Economic Pressures To Driving Gold and Silver Prices Higher Long-Term

Commodities / Gold and Silver 2018 Mar 12, 2018 - 09:27 AM GMTBy: Chris_Vermeulen

The analysis we have been conducting regarding the US and global markets shows one very interesting component that many people are overlooking – the pricing pressure in precious metals. Our research team at Technical Traders Ltd. has attempted to understand and this pricing pressure in relation to the strong international demand exhibited by China, India, Russia, and others.

The analysis we have been conducting regarding the US and global markets shows one very interesting component that many people are overlooking – the pricing pressure in precious metals. Our research team at Technical Traders Ltd. has attempted to understand and this pricing pressure in relation to the strong international demand exhibited by China, India, Russia, and others.

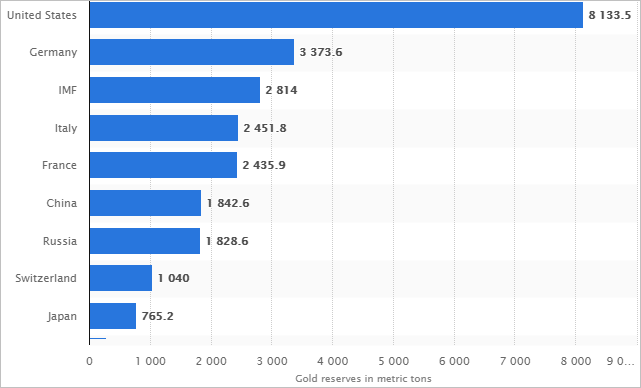

The below chart showing top gold reserves being accumulated by countries.

The United States holds the largest gold reserve of any country on the planet. Yet, China, India, and Russia have all been increasing their reserves dramatically over the past few years. We believe this is a move to support their currencies and economies by moving away from fiat currency and preparing for an eventual massive price advance in precious metals.

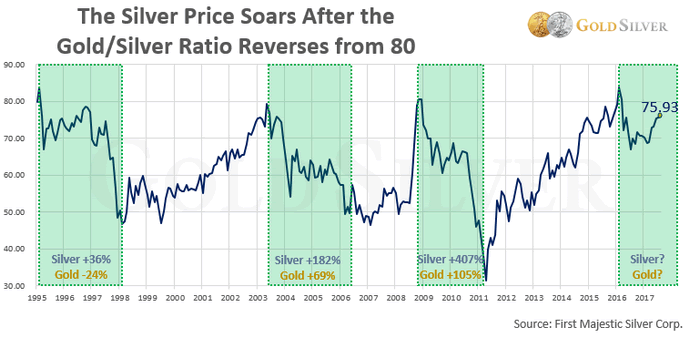

Comparatively, the Gold to Silver ratio is indicating that it would take nearly 79.66 ounces of Silver to equal 1 ounce of Gold (in terms of price comparison). This level typically indicates that Silver is dramatically undervalued compared to Gold. Yet, as we believe the price of Gold is about to launch to new highs and potentially push much higher into the future, this would indicate that opportunities for investment in either Gold or Silver could be substantial.

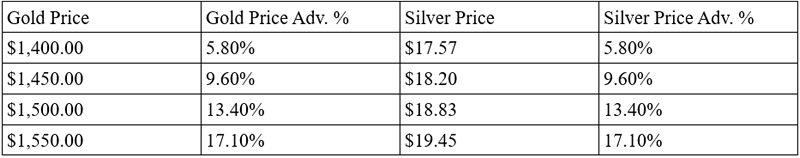

Currently, the price ratio between Gold and Silver points to the opportunity that Silver will advance in price faster than Gold, yet we believe these ratios could remain relatively stable as both price levels advance substantially. Should this ratio level remain relatively constant between both Gold and Silver, projected price levels should be as follows:

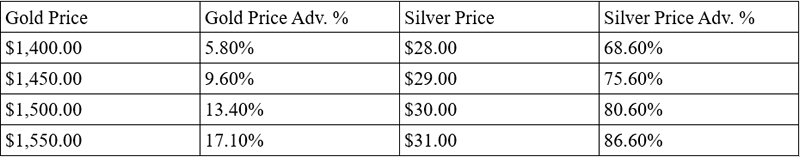

Should a similar disparity in price advance occur as it did in 2009~2010 moving from near 80 to near or below 50, then the price advance in Silver will become dramatically more pronounced.

We believe this type of move will likely become more evident as any greater market crisis event becomes more visible to global investors. In other words, there is a massive opportunity right now for strategic investments in physical precious metals as well as select equities that correlate to these potential moves.

Just recently, we profited 20% from the gold miner’s pullback taking advantage of our downward prediction. Now, we are looking at what could be the beginning of a new bullish leg upwards.

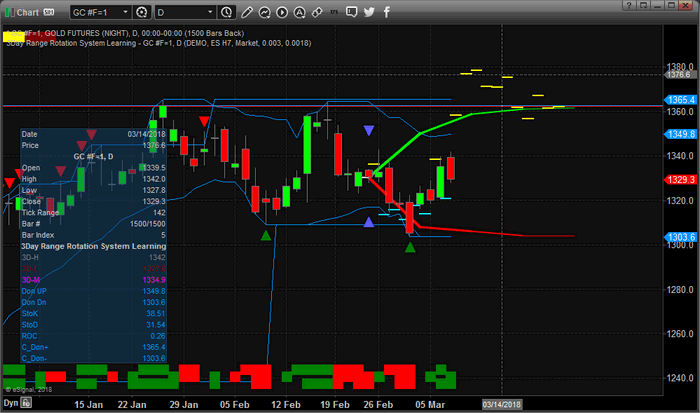

Our predictive modeling system is showing a very strong likelihood that Gold will rally to near $1380 within just a few weeks and continue to rotate near this level for a period of many weeks. This move, establishing a new recent high price level as well as potentially prompting a rising fear level in global investors may prompt a disparity in the Gold to Silver price ration resulting in a much more dramatic price advance in Silver.

Investors should prepare for a moderately strong price advance in the precious metals that may be associated with a US Dollar price decline as well as a moderate price advance in certain commodities. Now is the time to think about how you can profit from these moves and the potential disparity in the Gold/Silver price ratio.

We share our analysis so that you have some real predictive analysis data to research and review. We are not always 100% accurate in our pricing or timing modeling systems predictions, but you can spend a little time reading our research reports through most of this year to see how we’ve been calling these market moves since well before the start of 2018. Visit www.TheTechnicalTraders.com to see what we offer our subscribers and learn how we can assist you in finding great trading opportunities. In fact, pay attention to the market moves as they play out over the next few weeks to see how accurate our research really is. We’re confident you will quickly understand that we provide some of the best predictive analysis you can find and we are proud to offer our clients this type of research.

In closing, don’t fall for the fear and panic articles. Yes, the market is extended. Yes, the market may correct sometime in the future. Yes, the Fed has likely created a massive bubble. But it’s not over yet and the real trade is this 80%+ rally that is setting up in Silver while Gold is setting up for a 10~20% rally. Hope to see you in our member’s area where we can share more data and research to help you profit from these moves – visit www.TheTechnicalTraders.com to learn more.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.