Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver”

Commodities / Gold and Silver 2018 Jan 16, 2018 - 01:33 PM GMTBy: GoldCore

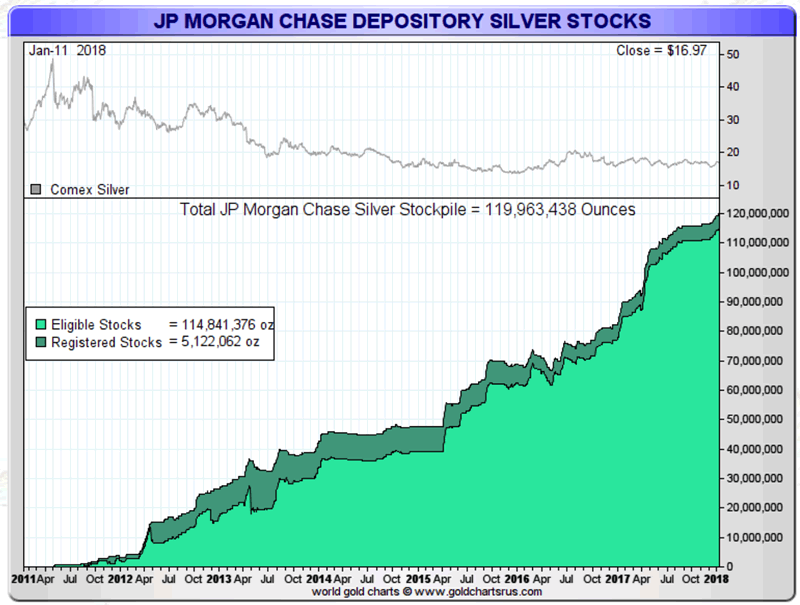

– JP Morgan continues to accumulate the biggest stockpile of physical silver in history

– JP Morgan continues to accumulate the biggest stockpile of physical silver in history

– “JPM now holds more than 133m oz -more than was held by the Hunt Bros” – Butler

– Silver hoard owned by JPM has increased from Zero ozs in 2011 to 120m ozs today

– Money managers showing more optimism towards silver through record buying

– “Near impossible to rule out an upside price surprise at any moment”

Editor: Mark O’Byrne

Source: Sharelynx

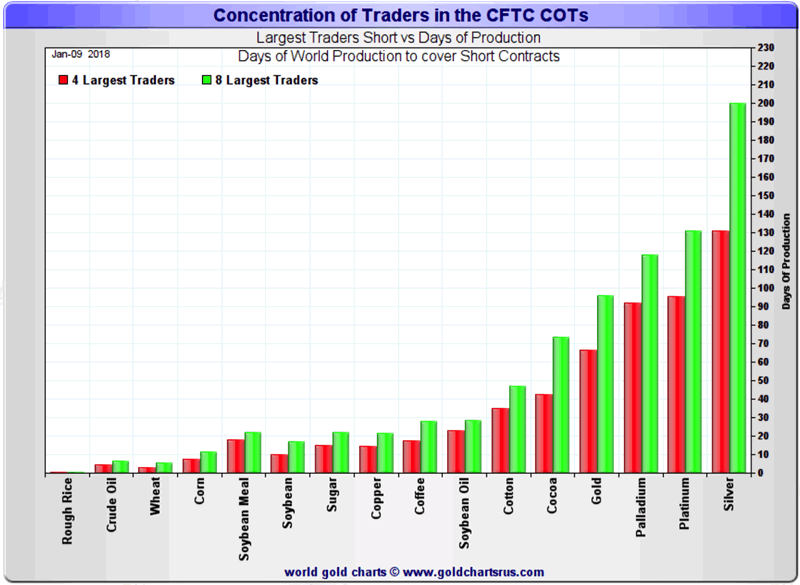

Money managers are feeling increasingly optimistic about silver, against a backdrop of cautiousness regarding gold according to the latest Commitment of Traders (COT) report.

There has been some record buying in the last fortnight. The report shows some impressive moves given just under a month ago the silver market was net short. Last week speculative gross long positions in Comex silver futures rose by 11,920 contracts to 66,224. Whilst short positions fell by 10,379 contracts to 28,122. Silver’s net long positions now stand at 38,102 contracts.

For the current week’s reporting, the four largest traders are short 130 days of world silver production-and the ‘5 through 8’ large traders are short an additional 70 or so days of world silver production-for a total of 200 days. This is around seven months of global silver production.

JP Morgan are out Hunting the silver market

Much of this is attributed to JP Morgan, who according to respected silver analyst Ted Butler, is responsible for the ‘third great investment accumulation of physical silver’.

The silver market has been closely monitoring JP Morgan’s activities for some time. Since April 2011 the powerful bank has been accumulating silver at a quite a rate. It has taken its position from zero to nearly 120m ounces this month, less than six years later.

Butler explains:

‘Just about every ounce moved into the JPMorgan COMEX warehouse over the past 7 years has come from futures deliveries stopped (taken) by JPM in its own name. JPMorgan took delivery of 14 million ounces in December and so far, 13 million ounces have remained in the warehouses from which the metal was delivered. So this means that JPMorgan now holds more than 133 million ounces of silver in COMEX warehouses, or more than was held by the Hunt Bros or by Berkshire Hathaway at their peaks. There was a lot more silver in the world in 1980 and 1998 than there is today, meaning that JPMorgan’s accumulation is much more of an accomplishment than previous silver acquisitions.’

Why would JP Morgan be stockpiling silver? As we pointed out a few years ago, it may be the case that they are anticipating geopolitical and financial turmoil?

This would not come as a surprise to JP Morgan shareholders who have previously received such warnings from CEO Jamie Dimon who has stated ‘there will be another crisis’.

Dimon has even admitted that the trigger for the next crisis may not be the same trigger as the last one – but there will be another crisis:

“Triggering events could be geopolitical (the 1973 Middle East crisis), a recession where the Fed rapidly increases interest rates (the 1980-1982 recession), a commodities price collapse (oil in the late 1980s), the commercial real estate crisis (in the early 1990s), the Asian crisis (in 1997),so-called “bubbles” (the 2000 Internet bubble and the 2008 mortgage/housing bubble), etc. While the past crises had different roots (you could spend a lot of time arguing the degree to which geopolitical, economic or purely financial factors caused each crisis), they generally had a strong effect across the financial markets.”

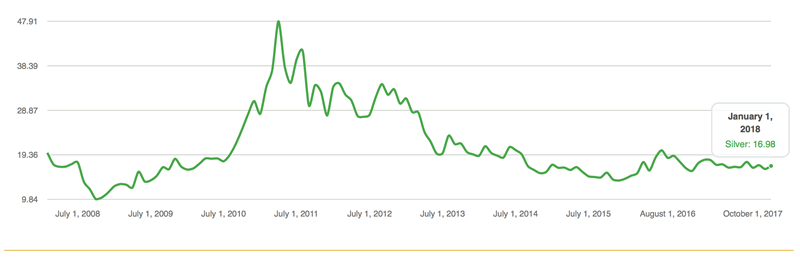

JP Morgan’s silver accumulation in the face of upcoming turmoil may lead some to ask why not go for gold? It’s likely that the depressed price is the deciding factor here.

Silver USD, Jan 2007 – Jan 2017, Goldcore.com

The bank is often compared to the Hunt brothers when it comes to cornering of the silver market, but in truth the bank has been much savvier and is set to make far more. After all, the Hunt’s accumulated primarily paper silver, JP Morgan are going after the hard stuff. Had the Hunt brothers, bought more physical silver bullion and less paper silver in the form of futures, they would likely have made even more money than they could imagine.

More silver bullion than we know?

Butler believes that ‘JPMorgan holds at least 675 million ounces of actual silver. Simply put, JPMorgan has acquired six times as much metal as bought by the Hunts or Berkshire Hathaway. If this really is the case then it would account for ‘nearly 45% of the 1.5 billion ounces of silver bullion in the form of industry standard 1,000 ounces bars in the world’.

The ability to accumulate so much physical silver whilst at the same time sell short huge quantities of paper derivatives or futures contracts could be the poster child for market manipulation. After all, the selling results in lower prices which then paves they way for more physical buying by the bank.

Butler again:

It couldn’t possibly be legitimate and that makes JPMorgan a market crook and manipulator. It also makes the federal regulator, the CFTC, and the self-regulating CME Group, incompetent, corrupt, or both. This takes a special kind of market manipulator, one most likely operating under some type of agreement with the regulators.

To what end are JP Morgan pursuing this path of silver hoarding?

That intent is to sell at as large a profit as possible. No one buys any investment asset with the intention of losing money, least of all JPMorgan. They didn’t spend the last seven years accumulating physical silver to sell that silver at anything but the highest price possible. I can’t tell you when JPM will let the price of silver fly, but I am certain that that day is coming.

Silver prices looks particularly undervalued right now. Last year it gained just 1.6%, compared to 11.5% for gold and 48% for palladium. Yet we (and big banks such as JP Morgan) remain bullish. We have previously written about our forecast that silver prices will surpass its nominal high of $50 per ounce and its inflation adjusted high of $150 per ounce in the coming years.

The fundamental reasons for our very bullish outlook on silver is very reasonable. There are increasing global macroeconomic, systemic, geopolitical and monetary risks. Silver’s historic role as money and a store of value has already been identified time and time again in the past and history is repeating itself. It is also worth considering the declining and very small supply of silver, not to mention increasing investment demand from one of the world’s most powerful banks and other contrarian investors.

We should see JP Morgan’s accumulation as not just a sign to buy physical silver but also that the next financial crisis is coming and its time to diversify into physical gold and silver bullion coins and bars.

Gold Prices (LBMA AM)

16 Jan: USD 1,334.95, GBP 970.38 & EUR 1,091.32 per ounce

15 Jan: USD 1,343.00, GBP 971.93 & EUR 1,092.93 per ounce

12 Jan: USD 1,332.90, GBP 978.75 & EUR 1,099.78 per ounce

11 Jan: USD 1,319.85, GBP 978.14 & EUR 1,104.45 per ounce

10 Jan: USD 1,321.65, GBP 976.96 & EUR 1,103.31 per ounce

09 Jan: USD 1,314.95, GBP 972.01 & EUR 1,102.19 per ounce

Silver Prices (LBMA)

16 Jan: USD 17.10, GBP 12.43 & EUR 13.99 per ounce

15 Jan: USD 17.12, GBP 12.58 & EUR 14.14 per ounce

12 Jan: USD 17.12, GBP 12.56 & EUR 14.12 per ounce

11 Jan: USD 17.01, GBP 12.64 & EUR 14.24 per ounce

10 Jan: USD 17.13, GBP 12.64 & EUR 14.27 per ounce

09 Jan: USD 17.05, GBP 12.60 & EUR 14.30 per ounce

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.