Stock Market Over Valued, Over Bought ETF's and Emerging Market Bargains

Stock-Markets / Global Stock Markets Sep 08, 2008 - 01:22 AM GMT

Bill King (The King Report): Albert Edwards – economic and equity market meltdown imminent

Bill King (The King Report): Albert Edwards – economic and equity market meltdown imminent

“Last week saw the publication of Q2 US whole economy profits data. They were shockingly bad. Core measures of profitability are in free-fall and have now reached a tipping point, where corporate activity could easily implode. We have also reached the point where companies give up ‘manipulating' their profits higher and admit they are actually in free-fall. A combination of economic and reported profits slumping will catalyse the next equity downleg.”

Source: Bill King, The King Report , September 5, 2008.

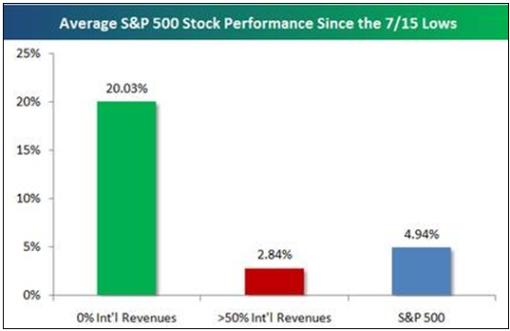

Bespoke: International revenues playing a role in the rally

“With the US dollar up sharply since the S&P 500 made its recent low on July 15th, we wanted to see how much the move might be impacting equities. As the dollar has declined over the last few years, US exports have risen sharply, and US companies with large international revenue exposure have benefited. But as the dollar has bounced off its lows recently, the international revenues play has reversed.

“Below we highlight the average performance since July 15th of stocks with no international revenues and stocks with more than 50% international revenues. As shown, S&P 500 stocks with no overseas exposure (148 stocks) are up an average of 20%, while those with more than 50% (106 stocks) are up 2.84%. The S&P 500 as a whole is up 4.94%. If the dollar continues to rally, this trend should stay in place.”

Source: Bespoke , September 3, 2008.

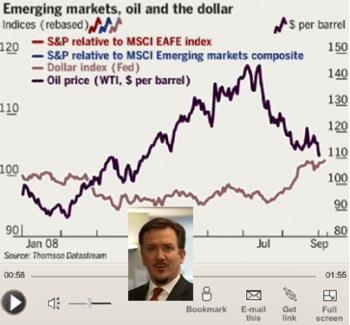

John Authers (Financial Times): US summer rally to be put to test

Click here for the full article.

Source: John Authers, Financial Times , September 2, 2008.

Bill King (The King Report): Merrill's Bernstein – valuations at historical extremes

“When one accounts for the headline CPI, equity valuations appear at historical extremes. By historical extremes, we mean similar to those seen in August 1987 or March 2000. In fact, the present combination of 5.6% headline inflation and S&P 500 trailing PE of roughly 25 has NEVER before occurred in the 44-year history of our data …

“Inflation expectations are literally imploding, and that is good for equities. Unfortunately, earnings estimates have yet to react, and that is worrisome. Thus, unless one believes in an immense productivity miracle, the S&P 500's PE multiple must substantially decrease because of rising inflation and nominal growth or earnings are likely to be very disappointing because of disinflation/deflation.”

Source: Bill King, The King Report , September 4, 2008.

Bloomberg: US stocks at 25.8 times profit means rally may end

“The best may already be over for the US stock market this year.

“The Standard & Poor's 500 Index, which had the worst first half since 2002, added 0.2% this quarter, the only gain among the world's 10 biggest markets in dollar terms. Shares in the benchmark index for American equity climbed to an average 25.8 times reported profits, the highest valuation in five years. The last time that happened, the S&P 500 fell 38%.

“Money managers at Federated Investors, Russell Investments and Morgan Asset Management, which oversee a combined $600 billion, said the gains won't last because corporate profits will fail to meet analysts' estimates. Wall Street forecasters, who were too optimistic about earnings for the past four quarters, predict income at America's biggest companies will grow by a record 62% in the final three months of 2008, according to data compiled by S&P.

“‘The market is pricing in the expectation of a good quarter, but we just don't see it,' said Philip Orlando, who helps manage $350 billion as chief equity market strategist at Federated in New York. ‘The fundamentals are going to be poor, earnings are going to be bad, and there are going to be more huge writedowns. We think stocks probably need to work 5% to 10% lower over the next month or two.'

“The index's price-earnings ratio rose above 25 three times in the last five decades, data compiled by Bloomberg show. The last was in 2001, during the bear market that followed the bursting of the dot-com bubble. The increase in valuations preceded a plunge that helped erase about half the market value of US companies.

“The ratio is being propped up now by analyst forecasts that call for the end of four quarters of slumping profits, the longest streak in seven years.”

Source: Michael Tsang and Jeff Kearns, Bloomberg , September 2, 2008.

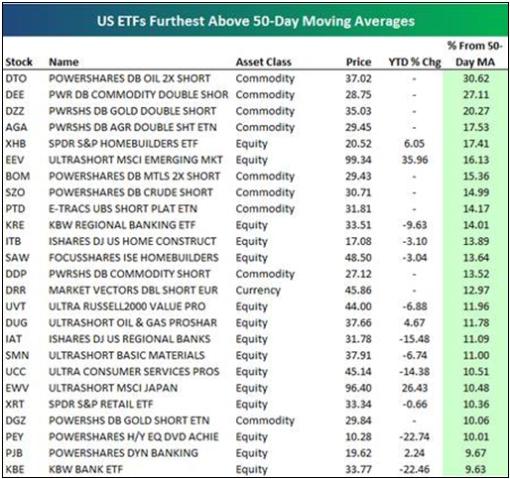

Bespoke: Most overbought US ETF's

“We recently analyzed the 800+ US ETFs to see which ones were the most overbought relative to their 50-day moving averages. As shown below, four double short commodity ETFs top the most overbought list, with the homebuilder ETF (XHB) ranking fifth. Other notables on the overbought list include KRE and IAT (regional banks), DUG (inverse oil & gas stocks), XRT (retailers), KBE and PJB (banks), and DGZ (inverse gold).”

Source: Bespoke , September 3, 2008.

Doug Kass (TheStreet.com): This is what bottoms look like

“… I am beginning to see some light at the end of the market's tunnel.

“I have long said that relative to intermediate- and long-term interest rates, stocks are not expensive – nor have equities, in the main, ever been taken to speculative extremes, though the same can't be said for residential real estate, commodities, derivatives or private equity deals.

“Several recent developments have conspired to elevate the chances of moving out of this summer's trading range to the upside. Some of the more positive catalysts include:

• A sharp drop in the price of most commodities (especially of an energy kind) will serve as a tax cut to the consumer and even stem the tide of lower disposable incomes that has been so apparent over the last few years.

• The aforementioned reduction in cost pressures (if sustained) decreases the vulnerability of corporate profit margins. A compression in profitability had previously been the source of my concern over the last two years. Alleviating this concern is an important market tailwind.

• With raw costs dropping and wage inflation nonexistent, inflation has probably peaked in this economic cycle. Indeed, it may now have become the battle past.

• The insular, mainstream media may have underestimated Republican Vice Presidential candidate Sarah Palin and her potential impact on the McCain ticket in the November election. She hit a home run last night in a remarkably wise, poised, scorching and sassy speech.

• Regardless of the election's outcome, given the gravitas of the economic downturn, both Presidential candidates will now likely reduce individual tax rates to the middle class and introduce an additional fiscal stimulus package.

• The housing markets, which are at the epicenter of our credit problems, show preliminary signs that the bottom in activity and price declines may be only six to nine months away, even though the magnitude of the recovery remains an ongoing issue. The same may be true for the automobile industry.

• A continuing high (and increasing) level of investor pessimism is reflected in the multiyear lows in the net long positions of the hedge fund community.

“Importantly, I have long written this summer that, given the complexity of today's investment issues, I will let the market tell me its story, and Mr. Market is telling a clear disinflationary tale based on the classic relative strength and revival of early cycle sectors (homebuilding, finance and retailing).

“This is what market bottoms look like.”

Source: Doug Kass, The Street.com , September 4, 2008.

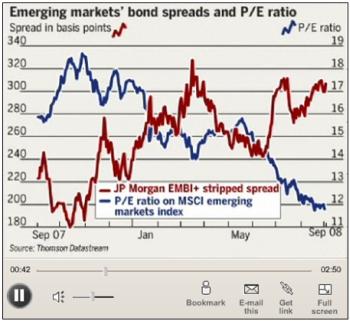

John Authers (Financial Times): Emerging markets – bargains ahead

“If you want to buy emerging markets stocks, you no longer need to pay a premium.

“For several months last year, the MSCI emerging markets index traded at a higher multiple of earnings than its world index of developed world stocks.

“But this gap began to narrow after the world index peaked in October. Now, emerging markets are trading once more at a significant discount.

“There are some good reasons for this. The turmoil in states bordering Russia suggests a rise in political risk. For example, stocks in the Ukraine doubled in barely 18 months, but since January they have halved.

“This year, the extra spreads payable on emerging market bonds have widened, according to JPMorgan. But bond markets suggest risk is lower than in March this year, while emerging market stock valuations have eroded sharply since then.

“Another ‘good' reason to sell emerging markets stocks is inflation, a serious problem for several big emerging economies.

“But above all, valuations seem to be driven by the developed world. A graph of the emerging p/e relative to the world p/e over time looks identical to a graph of the world index itself. The better world stocks are doing, the more of a premium emerging markets command. When developed world prices fall, the more of a discount traders require to buy emerging market stocks.

“Under the once-popular ‘decoupling' argument – that emerging markets could grow independent of the developed world – the emerging market premium should rise when there are problems for the US and Europe, not fall.

“Swings of fear and greed in the developed world will work against emerging markets for a while. But in the longer term, decoupling has a kernel of truth. When developed markets hit bottom, emerging markets are likely to trade at a big discount – and be a bargain.”

Source: John Authers, Financial Times , September 3, 2008.

David Fuller (Fullermoney): China – a buyer's market

“Economics 101 on fiscal prudence would suggest that countries save during the boom years, so that they are in a strong position to stimulate GDP growth in the next slowdown. This is exactly what China has done, while also deflating speculative bubbles in its housing and stock markets.

“Inevitably, China's export sector was going to suffer as the economies of OECD countries skirted close to recession, but the PRC is in an enviable position to boost growth as required. My guess is that China's economy has continued to slow in the current quarter, in line with the global trend and also due to its own additional lull during the Olympics.

“Interestingly, China's stock market has not yet responded to talk of economic stimulus, beyond the occasional one-off upward dynamic as last seen on 20th August, but these rebounds have not been maintained.

“This may be because officials have yet to implement tax cuts, reductions in bank reserve requirements or other confidence boosting measures mentioned in recent weeks. Therefore inflating fighting policies remain largely in place. Also, China's stock market did not perform in the last cycle, until it was actively targeted by the government in 2005. The current drift may actually suit China's SWFs, should they wish to invest at home.

“Meanwhile, subscribers with investments in China may have to be patient for a while longer. Those contemplating investing in China are dealing with a ‘buyer's market' in which they can either wait more evidence of a bottom or nibble incrementally on weakness. Taking the long view, we can probably expect last year's high to be exceeded on the next bull trend, possibly by a significant margin.”

Source: David Fuller, Fullermoney , September 1, 2008.

GaveKal: Thailand – buy when the cannons are sounding

“… while we acknowledge that the situation in Thailand is currently very touch-and-go, we think the current sell-off warrants a reminder about some of the country's positives:

• The market is cheap. The SET is trading at 9.6x earnings with a 4.6% dividend. Moreover, many small caps are trading at dirt cheap PEs with even better yields. In the property sector, for example, some companies are trading on nearly double-digit yields, even though the coming year's earnings are already locked in through pre-sales (and default rates are very low in Thailand).

• Strong balance sheets. Leverage has been very low in Thailand since the Asian crisis. More crucially, there has not been a US$ debt binge, contrary to many other Asian countries (which are now getting squeezed as the US$ carry trade reverses).

• The currency is cheap. The Baht remains dramatically undervalued on a PPP basis.

• Economic growth rate of 4.8% to 5.8%. Thailand's manufacturing base has been expanding, with double-digit industrial output growth rates for much of the past two years. Exports have been sizzling – they rose 44% YoY in July, to a record US$17.8bn (one caveat here: agricultural products was one of the drivers, and commodities have obviously corrected some since July). Consumer and business confidence is much stronger in Thailand than in some other Asian nations (Vietnam, India, Philippines).

“No doubt, these positives are set against a number of negatives – liquidity in Thai stocks can be spotty; the trade balance is negative; Thai leading indicators have been falling for several months … But there is a price for everything … and sometimes you get a better price if you buy when the cannons are sounding.”

Source: GaveKal – Checking the Boxes , September 1, 2008.

CNBC: Merrill's Bernstein on the strong US dollar

Insight on whether the strengthening the dollar is really all it is cracked up to be, with Richard Bernstein, Merrill Lynch's chief investment strategist.

Source: CNBC , September 5, 2008.

Bespoke: US dollar's golden cross

“The US dollar index has made a ‘golden cross' today, as its 50-day moving average has crossed above its 200-day moving average as both are rising. The ‘golden cross' is viewed as a positive by market technicians, as it is thought to signal a significant favorable turning point. Regardless of your thoughts on technical analysis, the chart below highlights a clear shift in the dollar over the last few weeks.”

Source: Bespoke , September 3, 2008.

Ulrich Leuchtmann (Commerzbank): Russian rouble depreciating swiftly

“The inability of the Russian central bank (CBR) to stem the rouble's latest bout of weakness is a bad signal for the currency, says Ulrich Leuchtmann, analyst at Commerzbank.

“He notes the CBR failed to stabilise the rouble this week when it fell past the level at which it intervened at the height of the Georgia conflict last month, even though data show the bank's reserves are still at a comfortably high level.

“‘The CBR's motivation to refrain from more effective interventions might be that they do not want to waste reserves but expect the market to normalise soon,' Mr Leuchtmann says. ‘Such a gamble could fail.'

“He says the arguments to sell the rouble stretch far beyond the Georgia crisis and therefore might persist for some time. ‘Falling oil prices have triggered speculation about the future path of Russia's current account. The bulk of Russia's exports are commodity-related, and its oil-production costs are among the highest in the world. That means any fall in the oil price hits Russia's export margin and therefore the current account.'

“He says it is also possible that the CBR finds some degree of rouble weakness welcome, given the risk factors that stem from falling oil prices and the new scepticism of foreign investors. ‘This strategy is also risky. The recent swift depreciation has opened a Pandora's box which might be difficult, and costly, to close at a future point when the CBR decides the depreciation is sufficient.'”

Source: Ulrich Leuchtmann, Commerzbank (via Financial Times ), September 4, 2008.

CNBC: Templeton's Mobius – bullish on commodities, China

Source: CNBC , September 2, 2008.

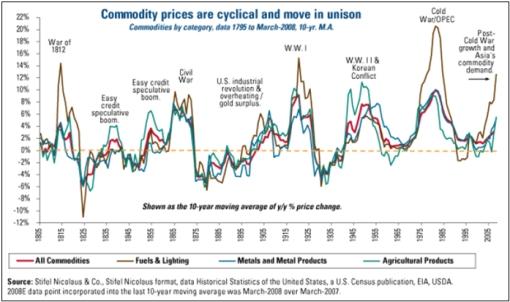

US Global Investors: Commodities supercycle has many years to go

“This chart from Morgan Stanley goes back more than 200 years to show cyclical trends in commodities prices. What you see here is that the upswings tend to be sustained for long periods of time before retreating. These commodities supercycles often last 20 to 25 years, according to Morgan Stanley's research, and if this one follows the pattern, we have many years to go before it plays out. The key drivers are the rapid economic growth in China and infrastructure spending in other large emerging markets.”

Source: US Global Investors – Weekly Investor Alert , September 5, 2008.

David Fuller (Fullermoney): CRB trend has peaked

“There is little doubt in my mind that the CRB's trend has peaked, possibly for several years, although it would not be unusual to see some top extension.

“Also, individual commodities will experience some sharp rallies on supply concerns from time to time. However I would not expect too many new highs, especially where we have seen big upward accelerations. In this new environment, short positions following rallies are likely to outperform buys following dips, at least until the next big asset reflation commences.

“Commodity shares may perform somewhat differently, depending on valuations and earlier performance. Where they accelerated higher, we can expect sharp reactions. Due to stock market headwinds, some very profitable commodity shares lagged on the upside. They will probably fall less and outperform the actual commodities to which they are related, particularly as a broad stock market recover occurs. I would hold the best but be wary of the more speculative small-cap commodity stocks.

“Lastly, the good thing about significant shakeouts in secular themes is that if we keep a portion of our powder dry, we get to play the game all over again from a lower level.”

Source: David Fuller, Fullermoney , September 3, 2008.

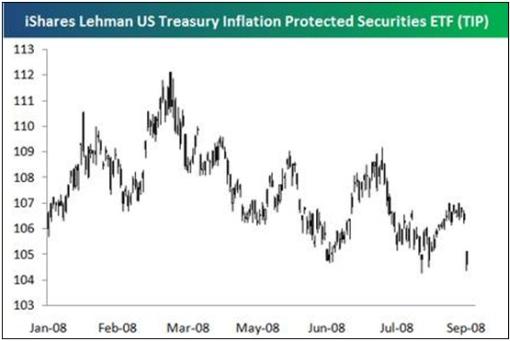

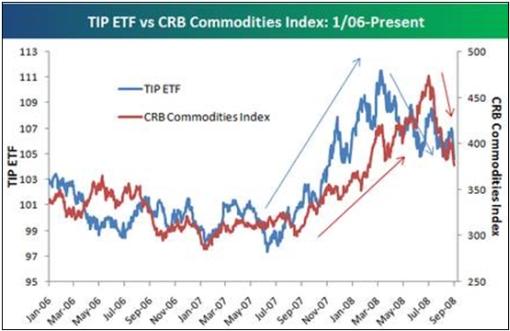

Bespoke: Look for bottom in TIP before committing to commodities rally

“The Lehman US Treasury Inflation Protected Securities ETF (TIP) is having one of its worst days of the year today, down a little more than 1.5%. As shown in the first chart below, the ETF has been in a downtrend since topping out in mid March. In the bottom chart, we compare the TIP ETF with the CRB Commodity index. The two are relatively correlated, since TIPS ‘protect' against inflation, while the CRB index measures commodity prices.

“Interestingly, the TIP ETF has led the CRB index in their most recent rallies and declines. The TIP made a short-term bottom last June and rallied sharply through this March. The CRB index didn't really begin its spike until last August, and it didn't top out until early July. Both are currently declining, which means inflation concerns are subsiding. Based on recent trading patterns in the two, it may be worthwhile to look for a bottom in TIP before looking for a rally in commodities.”

Source: Bespoke , September 3, 2008.

Richard Russell (Dow Theory Letters): Has gold bottomed?

“No tradeable item is more subject to emotional swings than gold. Because of this, gold often whips past supposed barriers, on both the upside and the downside. I've been thinking that the 800 level represented major support for gold, and sure enough, true to form, gold broke temporarily below 800 for a few days. Gold closed again today above 800.

“The following are words from the latest edition of my friends at Growth Fund Guide out of Rapid City, SD – ‘We should also point out that in the middle area of the previous precious metals super bull market (it eventually peaked in 1980) a high point was reached in December 1974, from which gold declined 47% into August 1976, and then rose an additional 721% to its 1980 peak. The recent decline amounted to about 22%, so if the recent decline were to continue and end up closer to the large decline in the middle of the previous super bull market, gold and gold funds could decline quite a bit further. Our guess is that there is a better than even chance the lows for gold funds were witnessed on August 11th and 15th. But only time will tell.' Wise words – Russell.”

Source: Richard Russell, Dow Theory Letters , September 4, 2008.

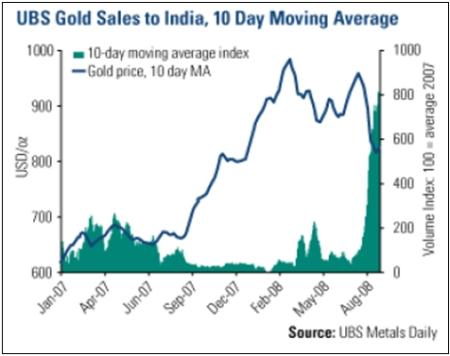

US Global Investors: Physical demand for gold has never been stronger

“Physical demand has never been stronger as we head into the strongest buying month of the year. Imports into India increased for the first time in nearly a year. Additionally gold jewelry sales in Abu Dhabi soared by 250% in August.”

Source: US Global Investors – Weekly Investor Alert , September 5, 2008.

MarketWatch: Big jump in gold sales spurs manipulation talk

“Recent heat from Congress and regulators, along with public speculation, over whether commodity prices are being manipulated has also reached gold pits, where the debate was stirred by a surge in bets in August that gold prices would fall.

“Three unidentified US banks held 86,398 short positions, or bets that gold prices will fall, in the COMEX gold market as of August 5 – 10 times more short positions than a month earlier, a government report showed.

“The report by the Commodity Futures Trading Commission, which regulates US futures markets, also showed short positions held by three US banks in silver futures had increased more than four times during the same period.

“‘The data in the bank participation report is so clear and compelling that it is hard to conclude anything but manipulation,' said Theodore Butler, a precious metals analyst, in a note.

“The sudden jump in short positions coincided with a slide in silver and gold prices, which fell $12.30 an ounce in July and another $89.20 in August, their biggest monthly loss since at least 1984, according to Factset. Silver has slumped more than $4 an ounce in August, also the biggest since 1984.

“‘Congress is already investigating allegations of manipulation in the oil market, and it seems likely that it is only a matter of time before a similar investigation will be required in the precious metal markets,' said Mark O'Byrne, executive director at Gold and Silver Investment.

“The CFTC, in a report published in May on its Web site addressing the allegation that the silver market was manipulated, said ‘there is no evidence of manipulation in the silver futures market.'”

Source: Moming Zhou, MarketWatch , August 29, 2008.

David Fuller (Fullermoney): Gold faced with period of support building

“Gold bullion and gold shares were among the last to break down in the global deleveraging cycle and some technical damage has occurred. Both bounced recently in response to short-term oversold conditions. However, a period of support building may be required before these patterns can sustain advances into the overhead trading ranges. Nevertheless gold bullion looks somewhat stronger against other currencies, as you can see with these examples of gold in euros and gold Australian dollars.

“I like gold for the long term, but as with many markets, we may be in this defensive period of uncertainty for a while longer before asset appreciation commences once again.”

Source: David Fuller, Fullermoney , September 1, 2008.

Bloomberg: Pickens – oil to return to record by end of 2008

Source: Bloomberg , September 3, 2008.

Bloomberg: Ospraie to close Flagship Hedge Fund after 38% loss

“Management LLC, the investment firm run by Dwight Anderson, will close its biggest hedge fund after slumping 38.6% this year because of bad bets on commodity stocks.

“The New York-based Ospraie Fund fell 26.7% in August after a ‘substantial sell-off' in energy, mining and resource equity investments, Anderson said in a letter to investors yesterday.

“Losses at Ospraie, once the largest commodity hedge fund firm, underscore how the sudden swing in commodities caught even experienced managers off-guard. The Morgan Stanley Commodity Related Index of 20 mining, energy and agricultural companies declined 13% in July and August as the slowing global economy cut demand for raw materials.

“‘Commodities have been the story du jour, what with China's 1.2 billion population industrializing,' said Peter Rup, chief investment officer at New York-based Orion Capital Management, which invests in hedge funds. ‘It's easy to find a trend and ride the train. The problem is, managers don't know when to get off it.'”

Source: Katherine Burton, Saijel Kishan and Christine Harper, Bloomberg , September 3, 2008.

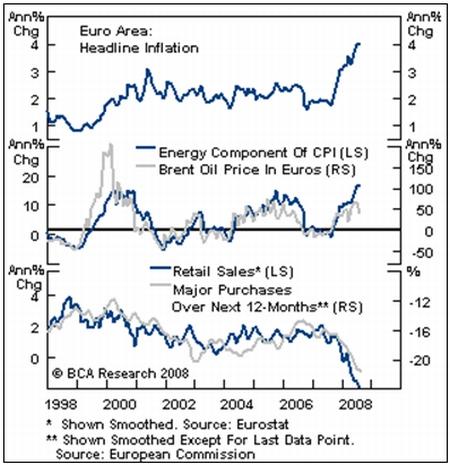

BCA Research: ECB – still hawkish

“The ECB opted to leave policy rates at 4.25% as expected. However, monetary policy should slowly begin to ease.

“For the last year the central bank has talked and acted tough on monetary policy. Yesterday's rate decision and the announcement that it would apply a 12% ‘haircut' to collateral offered from next February continues this trend, unnerving investors. However, the next move will be towards more accommodative monetary policy, beginning early next year.

“Headline inflation is peaking and price pressures will ease further in the months ahead as the economy weakens. Indeed, external demand is slowing and this week's retail sales and PMI services releases painted a very bleak picture.

“Still, policymakers will be slow to shift their rhetoric. As we highlighted in the past, the ECB remained concerned about inflation risks even as it eased policy in 2001. Bottom line: Rates will fall 100 basis points next year. Stay overweight 10-year bunds versus Treasurys and use any relative weakness from yesterday's announcement to add to positions.”

Source: BCA Research , September 5, 2008.

Victoria Marklew (Northern Trust): ECB's economic projections

“Alongside today's policy meeting, the ECB staff economic projections were released. As expected, the inflation forecast was revised up while the growth forecast was revised down. The annual rate of EU-harmonized inflation is now expected to average 3.4% to 3.6% this year, slightly up from the June outlook of 3.2% to 3.6%, with 2009 inflation at 2.3% to 2.9% (1.8% to 3.0% previously). Real GDP for this year has been revised down to just 1.1% to 1.7% (1.5% to 2.1% in June), and 0.6% to 1.8% next year (down from the earlier 1.0% to 2.0%).”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , September 4, 2008.

Edmund Conway (Telegraph): ONS called to account as doubts over figures start to stack up

“It all started when the Bank of England Governor warned that he suspected the Office for National Statistics' first estimate of gross domestic product growth was unrealistically high – a fear later borne out as the ONS cut it from 0.2 per cent to zero. Humiliatingly, the Bank has started publishing ‘back-casts' alongside its forecasts to indicate whether it feels recent ONS numbers properly reflect past economic growth.

“Then came the retail sales controversy. The ONS reported a record rise in May, a record fall in June, then an entirely unexpected rise in July. The British Retail Consortium, the Confederation of British Industry, the Bank and many economists were sceptical.

“The final embarrassment came earlier this month when, on the advice of the ONS, the Department for Communities and Local Government withdrew three years' worth of housing data after discovering ‘inconsistencies'.”

Source: Edmund Conway, Telegraph , September 4, 2008.

Bloomberg: Spanish retail sales fall for eighth month as “crisis” deepens

“Retail sales in Spain fell for an eighth month in July as record oil prices and higher interest rates eroded consumers' purchasing power.

“Sales fell 6% from the year-earlier month, after adjusting for the number of days worked, the second-biggest decline since the series began in 2005, the National Statistics Institute said on its Web site today. That decline followed a 7.9% slump in June. Adjusted sales fell 0.4 percent on the month.

“‘Spain has a crisis,' Nick Hayek, chief executive officer of Swatch Group AG, the world's largest watchmaker, said. ‘Without any doubt that's the country in Europe that really gives us a headache.'

“Spain's economy has been battered by surging gasoline prices and the fastest inflation in 10 years just as the global credit shortage undermines the housing market. House prices fell for the first time in a decade in the second quarter as the European Central Bank pushed interest rates to a seven-year high in its bid to control price gains.”

Source: Ben Sills, Bloomberg , August 29, 2008.

Financial Times: Fukuda quits as Japanese PM

“Yasuo Fukuda, Japan's prime minister, on Monday night shocked even his own party by abruptly resigning after less than a year in office, paving the way for possible snap elections in the world's second-largest economy.

“Mr Fukuda, the second prime minister to quit in a year, said he had resigned in the hope that a new leader could break the political deadlock that had plagued his term in office.

“The deadlock arose from a hung parliament in which the opposition Democratic Party of Japan blocked legislation needed to bolster Japan's flagging economy and realise its global diplomatic and security ambitions.

“Explaining his resignation to a hastily convened press conference on Monday night, Mr Fukuda said: ‘In order to put priority on the people's livelihood, a political vacuum must be avoided and there should be no lapse in policies. We need a new team.'

“The 72-year-old leader, drafted in last September to take over a party reeling from the equally sudden resignation of Shinzo Abe, Japan's youngest post-war leader, added: ‘I feel that it would be best to hand over the reins of power to a new leader.'

“The uncertainty comes just as Japan has slipped into an economic slowdown, triggered by falling exports and high food, energy and commodity prices. A recent contraction in gross domestic product ended more than six years of continuous growth, the longest, if not fastest period of expansion in post-war Japan. This prompted the government last week to launch an Y11,500bn ($106 billion) emergency fiscal stimulus package.”

Source: Michiyo Nakamoto and David Pilling, Financial Times , September 1, 2008.

Bloomberg: China's manufacturing contracts for second month

“Manufacturing in China, the world's fastest-growing major economy, contracted for a second straight month in August, according to a survey of purchasing managers.

“The Purchasing Managers' Index was a seasonally adjusted 48.4, unchanged from July, the China Federation of Logistics and Purchasing said today in an e-mailed statement.

“Since July, Chinese policy makers have put extra emphasis on sustaining the economy's expansion rather than cooling inflation. Growth has slowed for four quarters and Vice Commerce Minister Gao Hucheng said last week that weakness in global demand will weigh on China's exports for the rest of the year.

“‘This suggests economic growth will continue to slow,' said Sun Mingchun, an economist at Lehman Brothers in Hong Kong.”

Source: Nipa Piboontanasawat, Bloomberg , September 1, 2008.

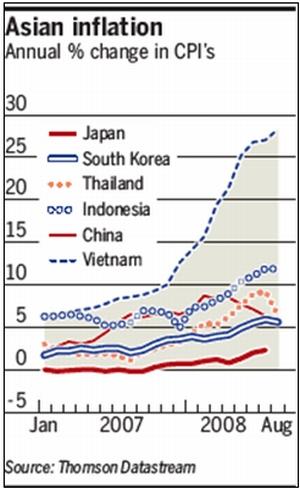

Financial Times: Asian inflation pressures set to ease

“South Korea, Thailand and Indonesia reported slowing rates of growth in consumer prices on Monday, prompting suggestions that Asian inflation has peaked and probably monetary policy tightening with it.

“Tim Condon, head of Asia research at ING, said: ‘The tightening cycle is over across Asia. A lot of this is an oil call, and if oil spikes again we will see upward inflationary pressures.'

“Although China has been reporting slowing price growth since May, inflation continued to rise in much of the rest of the region. Last week Japan reported that its core inflation rate hit a decade high of 2.3% in July from the same month in 2007, while Vietnam said consumer prices rose 28.3% in August, up from 27% in July.

“Falling commodity prices and a resultant slowing of food price inflation was a key factor in Monday's data reports. Robert Prior-Wandesforde, a senior Asia economist for HSBC, said: ‘In Asia, food explains 60% of the overall inflation rate in the last year, with energy accounting for 15%.'

“The extent to which inflation drops across Asia will be limited by food commodity prices remaining relatively high, wage increases, exchange rates weakening against the dollar and monetary authorities' reluctance to tighten further.”

Source: John Aglionby and Song Jung-a, Financial Times , September 1, 2008.

Bloomberg: Brazil's industrial output rises 8.5% versus year ago

“Brazil's industrial production expanded faster than forecast by economists in July, cementing expectations that the central bank will raise interest rates further next week.

“Output rose 8.5% from a year ago, more than the revised 6.4% increase in June and more than the 8% median forecast in a Bloomberg survey of 32 economists. After stripping out seasonal factors, output rose 1% from June, the statistics agency said in a statement in Rio de Janeiro.

“Today's report highlights the sustained domestic demand that is powering growth and consumer price increases in Latin America's largest economy. Policy makers next week will probably vote to raise Brazil's benchmark lending rate by three-quarters of a percentage point for a second time in as many meetings to slow inflation from a three-year high, Alexandre Lintz, chief strategist with BNP Paribas in Sao Paulo, said.

“‘We see no room for the central bank to change its current tightening stance, given economic activity remains robust,' Lintz said. ‘The bank needs to keep raising rates by 0.75 percentage point until there are clear signs that growth is slowing.'

“Inflation, running above the midpoint of the central bank's target range of 2.5% to 6.5% since January, fell in July for a second month, led by food. Consumer prices rose 6.37% in the 12 months to the end of July.”

Source: Joshua Goodman, Bloomberg , September 2, 2008.

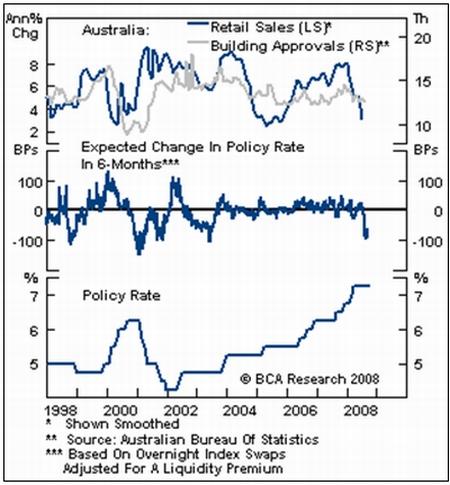

BCA Research: RBA cuts and adopts easing bias

“The Reserve Bank of Australia (RBA) lowered its key interest rate yesterday. The statement that followed suggests future cuts will be data dependant, but we suspect the central bank to ease again before yearend.

“The decision to cut interest rates by a quarter percentage point (to 7%) was designed to offset ‘tight' financial conditions. Mortgage holders have seen interest burdens increase markedly, causing housing affordability to drop to a 22-year low and approvals to fall to the lowest level since 2006.

“Meanwhile, retail sales have slowed dramatically, the unemployment rate is rising and business and consumer confidence has plunged. In turn, household spending is expected to slow further. That said, labor scarcity is an ongoing issue for the commodity intensive parts of the economy and core inflation has not peaked.

“Furthermore, the country has booked its first trade surplus in six years, highlighting the hefty stimulus accrued by the positive terms-of-trade shock. Regardless, the central bank has adopted an easing bias, saying ‘… it is looking more likely that … overall economic growth [will] slow over the period ahead.'

“Bottom line: Despite lingering price pressures, the RBA will be forced to ease policy further to avert a more serious domestic slowdown. Still, significant easing is already discounted by the market. Thus, we maintain a neutral weighting to government bonds within a globally hedged fixed income portfolio and are flat the Aussie dollar.”

Source: BCA Research , September 3, 2008.

Financial Times: Russia announces “spheres of interest”

“Russia's president Dmitry Medvedev on Sunday announced Moscow's intention to preserve geographical spheres ‘of privileged interest' on or near its borders as part of a five point foreign policy statement in a television interview.

“The announcement, in the wake of the recent conflict in Georgia, is likely to raise the political temperature in neighbouring states, especially those with significant Russian minorities, as they try to gauge Russia's appetite for future conflicts in the region.

“He said that Russia would defend ‘the life and dignity' of Russian citizens ‘no matter where they are located'. He was referring to Russia's intervention in Georgia with the declared aim of defending Russian citizens in South Ossetia against Georgian forces.

“Mr Medvedev announced that Russia would provide aid – including military help – to the enclaves of South Ossetian and Abkhazia.

“In the announcing his five-point foreign policy, he emphasised Russia's wish to avoid confrontation or international isolation as the result of the recent conflict, which has been widely criticised in the west. ‘Russia does not intend to isolate itself. We will develop, as much as possible, our friendly relations with Europe and the United States, and other nations of the world.'

“He also focused on a commitment to international law, and again expressed Moscow's now familiar antipathy to a ‘unipolar' world dominated by Washington, saying ‘this type of world is unstable and threatens conflict'.

“Mr Medvedev's announcement that Russia has ‘regions of priviledged interest' is likely to be greeted with concern in the west, where it might be interpreted as the announcement that Moscow has imperial ambitions in the former Soviet Union. It is also likely to resonate in Crimea, the province of Ukraine that is dominated by ethnic Russians, ethnically Russian northern Kazakhstan, and Baltic states with large Russian minorities.

“‘Russia, like other countries in the world, has regions in which it has privileged interests' said Mr Medvedev. ‘In these regions are located countries which have friendly relations … Russia will work attentively in these regions' he said, adding these ‘privileged' regions included states bordering Russia, but not only those.”

Source: Charles Clover, Financial Times , August 31, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.