Gold And Silver – Review of Annual, Qrtly, Monthly, Weekly Charts. Reality v Sentiment

Commodities / Gold and Silver 2018 Jan 13, 2018 - 02:45 PM GMTBy: Michael_Noonan

Usually we have a commentary of some kind as a back story to what is going on in the PMs. Our commentaries have become fewer and farther between because of the absurdity of government control, which in turn is controlled by the ruling elite. Not a day goes by that the president elect, Donald Trump, is not severely criticized by mainstream media, both televised and in print. We have never seen this kind of maltreatment toward a president, ever. It is the Deep State exposing its ugly tentacles to keep Trump from gaining any traction in popularity, and it speaks to the bitter disappoint that Deep State favorite, and one upon whom they could depend, Hillary Clinton lost.

Usually we have a commentary of some kind as a back story to what is going on in the PMs. Our commentaries have become fewer and farther between because of the absurdity of government control, which in turn is controlled by the ruling elite. Not a day goes by that the president elect, Donald Trump, is not severely criticized by mainstream media, both televised and in print. We have never seen this kind of maltreatment toward a president, ever. It is the Deep State exposing its ugly tentacles to keep Trump from gaining any traction in popularity, and it speaks to the bitter disappoint that Deep State favorite, and one upon whom they could depend, Hillary Clinton lost.

Sadly, Trump has been overwhelmed by the shadow powers and turned into yet another presidential puppet that will disappoint perhaps even more than turncoat Obama. Many of Trump’s promises of reform have been cast aside in favor of bowing to the dictates of the ruling elites. the swamp creature have survived the draining attempt and are back stronger than ever.

It makes absolutely no sense to discuss any information that the government puts out because it is all based on lies and deceit and probably worse in Europe than the dismal state of affairs in the US. No one has defined the “shithole” countries Trump denies saying, but few have stated the more obvious ones, America and almost every European country.

America has become a police state with a tightening noose on all freedoms, including free speech and the internet. Europe is worse, compounded by the massive immigration of Middle Easterners, many legitimately wanting to escape from wars and unlivable conditions, but there are too many extremist Middle Easterners infesting the overall numbers, and they have become breeders of rape, robbery, and living instability.

The European immigration issue is also an attack on Christianity and the white race with the intent to eliminate sovereignty, national borders, even individual identity. Those governments most effected, Sweden a prime example, have lost control over the criminal elements that have invaded their countries, and it is considered a crime to point the finger at those elements most guilty. The victims are being victimized by their own elected officials.

Yet, people like Merkel are still in charge. A country like Poland, with zero immigration problems, because Poland has refused Middle Easterners into the country, has become the target of the EU bureaucrats to be punished for exercising Polish sovereignty. The EU is telling Poland, if you are not willing to destroy your country with immigrants, we will help destroy your existence by financially punishing and weakening Poland. How dare you defy our dictates on how you should run your country!

Congress just passed an extension of the massive spying on all Americans, well the entire world, for that matter. Facebook wants to have video and microphone capability in every home. [1984 is alive and well, everywhere.] Twitter has been exposed for shadow censoring dissenting views, like those favorable to Trump, freedom, and truth. What is going on everywhere is disgusting, and very few seem to care or want to do anything about it.

The debt in this country is in unabated trillions that continues to grow, but all that financial enslavement of the population has done nothing to grow the economy, improve severely deficient infrastructure, or show up in some positive manner anywhere…except for the Fed’s balance sheets in order to support the severely bloated stock market and support the financial farce known as Treasury Bills and bonds.

The world makes less and less sense, except for the realization that the central bankers and ruling elites are spinning it out of control, even losing control themselves, to a degree, but they will ultimately prevail. This will all come crashing down, sooner or later, and later seems to be the operative word, but subject to a reality check in any given month.

Just like the stock market crash of 2008-2009 turned the fundamental investment world upside down and destroyed all sense of what is value, in addition to wiping out millions of individual investors, many of whom have never recovered, what will inevitably happen next in the stock markets around the world will be an even greater shock.

We are painting broad strokes here, and we suggest everyone do their own due diligence and draw their own conclusions. We already have, and for that reason we continue to withdraw from the insanity that has gripped the world. Unfortunately, too many have become anesthetized and keep believing in the treadmill of their daily existence because to believe otherwise is too scary or simply unfathomable.

Commentaries just do not make sense because the world has become senseless and very dangerous. The US has more armed bases around the world and is fomenting as much proxy war and chaos as possible. Russiagate, as it were, will not go away, at least in the MSM and Congress, even though it has been proven that there is not a single piece of evidence to back up any such claim. The US wants to punish Russia for being in and even winning in Syria, for being against US financial interests, and for refusing US access to Russia’s many natural resources that the neocons in this country want to exploit/steal.

The one arena where we find calm and reliability, even truth, is in the charts. Both gold and silver continue to be suppressed, and those doing the suppression have been given a pass recently by Donald Trump. He just exempted the five largest banks in the world from any criminal actions. Theft on the highest level and in the greatest amounts of money can operate with impunity.

The Deep State is operating in the open, more and more, but the warning signs are being ignored. Society is disintegrating as people are being herded like lemmings to do the bidding of governments or suffer the consequences. In the past, owning gold and silver kept those who had it free from government dependence, which is yet another reason why governments do not want people to have it. There is a message there, and one worth heeding.

Some have asked our opinion on Bitcoin. We have not participated, at all, even when it was first introduced to us at under a dollar! It was not understood then, and it still is not understood now, [by us]. We see it as akin to the Tulip Mania. It has no intrinsic value that we know of. It has no history of performance during bad times, which may be fast approaching, and we choose to steer clear of it. Good for those who have made money with it over the past few years. We will stick with what we know, or choose to think we know…the charts. Hint: governments will not stand for competition and are already taking defensive measure, as is the IRS. Too many unanswered questions remain.

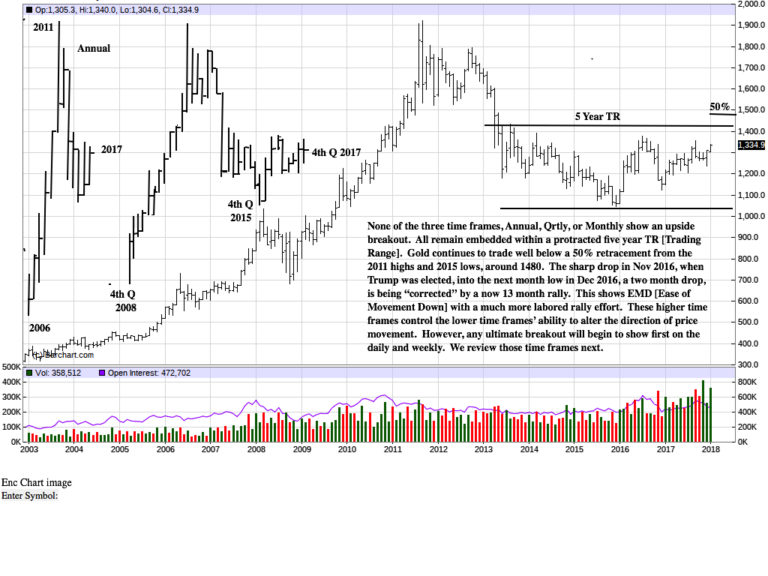

Those who have no patience for or understanding of the higher time frames, particularly the annual and quarterly charts, are missing out on some very valuable market information. No, they are not timing tools, and one cannot use them for trading, but they are invaluable for keeping the market in context.

What these charts have been saying since the highs of 2009 and 2011 is that there is little reason for trading from the long side, if one wants to maximize potential results. Our largest losses in the past few years have come from the long side of gold and silver. We know first hand of what we speak. Sentiment does have a way of clouding reality.

The chart comments are apt. Unfortunately, was can not make them larger should one find it difficult to read the comments.

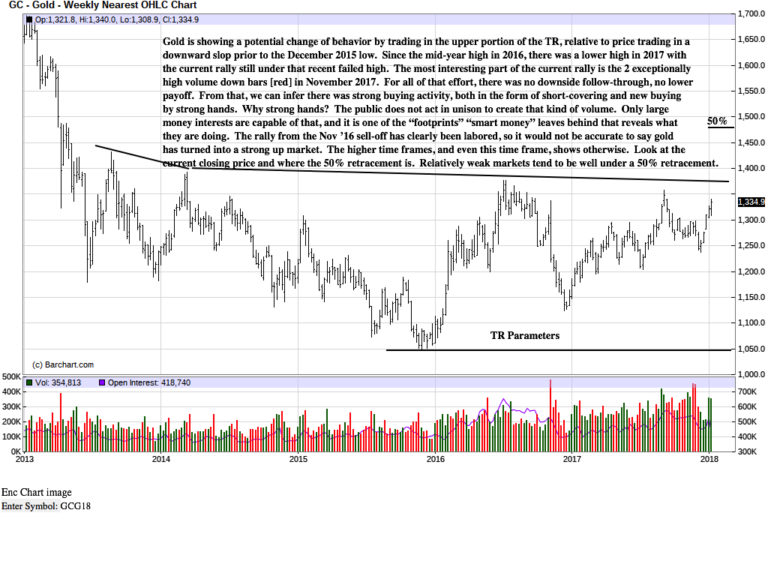

We focused on the two largest volume trading weeks in late 2017, the red bars depicting volume at the bottom. It is only large money interests and those most in a position to know of a shift in price sentiment that can produce such large trading volumes at any point in time. It is impossible for the public to act in unison to create large volumes. Instead, it is the public that reacts to them, almost always to their detriment.

You can see how the high volume weeks correspond to almost the exact week low before price turned around for an extended rally. High volume periods, monthly, weekly, daily, intraday even, are very significant pieces of information.

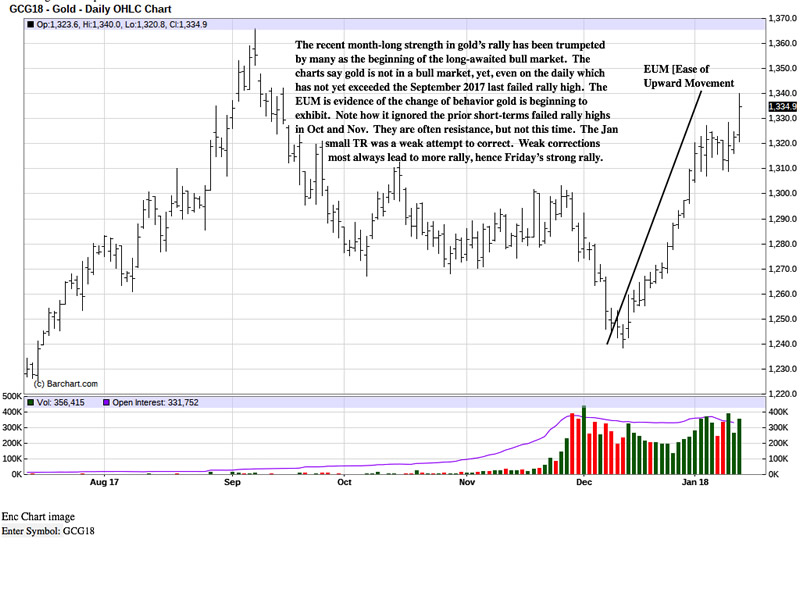

We watched the market turnaround from the December low, a week or two after the low. We choose to buy on pullbacks in response to market activity. It is obvious from the chart that there were no pullbacks from 1250 up to 1320. Entry under these circumstances is more difficult because past recent history says market rallies have not been sustained, and identifying risk as price continues higher become a mitigating factor for risk v reward.

The higher controlling time frames were of no help and suggested price still has a way to go before turning into a bullish market. Right now, risk is greater than potential reward. [We are talking trading the market and not buying physical gold. We have been purchasers of physical metals consistently over the past few years, as advocated.]

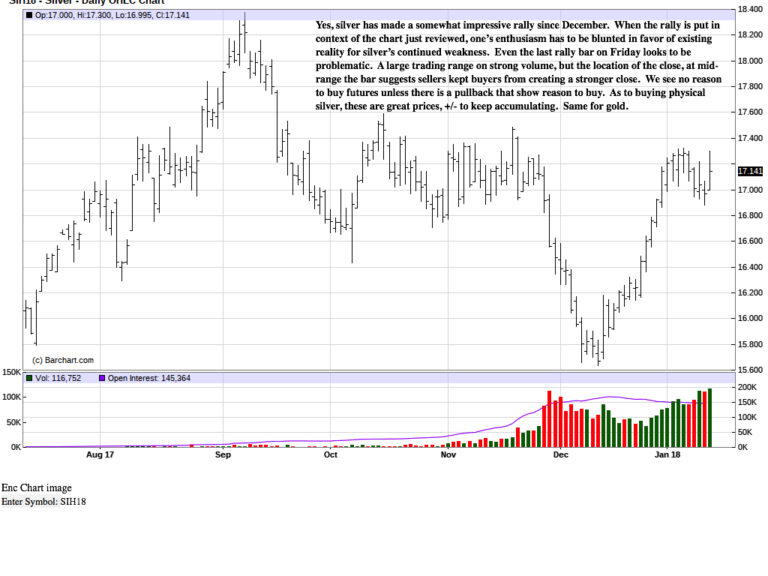

At first, there appeared to be little to say about silver, given its location at/near the bottom of its multi-year TR. We drew attention to the Qrtly chart last October, and we saw even more reason to keep a strong focus on it currently because it appears to be offering some valuable information that is not as apparent on the other time frames.

This is a great example of what is meant by saying smart money always leaves a footprint on the charts that can reveal their intent, something they are keen on hiding from the public. It is a matter of knowing what to look for and how to interpret it. This is more of the art form of chart reading, for reading charts is not a cookie-cutter exercise as so many might think or want it to be.

The clustering of closes, occurring during this labored correction, adds weight to the potential for preparing for a long position on breakouts. Plus, you can see the location of the closes for the ;sat 2 Qtrs was near the high indicating buyers overwhelming sellers.

Again, the potential for a trade from the long side is not even close to apparent on the weekly chart. This is why it is so important to have an awareness of all time frames. Otherwise, the possible clue[s], as described on the Qtrly, would be lost.

As we said, the higher time frames are not for timing, and the weekly and this daily chart are examples. There does not appear to be a possible trade or reason for trading from the long side, yet. The Qtrly says to be aware and keep looking for a reason.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2017 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.