which are set to occur. Nothing can stop them, and both will be powerful. He knows what they are, but is not at liberty to offer further details, very clear events in development. They are near-term triggers, which will release Gold & Silver prices. Once gold is released, silver will take flight. He stressed how the Global Currency RESET will have some very visible unexpected aspects in a complete restructuring of the financial world versus its present form. He seems to be part of the planned restructure, planning, testing, and implementation, if not the upcoming crisis management.

The Jackass tried to guess on the key trigger events with Saudi oil sales taken in RMB payments. He was evasive but admitted that is a certainty already to occur between the Chinese and Arabs. My next gambit guess was to describe the development of non-USD platforms. He repeated that two key events are in the near-term schedule in progress. Before the Jackass could mention the near-term chaos with Deutsche Bank and the entire Italian banking system, he offered more details, but still somewhat general.

This will unfold as an event schedule sequence. He gave emphasis that silver metal was in dire shortage, the deficit growing worse with each passing month. Upon further reflection, the Jackass believes a widespread shutdown of principal globalist cabal banks might occur, which would alter the entire global financial framework, and unleash the gold demand. The remaining banks could then replace a large swath of their USTreasury Bonds, EuroBonds, UKGilts, and JapGovtBonds in favor of Gold bullion for the formally held assets in reserves. The RESET would then dictate how global banking systems must migrate toward gold and away from sovereign debt in their reserves management systems. The rising Gold price in the following years would ensure the banks of healthy solvency. Or at least gold will aid the central banks in their struggle toward survival, which have made disastrous decisions in the accumulation of $9 trillion of toxic sovereign bonds just in the USFed and EuroCB.

Here are several potential key events to force a grand grotesque disruption. The others pertain to deep impact events, also certain to continue the disruption. The Jackass guess on the two events are first a combination of Deutsche Bank failure with Italian banking system collapse. The second guessed event would be the introduction of the Gold Trade Note, designed to sit atop the Shanghai Gold-Oil-RMB futures contracts, with a possible announcement of interchangeable Chinese Yuan with the Gold Trade Note in a caretaker temporary transition role. Be sure to know that Jackass conjecture on the two key events is a much better descriptor, since guess seems flimsy flighty and conjecture seems educated calculated.

LIST OF POTENTIAL KEY EVENTS

VERY SERIOUS MAJOR GLOBAL GAME CHANGERS

- Deutsche Bank failure, talk of restructure, with rupture of derivative complex

- Italian banking system collapse, complete with numerous bank runs

- Italian sovereign currency announced as new Lira currency in EU exit

- London Metals Exchange launches RMB-based metals contracts

- COMEX & LBMA rupture from lost control of integration with oil & currencies

- Formal launch of Gold Trade Note atop the Shanghai G-O-R contracts

- Saudi oil sales in RMB to China, adopted by other Arabs and other Asians

- London flips East, with RMB Hub development, following their AIIBank membership

DEEP IMPACT DISRUPTIONS

- Flourishing non-USD platforms, led by Chinese design and efforts

- Germans and French formally end Russian sanctions, thus flipping East

- CIPS bank transaction system gains wider adoption, even among Western nations

- BRICS Gold Platform announces conversion of sovereign bonds to Gold

- China pre-announces gold-backed Yuan in form of convertible Gold Trade Note

- China announced Yuan backed by basket of currencies, Gold, other commodities

- Introduction of a new IMF SDR basket that includes gold, crude oil, iron

- EU opens door to Euro payments in external trade with trading partners

- Emerging Markets rupture on debt defaults, due to currency crisis

- NATO fractures in the open and EU pursues independent military security

PROOF OF MONETARY POLICY FAILURE

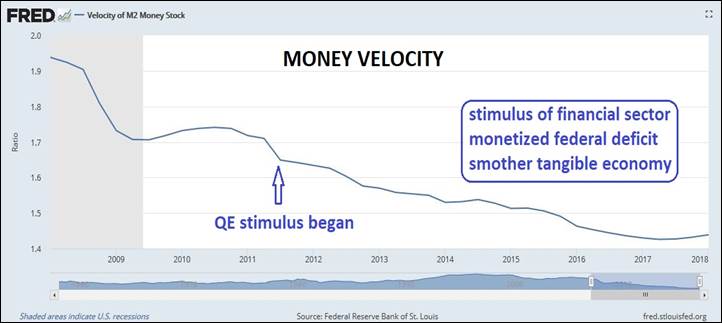

The Global RESET has already begun. The USFed has brought about a chronic slowdown in money velocity, which reveals the horrendous chronic recession. Damage has been done for over six years during the heretical QE monetary policy. The chart is only through end of year 2018. The malinvestments are hitting the wall. Add to the discussion on the bond market, aside from the USTreasurys, where much distress is seen. The USFed cannot manage the entire asset backed securities (mortgage bond) market and the corporate bond market, let alone the high yield (junk) bond market. Far afield is the Emerging Market arena, with scary damage. The Quantitative Tightening has caused severe problems already. It all seems like a scuttle project. Thus the new chairman of the USFed is certainly not a banker cabal player, with no Wall Street experience.

The following is from the Voice, with minor edits for flow. The chart is for data ending January 1st. “Chaos has entered many parts of the lateral portions from the bond market, but more visibly worse to the center of the tangible economy. It is all much simpler than you think. The Velocity of Money has slowed down dramatically and in some sectors of the economies have gone close to zero. It is much like cutting off oxygen from a passenger jet, where the passengers suffocate. Refer to the Austrian School of Economics describing the Crackup Boom scenario where malinvestments finally collapse. It is much like an earthquake triggered tsunami. The entire financial and economic system is like a totaled car that needs to go to the scrapyard to be crushed. However, the banker cabal and government officials attempt to keep things going with plenty of music and ample propaganda. Not even wars will be saving the system, as has been practiced in the past. The entire global system is defacto in an Intensive Care Unit watching the life support system screen. What is most fascinating for me to see, is the fact that everybody is waiting for the RESET, whereas we are already in the RESET process. It has begun. In all this cataclysmic turmoil lies an incredible opportunity. The fortunes ahead are in precious metals, and not paper assets. The Gold & Silver asset will survive and thrive since true money, while the paper assets will burn.”

The Jackass adds that precious metals will do very well, but with a transition period of unknown duration, while the paper assets (like stocks) might have a final burst upward before major decline is witnessed. As a final note concerning the RESET, leave it for another day to discuss restored stolen legacy wealth, debt forgiveness, end to global poverty, defanging the banker cabal, and disarming militaries. These are controversial topics loaded with political mustard, without much clarity or reliable information.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

"As a Golden Jackass subscriber, I greatly enjoy listening to your interviews because it really lends a sense of passion that lies behind the tremendous body of information and formulation that goes into your monthly research. Though I must admit, it scares the hell out of me most of the time. Still, I will not miss it for the world. I feel that having a truly objective insight from your research, in depth analysis, and accurate forecasts gives me and my family an important life saving advantage. And I mean that sincerely."

(MichaelS in Ontario)

"I have continued my loyal patronage of your excellent commentaries not so much because of my total agreement with your viewpoints, but because you have proven yourself to be correct so often over the years. When you are wrong, you have publicly admitted it. You are, I suppose by nature, an outspoken and irreverent spokesman for TRUTH against power, which differentiates you from almost all other pundits on world affairs."

(PaulR in Hawaii)

"For over five years I have been eagerly assimilating any and all free information (articles, interviews, etc) that Jim Willie puts out there. Just recently I finally took the plunge and became a paid subscriber. I regret not doing this much sooner, as my expectations were blown away with the vast amount of sourced information, analysis tied together, and logical forecasts contained in each report."

(JosephM in South Carolina)

"Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com, which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.