Bitcoin Crash Sees Flight To Physical Gold Coins and Bars

Commodities / Gold and Silver 2018 Jan 18, 2018 - 05:20 PM GMTBy: GoldCore

‘Digital Gold’ Bitcoin Flight To Safe Haven Physical Gold

‘Digital Gold’ Bitcoin Flight To Safe Haven Physical Gold

– Latest bitcoin, crypto crash causes gold coin and bar demand to surge

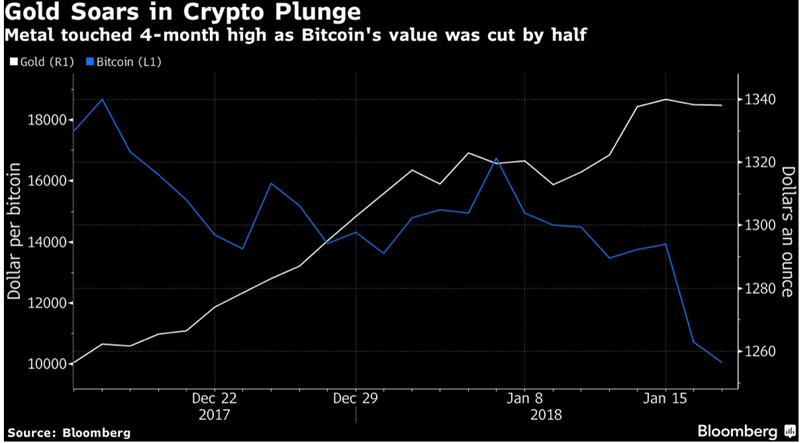

– Bitcoin down 40% from high, Ripple down 50% and Ethereum down 30%

– Ripple and ‘Digital gold’ Bitcoin fall past key psychological price levels

– $300bn wiped from cryptocurrency fortunes in just 36 hours

– New research says that there is ‘Price Manipulation in the Bitcoin Ecosystem’

– Savvy crypto buyers converted their short term gains into physical gold bars, coins

– Bitcoin and Ripple sellers bought gold both for delivery and storage from GoldCore

– Gold ETF holdings rise – Assets in iShares Gold soar to $10.7 b, highest in 5 years

– 95% of cryptocurrencies will go to zero …

Editor: Mark O’Byrne

30% to 50% price drops in a matter of days and the loss of $300 billion in value is quite a knock for a market that was not meant to be in a speculative bubble.

In just 36 hours the cryptocurrency market has managed to make a fair few people feel very nervous as they watched crypto currency prices fall very sharply.

The two most popular cryptocurrencies (as measured by market cap) saw the biggest losses over Tuesday and Wednesday, this week. Digital gold bitcoin dropped below it’s key psychological level of $10,000, whilst ether also made a drop below the all-important level of $1,000.

The crypto market has been on a tear for the last few months. We are frequently asked by people about bitcoin and whether or not they ‘should’ be getting into it.

Gold is the best way to secure value from crypto volatility

Unsurprisingly many cryptocurrency buyers or investors have been looking at how they can secure their gains. Since early December and continuing in recent days, we are seeing numerous existing and new clients who had seen massive gains in bitcoin, ripple etc diversifying into physical gold. They have been buying both gold coins and bars, for both delivery and storage.

One high net worth British entrepreneur involved in tourism sold a substantial amount of bitcoin and bought kilo bars (gold) for storage in Zurich. Another tech entrepreneur told us he was selling Ripple after having very large profits and a “nine bagger” meaning his initial punt on Ripple had surged nine times. He bought a substantial amount , over 100, of gold maple leaf coins for insured delivery.

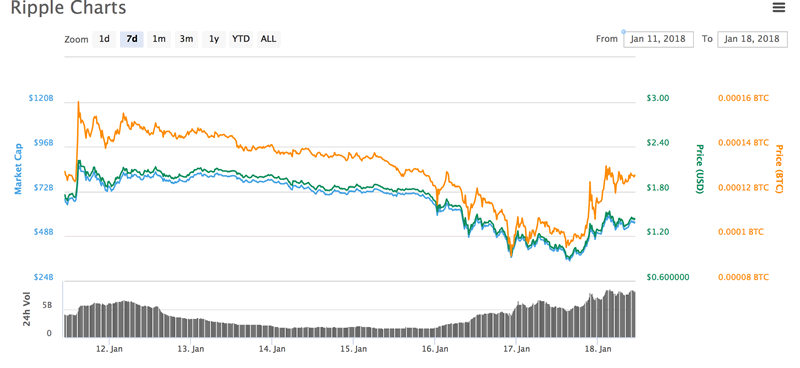

Ripple lost 50% of value in one day

It’s not just digital gold bitcoin gains that have people diversifying into gold. In the last two weeks, we have had a few clients who had seen huge short term gains in Ripple diversify back into gold.

They told us they were concerned that the massive price appreciation was unsustainable and they got nervous about it and decided it was a good time to sell and take some profits. This was a fortuitous move given XRP (the Ripple currency) lost 50% of its value on Tuesday alone.

Source: Coinmarketcap.com

This price action (along with the other major cryptocurrencies) has got many asking as to where the value in a cryptocurrency really is. Some in the newly rich crypto community are recognising that it is about realising real value when you cash out and place it into real assets such as gold and silver.

Those we have spoken to and have assisted in recent weeks are selling a very overvalued asset and putting it into a still undervalued asset. Gold prices remain quite depressed, especially from where they were compared to six or seven years ago, and sentiment is still quite poor.

There is a definitely a trend there and we think that trend is likely to continue given the overvaluation of crypto currencies and the undervaluation of precious metals.

This trend is already playing through the price of gold which has been on a winning streak just as cryptos begin to fall out of favour (see chart above).

It is also being seen in a sharp increase for gold coins and bars as reported by Bloomberg overnight.

There are people in the cryptocurrency industry that have been trying to position cryptocurrencies as alternatives to gold and indeed as “digital gold.” We think increasingly people are realizing that these digital assets have much higher risk levels than the traditional safe haven asset – gold.

Risk of manipulation

As we explained earlier this week, there are some dodgy dealings and market manipulation going on in the world of precious metals namely silver but also gold. Whilst it is a disconcerting prospect, the beauty of it is that precious metal investors can take advantage of it and secure physical silver and gold at relatively low prices, in preparation for the coming bull markets.

However, when it comes to the manipulation of digital or ‘paper’ assets then it doesn’t work out so well for the average investor. One of the reasons so many of the early adopters took to bitcoin wasn’t just because it was a cheap punt but also because it was supposedly more secure and offered a more honest form of exchange than those currently seen in the wider financial world.

Yet it has been victim to a number of security breaches and even price manipulation scandals. A new paper by researchers at Tel Aviv University and the University of Tulsa finds that bitcoin has been victim to price manipulation.

In a paper entitled ‘Price Manipulation in the Bitcoin Ecosystem’ , they find that ‘Suspicious trades on a Bitcoin currency exchange are linked to rises in the exchange rate.’

Making particular reference to the infamous Mt Gox debacle they analyse:

the impact of suspicious trading activity on the Mt. Gox Bitcoin currency exchange, in which approximately 600,000 bitcoins (BTC) valued at $188 million were fraudulently acquired. During both periods, the USD-BTC exchange rate rose by an average of four percent on days when suspicious trades took place, compared to a slight decline on days without suspicious activity. Based on rigorous analysis with extensive robustness checks, the paper demonstrates that the suspicious trading activity likely caused the unprecedented spike in the USD-BTC exchange rate in late 2013, when the rate jumped from around $150 to more than $1,000 in two months.

So bitcoin might be vulnerable to manipulation and not be as unbreakable after all.

From digital gold to real physical gold

As we have explained repeatedly, bitcoin (or any other crypto) is not a substitute for gold or silver. But, they can have a complementary relationship as we are seeing today.

Bitcoin and crypto currencies are digital assets. Most are no more secure in terms of value or pricing than any other form of digital gold, stock or ETF. However, many of those who choose to hold cryptocurrencies do so for the same reason many choose precious metals – because they wish to diversify outside of the global monetary and financial system.

Physical gold and silver bullion that is allocated and segregated in your name is the best way to guarantee the securing of the profits achieved from and wealth created by cryptocurrencies.

Most crypto currencies have little real value whatsoever other than to make hard and fast profits from – or indeed hard and very large losses.

The lesson here is to take profits on overvalued assets – be they cryptos, stocks, bonds or property. Sell over valued assets and buy undervalued assets. Rebalance investments and diversify into undervalued assets such as gold bullion – the proven safe haven.

Gold Prices (LBMA AM)

18 Jan: USD 1,329.75, GBP 961.14 & EUR 1,088.40 per ounce

17 Jan: USD 1,337.35, GBP 969.45 & EUR 1,092.48 per ounce

16 Jan: USD 1,334.95, GBP 970.38 & EUR 1,091.32 per ounce

15 Jan: USD 1,343.00, GBP 971.93 & EUR 1,092.93 per ounce

12 Jan: USD 1,332.90, GBP 978.75 & EUR 1,099.78 per ounce

11 Jan: USD 1,319.85, GBP 978.14 & EUR 1,104.45 per ounce

10 Jan: USD 1,321.65, GBP 976.96 & EUR 1,103.31 per ounce

Silver Prices (LBMA)

18 Jan: USD 17.09, GBP 12.31 & EUR 13.96 per ounce

17 Jan: USD 17.21, GBP 12.49 & EUR 14.10 per ounce

16 Jan: USD 17.10, GBP 12.43 & EUR 13.99 per ounce

15 Jan: USD 17.12, GBP 12.58 & EUR 14.14 per ounce

12 Jan: USD 17.12, GBP 12.56 & EUR 14.12 per ounce

11 Jan: USD 17.01, GBP 12.64 & EUR 14.24 per ounce

10 Jan: USD 17.13, GBP 12.64 & EUR 14.27 per ounce

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.