Mars and Mercury Decide the Fate of the U.S. Dollar and Gold

Commodities / Gold and Silver 2018 Feb 09, 2018 - 03:49 PM GMTBy: Arkadiusz_Sieron

The U.S. dollar has been bleeding recently, despite all the Fed’s tightening efforts and the passage of Trump’s tax cuts. An accelerating economy, rising interest rates and pro-growth reforms should logically drive the value of the American currency. But they didn’t.

The U.S. dollar has been bleeding recently, despite all the Fed’s tightening efforts and the passage of Trump’s tax cuts. An accelerating economy, rising interest rates and pro-growth reforms should logically drive the value of the American currency. But they didn’t.

Given the strong negative correlation between the greenback and gold, finding the cause behind the dollar’s wounds is highly critical. The most common explanation among analysts is Trump the Destroyer. It shouldn’t be surprising, as the U.S. President is known for his passion for trade protectionism. He also explicitly favors the weak currency to help the exporters. So maybe Trump just got what he wanted?

It definitely may be part of story, but there is one catch. Trump’s economic policy hasn’t been as bad as expected. The costs of the tax cuts would be smaller than those resulting from his campaign promises. And the trade policy turned out to be more moderate with respect to Trump’s worst ideas – such as broad tariffs on Chinese or Mexican imposts – which were abandoned, or at least frozen (but in January 2018, the President managed to introduce steep tariffs on imported washing machines and solar panels).

However, the administration’s isolationist and capricious foreign policy is a different kettle of fish. Investors should remember that there are two sides of a reserve currency’s international appeal. One of them is economic (safety, liquidity, yield, economic relations), but the second – which is also important – is geopolitical (diplomatic and military power). Referring to Roman mythology, we could say that two gods determine the dollar’s value: Mercury and Mars. The former was the god of commerce, while the latter the god of war.

In 2017 paper, Barry Eichengreen of the University of California, Berkeley, and Arnaud Mehl and Livia Chitu of the European Central Bank tested both – Mercury and Mars – hypotheses. The scholars found an important geopolitical or security premium in international currency choice. According to their estimates, military alliances boost the share of the currencies of alliance partners in foreign reserve portfolios by close to 30 percentage points.

OK, that’s quite a lot, but how does this relate to Trump, the U.S. dollar’s freefall and gold? Well, the part of greenback’s attractiveness as a currency results from the security premium, i.e. the belief in the U.S. security guarantees. The unpredictable and clumsy foreign policy of the new administration undermines this conviction, dragging away at the U.S. dollar’s value. As Eichengreen et al. point out,

the dollar’s dominance as an international unit is buttressed by the country’s role as a global power guaranteeing the security of allied nations. If that role were seen as less sure and that security guarantee as less iron clad, because the U.S. was disengaging from global geopolitics in favor of more stand-alone, inward-looking policies, the security premium enjoyed by the U.S. dollar could diminish. Our estimates suggest, in this scenario, that $750 billion worth of official U.S. dollar-denominated assets – equivalent to 5 percent of US marketable public debt – would be liquidated and invested into other currencies such as the yen, the euro or the renminbi, if the composition of global reserves changes but their level remains stable, an event that would presumably have significant implications for U.S. bond markets and the dollar exchange rate.

Indeed, the latest IMF data shows that the dollar’s share of global foreign exchange reserves dropped throughout the first three quarters of last year to 63.5 percent, the lowest level since mid-2014. Declining appeal of the greenback (although it still dominates the international reserves) might contribute to the demise of the American currency. But it could also be the other way around: the persistent bear market in the U.S. dollar could draw some investors away. Which came first: the chicken or the egg? (economics aside, the answer to this eternal question is that the egg came first because after all, birds are not the only creatures that lay eggs).

But there is one more explanation, which could please Mercury’s worshippers. The dollar bull market is over due to the Europe’s triumphant comeback. You see, the U.S. business cycle is more advanced than in the Eurozone. The strong economic momentum and the rising expectations that the ECB will join the Fed and start to raise interest rates boosted the euro against the greenback.

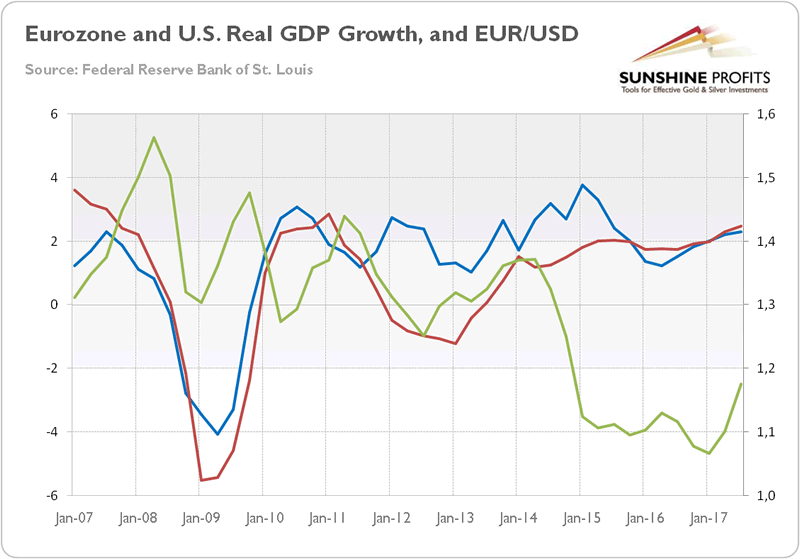

Let’s look at the chart below. As one can see, Uncle Sam recovered faster after the Great Recession than Queen Europe. And it didn’t fall back into recession in 2012.

Chart 1: The real GDP growth for the Eurozone (red line, left axis), the real GDP growth for the U.S. (blue line, left axis), and the EUR/USD exchange rate (green line, right axis) from 2007 to Q3 2017 (percent change from the year ago).

Summing up, the weakness of the U.S. dollar has persisted in spite of the Fed’s hiking federal funds rate and unwinding of its massive balance sheet. It happened for various reasons, including worries about Trump’s economic policy (think about the rising public debt), the deteriorating perception of the U.S. as a reliable ally, and the revival of the Eurozone. Both Mars (dubious foreign policy of a new administration) and Mercury (the expected convergence of monetary policies of the major central banks) signal now that the dollar may fall further against the euro. Gold should shine, then. Be prepared – but remember that gods are whimsical and the technical factors could change the medium-term outlook!

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.