Gold Prices Choppy after Payrolls

Commodities / Gold and Silver 2018 Jan 09, 2018 - 10:08 AM GMTBy: Arkadiusz_Sieron

The U.S. economy added only 148,000 jobs in December. Gold prices reacted in a choppy way, confusing some analysts. Why?

The U.S. economy added only 148,000 jobs in December. Gold prices reacted in a choppy way, confusing some analysts. Why?

December Payrolls Disappoint

Total nonfarm payroll employment increased only 148,000 in December, the slowest pace in three months. The employment gains were generally widespread, but the biggest employers were construction (+30,000), leisure and hospitality (+29,000), education and health services (+28,000), and manufacturing (+25,000). The latter rise is a particularly bright spot, given the not-so-distant problems of the sector. On the other hand, retail trade cut 20,000 jobs, which confirms that some traditional brick-and-mortar stores struggle.

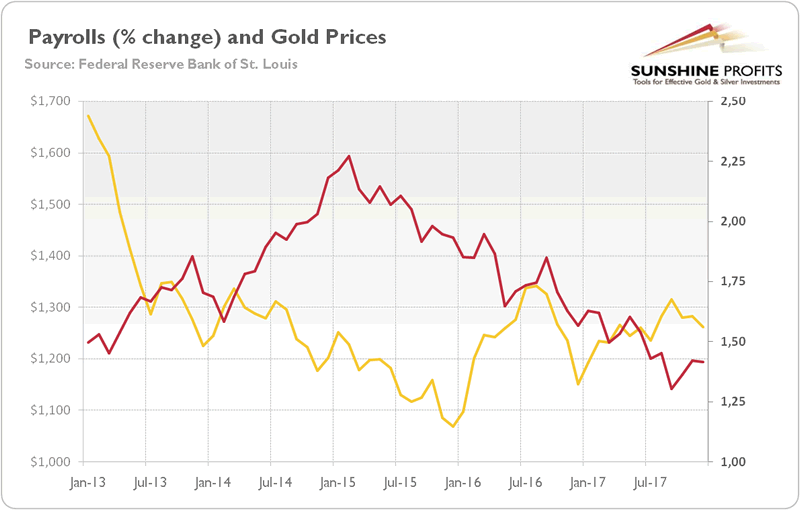

The rise followed an increase of 252,000 in November (after an upward revision), according to the U.S. Bureau of Labor Statistics. This is slowdown. An unexpected slowdown. The markets anticipated 191,000 job gains in the previous month. Moreover, employment gains in October and November combined were 9,000 lower than previously reported. When it comes to the medium term, the annual job growth rate remains in a downward trend, as the chart below shows.

Chart 1: Total nonfarm payrolls (red line, right axis, percent change y-o-y) and gold prices (yellow line, left axis, London P.M. Fix, $) over the last five years.

On the surface, the report should be negative news for the U.S. labor market and positive for the gold market. However, the price of gold didn’t rally (see the chart below), making many so-called experts uncomfortable. Why?

Chart 2: Gold prices from January 5 to January 8, 2018.

Labor Market Remains Solid

The first reason is that the Employment Situation Report showed that the U.S. labor market remained healthy. Job gains averaged 204,000 in the last three months, significantly more than what is needed to keep up with the growth of population. In the whole year, about 2 millions jobs were created. Moreover, the unemployment rate stayed at 4.1 percent, a pleasingly low level. And wages saw gains. Average hourly earnings rose by 9 cents to $26.63. It means that they jumped 2.5 percent in 2017. Does this look like an economic slowdown to you? Neither does it to precious metals traders. Although the price of gold jumped initially from $1,316 to $1,321 after the release of the report, the direction was quickly reversed and the yellow metal fell below $1,314, just to steadily undo the losses. Gold can be quite choppy, can’t it?

Inflation Still Lacking

Another issue is that inflation is still subdued. This is why data on inflation is now much more important for the Fed and, thus, markets. Everyone sees that the labor market remains tight and economic growth is picking up. What is missing to fully please the monetary hawks is the inflation reaching the U.S. central bank’s target. This is why gold does not react as strongly to nonfarm payrolls as it used to in the past. Even if the headline surprises (within a certain range), the general outlook for the U.S. labor market will remain positive and little changed.

Conclusions

The December U.S. nonfarm payrolls were worse than expected. The economy added only 148,000 jobs in the last month, significantly below expectations. But the price of gold didn’t rally. This is because the number was much more than Fed needed to maintain its policy of gradual tightening. The unemployment remains low and the labor market still looks solid. Surely, if the slowdown continues, the FOMC may become more cautious. However, it should remain on track to raise interest rates in March and twice later in the year. Indeed, San Francisco Fed President John Williams said on Saturday that the Fed should raise interest rates three times this year given the strong economy, while Cleveland President Loretta Mester expected roughly four interest rate hikes. Don’t underestimate the power of the hawkish side!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.