Gold +1.8%, Silver +2.5% As Fed Increases Rates And Trade War Looms

Commodities / Gold and Silver 2018 Mar 22, 2018 - 04:18 PM GMTBy: GoldCore

– Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday

– Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday

– Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range

– Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018

– Markets disappointed at lack of hawkish comments from new Fed Chair

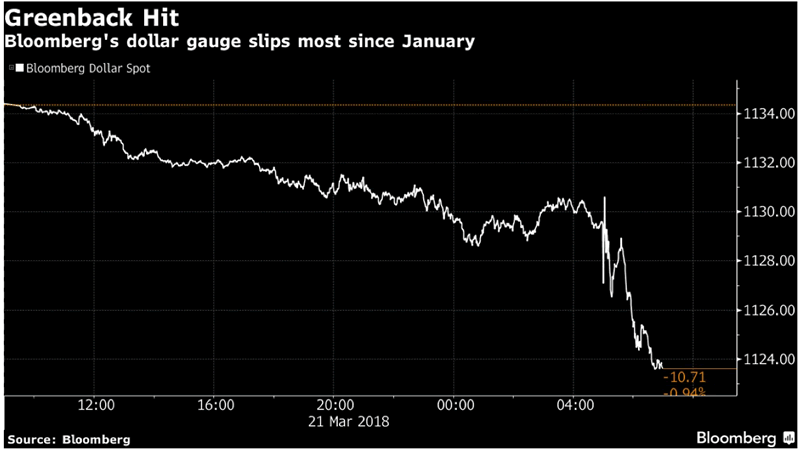

– Dollar LIBOR rises to highest level since November 2008 – $200 trillion worth of dollar-denominated financial products including mortgages based off LIBOR

– Trade wars look set to escalate and Trump expected to announce tariffs on Chinese imports today

Editor: Mark O’Byrne

Gold in USD – 1 Week (GoldCore)

Gold gained 1.7% and silver 2.5% to $1,333/oz and $16.60/oz respectively yesterday after the Federal Reserve announced a 25 basis point increase in rates to the slightly higher range of 1.5% to 1.75%. Gold and silver consolidated on those gains overnight in Asia and this morning in European trading, as markets digested the Federal Reserve’s post-announcement comments.

The first Federal Reserve meeting chaired by Jerome Powell offered little in the way of surprise. A hawkish tone was expected from new Chair Powell, however his statement was slightly more dovish despite what he claimed was a strengthened economic outlook and confidence that tax cuts and government spending will provide an much needed boost.

The Fed confirmed that there would be just three rate hikes this year, as stated in the December 2017 minutes. Currently the interest rate remains 50bp below LIBOR which continues to climb, widening the spread between itself and OIS.

Should this continue to worsen the impact could be greater on the economy and wealth, than Fed set interest rates. On this basis, the Powell and co. may well decide on additional rate hikes on top of the two expected this year and those forecast for 2019 and 2020.

Yesterday CME Group reported that speculative betting on future Fed rate rises in June are 84.4% likely (up from 58.5% a month ago) and September’s meeting 52.2% (jumping from 37.3% a month ago).

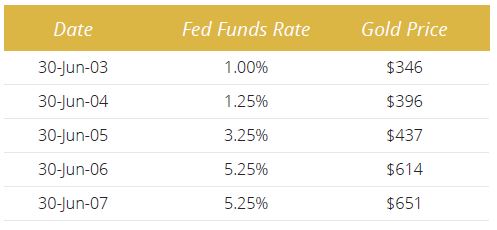

Data shows rising interest rates is positive for gold as seen in 1970s and again from 2003 to 2007. Source: New York Federal Reserve for Fed Funds Rate, LBMA.org.uk for Gold (PM fix)

Gold to find further support in trade wars

Later today President Trump will almost certainly announce tariffs on Chinese imports. The White House is said to be considering between $30bn-$60bn in tariffs and measures that would restrict investment. Yesterday the country’s top trade negotiator, Robert Lighthizer, told Congress the US will put “maximum pressure on China and minimum pressure on US consumers”.

Any changes to current trade arrangements will no doubt increase tension between the super powers. Many expect retaliation from Beijing (to any US measures) prompting a trade war and there is also the real of currency wars returning with a vengeance.

Elsewhere, EU leaders will today consider how best to respond to Trump’s decision to place tariffs on aluminium and steel imports, another move likely to trigger a trade war.

Recent Fed meetings and interest rate announcements have coincided with short term lows in the gold price and a good entry point for those looking to accumulate on the dip (see chart above).

We expect the same on this occasion and we should again test resistance at $1,360/oz in the coming weeks. Growing uncertainty and deepening risks will provide further support for gold and should see higher gold prices.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

22 Mar: USD 1,328.85, GBP 939.36 & EUR 1,078.10 per ounce

21 Mar: USD 1,316.35, GBP 935.53 & EUR 1,071.64 per ounce

20 Mar: USD 1,312.75, GBP 935.60 & EUR 1,066.22 per ounce

19 Mar: USD 1,311.70, GBP 934.59 & EUR 1,066.41 per ounce

16 Mar: USD 1,320.05, GBP 945.42 & EUR 1,071.09 per ounce

15 Mar: USD 1,323.35, GBP 949.24 & EUR 1,070.72 per ounce

14 Mar: USD 1,324.95, GBP 949.59 & EUR 1,071.35 per ounce

Silver Prices (LBMA)

22 Mar: USD 16.52, GBP 11.64 & EUR 13.41 per ounce

21 Mar: USD 16.25, GBP 11.56 & EUR 13.23 per ounce

20 Mar: USD 16.25, GBP 11.60 & EUR 13.22 per ounce

19 Mar: USD 16.29, GBP 11.59 & EUR 13.24 per ounce

16 Mar: USD 16.48, GBP 11.79 & EUR 13.36 per ounce

15 Mar: USD 16.52, GBP 11.86 & EUR 13.37 per ounce

14 Mar: USD 16.61, GBP 11.88 & EUR 13.42 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.